Best & Cheapest Car Insurance Quotes in South Dakota (2024)

State Farm has the best cheap car insurance quote in South Dakota, at $93 per month for a full-coverage policy.

Find Cheap Auto Insurance Quotes in South Dakota

Best car insurance companies in South Dakota

How we chose the top companies

Best and cheapest car insurance in South Dakota

- Cheapest full coverage: State Farm, $93/mo

- Cheapest minimum liability: Auto-Owners, $20/mo

- Cheapest for young drivers: State Farm, $243/mo

- Cheapest after a ticket: State Farm, $98/mo

- Cheapest after an accident: State Farm, $104/mo

- Cheapest for teens after a ticket: State Farm, $82/mo

- Cheapest after a DUI: State Farm, $165/mo

- Cheapest for poor credit: Nationwide, $209/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

State Farm has the best mix of great customer service and affordable rates in South Dakota. You should also compare quotes from Nationwide, American Family, Geico and Auto-Owners. These companies all have reliable customer service, and their rates are typically cheaper than average.

State Farm, Nationwide, American Family and Geico offer online quotes, so it's easy to compare rates and find the best policy for you. To get a quote from Auto-Owners, you'll have to speak with a local insurance agent.

Cheapest car insurance in South Dakota: State Farm

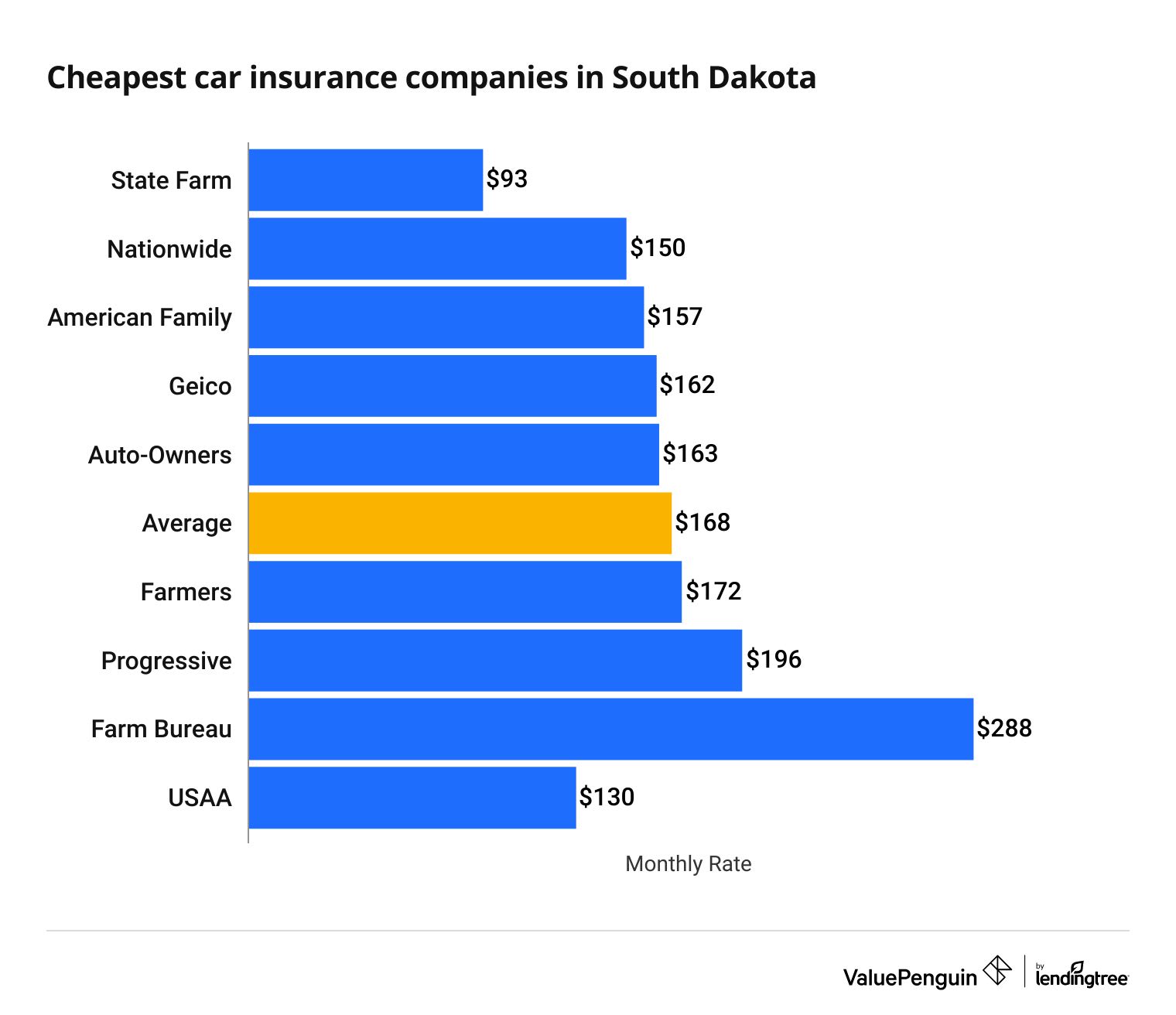

State Farm is the cheapest full-coverage car insurance company in South Dakota. At $93 per month, full coverage from State Farm costs 44% less than the state average of $168 per month.

Find Cheap Auto Insurance Quotes in South Dakota

American Family, Auto-Owners, Geico, Nationwide and USAA also offer cheaper-than-average car insurance in South Dakota. However, only military members, veterans and their families can get car insurance from USAA.

Cheapest SD full-coverage car insurance

Company | Monthly rate | |

|---|---|---|

| State Farm | $93 | |

| Nationwide | $150 | |

| American Family | $157 | |

| Geico | $162 | |

| Auto-Owners | $163 |

*USAA is only available to current and former military members and their families.

Cheapest liability insurance quotes in South Dakota: Auto-Owners

Auto-Owners offers the cheapest minimum-coverage car insurance quotes in South Dakota. A policy from Auto-Owners costs $20 per month, or $234 per year, which is 33% cheaper than average.

The average cost of car insurance in South Dakota is $29 per month, or $351 per year, for minimum coverage.

Cheapest SD car insurance companies

Company | Monthly rate |

|---|---|

| Auto-Owners | $20 |

| American Family | $22 |

| State Farm | $22 |

| Farm Bureau | $31 |

| Progressive | $31 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in South Dakota

Cheapest car insurance quotes for young drivers in South Dakota: State Farm

State Farm has the cheapest widely available minimum-coverage rates for 18-year-old drivers in South Dakota, at $75 per month.

If you're looking for a full-coverage policy, State Farm also offers the best rates for 18-year-old drivers in South Dakota, at $243 per month — 43% less than average.

Young drivers in the military or who are otherwise eligible can find even cheaper quotes from USAA. Its rates are 27% lower than State Farm, and 46% lower than the state average.

Cheapest SD car insurance companies for teens

Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $75 | $243 |

| Farm Bureau | $78 | $585 |

| Auto-Owners | $84 | $343 |

| American Family | $86 | $451 |

| Geico | $94 | $377 |

Cheapest car insurance quotes with a ticket: State Farm

State Farm offers the best quotes for South Dakota drivers with a speeding ticket, at an average rate of $98 per month for full coverage.

Company | Monthly rate |

|---|---|

| State Farm | $98 |

| Auto-Owners | $163 |

| Geico | $185 |

| American Family | $189 |

| Nationwide | $199 |

South Dakota drivers with a speeding ticket pay 19% more for car insurance, on average.

However, not all companies treat a speeding ticket the same way. Auto-Owners doesn't increase rates for all drivers after a single ticket, but drivers insured with Farmers can expect rates to go up by 33%.

That's why it's important for drivers to shop around for the best rates after a ticket or accident.

Cheapest car insurance after an accident: State Farm

State Farm has the cheapest car insurance quotes for South Dakota drivers with an at-fault accident on their record. A full-coverage policy from State Farm costs $104 per month, which is less than half the state average in South Dakota.

Company | Monthly rate |

|---|---|

| State Farm | $104 |

| Auto-Owners | $183 |

| Farmers | $229 |

| Nationwide | $248 |

| Geico | $255 |

In South Dakota, a single accident on your driving record can increase your auto insurance quotes by an average of 43%, or $72 per month.

Cheapest car insurance for young drivers after a ticket or accident: State Farm

State Farm is the cheapest South Dakota car insurance company for 18-year-old drivers with a speeding ticket or an accident on their record.

At $82 per month, a minimum-coverage policy from Auto-Owners with a ticket is 27% cheaper than the state average.

Minimum coverage for a teen driver from State Farm after an at-fault accident costs $90 per month, which is $43 less per month than the state average.

Company | Ticket | Accident |

|---|---|---|

| State Farm | $82 | $90 |

| Auto-Owners | $84 | $115 |

| American Family | $94 | $152 |

| Farm Bureau | $95 | $119 |

| Geico | $100 | $124 |

A speeding ticket increases the average rate for young South Dakota drivers by 13%, which means they pay an average of $13 per month more. Young drivers in South Dakota who have caused an accident pay 32% more, on average.

Cheapest car insurance in SD after a DUI: State Farm

State Farm has the cheapest quotes for South Dakotans after a DUI. At $165 per month, a full-coverage policy from State Farm is 42% cheaper than the state average.

Company | Monthly rate |

|---|---|

| State Farm | $165 |

| Geico | $206 |

| Progressive | $207 |

| Auto-Owners | $229 |

| Farmers | $267 |

Drivers in South Dakota with a DUI citation can expect their insurance rates to increase by 70%, on average. In addition, most drivers are required to purchase SR-22 insurance after a DUI, which makes car insurance even more expensive.

Cheapest car insurance quotes for drivers with poor credit: Nationwide

Nationwide offers the cheapest quotes for South Dakota drivers with a poor credit score, at $209 per month for full coverage. That's 37% less expensive than the state average of $332 per month.

Company | Monthly rate |

|---|---|

| Nationwide | $209 |

| Geico | $244 |

| American Family | $259 |

| Farmers | $262 |

| Auto-Owners | $321 |

Poor credit does not reflect on a customer's ability to drive, but insurance companies have found that drivers with bad credit scores are more likely to file a claim, which makes them more expensive to insure.

Best car insurance companies in South Dakota

USAA has the best-rated car insurance in South Dakota based on its reputation for reliable customer service, affordable rates and coverage availability.

However, only military members, veterans and their families can buy car insurance from USAA. State Farm and Auto-Owners are also good companies for most South Dakota drivers to consider.

Best SD car insurance companies

Company |

Editor's rating

|

J.D. Power

|

A.M. Best

|

|---|---|---|---|

| Farm Bureau | NR | A | |

| USAA | 881 | A++ | |

| State Farm | 842 | A++ | |

| Auto-Owners | 837 | A++ | |

| Geico | 835 | A++ |

Comparing customer service scores is an important part of shopping for an insurance policy.

An insurance company with great customer service will address claims quickly after an accident. On the other hand, a company with poor service may take longer to pay your claim, and you could end up paying more out of pocket for repairs.

Average cost of car insurance in South Dakota by city

South Dakota's cheapest car insurance can be found in Brookings, where the average price of full coverage is $144 per month. Pine Ridge has the most expensive quote, at $189 per month.

The best car insurance quotes in South Dakota differ depending on where you live. Factors like auto theft rates and the amount of traffic in your area can raise or lower your costs.

City | Monthly rate | % from average |

|---|---|---|

| Aberdeen | $149 | -11% |

| Agar | $173 | 3% |

| Agency Village | $158 | -6% |

| Akaska | $170 | 1% |

| Alcester | $149 | -11% |

In many states, larger cities tend to have higher rates, but South Dakota doesn't follow that trend. Rates in Sioux Falls, the state's largest city, are 15% cheaper than average. In contrast, three cities with fewer than 3,400 people have the highest rates.

Minimum auto insurance requirements in South Dakota

Drivers in South Dakota are required to carry a minimum amount of bodily injury liability and property damage coverage, sometimes written as 25/50/25. You must also have matching uninsured/underinsured motorist bodily injury liability limits.

Coverage | Liability |

|---|---|

| Bodily injury (BI) liability | $25,000 per person; $50,000 per accident |

| Property damage (PD) liability | $25,000 per accident |

| Uninsured/underinsured motorist (UM/UIM) bodily injury liability | $25,000 per person; $50,000 per accident |

What's the best car insurance coverage for SD drivers?

Minimum-coverage auto insurance policies meet South Dakota's minimum legal requirements. Unlike full-coverage policies, minimum coverage doesn't include comprehensive and collision insurance, which protects your car from damage after theft, vandalism, a natural disaster or a crash — regardless of who's at fault.

The average difference in cost between full- and minimum-coverage car insurance in South Dakota is $139 per month.

Although minimum coverage costs less, it comes with lower liability coverage limits and doesn’t include comprehensive and collision coverages. That means you might not have enough coverage to pay for all the damage after an accident.

Comprehensive and collision coverages are included in full-coverage policies and cover damage to your car after most accidents, thefts, natural disasters and vandalism. Both are usually required for cars that are loaned or leased.

South Dakota drivers should strongly consider higher liability limits, as well as comprehensive and collision coverages. Minimum-coverage policies may not be enough to fully cover the cost of damage in an expensive accident, and they don't provide protection against damage to your car.

Frequently asked questions

How much is car insurance in South Dakota?

A minimum-coverage policy costs $29 per month, or $351 per year, in South Dakota, on average. Drivers can expect to pay $168 per month or $2,016 per year for full coverage.

Who has the cheapest car insurance in South Dakota?

Auto-Owners has the cheapest quotes for a minimum-coverage policy — it costs $20 per month, or $234 per year. State Farm offers the cheapest full-coverage rate, at $93 per month, or $1,121 per year.

What are the auto insurance requirements in South Dakota?

Drivers in South Dakota are required to purchase insurance with a minimum of $25,000 of bodily injury liability per person and $50,000 per accident, and matching uninsured/underinsured motorist limits. In addition, drivers must have $25,000 of property damage liability per accident.

Is car insurance in South Dakota expensive?

South Dakota has the cheapest minimum-coverage quotes in the country, at $29 per month, on average. However, the cost of full-coverage insurance is average compared to other states. South Dakota is the 30th-cheapest state, at $168 per month.

Methodology

ValuePenguin collected thousands of quotes from ZIP codes across South Dakota for the largest insurers. Unless otherwise noted, rates are based on a 30-year-old man with good credit who drives a 2015 Honda Civic EX.

Full-coverage quotes are based on a full-coverage policy with the following limits:

- Bodily injury liability: $50,000 per person; $100,000 per accident

- Personal injury protection: $10,000

- Property damage liability: $25,000 per accident

- Uninsured/underinsured motorist bodily injury: $50,000 per person; $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.