Best and Cheapest Home Companies in Kentucky (2024)

Cincinnati Financial has Kentucky's cheapest home insurance, with an average rate of $1,379 per year.

Compare Home Insurance Quotes in Kentucky

Best Cheap Home Insurance in Kentucky

ValuePenguin gathered thousands of quotes for Kentucky home insurance across every ZIP code in the state. Our insurance experts used average rates, coverage options, discounts and customer satisfaction ratings to choose the companies to highlight as the best and cheapest. Full methodology.

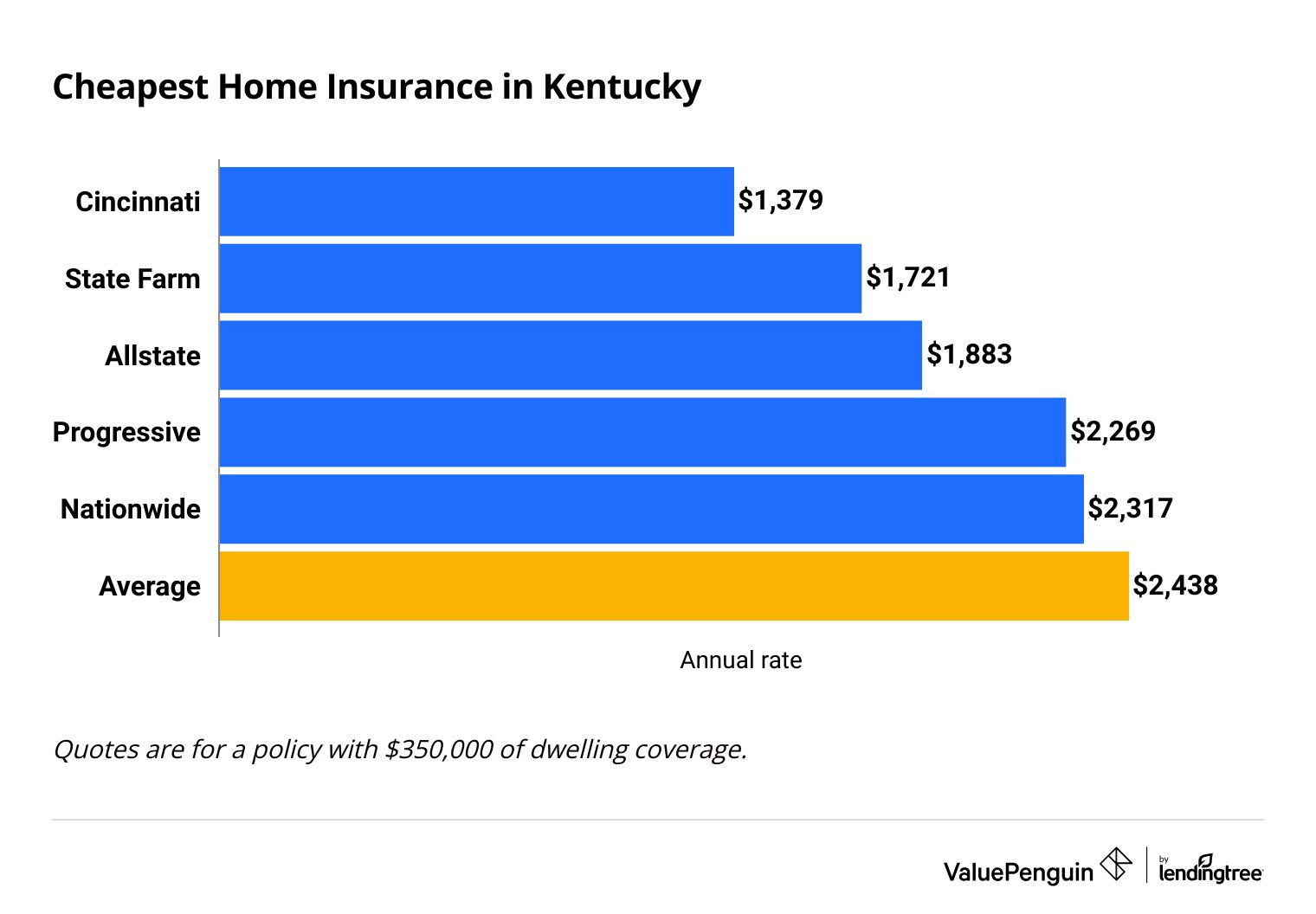

Cheapest homeowners insurance companies in Kentucky

Cincinnati Financial has the cheapest and best home insurance in Kentucky for most people.

Cincinnati's average rate for a policy with $350,000 in dwelling coverage is $1,379 per year, which is much cheaper than the state average of $2,438.

Compare Home Insurance Quotes in Kentucky

While cost is important, it's not the only part of your home insurance quote you should think about. Make sure you understand the coverage you need as well. Getting a cheap quote with poor coverage isn't a good financial decision.

Cheap home insurance in Kentucky

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Cincinnati | $940 | ||

| Allstate | $1,063 | ||

| State Farm | $1,201 | ||

| Nationwide | $1,513 | ||

| Progressive | $1,683 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Cincinnati | $940 | ||

| Allstate | $1,063 | ||

| State Farm | $1,201 | ||

| Nationwide | $1,513 | ||

| Progressive | $1,683 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Cincinnati | $1,379 | ||

| State Farm | $1,721 | ||

| Allstate | $1,883 | ||

| Progressive | $2,269 | ||

| Nationwide | $2,317 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Cincinnati | $1,963 | ||

| State Farm | $2,298 | ||

| Allstate | $2,859 | ||

| Westfield | $2,930 | ||

| Progressive | $3,052 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Westfield | $3,743 | ||

| Cincinnati | $3,881 | ||

| State Farm | $3,995 | ||

| Progressive | $5,187 | ||

| Allstate | $6,138 | ||

Severe weather in Kentucky

Flooding, earthquakes and even tornadoes can damage homes in Kentucky. Home insurance usually covers tornado damage, but you need an add-on for earthquake coverage and a separate policy for flood coverage.

Best and cheapest home insurance in Kentucky: Cincinnati Financial

-

Editor's rating

- Cost: $1,379/yr

Cincinnati has cheap rates and excellent customer service.

Pros:

-

Cheap rates

-

High customer satisfaction

-

Local agents

-

Few discounts

-

No online quotes

Cincinnati Financial is the best home insurance company in Kentucky for most people. A home insurance policy with $350,000 in dwelling coverage costs $1,379 per year, on average, making it the cheapest average rate in the state. The company also has cheap rates for homes that are cheaper to rebuild.

Cincinnati also has excellent customer service, with 78% fewer complaints than an average company its size, according to the National Association of Insurance Commissioner (NAIC). Choosing a company with good customer service can mean less stress and a smoother process if you have to file a claim.

But Cincinnati doesn't offer online quotes, so it's not the best choice if you want to buy your policy online. You have to work with a local agent to get a quote and buy a policy. The company also doesn't have as many discounts as its competitors, but with its cheap rates, that might matter less.

Best home insurance in Kentucky for local agents: State Farm

-

Editor's rating

- Cost: $1,721/yr

State Farm's local agents can give you personalized insurance guidance.

Pros:

-

Local agents

-

Cheap rates

-

Good customer service

-

Fewer discounts than other companies

-

Not many add-on coverages

State Farm is the best home insurance company in Kentucky if you want to work with a local agent. The company has agents in 120 cities in Kentucky, so it's likely you'll find an agent near you. Working with a local agent can help you feel confident that you are getting the right coverage.

State Farm has cheap rates for Kentucky home insurance. It also has cheap car insurance in Kentucky. If you want to bundle your coverage, it's a good choice.

But State Farm doesn't have as many other discounts or add-on coverage options as some other companies. You might have a harder time personalizing your coverage to your specific needs. Because of that, State Farm is only a good choice if you need a basic policy. If you need extra coverage, Auto-Owners is a better choice.

Best Kentucky home insurance coverage and discounts: Auto-Owners

-

Editor's rating

- Cost: $3,050/yr

Auto-Owners lets you personalize your insurance with add-ons and discounts.

Pros:

-

Lots of extra coverage options

-

Numerous discounts

-

Good customer service

-

High rates

-

No online quotes

Auto-Owners is a great option for personalized home insurance in Kentucky. The company has numerous add-on coverages that can help you build a policy that is unique to your needs.

For example, if you're concerned about online security, you could add Auto-Owners' home cyber protection coverage, which pays for professional help if your data is stolen or your computer is infected with ransomware.

Auto-Owners also offers inland flood insurance coverage that you can add to your home insurance policy. This is a huge perk for Kentucky homeowners, because flooding is a concern throughout much of the state. Homeowners usually have to buy a separate flood insurance policy to get coverage.

But Auto-Owners has high rates for Kentucky home insurance. It's not a good option if you're on a budget or if price is more important to you than coverage. The company has many discounts to help you save, including savings for being mortgage-free and having an automatic generator. But you can still probably find a cheaper price with another company.

What is the average cost of home insurance in Kentucky?

Home insurance in Kentucky costs $2,438 per year, on average, for a policy with $350,000 in dwelling coverage.

It costs more to insure a home in Kentucky than it does in nearby Indiana or Ohio, where average rates are $2,144 and $1,436 per year, respectively. That's likely because homes have a higher risk for damage in Kentucky due to the risk of severe weather, which means you're more likely to file a claim. But Tennessee homeowners pay even more, with an average rate of $2,818 per year.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,721 |

| $350,000 | $2,438 |

| $500,000 | $3,295 |

| $1,000,000 | $6,085 |

The more coverage you need, the more you'll pay for home insurance. That's because when your home is more expensive, it will cost the insurance company more to fix if you file a claim.

Kentucky home insurance rates by city

Fort Thomas, in northern Kentucky near Cincinnati, OH, has the cheapest home insurance rates in the state, at $1,939 per year.

In Louisville, Kentucky's largest city, home insurance costs $2,598 per year for $350,000 in dwelling coverage. That's 7% more than the state average.

Tiline, a small river town in western Kentucky near the Illinois border, has the most expensive home insurance. Average rates in the area are $3,783 per year, which is 55% higher than the state average.

City | Annual rate | % from avg |

|---|---|---|

| Aberdeen | $3,025 | 24% |

| Adairville | $2,981 | 22% |

| Adams | $3,322 | 36% |

| Adolphus | $2,832 | 16% |

| Ages Brookside | $3,129 | 28% |

Rates are for a policy with $350,000 of dwelling coverage.

The best-rated homeowners insurance companies in Kentucky

Auto-Owners and Cincinnati Financial are the best-rated home insurance companies in Kentucky.

Both companies have excellent customer service and very few complaints. But Auto-Owners does have high average rates, so it's not a good option if you're on a budget.

Company |

Rating

|

Complaints

|

|---|---|---|

| Auto-Owners | Low | |

| Cincinnati | Low | |

| State Farm | Average | |

| Westfield | Low | |

| Farm Bureau | Average |

Common causes of home damage in Kentucky

Kentucky might not be the first place that comes to mind when it comes to severe weather. But tornadoes, earthquakes and floods can all damage Kentucky homes. Understanding how home insurance covers these events can help you make sure you have good coverage.

Does home insurance in Kentucky cover tornadoes?

Home insurance almost always covers tornado damage. Tornadoes are becoming increasingly common in Kentucky as "Tornado Alley" shifts to the east. Kentucky had 41 tornadoes in 2023.

Even though tornado damage is covered, you might pay a higher "wind/hail" deductible when you file a claim. If you're shopping for insurance, pay attention to the deductible options so you know what you would have to pay if a tornado hits your home. If you already have a policy, check your documents or talk to your agent to see if you have a wind/hail deductible.

Does Kentucky home insurance cover earthquakes?

Home insurance does not automatically cover earthquake damage. You have to buy an earthquake add-on to have coverage. If you're in an area with a high risk for earthquakes, you might need a separate earthquake policy.

Kentucky lies close to a few different fault lines, most notably the New Madrid Seismic Zone in the western part of the state. Although Kentucky hasn't had a large earthquake in a while, they have happened in the past and could happen again.

Does home insurance in Kentucky cover flooding?

Home insurance never covers damage from floods. You have to buy a separate flood insurance policy if you want coverage for flood damage.

Nearly every county in Kentucky has had a flood since 1953, as far back as records go. Even though the state is landlocked, floods can still happen when heavy rains don't have time to soak into the ground, or when rivers or lakes jump their banks. You can use the flood zone tool from the Federal Emergency Management Agency (FEMA) to figure out how likely your home is to flood.

How to save on home insurance in Kentucky

Kentucky home insurance rates can be expensive, depending on where you live in the state. But you might be able to get a lower rate.

Shop around. Comparing home insurance quotes can save you thousands of dollars per year. Different insurance companies charge different rates for the same coverage. Shopping around lets you find the cheapest rate for the coverage you need.

Maintain your roof. Old or worn down roofs are more likely to be damaged, and could even let in water that damages your ceiling or walls. If you keep your roof in good condition, you'll lower your risk for needing to file a claim, which reduces your rates. And if you replace your roof, you'll probably get a home insurance discount.

Install a water sensor. A water sensor can alert you when water is somewhere in your home that it shouldn't be, like in your basement or bathrooms. Sensors can help you catch leaks, overflows and floods while you still have a chance to lessen the damage. Some insurance companies will give a discount for these sensors.

Frequently asked questions

How much is home insurance in Kentucky?

The average cost of home insurance in Kentucky is $2,438 per year for $350,000 in dwelling coverage. But rates depend on where you live, how much coverage you need, if you have a history of home insurance claims and more. Your price will probably be different.

Who has the cheapest home insurance in Kentucky?

Cincinnati Financial has the cheapest home insurance in Kentucky, with an average rate of $1,379 per year for $350,000 in dwelling coverage. That's far cheaper than the state average.

Who has the best home insurance in Kentucky?

Cincinnati Financial has the best home insurance in Kentucky because of its low rates and excellent service. But if you want a local agent, State Farm is also a great choice. Auto-Owners is good if you want a lot of options for add-ons and discounts, but its average rates are high.

Methodology

To compare the rates of Kentucky's largest home insurance companies, ValuePenguin studied quotes from every ZIP code in Kentucky. The quotes use a 45-year-old man with no home insurance claims as the homeowner and have the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services, which was publicly sourced from insurance filings. These quotes should only be used for comparative purposes.

Home insurance ratings are based on complaint data from the National Association of Insurance Commissioners (NAIC), as well as the J.D. Power customer satisfaction survey and ValuePenguin's own editorial ratings.

Other sources include the Federal Emergency Management Agency (FEMA), KY.gov, the Kentucky Geological Survey and the Storm Prediction Center.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.