Who Has the Cheapest Renters Insurance Quotes in Kansas? (2024)

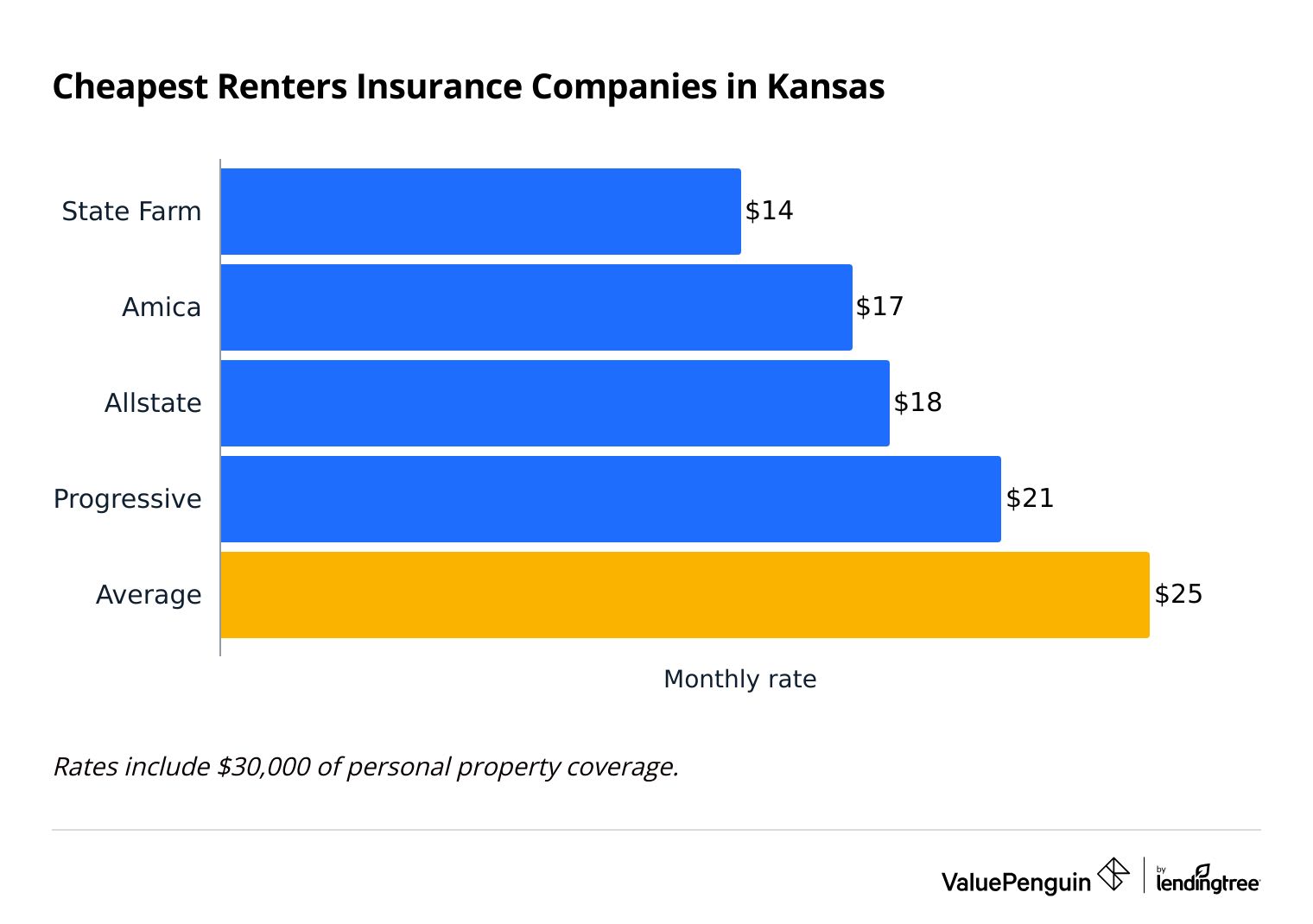

State Farm has the cheapest renters insurance in Kansas, at $14 per month on average.

Compare Cheap Renters Insurance Quotes in Kansas

Best Cheap Renters Insurance in KS

ValuePenguin editors found the best cheap renters insurance companies in Kansas by looking at rates, customer satisfaction, coverage options and discounts.

Our experts calculated average renters insurance rates by gathering quotes from seven top companies across 25 major Kansas cities.

Cheapest renters insurance companies in Kansas

State Farm has the cheapest renters insurance in Kansas, at $14 per month for $30,000 of personal property coverage. That's 44% cheaper than the Kansas state average.

Compare Cheap Renters Insurance Quotes in Kansas

The average cost of renters insurance in Kansas is $25 per month, but there's a big price jump between the cheapest and most expensive options. The priciest company, American Family, is more than three times as expensive as State Farm.

The cost of renters insurance in Kansas is slightly cheaper than most neighboring states. Rates in Oklahoma are much higher at $31 per month, while Nebraska and Colorado are slightly cheaper than in Kansas.

Top renters insurance companies in Kansas

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $14 | ||

| Amica | $17 | ||

| Allstate | $18 | ||

| Progressive | $21 | ||

| Farmers | $28 | ||

Best renters insurance for most people in Kansas: Amica

-

Editor's rating

- Cost: $17/mo

Amica has affordable rates, top-tier customer service and great discounts.

-

Strong customer service

-

Affordable rates

-

Lots of discounts available

-

No in-person offices

Amica has a strong reputation for dependable customer service, plus great prices and lots of discounts. The company gets two-thirds fewer complaints than an average insurance company. in the U.S.

Amica also came in first on a recent J.D. Power survey measuring claims satisfaction for home insurance (it wasn't ranked for renters insurance). A company with good customer service will save you time and effort, especially in a stressful claims scenario.

At $17 per month, Amica is 31% cheaper than the state average.

Amica gives you several ways to lower your monthly rate, too. It offers a bundle discount, which is one of the best ways to reduce your insurance bill. The company also offers discounts if you go at least three years without an accident, buy online, renew your policy two years in a row or sign up for autopay.

Despite its great service, one drawback to Amica for Kansans is that it doesn't have in-person service in Kansas. You can't go to an office to get help with a claim or have a question answered; you'll have to call or email the company directly to get an answer.

Cheapest renters insurance in Kansas: State Farm

-

Editor's rating

- Cost: $14/mo

State Farm offers the best prices in Kansas, but its customer service is only okay.

-

Affordable quotes

-

Good renters-auto bundling discount

-

Flood insurance available

-

Average customer service

-

Few discounts

State Farm has some of the cheapest rates in Kansas, at $14 per month for $30,000 of coverage to replace the items you own, called personal property coverage. That's 44% less than the Kansas state average.

Customer service at State Farm is about average. It receives slightly more complaints from customers than a typical company, according to the NAIC. But it also received a positive score in a customer survey by J.D. Power. But one perk of State Farm's service is its in-person offices. State Farm customers are assigned to an agent when they buy a policy, and you can call them on the phone or visit in person to ask questions or file a claim. Many renters insurance companies operate primarily online.

State Farm has a good renters-auto bundling discount. It's also the cheapest car insurance in Kansas, so bundling your auto and renter policies can save you even more.

Best renters insurance for extra coverage and discounts in Kansas: Progressive

-

Editor's rating

- Cost: $21/mo

Progressive offers a wide range of discounts and extra coverage options to customize your policy.

-

Many extra coverage options and discounts

-

Cheaper-than-average rates

-

Weak customer service

You can lower your monthly rate by taking advantage of one or more of Progressive's many discounts.

Progressive discounts for Kansas renters

- Renters-auto bundling

- Electronic document delivery

- Gated community

- Quote in advance

- Single deductible

- Pay in full

Progressive also lets you share a deductible across a bundled renter and auto policy. For example, if your apartment and car are both damaged by the same fire, you'll only have to pay your deductible one time. You'll also only need to file one claim instead of two.

For renters who need more than just basic protection, Progressive offers several coverage add-ons. For example, you can buy a identity theft protection, umbrella coverage, higher limits for expensive items , equipment breakdown and damage caused by mold.

Progressive also sells flood insurance policies, though it is usually sold separately, not as an add-on to renters insurance.

Progressive renters insurance costs $21 per month for $30,000 of personal property coverage, on average. That's 16% cheaper than the Kansas state average of $24 per month.

Unfortunately, Progressive has poorly rated customer service for renters insurance.

Progressive ranked last in the most recent J.D. Power customer satisfaction survey for renters insurance. The company also gets 43% more complaints than an average company its size, according to the NAIC.

Kansas renters insurance: Costs by city

Kansas City has the most expensive renters insurance among major Kansas cities, at $28 per month.

Lawrence, home of the University of Kansas, has the cheapest rates, averaging $22 per month.

How much you pay for renters insurance will depend on where you live in Kansas, but the price of insurance doesn't vary much statewide. There's only a $6 per month difference in price between the most and least expensive larger cities.

City | Monthly rate | % from average |

|---|---|---|

| Andover | $25 | 2% |

| Derby | $25 | 3% |

| Dodge City | $25 | 1% |

| Emporia | $25 | 0% |

| Garden City | $23 | -6% |

Tips for getting cheap renters insurance in Kansas

Save money on your renters insurance by comparing quotes, using discounts and finding your accurate coverage needs.

Start by adding up the cost of the items you own to find out how much coverage you need. The value of your personal belongings should equal how much personal property coverage you have. This amount will have a big impact on your monthly rate.

You want to have enough coverage to replace all your stuff if the worst happens, but you don't want to overpay for coverage you don't need.

You can save hundreds of dollars per year with just a few minutes of work by comparing quotes. The most expensive renters insurance company in Kansas, American Family, costs $350 per year more than the cheapest company, State Farm, for the same level of coverage.

It's a good idea to compare quotes each year because companies change their prices over time. The cheapest company today might not have the best rates the next time you renew your policy.

Renters insurance companies almost always discounts.

It's important to consider which discounts you might qualify for when comparing quotes. That's because discounts can lower your final costs significantly.

Common renters insurance discounts in Kansas

- Renters-auto bundling

- Claims free discount

- Automatic payments

- Pay in full

- Loyalty

- Home protection device

Common natural disasters in Kansas

Renters in Kansas should take extra care to be sure they're protected from tornadoes, windstorms and floods.

Renters insurance will typically pay to replace the items you own after a tornado or windstorm. Your policy will also pay to put you up in a hotel or short-term rental as long as you have loss of use coverage.

Keep in mind that your policy won't pay to repair the structure of your apartment or rented home. That's your landlord's responsibility.

Renters insurance basically never covers damage from flooding due to rain. If you live in an area at a high risk of flooding, you should buy a separate flood insurance policy. Many renters insurance companies, including State Farm and Progressive will sell you flood insurance.

However, many renters insurance companies do offer water backup coverage that protects you if a water line overflows into your home.

Frequently asked questions

How much does renters insurance cost in Kansas?

Renters insurance costs $25 per month in Kansas, on average. State Farm has cheap quotes for Kansas renters at around $14 per month.

Is renters insurance required in Kansas?

Renters insurance is not required by law in Kansas, but it's important to check your lease agreement to see if your landlord or property management company requires you to buy a policy.

How much is renters insurance in Wichita?

Renters in Wichita can expect to pay $25 per month for insurance, which is about equal to the state average. In comparison, people living in Kansas City pay $28 per month.

Methodology

ValuePenguin collected more than 150 quotes from across 25 major cities in Kansas for a single 30-year-old woman who has never filed a renters insurance claim. Coverage limits include:

- $30,000 of personal property coverage

- $9,000 for loss of use

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

Customer service ratings were created using cost data, information from the National Association of Insurance Commissioners (NAIC) complaint index scores and J.D. Power's 2023 renters insurance customer satisfaction study rankings.

These rates should be used for comparative purposes only. Your quotes will likely differ.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.