The Best and Cheapest Home Insurance Companies in Idaho (2024)

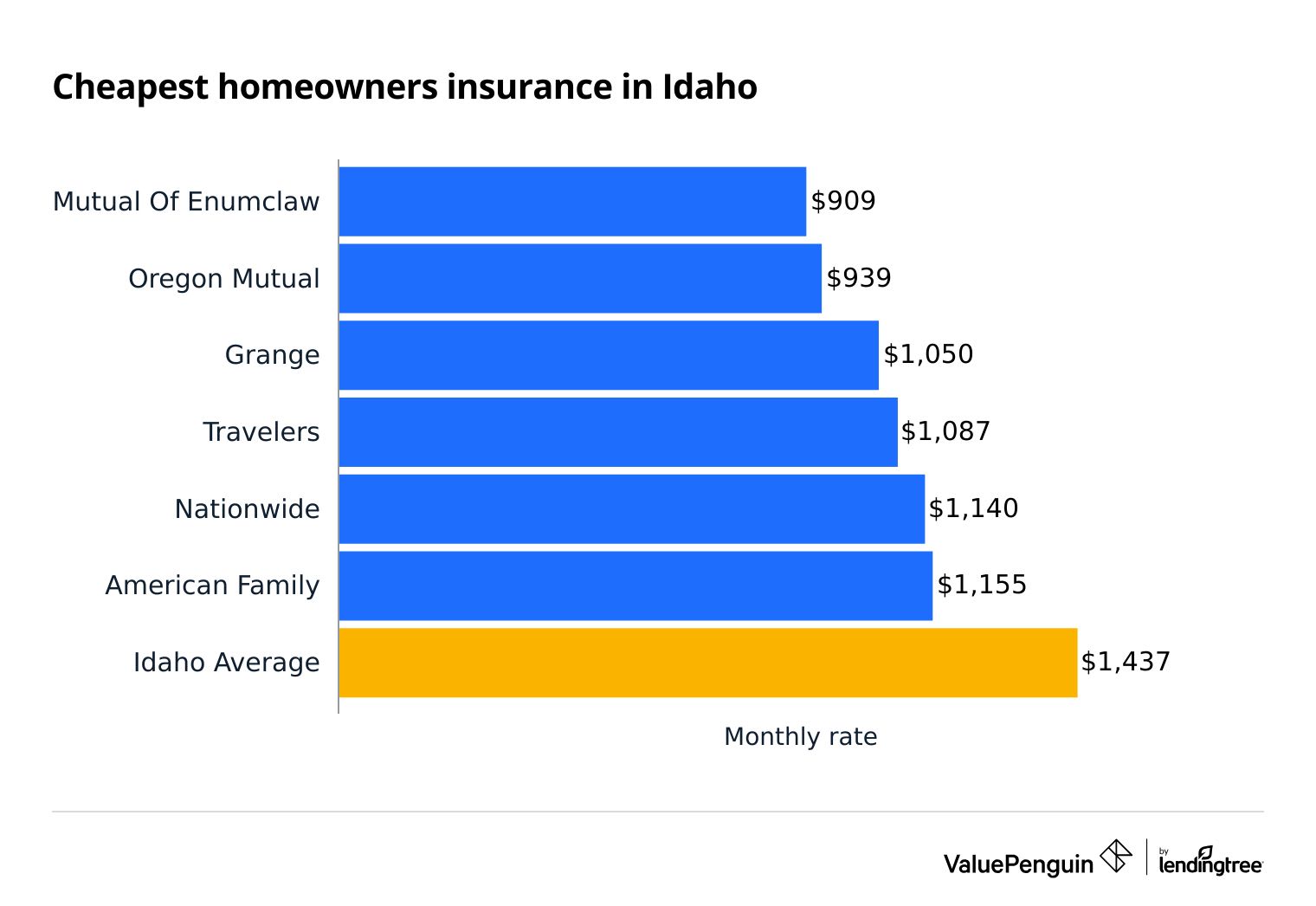

Mutual of Enumclaw is the cheapest homeowners insurance company in Idaho, with an average rate of $909 per year.

Compare Home Insurance Quotes from Providers in Idaho

Best Cheap home Insurance in Idaho

ValuePenguin collected thousands of quotes across hundreds of ZIP codes from Idaho's top home insurance companies.

Our experts compared cost, customer service, reliability and coverage benefits to find the best insurance companies in ID.

Cheapest options for homeowners insurance in Idaho

Mutual of Enumclaw offers the cheapest rates for home insurance in Idaho, at $909 per year for $350,000 of coverage.

Mutual of Enumclaw edges out Oregon Mutual, which charges an average of $939 per year. Grange and Travelers also offer cheaper-than-average rates.

The average cost of home insurance in Idaho is $1,437 per year. That's considerably cheaper than the average rate nationally: $2,151 per year.

Compare Home Insurance Quotes in Idaho

Mutual of Enumclaw also has the best rates for higher coverage levels. For $1 million of dwelling coverage, Enumclaw's average quote of $1,965 per year is 45% less than the state average.

Cheap annual home insurance in Idaho

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Oregon Mutual | $613 | |

| Mutual Of Enumclaw | $633 | ||

| Grange | $657 | ||

| Travelers | $662 | ||

| Nationwide | $738 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Oregon Mutual | $613 | |

| Mutual Of Enumclaw | $633 | ||

| Grange | $657 | ||

| Travelers | $662 | ||

| Nationwide | $738 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Mutual Of Enumclaw | $909 | ||

| Oregon Mutual | $939 | |

| Grange | $1,050 | ||

| Travelers | $1,087 | ||

| Nationwide | $1,140 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Mutual Of Enumclaw | $1,169 | ||

| Oregon Mutual | $1,359 | |

| Grange | $1,475 | ||

| Nationwide | $1,558 | ||

| Travelers | $1,562 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Mutual Of Enumclaw | $1,965 | ||

| Nationwide | $2,888 | ||

| Oregon Mutual | $2,966 | |

| Grange | $3,012 | ||

| American Family | $3,083 | ||

What home insurance do I need in Idaho?

Wildfires are common in the forests of Idaho, so people who live in wooded areas should look for a policy that includes wildfire coverage.

Most basic home insurance policies cover wildfire damage in Idaho. However, your insurance company may exclude wildfire coverage if your home is in a high-risk area.

If your insurance doesn't cover wildfire damage, you should consider buying a separate fire insurance policy.

Best ID home insurance for most people: Mutual of Enumclaw

-

Editor's rating

- Cost: $909/yr

Mutual of Enumclaw has the cheapest rates in Idaho, plus well-liked customer service and coverage options.

Pros:

-

Cheapest home insurance in Idaho

-

Offers wildfire coverage

Cons:

-

No online quotes

-

Must work with an agent to buy

Enumclaw is the best option in Idaho for most homeowners because of its great rates, useful coverage options and stellar service.

It offers the best price for home insurance in the state across a wide range of coverage levels, from a basic $100k policy, all the way to $1 million in coverage.

Wildfire protection is a highlight of Enumclaw home insurance policies. If there's a wildfire in your area, Mutual of Enumclaw will dispatch a fire protection service to help keep your home safe, for free.

The only potential downside to Mutual of Enumclaw is that it's only available through an independent insurance agent. You can't get a quote online, so it may be slower to get coverage.

Best coverage options: Travelers

-

Editor's rating

- Cost: $1,087/yr

Travelers has lots of coverage options, plus cheap rates and convenient online quotes.

Pros:

-

Customizable coverage options

-

Affordable prices

-

Online quotes

Cons:

-

Mediocre customer service

-

Few discounts

-

Bad for bundling

Travelers offers a wide range of coverage options beyond standard choices like dwelling coverage and personal property coverage:

- Contents replacement cost

- Additional replacement cost protection coverage

- Jewelry and valuable items coverage

- Water backup and sump pump discharge/overflow coverage

- Identity fraud

- Green home coverage

Homeowners will find good, but not amazing prices for home insurance at Travelers. Home insurance prices from the company are 24% less than the state average, but still about $200 more per year higher than at Mutual of Enumclaw.

Unfortunately, Travelers doesn't offer a lot of discounts to help reduce what you pay. And it's a bad choice for bundling with your car insurance because its auto rates tend to be high — offsetting what you might save with a bundle discount.

Customer service at Travelers is about average. It has relatively few complaints from customers, but fared poorly in a customer satisfaction survey from J.D. Power.

Best-rated customer service: Farm Bureau

-

Editor's rating

- Cost: $3,296/yr

Farm Bureau has top-tier service, but its rates are very high.

Pros:

-

Exceptional customer service

-

Plenty of useful coverage add-ons

Cons:

-

Very expensive

-

No online quotes

Farm Bureau offers strong customer service for Idaho residents, as well as a strong set of coverage options. The company has a low rate of complaints when it comes to home insurance, according to the National Association of Insurance Commissioners (NAIC).

However, Farm Bureau's quotes are the highest in Idaho. For a $350,000 policy, it charged $3,296 per year — more than double the average price in Idaho, and three times as much as Mutual of Enumclaw.

Farm Bureau also doesn't give quotes online. You'll have to reach out to the company to get a quote.

Best for mobile homes: Foremost

-

Editor's rating

Foremost offers mobile home insurance with a dependable service and a broad selection of coverage options.

Pros:

-

Coverage tailored to mobile homes

-

Few customer complaints

Cons:

-

Online quotes not available

-

Few discounts

If you own a mobile home in Idaho, Foremost is a worthy option. The subsidiary of Farmers is one of only a few options for mobile home insurance, and it has useful coverage options that you won't find everywhere. It has options for agreed loss settlement coverage, and covers additional living expenses, debris removal and even your lawn and trees after a catastrophe.

The lighter construction of a mobile home means an event like a storm or flood has a better chance of totally destroying your home. That only increases the need to have solid coverage. One drawback with Foremost is you will need to work with an agent for a quote, though mobile home insurance usually isn't available online.

Average home insurance cost in Idaho

The average price of home insurance in Idaho is $1,437 per year for $350k of dwelling coverage

That's 33% cheaper than the national average of $2,151 per year.

Average cost of home insurance in ID by dwelling coverage amount

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $988 |

| $350,000 | $1,437 |

| $500,000 | $1,932 |

| $1,000,000 | $3,578 |

Homeowners insurance in Idaho is about average compared to neighboring states. Oregon and Nevada are slightly cheaper, while Montana homeowners can expect to pay about 74% more than Idaho residents.

Idaho home insurance rates by city

Idaho's cheapest home insurance rate can be found in Meridian, Idaho's second-largest city, at $1,341 per year.

Fenn, a small town near the Washington border, has the highest rate, at $1,619 per year.

Where you live can affect rates because of factors such as crime, weather and natural disasters. Idaho has a relatively small price difference between cities, with only a 20% gap between the cheapest from the most expensive.

Boise and Nampa, two of the state's other largest cities, both have below average rates.

City | Annual rate | % from avg |

|---|---|---|

| Aberdeen | $1,529 | 6% |

| Ahsahka | $1,491 | 4% |

| Albion | $1,427 | -1% |

| Almo | $1,415 | -1% |

| American Falls | $1,507 | 5% |

Rates are for a policy with $350,000 of dwelling coverage.

Best-rated homeowners insurance companies in Idaho

The home insurers we rated as the best in Idaho are USAA and Mutual of Enumclaw. Each offers a blend of good coverage options and strong service. Mutual of Enumclaw, Farm Bureau and State Farm are also highly-rated options.

It's worth noting that Idaho companies with great service often have high prices. Farm Bureau in particular has the highest rates for home insurance in the state.

Idaho home insurance company reviews

Company |

Rating

|

Complaints

|

|---|---|---|

| USAA | Low | |

| Mutual Of Enumclaw | Low | |

| State Farm | Average | |

| Farm Bureau | Low | |

| Grange | Low |

When buying the best homeowners insurance in Idaho, it's important to consider customer service, not just price.

Excellent customer service will make your life much easier if you need to fix or replace your home or belongings after an accident. On the other hand, bad service could make it take longer to fix your home, and cost more money on repairs.

What home insurance do I need in Idaho?

Wildfires are one of the largest threats to homeowners in Idaho, so it's essential to buy a policy that covers wildfire damage.

Idaho's mountainous terrain means that it's also a good idea to talk to your insurance provider about protection from mudslides or landslides if you live in a hilly area.

Does ID home insurance cover wildfires?

Standard homeowners insurance policies protect you from fire, including wildfires. However, if you live in an area that's at high risk of wildfires, it's possible that some insurers will decline to sell you fire insurance. Every insurance company calculates risk differently, so you may need to call several insurers to get a quote.

If you live in an area with a lot of fires and can't get a standard home insurance policy that covers wildfires, you may also be able to buy a separate wildfire insurance policy.

Does Idaho home insurance cover earthquakes?

No, standard home insurance almost never covers earthquakes or other kinds of earth movement, like mudslides.

If your home is located in an area at risk for earthquakes or rock slides, talk to your home insurance company about buying earthquake insurance.

Methodology

To find the best homeowners insurance in Idaho, ValuePenguin collected quotes from the top companies across every residential ZIP code in the state. Rates are for a 45-year-old married man with no prior insurance claims.

Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. Quadrant's rates were publicly sourced from insurer filings and should only be used for comparative purposes.

Home insurance ratings are based on complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey, and ValuePenguin's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.