Grange Insurance Review: Strong Coverage Options, but Expensive

Grange Insurance is good if you want flexibility for different coverage options, but its rates are higher than average.

Find Cheap Auto Insurance Quotes in Your Area

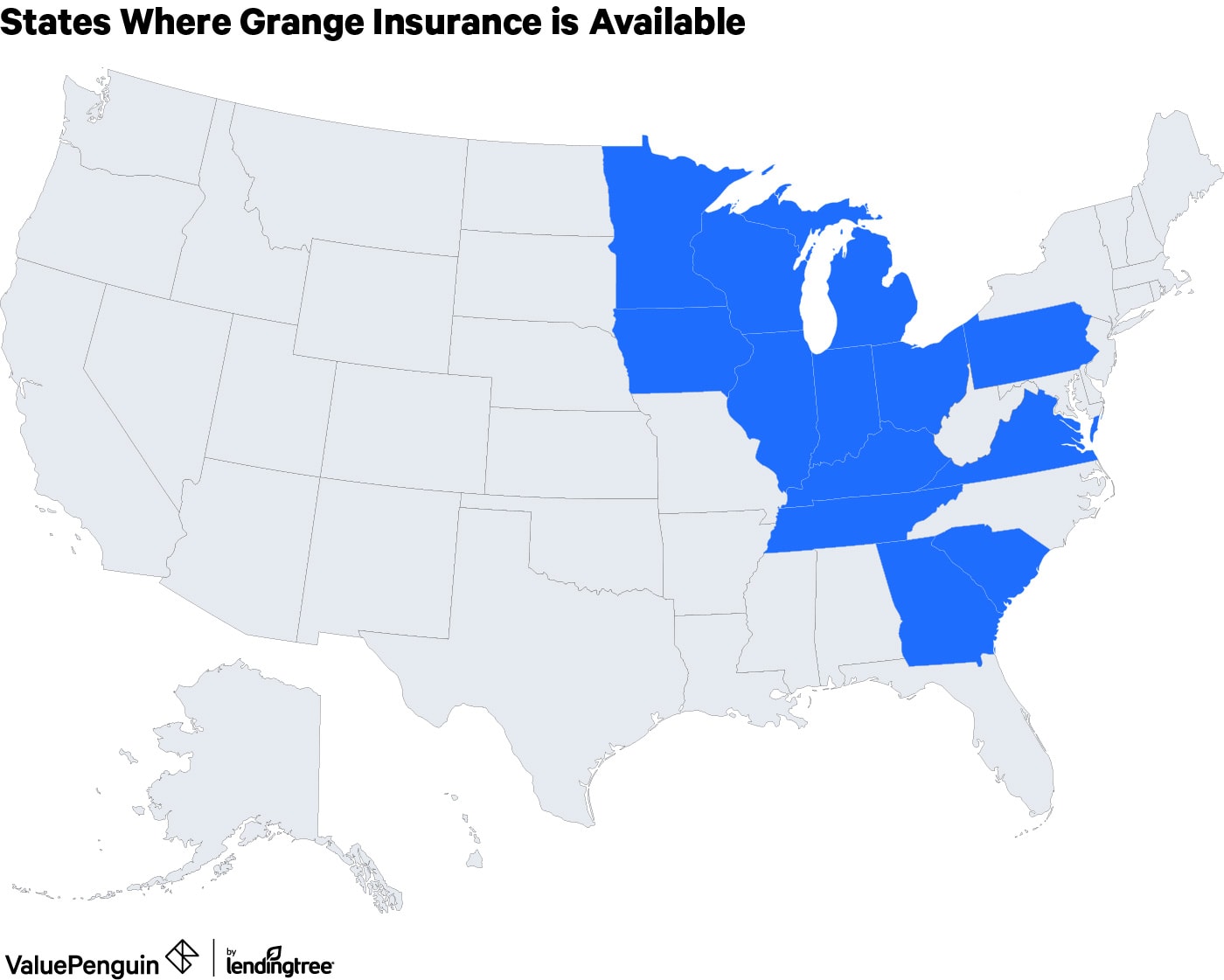

Grange Insurance is a reasonably good insurance company for those who live in the 13 states where it's available.

Grange stands out for its policy customization and flexibility. A wide selection of coverage options are available, such as cracked windshield replacement or coverage for family members in assisted living.

However, quotes for car and home insurance are slightly more expensive than average. Grange also has mixed customer satisfaction.

Pros and cons

Pros

Extra coverage for home and auto policies

Discounts for safe drivers

Helpful independent agents

Cons

Expensive rates

Can't get a quote online

Only available in 13 states

Grange Insurance: our thoughts

Grange may be a good choice if you're willing to pay more for a company that offers specialty add-ons. Options include personal cyber-security insurance, identity theft protection, coverage for manufacturer car parts, roadside assistance packages and more.

Insurance from Grange is only available through independent agents. This means you can't simply go on the company's website to get a price like you can with many other insurers. You'll have to pick up the phone or visit an insurance agency to get a quote.

Quotes from Grange are higher than some major insurers. For example, Grange's car insurance policies cost 7% to 25% more than average, and its home insurance plans cost 16% more than average.

If you're looking for the cheapest rates, consider Erie Insurance or State Farm, both of which tend to have good prices.

Where is Grange Insurance available?

Grange Insurance is available in 13 states, mostly in the Midwest and Southeast: Georgia, Illinois, Indiana, Iowa, Kentucky, Michigan, Minnesota, Ohio, Pennsylvania, South Carolina, Tennessee, Virginia and Wisconsin.

Grange is based in Columbus, Ohio, and does the most business in Ohio.

Grange auto insurance

Grange car insurance quote comparison

Grange's car insurance rates are usually more expensive than average. However, minimum coverage policies tend to be a better deal than full coverage.

Find Cheap Auto Insurance Quotes in Your Area

Minimum coverage policies from Grange cost about $44 per month, which is 7% more than average.

Full coverage policies from Grange cost about $136 per month. That's 25% more expensive than average.

Minimum coverage

Full coverage

Grange car insurance rates vs. competitors

Company | Monthly rate | |

|---|---|---|

| Erie | $23 | |

| Progressive | $29 | |

| Geico | $37 | |

| Grange | $44 | |

| Nationwide | $55 |

USAA is only available to current and former military members and their families.

Minimum coverage

Grange car insurance rates vs. competitors

Company | Monthly rate | |

|---|---|---|

| Erie | $23 | |

| Progressive | $29 | |

| Geico | $37 | |

| Grange | $44 | |

| Nationwide | $55 |

USAA is only available to current and former military members and their families.

Full coverage

Company | Monthly rate | |

|---|---|---|

| Erie | $67 | |

| Geico | $86 | |

| Progressive | $94 | |

| Nationwide | $117 | |

| Grange | $136 | |

| State Farm | $140 | |

| Allstate | $166 | |

| USAA/* | $60 |

USAA is only available to current and former military members and their families.

If you've had a DUI, minimum coverage through Grange is 6% cheaper than average, at $58 per month.

But if you're a teen driver, Grange is very expensive. An 18-year-old pays about 28% more with Grange.

Savings highlight: safe driving discount

Safe drivers can save by using the OnTrack app, a telematics program that tracks your driving habits.

You'll get a 10% discount for signing up, and you could save an additional 25% based on when you drive, the types of roads you use, your mileage and any hard braking.

Grange only uses your driving data to give you a discount, and your rates won't go up because of your driving behaviors.

With most other companies that have an app, you run the risk of paying a higher premium based on your driving behavior. Grange and Nationwide are the two main exceptions.

Grange auto insurance coverages

Even though Grange is a regional insurance company, it provides a solid range of additional coverages beyond the basics.

For example, you can get glass repair coverage to fix a cracked windshield without paying a deductible. You can also get original equipment manufacturer (OEM) parts coverage, which means that aftermarket parts won't be used to repair your car after an accident. Instead, parts from your car's manufacturer will be used whenever possible.

Grange auto insurance coverage options

- Roadside assistance: Pays for the cost of a tow truck, locksmith, fuel delivery or tire change if you're stuck on the side of the road. Some packages also cover lodging if you're stranded far from home.

- Glass repair: Covers the full cost to fix your windshield, with no deductible.

- Pet injury: Pays for medical care of your pet if it's injured due to a covered crash or incident.

- Mobile device: Pays for damage to your phone if it's damaged during an accident.

- Identity theft: Pays for expenses related to having your identity stolen.

- OEM parts coverage: Repairs to your car after a covered crash will be made using genuine manufacturer parts.

- Loan/lease gap coverage: Pays the difference between your car's value and the amount you have left on your loan or lease, should your car get totaled or stolen.

- Rental reimbursement coverage: Helps cover your transportation costs when your car is in the shop after an accident.

Grange home insurance

Grange homeowners insurance quote comparison

Grange home insurance costs about $1,020 per year, which is around 16% more than average.

Find Cheap Homeowners Insurance Quotes in Your Area

Companies such as Cincinnati Financial, Erie and State Farm have much cheaper rates for home insurance.

Homeowners insurance rates

Company | Annual rate | |

|---|---|---|

| Cincinnati Financial | $528 | |

| Erie | $756 | |

| State Farm | $756 | |

| American Family | $864 | |

| Nationwide | $900 |

USAA is only available to current and former military members and their families.

Savings highlight: DIY home inspection discount

Grange gives you a home insurance discount if you use its app to do a virtual insurance inspection, rather than having an insurance inspector come to your home.

This discount is not offered by many insurance companies. It's a convenient way to save, and the app lets you easily upload photos of your home.

Grange also offers discounts for bundling policies, new homeowners, getting a quote early, some types of home maintenance and some smart home alarms.

Grange home insurance coverage options

In addition to the standard coverages for dwelling, personal property and liability, Grange offers additional protection options:

- Underground service live coverage: Covers repairs to buried utilities such as internet, cable, water, heat or waste.

- Furnace and central air coverage: Helps pay for repairs if your HVAC equipment breaks down.

- Assisted living coverage: Covers a family member's belongings if they're in an assisted living facility.

- Identity theft and personal cyber insurance: Pays for expenses related to having your identity stolen and the financial cost of a cyber attack.

- Umbrella insurance: Gives you additional liability coverage on top of your home and auto policies.

- High-value property coverage: Can be used to cover jewelry, art, collectables, expensive equipment or other high-value items.

- Back-up of drains and sewers: Pays for damage if your drain lines back up into your home.

Grange auto insurance reviews and ratings

Grange Insurance has mixed customer satisfaction.

The company has a below-average customer satisfaction for auto insurance, according to J.D. Power's annual survey. However, the company receives 9% fewer formal complaints than a typical insurer of its size, according to the National Association of Insurance Commissioners (NAIC).

Grange Insurance is on stable financial footing. Grange's "A" rating from A.M. Best indicates an "excellent" ability to pay out claims regardless of financial climate or other mitigating factors.

Grange Insurance subsidiaries

- Grange Indemnity Insurance Company

- Grange Insurance Company of Michigan

- Grange Life Insurance Company

- Grange Mutual Casualty Company

- Grange Property & Casualty Insurance Company

- Integrity Mutual Insurance Company

- Integrity Property & Casualty Company

- Integrity Select Insurance Company

- Trustgard Insurance Company

Note that Grange Insurance is not affiliated with Grange Insurance Association, based in Seattle, or National Grange Insurance, based in Keene, N.H.

Frequently asked questions

Is Grange a good insurance company?

Grange is a mediocre insurance company. It has good coverage options and discounts. However, its rates are not the cheapest, and its customers are less satisfied than average.

Where is Grange Insurance available?

Grange sells insurance in 13 states across the Midwest and Southeast: Georgia, Illinois, Indiana, Iowa, Kentucky, Michigan, Minnesota, Ohio, Pennsylvania, South Carolina, Tennessee, Virginia and Wisconsin.

What is the phone number for Grange Insurance?

Grange Insurance's 24-hour claims phone line: 800-445-3030. For Grange Insurance customer care or billing questions, call 800-422-0552, Monday through Friday, 8 a.m. to 5:30 p.m. Eastern.

Methodology

ValuePenguin's analysis is based on quotes from hundreds of ZIP codes across Ohio for the largest insurers in the state. Unless otherwise noted, rates are based on a 30-year-old man with a clean driving record and good credit who has a 2015 Honda Civic EX.

Quotes for full coverage car insurance policies include comprehensive and collision coverage, with liability limits that are higher than the Ohio state requirements.

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Medical payments coverage | $10,000 |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

Quotes for home insurance are based on the median home value in Ohio, according to U.S. Census data.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.