Best Cheap Home Insurance in South Dakota (2024)

Auto-Owners has the best home insurance in South Dakota for most people, at $2,107 per year.

Compare Home Insurance Quotes in South Dakota

Best Cheap South Dakota home insurance

To help South Dakota homeowners find the best deal on home insurance, our editors collected and analyzed thousands of quotes and customer satisfaction ratings from the largest South Dakota house insurance companies.

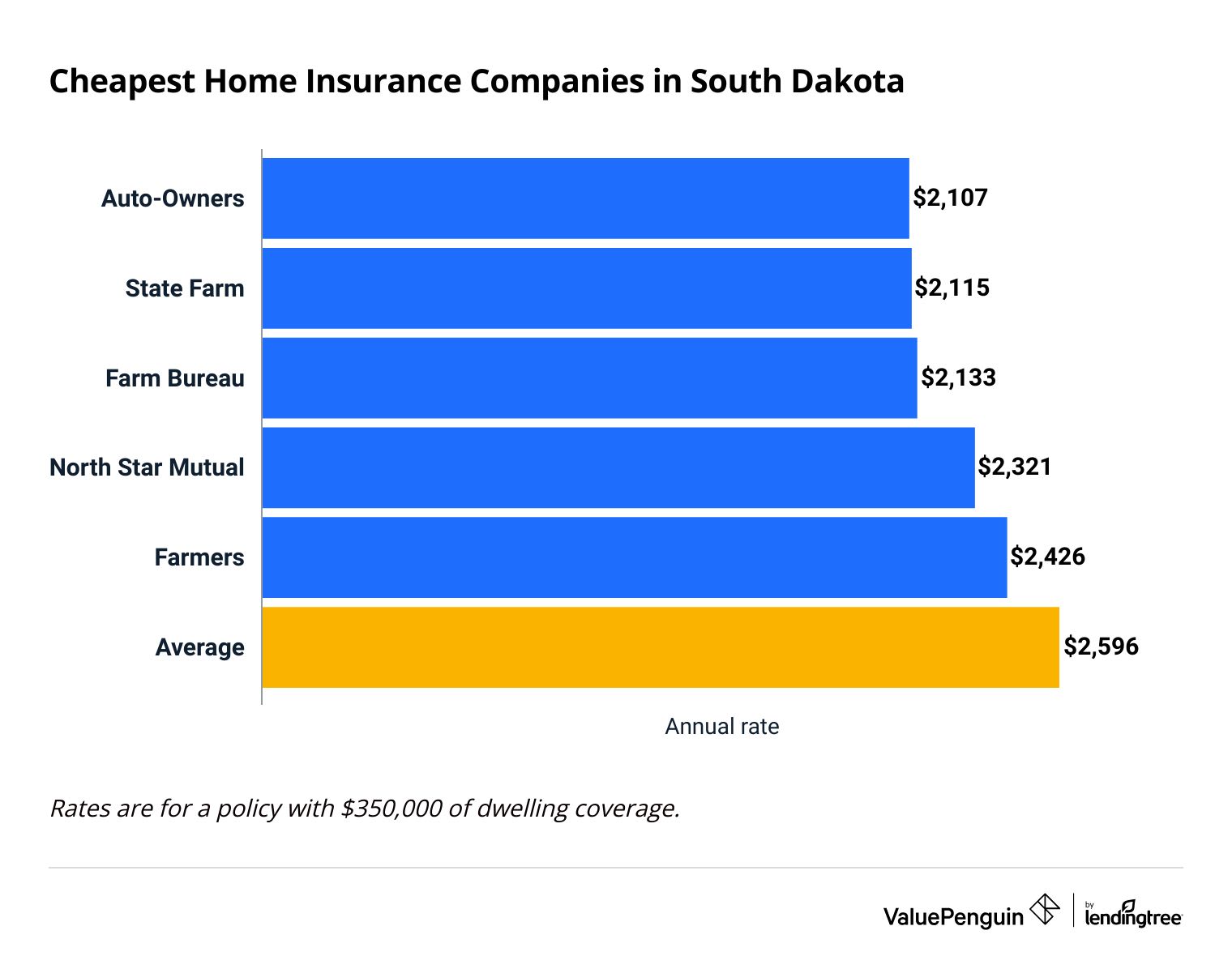

Cheapest homeowners insurance in South Dakota

Farm Bureau, Auto-Owners and State Farm offer the cheapest home insurance rates in South Dakota.

Auto-Owners is the cheapest company for most people, at $2,107 per year for $350,000 of dwelling coverage.

Farm Bureau is the cheapest company for inexpensive homes. It offers $250,000 of dwelling coverage for $1,357 per year. That's $354 per year less than the state average.

Compare Home Insurance Quotes in South Dakota

The amount of coverage you need has a big effect on your home insurance quotes. However, companies also consider factors like where your home is located, your credit score and insurance history. You should always compare quotes from multiple companies to find the best rate for you.

Cheap home insurance quotes in SD by dwelling coverage

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Farm Bureau | $1,357 | ||

| North Star Mutual | $1,367 | |

| State Farm | $1,472 | ||

| Farmers | $1,591 | ||

| Farmers Mutual of Nebraska | $1,635 | |

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Farm Bureau | $1,357 | ||

| North Star Mutual | $1,367 | |

| State Farm | $1,472 | ||

| Farmers | $1,591 | ||

| Farmers Mutual of Nebraska | $1,635 | |

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Auto-Owners | $2,107 | ||

| State Farm | $2,115 | ||

| Farm Bureau | $2,133 | ||

| North Star Mutual | $2,321 | |

| Farmers | $2,426 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $2,827 | ||

| Auto-Owners | $2,872 | ||

| Farm Bureau | $3,008 | ||

| Farmers | $3,126 | ||

| North Star Mutual | $3,463 | |

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Farmers | $4,723 | ||

| State Farm | $4,919 | ||

| Farm Bureau | $5,139 | ||

| USAA | $5,978 | ||

| Auto-Owners | $6,006 | ||

What home insurance do I need in SD?

South Dakota homes are at a high risk for hail damage during the stormy spring and summer seasons.

Most basic home insurance policies cover hail damage. However, your insurance policy may include restrictions for hail damage. It's important to understand what your policy covers so you're prepared in an emergency.

Best South Dakota home insurance for most people: Auto-Owners

-

Editor's rating

- Cost: $2,107/yr

Auto-Owners' cheap rates and excellent customer service make it the best choice for most South Dakota homeowners.

-

Cheap quotes

-

Lots of coverage options and discounts

-

Great customer service

-

Can't get a quote online

Homeowners insurance from Auto-Owners is 3% to 19% cheaper than average in South Dakota, depending on how much coverage you need.

Auto-Owners also offers many discounts to help you lower your insurance bill. Some of its discounts are very easy to get, like the advance quote discount for getting a quote before the start date of your new policy.

There are lots of ways to customize your Auto-Owners coverage with extra protection. For example, you can add coverage that protects your HVAC unit, appliances or computers from damage caused by an electrical or mechanical failure, like a power surge. This is called mechanical breakdown coverage.

Homeowners are typically happy with the service they get from Auto-Owners. It earned one of the top scores on J.D. Power's customer satisfaction survey. Auto-Owners also gets one-third as many complaints as an average company its size, according to the NAIC. That means you can count on Auto-Owners to take great care of you after a disaster.

The main downside to Auto-Owners is that you can't get a quote online, so you must call an independent agent to compare rates.

Cheapest for bundling home and auto insurance in South Dakota: State Farm

-

Editor's rating

- Cost: $2,115/yr

State Farm has very affordable home and auto insurance rates in South Dakota.

-

Affordable home insurance

-

Cheap auto insurance

-

Reliable customer service

-

Few coverage options and discounts

South Dakota homeowners can get insurance from State Farm for 14% to 21% less than the state average, depending on how much coverage you need.

In addition, you can save around 24% by bundling your home and auto insurance with State Farm. The company also offers some of the cheapest car insurance rates in South Dakota.

However, State Farm doesn't offer as many home insurance discounts as most other companies. The only other way to save is by installing a smoke, fire or burglary alarm in your home.

You can expect a fast and fair claims process from State Farm. It earned a good score on J.D. Power's customer satisfaction survey. And State Farm gets fewer customer complaints than an average company its size.

Best insurance company for inexpensive homes in SD: Farm Bureau

-

Editor's rating

- Cost: $1,357/yr

Farm Bureau offers the cheapest rates for inexpensive homes along with reliable customer service.

-

Cheap rates

-

Few customer complaints

-

Limited coverage add-ons

-

Can't compare quotes online

A policy from Farm Bureau costs $1,357 per year for $200,000 of dwelling coverage. That's $354 per year cheaper than the South Dakota average.

Farm Bureau gets very few complaints compared to other insurance companies its size. That means Farm Bureau tends to take good care of its customers after an emergency.

However, Farm Bureau offers fewer coverage add-ons than other insurance companies. So it may not be the best choice if you want to add extra protection to your policy.

In addition, you must sign up for a Farm Bureau membership to buy its home insurance policies. Farm Bureau usually has an membership fee of $20 to $120 per year depending on where you live.

A Farm Bureau membership also comes with benefits unrelated to insurance, like discounts on:

- Hotel stays

- Rental cars

- Car repairs

- Firearms

Average cost of homeowners insurance in South Dakota

The average cost of home insurance in South Dakota is $2,596 per year.

Home insurance in South Dakota can be a little more expensive than other states because of its severe storms. The national average rate for home insurance is $2,151 per year, which is $446 less per year than the South Dakota average.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,710 |

| $350,000 | $2,596 |

| $500,000 | $3,537 |

| $1,000,000 | $6,246 |

South Dakota insurance rates by city

Milbank, a city near the Minnesota border, has the cheapest home insurance rates in South Dakota.

The average cost of home insurance in Milbank is $2,250 per year.

Buffalo Gap is the most expensive city for home insurance in South Dakota, with an average rate of $3,228 per year. Buffalo Gap is a town of fewer than 150 people just north of the Nebraska National Forest.

Cost of homeowners insurance in SD by city

City | Annual rate | % from avg |

|---|---|---|

| Aberdeen | $2,264 | -13% |

| Agar | $2,446 | -6% |

| Agency Village | $2,296 | -12% |

| Akaska | $2,421 | -7% |

| Alcester | $2,551 | -2% |

Rates are for a policy with $350,000 of dwelling coverage.

Best home insurance companies in South Dakota

Auto-Owners and Farm Bureau are the best-rated home insurance companies in South Dakota.

Both companies combine great customer satisfaction ratings with affordable rates.

Top homeowners insurance companies in SD

Company |

Rating

|

Complaints

|

|---|---|---|

| Auto-Owners | Low | |

| Farm Bureau | Low | |

| Farmers Mutual of Nebraska | Low | |

| State Farm | Average | |

| North Star Mutual | Average |

USAA also has outstanding customer service. But policies with USAA are only available to military members and their families, and its policies tend to be expensive in South Dakota.

When shopping for the best home insurance, it's important to consider customer service reviews along with price.

Companies with excellent customer service reviews can make your life easier by offering a quick and fair claims process. Poor customer service reviews could mean you'll need to engage in a lot of back and forth with the insurance company before they pay your claim.

What homeowners insurance coverage do I need in South Dakota?

Due to South Dakota's location and climate, the state has large hail storms in the spring and summer.

In 2023, South Dakota had 61 days with hail storms. The state even holds the record for the largest recorded hailstone in the U.S., which weighed almost 2 pounds. Hail this large and frequent could dent siding on your home, break windows or start a roof leak.

Does South Dakota homeowners insurance cover hail damage?

Almost all home insurance companies cover hail damage under their standard homeowners policy.

So you don't need to get a specific hail insurance policy like you would for flooding.

However, if you live in an area with frequent hail storms, your insurance company may decide not to cover cosmetic hail damage. For example, if hail dents your siding but doesn't cause a leak, your insurance company may not pay to replace it.

Some insurance policies may also have a separate hail deductible that's higher than your normal deductible. That means you could end up paying more if hail damages your home.

If you have a hail deductible, make sure you have enough money saved to cover it in case of an emergency.

How to find the best cheap home insurance in South Dakota

The best home insurance companies offer great customer service and helpful coverage at an affordable price. To find the best home insurance for you, start by deciding how much coverage you need. Then, you should compare quotes from multiple companies and read customer service reviews.

Figure out how much coverage you need. Most basic homeowners insurance policies come with the same types of coverage, like protection for the structure of your home and your belongings. However, some homeowners may want or need to add more protection to their policy.

For example, Auto-Owners offers mechanical breakdown coverage for an extra fee.

This coverage pays to fix or replace electronics or appliances damaged by mechanical or electrical failure. This is especially important if you live in an area with lots of thunderstorms, because a power surge can cause lots of damage.

Shop for quotes from multiple companies. There's a difference of $1,466 per year between the most and least expensive home insurance companies in South Dakota. That could add up to a savings of over $100 per month.

In addition, each insurance company calculates rates differently. So the best policy for your family, friends or neighbors isn't always the cheapest option for you.

Compare customer service ratings. ValuePenguin editors rate insurance companies based on customer satisfaction scores, coverage availability and cost.

Companies that earn 4 stars or higher will typically take good care of you in an emergency situation. However, companies with a poor score may have a longer claims process, or you could end up spending more to fix your home.

Frequently asked questions

What is the average cost of homeowners insurance in South Dakota?

The average cost of homeowners insurance in South Dakota is $2,596 per year, or $216 per month. That's 21% more expensive than the national average of $2,151 per year.

How much is home insurance in Sioux Falls, SD?

Homeowners insurance in Sioux Falls costs an average of $2,515 per year. That's $81 per year less than the South Dakota average.

How much is homeowners insurance in Rapid City, SD?

Rapid City home insurance costs an average of $2,992 per year, which is $477 more per year than the state average.

Who has the cheapest homeowners insurance in South Dakota?

Auto-Owners, Farm Bureau and State Farm offer the cheapest home insurance in South Dakota. The cheapest company for you depends on the coverage you need, the location of your home, your insurance history and other factors.

Methodology

To find the best cheap house insurance in South Dakota, ValuePenguin gathered quotes from every ZIP code across the state. Rates are for a 45-year-old married man with good credit and no prior home insurance claims. Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

To find the best insurance companies in South Dakota, ValuePenguin editors ranked each company's customer service scores by comparing the National Association of Insurance Commissioners (NAIC) complaint index, J.D. Power's home insurance customer satisfaction rankings and our own editor's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.