The Best and Cheapest California Motorcycle Insurance

Harley-Davidson has the cheapest motorcycle insurance in California, with an average of $42 per month.

Compare Motorcycle Insurance Quotes in California

Best cheap motorcycle insurance in California

ValuePenguin compared quotes from four top companies across 51 of the largest cities in California to help you find the best cheap motorcycle insurance in CA.

We ranked the best motorcycle insurance companies in California based on customer service, cost and coverage availability.

To find the cheapest companies, we compared quotes for a full coverage policy with higher liability limits than the state minimum, plus collision and comprehensive coverage. See our full methodology.

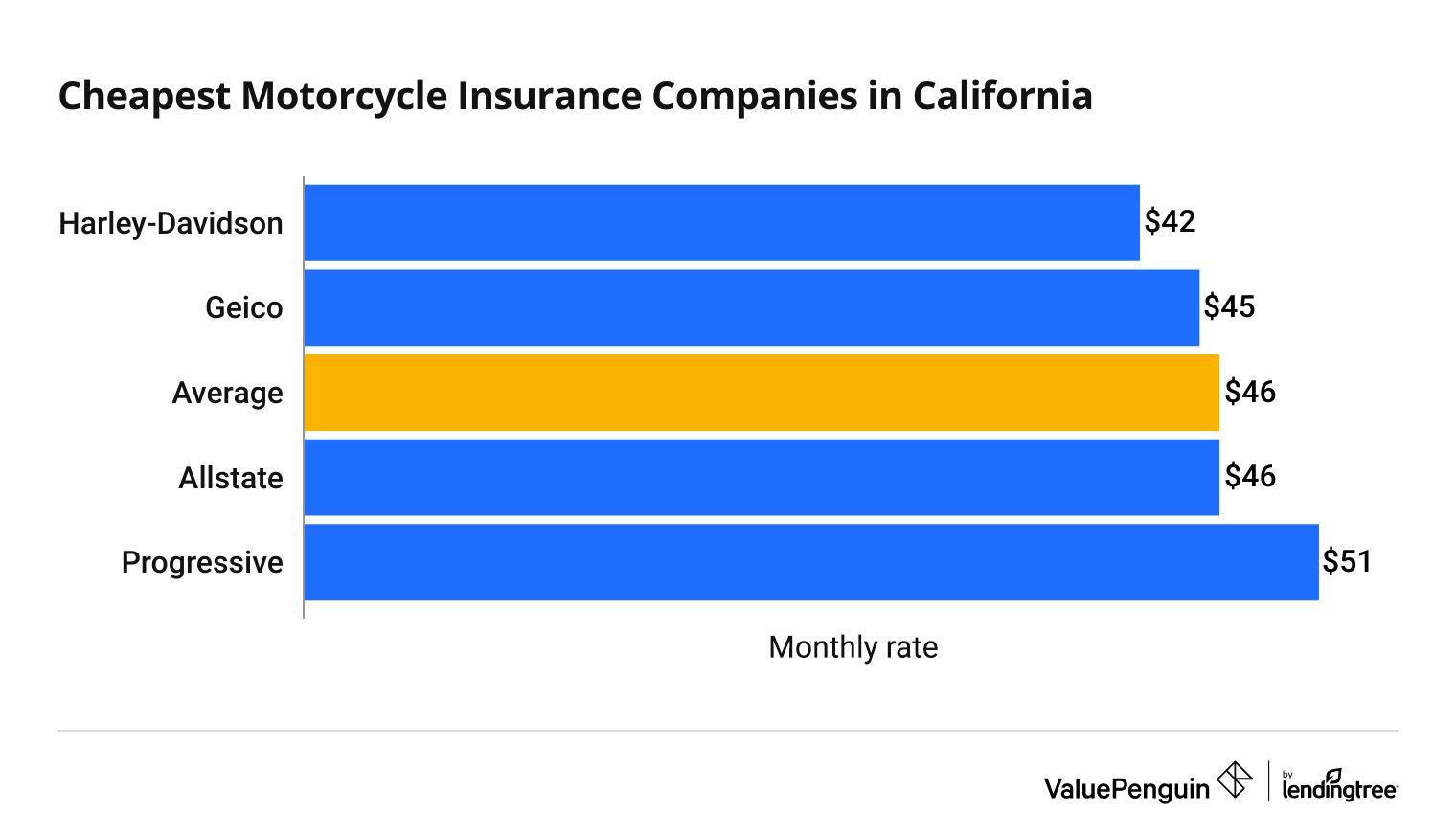

Cheapest motorcycle insurance in California

The cheapest motorcycle insurance in California comes from Harley-Davidson. It costs an average of $42 per month for a full coverage policy. That's 9% cheaper than the state average.

Compare Motorcycle Insurance Quotes in California

The average cost of motorcycle insurance in California is $46 per month, or $553 per year.

Cheapest motorcycle insurance companies in CA

Company | Monthly rate | ||

|---|---|---|---|

| Harley-Davidson | $42 | ||

| Geico | $45 | ||

| Allstate | $46 | ||

| Progressive | $51 | ||

Best motorcycle insurance in California: Harley-Davidson

-

Editor rating

-

Monthly rate

$42 ?

Pros and cons

The best motorcycle insurance company for most California riders is Harley-Davidson.

Full coverage motorcycle insurance from Harley-Davidson costs $42 per month, which is $4 per month less than the California average.

In addition, Harley-Davidson offers lots of discounts to make its motorcycle insurance even more affordable.

There are a number of ways for riders to customize their motorcycle insurance coverage with Harley-Davidson. The company offers replacement cost coverage for your bike and custom parts. You can also add on rental reimbursement coverage. This coverage pays for a rental while your bike is in the shop after an accident.

California riders can count on Harley-Davidson to help them get back on the road quickly after an accident. It gets far fewer complaints than other similar-sized insurance companies, according to the National Association of Insurance Commissioners (NAIC).

Harley-Davidson's biggest drawback is that it doesn't offer other types of insurance. If you own a car or home, you'll need to buy those policies from another insurance company.

Best for custom motorcycles in CA: Progressive

-

Editor rating

-

Monthly rate

$51 ?

Pros and cons

Progressive has the best motorcycle insurance for riders who don't mind spending a little more money for extra protection.

Progressive's basic policy includes:

- Full replacement cost for your bike and parts. That means it won't factor wear and tear into your payout after an accident. So your bike will be fixed using new parts.

- $3,000 of coverage for custom parts and accessories.

- Original equipment manufacturer (OEM) parts coverage, which helps ensure that your bike will be fixed using parts from the manufacturer, or the best parts available.

These coverages aren't typically included in basic motorcycle insurance. Most companies charge extra if you want to add them.

Progressive also gives riders lots of ways to upgrade their protection. People with custom bikes can add up to $30,000 of coverage for custom parts and accessories. It also offers roadside assistance and extra coverage for your personal belongings, like camping or hunting gear.

Progressive has the most expensive motorcycle insurance quotes in California, with an average of $51 per month. That's 11% more expensive than the California state average and 19% more expensive than the cheapest company, Harley-Davidson.

However, Progressive offers lots of discounts to help make its rates more affordable. Riders can save by getting multiple policies from Progressive, making automatic payments or having a motorcycle endorsement, among other things.

Best for California riders with military ties: USAA

-

Editor rating

-

Monthly rate

$49 ?

Pros and cons

USAA doesn't sell its own motorcycle insurance. It partners with Progressive to provide excellent coverage to its members. USAA members get a 5% discount, along with any other Progressive discounts they qualify for.

Even after USAA's discount, Progressive's motorcycle insurance quotes are the most expensive in California. Progressive's pre-discount rate is $51 per month, so USAA customers can expect to pay around $49 per month. That's still 6% more expensive than the state average.

However, Progressive's basic policy comes with more coverage than most companies typically offer. It includes extra protection for custom parts and equipment, replacement cost coverage for your bike and parts, and original equipment manufacturer parts. That could make Progressive's high rates worth it for some riders.

On a positive note, USAA has some of the best customer service in the industry. So you can expect a quick, easy claims process if you're in an accident.

Only military service members, veterans and some of their family members can get motorcycle insurance from USAA. But riders who don't qualify can still buy a policy from Progressive.

Motorcycle insurance cost in California by city

Fontana and Visalia have the cheapest motorcycle insurance in California, with an average cost of $36 per month for a full coverage policy.

Riders in Glendale pay the highest rate in the state, at $65 per month.

The cost of motorcycle insurance in California can vary by up to $29 per month, depending on where you live. That's because riders who live in a city with a lot of traffic or high theft rates are more likely to make a claim.

For example, the largest city in California, Los Angeles, has the second-highest rate in the state. A full coverage policy in LA costs $62 per month.

Average motorcycle insurance cost in CA by city

City | Monthly cost | % from average |

|---|---|---|

| Antioch | $50 | 8% |

| Bakersfield | $45 | -2% |

| Berkeley | $52 | 13% |

| Chula Vista | $43 | -6% |

| Clovis | $42 | -8% |

California motorcycle insurance requirements

Motorcycle insurance is required in California for all riders.

California's legal motorcycle insurance minimums only include liability coverage, which pays for damage you cause to others.

- Bodily injury liability: $15,000 per person and $30,000 per accident

- Property damage liability: $5,000 per accident

But California riders should consider getting more liability insurance than the state requires, along with extra coverage options.

For example, medical payments coverage will help pay your own medical bills if you're hurt in an accident, even if it's your fault. Comprehensive and collision coverages pay to repair or replace your bike if it's damaged.

In 2021, motorcycles were involved in almost 24 times as many fatal crashes per mile traveled as cars, according to the National Highway Traffic Safety Administration. You're also more likely to get hurt or damage your vehicle in a motorcycle crash than a car crash.

Motorcycle license requirements in California

To operate a motorcycle in California, you need to have a Class M1 license. This license also allows you to drive mopeds and motorized scooters.

If your motorcycle has a sidecar or three wheels, you'll need a Class C license instead. A Class M2 license allows you to operate other two-wheeled vehicles but excludes motorcycles.

To get a California motorcycle license, you need to:

- Pass a vision test

- Pass a written test

- Pass a motorcycle skills test or get a Certificate of Completion of Motorcycle Training

If you're under 21 and want to get a motorcycle license, you must have a motorcycle instruction permit for six months first. You also have to complete the California Motorcyclist Safety Program (CMSP).

Frequently asked questions

How much is motorcycle insurance in CA?

The average cost of motorcycle insurance is $46 per month in California. That's 38% more expensive than the national average, which is $33 per month.

What is the minimum insurance for a motorcycle in California?

California requires motorcycle riders to have a minimum of $15,000 of bodily injury liability coverage per person and $30,000 per accident, along with $5,000 of property damage liability.

Who has the best motorcycle insurance in California?

Harley-Davidson has the best motorcycle insurance for most riders in California. Its full coverage policy costs $42 per month, which is 9% cheaper than average. Harley-Davidson also has dependable customer service and plenty of ways to upgrade your coverage if you need extra protection.

How much is motorcycle insurance in Los Angeles?

The average cost of motorcycle insurance in Los Angeles is $62 per month for a full coverage policy. That's 35% more expensive than the California state average, which is $46 per month.

Compare motorcycle insurance in California vs other states

Methodology

To find the best cheap motorcycle insurance in California, ValuePenguin collected more than 200 quotes across the state. Rates are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

Quotes are for a full coverage policy, which includes higher liability limits than the state requirement, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

Motorcycle crash statistics were provided by the National Highway Traffic Safety Administration.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.