Best Cheap Home Insurance Companies in Virginia (2024)

Cincinnati has the best cheap home insurance in Virginia, at $679 per year.

Compare Home Insurance Quotes in Virginia

Best Cheap Virginia Homeowners Insurance

To find the best cheap homeowners insurance in VA, ValuePenguin compared quotes from 11 top companies across every ZIP code in the state. Our editors considered the cost for different home values, coverage availability and customer service reviews.

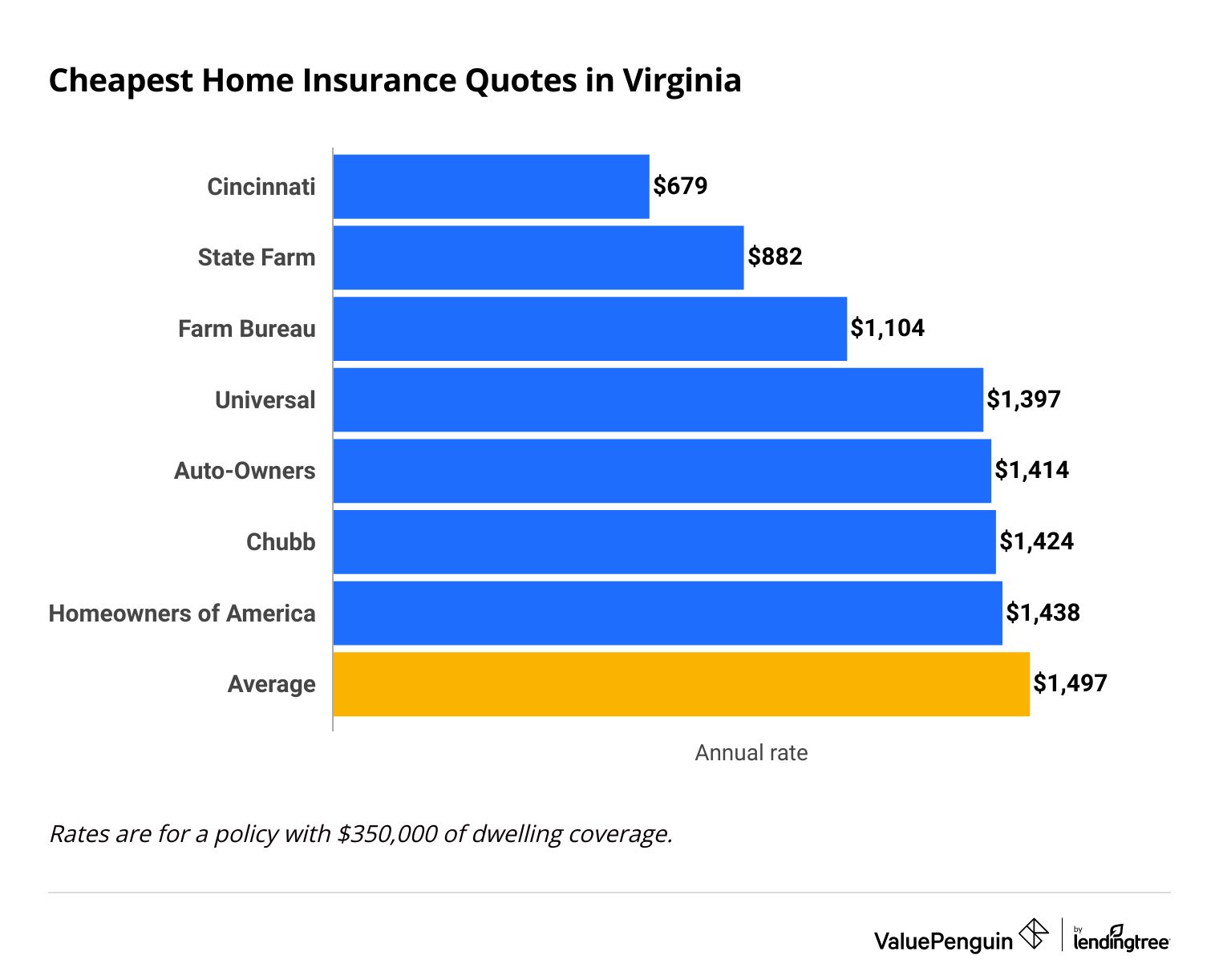

Cheapest homeowners insurance in Virginia

Cincinnati has the cheapest homeowners insurance rates in Virginia.

A policy from Cincinnati costs $679 per year for $350,000 of dwelling coverage. That's less than half the Virginia state average of $1,497 per year.

Compare Home Insurance Quotes in Virginia

Cincinnati also has the most affordable rates for expensive homes in Virginia.

Cincinnati charges around $1,830 per year for $1 million of dwelling coverage, which is also less than half the state average.

VA homeowners insurance quotes by dwelling coverage limit

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Cincinnati | $498 | ||

| State Farm | $634 | ||

| Farm Bureau | $779 | ||

| Universal | $947 | |

| Chubb | $948 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Cincinnati | $498 | ||

| State Farm | $634 | ||

| Farm Bureau | $779 | ||

| Universal | $947 | |

| Chubb | $948 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Cincinnati | $679 | ||

| State Farm | $882 | ||

| Farm Bureau | $1,104 | ||

| Universal | $1,397 | |

| Auto-Owners | $1,414 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Cincinnati | $956 | ||

| State Farm | $1,176 | ||

| Farm Bureau | $1,542 | ||

| Auto-Owners | $1,886 | ||

| Universal | $1,895 | |

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Cincinnati | $1,830 | ||

| State Farm | $2,040 | ||

| Farm Bureau | $3,204 | ||

| Homeowners of America | $3,436 | ||

| Universal | $3,505 | |

Homeowners on the Virginia coast, including Norfolk or Virginia Beach, may have more limited insurance options.

Companies such as Nationwide, State Farm and USAA may not offer new homeowners insurance policies in some areas of coastal Virginia with higher flooding risks.

What home insurance do I need in VA?

Tropical storms, hurricanes and nor'easters are common in Virginia. These weather events cause high winds, heavy rainfall and storm surges, which can all damage Virginia homes.

Most home insurance policies protect against wind damage. However, basic home insurance doesn't cover weather-related flood damage. You'll need to buy a separate flood insurance policy if you live in an area with a high flood risk.

Best homeowners insurance in VA for most people: Cincinnati

-

Editor's rating

- Cost: $679/yr

Cincinnati offers the best combination of cheap rates, reliable service and coverage options in Virginia.

-

Cheapest quotes in VA

-

Excellent customer service

-

Great coverage options for expensive homes, including flood coverage

-

Can't get a quote online

-

Few discounts

Cincinnati is the cheapest option for Virginia homeowners.

A basic policy typically costs half the Virginia state average, regardless of how much coverage you need.

Cincinnati also has some of the best customer service reviews in the state. It had fewer complaints than any other major insurance company, according to the National Association of Insurance Commissioners (NAIC). That means you can count on Cincinnati to take great care of you in an emergency situation.

A basic policy from Cincinnati comes with enough coverage for many homeowners. Cincinnati also offers some excellent coverage add-ons for expensive homes.

For example, if your home is worth more than $750,000, you can add replacement cost coverage. This coverage pays to rebuild your home exactly as it was before damage, even if it costs more than your dwelling coverage limit.

One of the main benefits of choosing Cincinnati for your high-value home is that you can add flood protection to your policy. Most home insurance companies don't offer this option. Cincinnati also offers higher flood insurance limits than you can get from a policy with the National Flood Insurance Program (NFIP). That's very important if you have an expensive home.

Best national home insurance company in Virginia: State Farm

-

Editor's rating

- Cost: $882/yr

State Farm is a great choice for homeowners who prefer to manage their policies online.

-

Affordable rates

-

Helpful online tools

-

Dependable customer service

-

Can't typically buy a policy fully online

-

Limited coverage options and discounts

-

May not offer coverage for coastal homes

State Farm is the largest home insurance company in the country, and it offers everything you would expect from a major company. That includes a well-rated app to help you manage your policy or file a claim.

State Farm offers a wide variety of insurance products. So it's unlikely you'll have to work with multiple companies if you need to insure a boat, get coverage for your small business or buy a life insurance policy.

State Farm is the second-cheapest home insurance company in Virginia.

A policy costs $882 per year for $350,000 of dwelling coverage, which is $615 cheaper than the Virginia average. However, it's $203 per year more than the cheapest option, Cincinnati.

Virginia homeowners can count on State Farm to get their home fixed quickly if they ever have to file a claim. The company earned a high score on J.D. Power's customer satisfaction survey. That means State Farm customers are typically happy with their experience with the company.

Best for bundling auto and home insurance in VA: Erie

-

Editor's rating

- Cost: $1,611/yr

Erie's excellent customer service and extra coverage perks may make it worth the extra cost.

-

Cheapest auto rates in VA

-

Top-rated customer service

-

Basic policy includes extra coverage

-

No online quotes

-

Not the cheapest option

Erie is an excellent option for bundling home and auto insurance policies in Virginia.

That's because it offers some of the cheapest car insurance in the state. In addition, it offers a bundle discount of 16% to 25%, according to Erie. That could make a home insurance policy from Erie much more affordable.

Erie isn't the cheapest home insurance company in the state. But its basic policy comes with more coverage than most other companies offer.

For example, a standard home insurance policy from Erie pays to fully rebuild your home, even if it costs more than your insurance limit. This is called replacement cost coverage, and it typically costs extra at other companies.

Erie also has the best-rated customer service in Virginia. Erie earned the top score on J.D. Power's customer satisfaction survey. And it only gets one-third as many complaints as similar-sized companies, according to the NAIC. That means homeowners can count on Erie to get their lives back to normal quickly after your home is damaged.

Average home insurance cost in Virginia

Virginia property insurance costs an average of $1,497 per year.

That's 30% cheaper than the national average of $2,151 per year.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,058 |

| $350,000 | $1,497 |

| $500,000 | $2,008 |

| $1,000,000 | $3,751 |

Home insurance in Virginia is also cheaper than in many of its neighboring states. For example, a policy in West Virginia costs an average of $1,803 per year, while North Carolina home insurance costs around $2,666.

Homeowners insurance rates in Virginia by city

Belmont, a small town outside of Leesburg, is the cheapest city for home insurance in Virginia.

Home insurance in Belmont costs an average of $1,180 per year.

Virginia Beach is the most expensive city, at $2,451 per year on average. Virginia Beach sits on the Atlantic coast, so homes in this area are prone to damage from hurricanes and tropical storms. That's why homeowners insurance in Virginia Beach costs 64% more than the state average.

Virginia home insurance rates by city

City | Annual rate | % from avg |

|---|---|---|

| Abingdon | $1,384 | -8% |

| Accomac | $2,231 | 49% |

| Achilles | $1,790 | 20% |

| Adwolf | $1,380 | -8% |

| Afton | $1,270 | -15% |

Rates are for a policy with $350,000 of dwelling coverage.

Best homeowners insurance in Virginia

Erie has the best-rated home insurance in Virginia.

Erie earned the top score on J.D. Power's customer satisfaction survey. It also has low rates of customer complaints for home insurance, according to the NAIC.

Auto-Owners, Cincinnati, Farm Bureau and Homeowners of America also have high customer satisfaction scores.

Best home insurance companies in VA

Company |

Rating

|

Complaints

|

|---|---|---|

| Erie | Low | |

| Auto-Owners | Low | |

| Cincinnati | Low | |

| Farm Bureau | Low | |

| Homeowners of America | Low |

What home insurance coverage is important in Virginia?

Virginia's location on the East Coast of the U.S. puts homes at risk for damage from hurricanes and tropical systems.

While they happen mostly in the summer and fall, other storms like nor'easters can strike any time of year. It's important for Virginia homeowners to have protection against the wind, rain and flood damage these storms cause.

Does homeowners insurance in VA cover hurricanes?

Homeowners insurance typically covers some, but not all, types of hurricane damage. Your insurance company will usually pay for damage caused by wind, but not weather-related flooding.

Some insurance policies may have a separate hurricane deductible. This is common for coastal homes. Your hurricane deductible is usually a percentage of your dwelling coverage amount and tends to be higher than your regular home insurance deductible.

Is wind damage covered by home insurance in Virginia?

Nearly all homeowners insurance policies cover wind damage.

However, homes with a high risk of wind damage may have a separate wind deductible. That means you could have to pay two deductibles if both the wind and rain from a thunderstorm damage your home. Your wind deductible is typically between 2% and 5% of your dwelling coverage limit.

If your home is more likely to suffer wind damage, you may want to take steps to protect it. You can do this by pruning limbs off nearby trees and having your roof inspected regularly.

High winds caused nearly $33 million of damage to Virginia homes over 51 days in 2023, according to the National Centers for Environmental Information (NCEI). This doesn't include hurricane or tropical storm damage.

Is flood damage covered by home insurance in Virginia?

Standard home insurance doesn't usually cover weather-related flood damage.

If your home is at high risk for flood damage, you will need to get a flood insurance policy to cover the damage to your property. You can either get a policy through a private insurance company or from the National Flood Insurance Program (NFIP).

How much is flood insurance in Virginia?

The average cost of flood insurance in Virginia is $863 per year for a National Flood Insurance Program (NFIP) policy. The average NFIP policy in Virginia has $283,146 of dwelling and personal property coverage.

How to find the best homeowners insurance in VA

The best home insurance companies in Virginia offer a combination of affordable rates, great customer service and helpful coverage.

Find a company that offers the coverage you need. Most standard homeowners insurance policies include the same basic coverage. However, some Virginia homeowners may need more protection.

For example, if you live in an area with a high risk of flooding, you may want a company that offers flood protection. Cincinnati, Auto-Owners and Chubb all offer flood insurance in addition to standard home insurance protection.

It's important to know what protection you need before you gather quotes. That way you can make sure each company you consider has the right coverage for you.

Compare quotes from multiple companies. The most expensive home insurance company in Virginia costs over three times more than the cheapest company. That's a difference of $1,782 per year.

In addition, every company calculates insurance quotes differently. So the cheapest company for you may be different from that of your neighbors, friends or family.

Consider customer service reviews. Choosing a company with great service reviews can give you peace of mind. That's because you know your insurance company will take care of you in an emergency.

Companies with excellent service typically have easier claims processes after an accident, and you may pay less for home repairs.

Erie, Cincinnati, Auto-Owners and Farm Bureau have the best-rated customer service in Virginia.

Frequently asked questions

How much is the average homeowners insurance in Virginia?

Virginia home insurance costs an average of $1,497 per year. That's around 30% cheaper than the national average of $2,151.

Is home insurance mandatory in Virginia?

The state of Virginia doesn't require homeowners insurance. However, if you have a mortgage, your lender will typically require you to buy a policy.

Who has the best home insurance in Virginia?

Cincinnati has the best home insurance for most people in Virginia. It has the cheapest rates in the state, along with excellent customer service and great coverage.

How much is home insurance in Virginia Beach, VA?

The average cost of homeowners insurance in Virginia Beach is $2,451 per year. That's $954 per year more expensive than the Virginia average. Cincinnati is the best choice for Virginia Beach homeowners. It has affordable rates and some homeowners can get flood protection as an add-on to their home insurance policy.

Methodology

To find the best home insurance in Virginia, ValuePenguin compared quotes from 11 of top insurance companies across all Virginia ZIP codes. Rates are for a 45-year-old married man with a good credit score and no prior insurance claims. Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Home insurance ratings are created based on a combination of complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey and ValuePenguin's own editorial ratings.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.