The Best and Cheapest Home Insurance Companies in Alaska (2024)

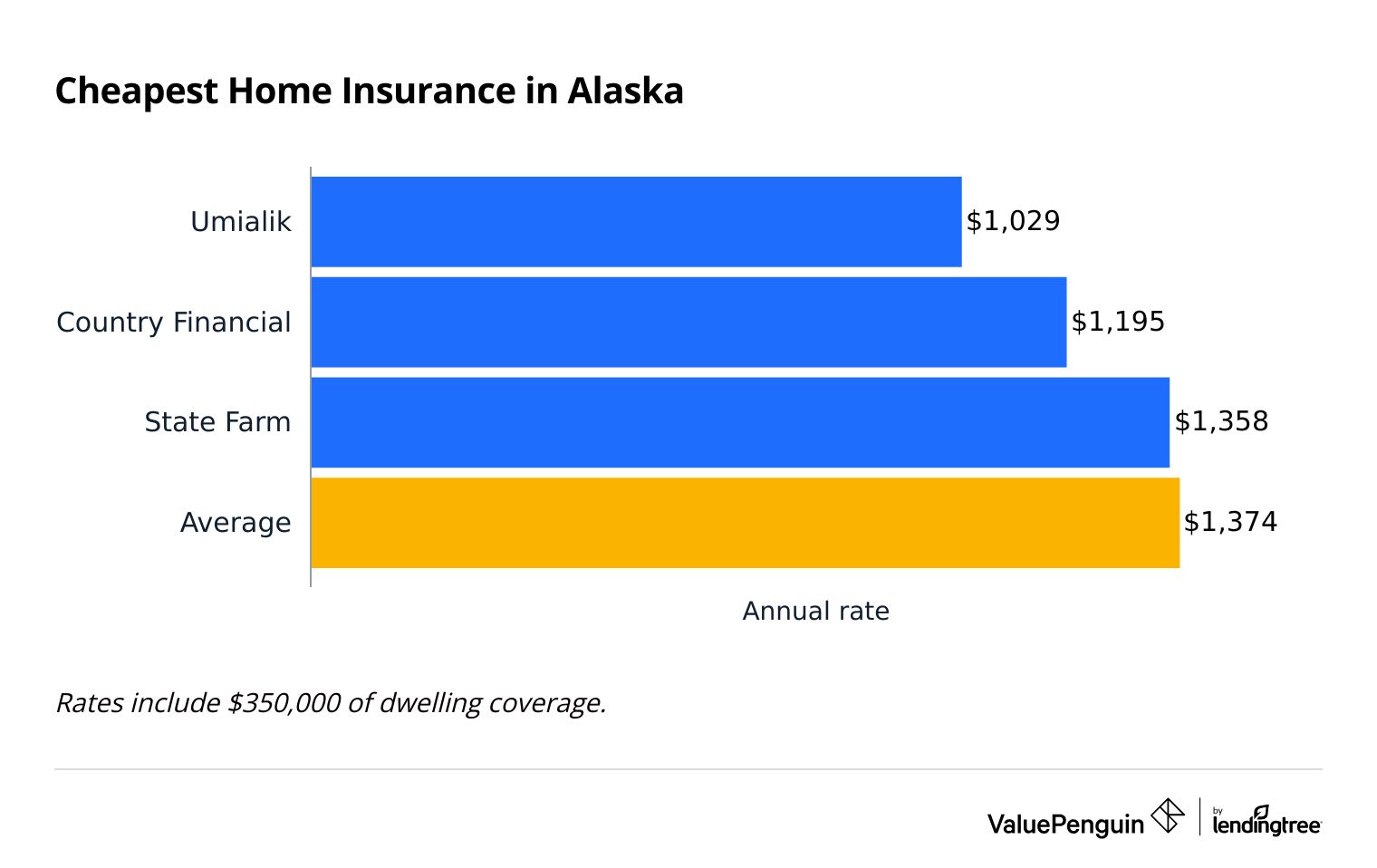

Umialik Insurance has the cheapest home insurance in Alaska, offering coverage at an average rate of $1,029 per year.

Compare Home Insurance Quotes in Alaska

Best Cheap Home Insurance in Alaska

ValuePenguin collected thousands of quotes across hundreds of ZIP codes from the top home insurance companies in Alaska. Our experts compared cost, customer service, reliability and coverage benefits to find the best insurance companies in the state.

Cheapest home insurance quotes in Alaska

Umialik has the cheapest rate for home insurance in Alaska, at $1,029 a year.

Compare Home Insurance Quotes from Companies in Alaska

Country Financial is also affordable for people with cheaper homes, at just $785 per year for $200,000 of dwelling coverage.

State Farm has great rates for expensive homes: a $1 million policy costs $2,572 per year, or 15% less than the state average.

Best cheap homeowners insurance in Alaska by dwelling coverage amount

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Country Financial | $785 | ||

| Umialik | $802 | |

| State Farm | $1,014 | ||

| Allstate | $1,095 | ||

| USAA | $1,359 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Country Financial | $785 | ||

| Umialik | $802 | |

| State Farm | $1,014 | ||

| Allstate | $1,095 | ||

| USAA | $1,359 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Umialik | $1,029 | |

| Country Financial | $1,195 | ||

| State Farm | $1,358 | ||

| Allstate | $1,514 | ||

| USAA | $1,772 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Umialik | $1,372 | |

| State Farm | $1,665 | ||

| Country Financial | $1,674 | ||

| Allstate | $1,961 | ||

| USAA | $2,170 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $2,572 | ||

| Umialik | $2,658 | |

| Allstate | $3,079 | ||

| Country Financial | $3,400 | ||

| USAA | $3,469 | ||

Disasters to look out for in Alaska

Two of the most common causes of damage to homes in Alaska are damage due to freezing and earthquakes.

Damage to your home from freezing, such as a burst pipe, is usually covered by home insurance — so long as you were doing your best to keep your home heated before the incident.

Earthquakes are very common in Alaska, since the state is on the Denali fault. Unfortunately, earthquakes aren't covered by regular home insurance, so you'll have to buy a separate earthquake insurance policy in order to be protected.

Best home insurance for most people: Country Financial

-

Editor's rating

- Cost: $1,195/yr

Country Financial has cheap prices and highly-rated service for Alaska homeowners.

Pros:

-

Affordable rates for most homeowners

-

Personal agent support

Cons:

-

Few options for custom coverage

-

Rates for high-value homes are less competitive

The best homeowners insurance for most people in Alaska is Country Financial because of its affordable rates, wide coverage options and good customer service.

Country isCountry Financial also offers a variety of discounts, which could make it even more affordable. Country Financial has excellent customer service, and because you'll have your own agent, you’ll get personalized guidance through filing your claims.

Country Financial doesn’t offer much in the way of customized coverage, with three main coverage packages: basic, combined or premier. If there's a specific coverage you want to get, you might end up paying for other extras you don't need.

However, you can get some additional coverage. Country Financial has an average rate under $1,000 per year and offers all the standard coverages you'd expect from a home insurance policy.

- Repair your home for damage from fire, storms, etc.

- Pay medical bills for visitors injured in your home

- Help rebuild your home if it's destroyed

- Protect against physical damage to the structure or your belongings

For solid customer service, low rates, and personalized service, Country Financial is a great option for most homeowners in Alaska.

Best local home insurance company: Umialik

-

Editor's rating

- Cost: $1,029/yr

Umialik has local Alaska insurance expertise, plus great rates and service.

Pros:

-

Affordable prices

-

Offers Alaska-specific coverage options

Cons:

-

No online quotes

Umialik Insurance Company offers the best coverages for Alaska-specific issues, such as coverage for snowmobiles, protection against animals or earthquake coverage. A standard home insurance policy from Umialik also has protection for everyday problems like fire, theft or storms.

Umialik is based in Alaska, so it has experience dealing with issues you won't find in the lower 48 states.

You can buy coverage for an average of $1,029 per year—about 25% cheaper than Alaska's average price of homeowners insurance.

Umialik also has a variety of discounts that could help lower your rates even more. You could save money if you:

- Own a newer home built in the past 15 years

- Update your home's electrical, heating and cooling systems

- Bundle auto insurance coverage from Umialik

- Have a highly-rated roof or siding material on your home

However, Umialik doesn't have a strong online presence. You have to contact an agent to get details about your policy and get a quote or sign up for a policy. There's very little information on Umialik's website, though you can pay your bills online and schedule automatic payments online.

Best for customer support in Alaska: State Farm

-

Editor's rating

- Cost: $1,358/yr

State Farm has the best-rated home insurance customer service in Alaska.

Pros:

-

Strong customer service

-

Affordable rates for high-value homes

-

Cheap auto rates if you bundle

-

Lots of local agents

Cons:

-

Average rates for low-cost homes

-

Few discounts

-

Limited coverage add-ons

State Farm offers good overall coverage for Alaska homeowners, alongside competitive prices for higher-value homes. For $1 million of coverage, State Farm is 15% cheaper than the state average. In addition to affordable rates, it has strong customer service for easy and convenient claims.

State Farm has the best-rated customer service in Alaska.

State Farm doesn’t offer many discounts to its customers, but with affordable overall rates, you can still afford to get any needed add-ons to your policy. It does offer a discount for bundling with auto insurance, though.

With State Farm's great coverage, strong customer service and national name, it is an excellent choice if you value convenience and great service.

Average home insurance cost in Alaska

The average cost of homeowners insurance in Alaska is $1,374 per year.

Prices in Alaska are 36% cheaper than the national average of $2,151 per year.

Average cost of home insurance in AK by dwelling coverage amount

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,011 |

| $350,000 | $1,374 |

| $500,000 | $1,768 |

| $1,000,000 | $3,036 |

Alaska home insurance rates by city

The town of Sitka, in southeast Alaska, has the state's cheapest home insurance rate at $1,030 per year for $350,000 of coverage.

Denali Park has the most expensive home insurance, at $1,954 per year — 57% more than average.

Anchorage, the most populated city in Alaska, has an average rate of $1,167, 15% less than the state average. Juneau, the second-largest city, has rates at 20% cheaper than the average rate of $1,101.

City | Annual rate | % from avg |

|---|---|---|

| Adak | $1,259 | -8% |

| Akiachak | $1,528 | 11% |

| Akiak | $1,528 | 11% |

| Akutan | $1,307 | -5% |

| Alakanuk | $1,225 | -11% |

Rates are for a policy with $350,000 of dwelling coverage.

Best-rated home insurance companies in Alaska

State Farm and USAA offer the best customer service for home insurance in Alaska

Both companies get top marks for insurance shopping and claims. However, USAA is only available to members of the military and some members of their families, and its home insurance rates are very expensive in Alaska.

Company |

Rating

|

Complaints

|

|---|---|---|

| State Farm | Average | |

| Umialik | Low | |

| Country Financial | Average | |

| Allstate | Average | |

| USAA | Low |

Strong customer service can be as important as cheap rates when it comes to homeowners insurance. A dependable home insurance company will help you through the claims process, and make sure you're paid quickly and fairly.

What home insurance coverage do I need in Alaska?

The most important risks for homeowners in Alaska are cold weather and earthquakes.

Alaska is the coldest state in the country, and has the most earthquakes nationwide.

Freezing temperatures

Alaska is the coldest state in the country. Fortunately, most homeowners insurance policies protect against damage to your home from frozen pipes, such as water damage.

Damage to your property because of freezing is usually covered as long as you tried to heat the location where the damage occurred and shut off your water when you found out about the issue.

If Alaska's cold weather damages your plumbing and you have to make a claim, an adjuster will visit your home to make sure you took the proper precautions to prevent damage. However, if there are signs your pipes were in poor condition prior to damage occurring, or if the damage was the result of the pipes' old age, you wouldn't be covered.

Does home insurance in Alaska cover earthquakes?

Earthquakes are common in Alaska, but they are almost never covered by standard homeowners insurance. So it's a good idea to consider buying earthquake insurance if you're an Alaska homeowner.

According to the Alaska Earthquake Center, more than 220,000 quakes shook the state in just the past five years.

How to get cheaper home insurance in Alaska

There are three main ways to save money on home insurance in Alaska: compare quotes, qualify for discounts and change your coverage.

Comparing rates from multiple companies is the easiest way to lower your home insurance payments.

There's a difference of $744 per year between Alaska's cheapest and most expensive home insurance companies. Companies also change their rates over time, so it's important to shop around for quotes every year or two.

Most home insurance companies offer at least a few discounts to help you save on home insurance.

One of the biggest discounts is for bundling your home insurance with a cheap auto insurance policy in Alaska. Some companies also offer discounts for military members, government employees or retirees.

You can lower your home insurance rates by raising your deductible or lowering your coverage limits.

A higher deductible means your insurance company will pay you less money to fix your home after a claim. It's important to choose a deductible you can easily pay in an emergency.

You can also lower your coverage limits and get rid of any coverage extras you may not need. However, make sure your limits are high enough to cover the cost of rebuilding your home and replacing your belongings if you have a major accident.

Frequently asked questions

How much is home insurance in Alaska?

The average cost of homeowners insurance in Alaska is $1,374 per year, or $109 a month, for a $350,000 policy. That's 36% lower than the national average cost of home insurance[/link.

Who has the cheapest home insurance in Alaska?

Umialik has the cheapest home insurance rates for Alaska residents at $1,029 per year. State Farm and Country Financial have great prices too, depending on how much coverage you need.

Who has the best home insurance in Alaska?

Country Financial is the best home insurance for most homeowners in Alaska because of its affordable rates, good coverage and personal agent support.

Methodology

To find the best homeowners insurance in Alaska, ValuePenguin collected quotes from the top companies across every residential ZIP code in the state. Rates are for a 45-year-old married man with no prior insurance claims.

Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. Quadrant's rates were publicly sourced from insurer filings and should only be used for comparative purposes.

Home insurance ratings are based on complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey, and ValuePenguin's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.