Best and Cheapest Home Insurance Companies in Connecticut (2024)

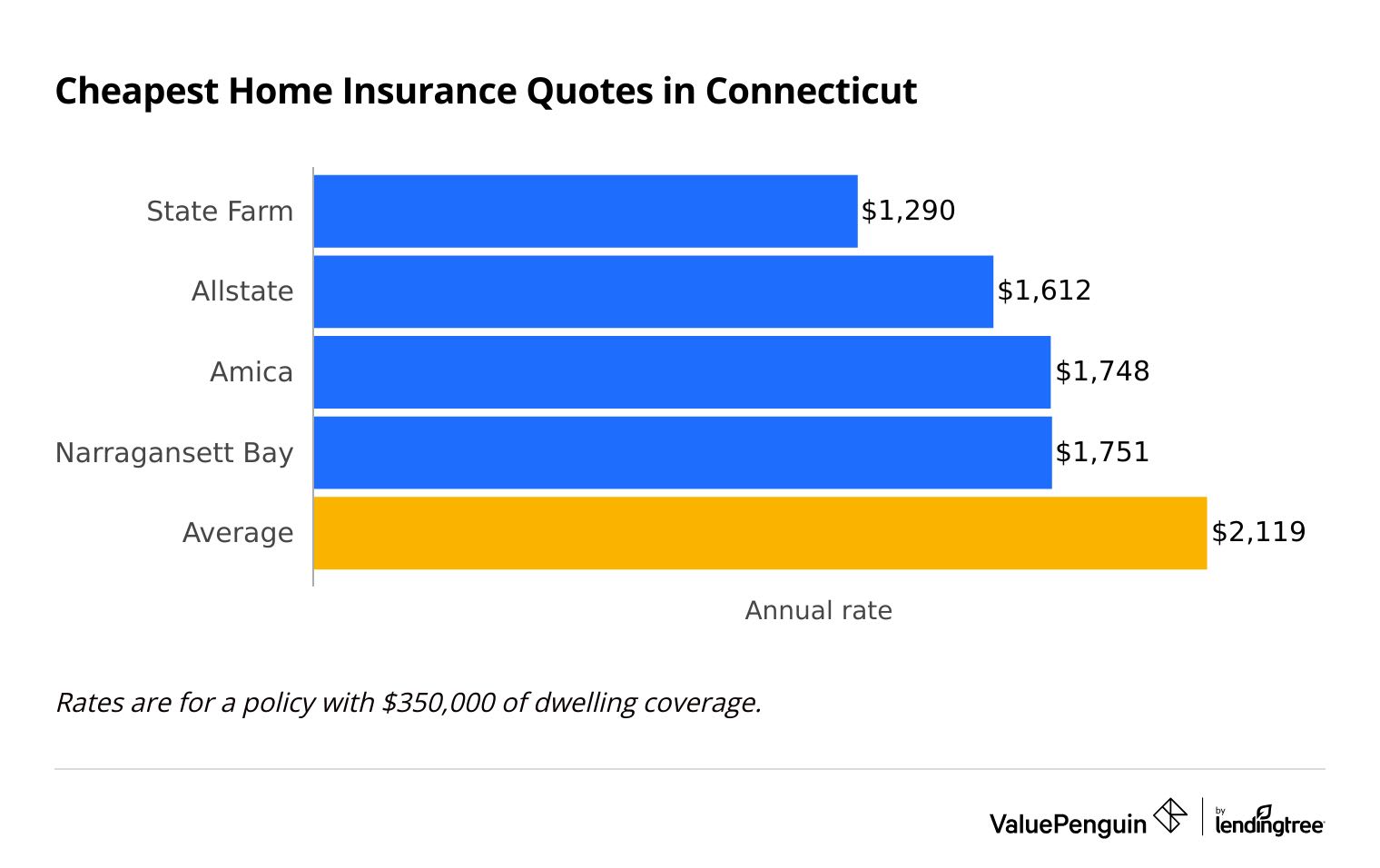

State Farm has the cheapest home insurance in Connecticut, at $1,290 per year.

Compare Home Insurance Quotes in Connecticut

Best Cheap Homeowners Insurance in CT

Home insurance in Connecticut costs an average of $2,119 per year for $350,000 of dwelling coverage.

To find the best cheap home insurance in CT, ValuePenguin collected thousands of quotes across hundreds of ZIP codes from Connecticut's top home insurance companies. Our experts rated companies by cost, customer service, reliability and benefits.

Cheapest home insurance companies in Connecticut

State Farm has the cheapest home insurance rates in Connecticut.

Home insurance from State Farm costs around $1,290 per year for $350,000 of dwelling coverage. That's $829 per year less than the statewide average.

Compare Home Insurance Quotes in Connecticut

State Farm also has the cheapest rates for expensive homes in Connecticut. A policy with $1 million of dwelling coverage costs $2,982 per year at State Farm, which is 42% less than average.

Home insurance quotes in CT by dwelling limit

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $901 | ||

| Allstate | $918 | ||

| Amica | $1,121 | ||

| Narragansett Bay | $1,244 | |

| Andover | $1,673 | |

$200,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $901 | ||

| Allstate | $918 | ||

| Amica | $1,121 | ||

| Narragansett Bay | $1,244 | |

| Andover | $1,673 | |

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,290 | ||

| Allstate | $1,612 | ||

| Amica | $1,748 | ||

| Narragansett Bay | $1,751 | |

| Progressive | $2,409 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,722 | ||

| Amica | $2,266 | ||

| Narragansett Bay | $2,274 | |

| Allstate | $2,524 | ||

| Progressive | $3,165 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $2,982 | ||

| Narragansett Bay | $3,656 | |

| Amica | $3,978 | ||

| American Family | $5,479 | ||

| Progressive | $5,527 | ||

What home insurance do I need in CT?

Seasonal nor'easters can damage Connecticut homes when they blow in from the ocean with high winds and heavy rains.

Most home insurance policies cover damage caused by heavy nor'easter winds. But your policy may not cover other expenses like flood damage or the cost to evacuate during an emergency.

Best CT home insurance for most people: State Farm

-

Editor's rating

- Cost: $1,290/yr

State Farm's cheap rates and dependable service make it the best choice for home homeowners in CT.

-

Cheapest quotes in CT

-

Great for bundling with auto insurance

-

Reliable customer service

-

Few coverage options

-

Some people can't buy a policy online

State Farm is the cheapest home insurance company in Connecticut.

At $1,290 per year, a policy with $350,000 of dwelling coverage is $829 cheaper than the state average.

State Farm is also the most affordable option for high-value homes in Connecticut. A policy with $1 million of dwelling coverage costs around $2,982 per year. That's $2,121 cheaper than average.

It also has some of the cheapest car insurance rates in Connecticut. That makes it an excellent option for homeowners looking to bundle their car and home insurance.

A policy from State Farm comes with enough coverage for most people. However, it doesn't offer as many add-on options as other companies. This could be an important consideration if you own an expensive or historic home in Connecticut.

Best home insurance in CT for flood coverage: Narragansett Bay

-

Editor's rating

- Cost: $1,751/yr

Narragansett Bay offers flood protection, making it the best choice for homes along the coast or near a river.

-

Affordable rates

-

Lots of coverage add-ons

-

Offers flood insurance

-

Very few customer complaints

-

Can't get a quote online

Narragansett Bay home insurance costs around $1,751 per year for $350,000 of dwelling coverage. That's cheaper than the Connecticut average by $368 per year.

In addition, Narragansett Bay is the second-cheapest company for million-dollar homes, at $3,656 per year.

One of the main benefits of choosing Narragansett Bay is its flood protection.

With this add-on, you'll get the same amount of flood protection for your home and belongings for other types of damage, like a fire. This can be very beneficial for people with expensive homes who can't get enough coverage from the National Flood Insurance Program (NFIP).

Having your home and flood insurance policies with the same company will also make your life easier if you ever have to file a claim. That's because you'll only need to work with one company and one adjuster.

Homeowners are typically happy with the service they get from Narragansett Bay. It gets 75% fewer complaints than other similar-sized companies, according to the National Association of Insurance Commissioners (NAIC).

Best CT homeowners insurance customer service: Amica

-

Editor's rating

- Cost: $1,748/yr

Amica's affordable rates and excellent customer service make it a great choice for Connecticut homeowners.

-

Top-rated customer service

-

Cheap rates

-

Lots of discounts

-

Difficult to customize policy coverage

Amica has the best customer service in the state of Connecticut.

It earned the highest score on J.D. Power's property claims study. That means homeowners can expect Amica to help get their lives back to normal quickly in an emergency. In addition, Amica only gets one-quarter as many customer service complaints as an average home insurance company its size.

Amica also offers affordable home insurance in Connecticut. It's the third-cheapest company for a policy with $350,000 of dwelling coverage, at $1,748 per year. That's $371 less than the Connecticut average.

Amica's policies have solid coverage that would work for most homeowners. However, Amica doesn't offer many add-ons to customize its home insurance plans.

How much does Connecticut homeowners insurance cost?

The average cost of home insurance is $2,119 per year in Connecticut.

That's $32 per year less than the national average, which is $2,151.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,539 |

| $350,000 | $2,119 |

| $500,000 | $2,842 |

| $1,000,000 | $5,102 |

Home insurance in Connecticut is more expensive than its neighboring states. For example, the average cost of home insurance in New York is $1,339 per year, while coverage in Massachusetts costs $1,777 per year.

Home insurance quotes in CT by city

Unionville, a neighborhood in Farmington, has the cheapest home insurance in CT.

The average cost of a policy in Unionville is $1,719 per year, which is $400 per year less than the state average.

The coastal village of Old Saybrook Center has the most expensive rates in the state, at $2,999 per year. Old Saybrook is near the water where the Long Island Sound meets the Connecticut River. That means homes there are prone to damage from coastal storms, which makes them more expensive to insure.

CT homeowners insurance rates by city

City | Annual rate | % from avg |

|---|---|---|

| Abington | $1,740 | -18% |

| Amston | $1,811 | -15% |

| Andover | $1,825 | -14% |

| Ansonia | $2,134 | 1% |

| Ashford | $1,803 | -15% |

Rates are for a policy with $350,000 of dwelling coverage.

Bridgeport, the largest city in Connecticut, has an annual average rate of $2,487, which is 17% higher than the state average. New Haven, the second-largest city, is 31% more expensive than the state average at $2,780 per year.

Best homeowners insurance in CT

Amica and Narragansett Bay offer the best customer service for home insurance in Connecticut.

Both companies have very few customer complaints, according to the NAIC . That means their customers are generally satisfied with their service.

Amica also has excellent scores on J.D. Power's home insurance survey and its property claims survey. J.D. Power did not rate Narragansett Bay because it focuses on large, national companies.

Best insurance companies in Connecticut

Company |

Rating

|

Complaints

|

|---|---|---|

| Amica | Low | |

| Narragansett Bay | Low | |

| State Farm | Average | |

| MAPFRE | Low | |

| American Family | Average |

What home insurance coverage is important in Connecticut?

Connecticut is a coastal state with numerous rivers, which means many homes across the state are at risk of flood damage. In addition, heavy wind and rain from nor'easters can cause significant damage to coastal homes.

Does Connecticut home insurance cover flooding?

Homeowners insurance typically doesn't cover weather-related flood damage.

If you live in an area with a high risk of flooding, your mortgage company may require you to buy a separate flood insurance policy.

Even if you're not in a high-risk flood zone, you may want to consider getting flood insurance. That's because just one inch of flood water can cause around $25,000 of damage to your home, according to the Federal Emergency Management Agency (FEMA).

Connecticut homeowners can get flood insurance through the National Flood Insurance Program (NFIP) or a private insurance company. In addition, some Connecticut home insurance companies, like Narragansett Bay and Chubb, sell flood insurance as an add-on to your home insurance policy.

Does home insurance in CT cover wind damage?

Homeowners insurance usually pays for damage caused by high winds.

This includes everything from thunderstorm winds to hurricane-force winds. Storm winds could blow off roof shingles or siding, or cause a tree to fall on your home.

If your home is near the coast or in an area with frequent high winds, your insurance policy may have a separate wind deductible. This deductible is usually between 2% and 5% of your dwelling coverage limit.

How to get the best homeowners insurance in Connecticut

The best insurance companies in CT offer a mix of affordable rates, useful coverage and helpful customer service. To find the best company for you, shop around for quotes, compare coverage options and consider customer feedback.

Get home insurance quotes from multiple companies. There's a difference of $1,399 per year between the most and least expensive home insurance companies in CT.

In addition, each company calculates rates differently. Insurance companies may consider the style of your home, its location, your insurance history and many other factors. So the cheapest policy for you may be different than the best option for your neighbors, family or friends.

Compare coverage options. Most basic home insurance policies are fairly similar. However, a standard policy may not offer enough coverage for you. In that case, it's important to find a company that has the right mix of coverage add-ons to fully protect your home.

For example, if you own a historic home in Connecticut, you should consider MAPFRE. The company offers a special package called restorationist coverage with protection tailored to antique homes. Or, if your home is near a river or the Atlantic coast, you might consider Narragansett Bay for its flood insurance coverage.

Look for excellent customer service reviews. It's important that you can count on your home insurance company to take care of you if your home is ever damaged.

Companies with excellent customer service reviews are more likely to have an easy claims process and help you repair your home quickly. On the other hand, poor customer service could lead to a lot of back and forth with the insurance company. And, you could end up paying more to fix your house.

Frequently asked questions

What is the average home insurance cost in CT?

Home insurance costs an average of $2,119 per year in Connecticut. That's 1% less than the national average, which is $2,151.

What is the best home insurance in Connecticut?

State Farm has the best home insurance for most people in Connecticut because of its low monthly rates, reliable customer service and availability.

What is the cheapest home insurance in Connecticut?

State Farm has the cheapest rates in Connecticut at $1,290 per year, 39% below the state average. Allstate, Amica and Narragansett Bay also offer rates below the state average.

Does CT require home insurance?

The state of Connecticut doesn't require you to have home insurance. However, if you have a mortgage, your lender typically requires you to buy a policy.

How much is home insurance in Fairfield, CT?

Homeowners insurance in Fairfield costs an average of $2,207 per year. That's 4% more expensive than the Connecticut state average.

Methodology

To find the best home insurance in Connecticut, ValuePenguin collected quotes from nine of the top home insurance companies in the state. Rates are for a 45-year-old married man with good credit and no prior home insurance claims. Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Home insurance ratings are based on complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey, as well as ValuePenguin's ratings from the editorial staff.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.