Who Has the Best Cheap Renters Insurance in Wisconsin for 2024?

Amica has the best cheap renters insurance for most people in Wisconsin.

Compare Cheap Renters Insurance Options in Wisconsin

Best Cheap Renters Insurance in WI

ValuePenguin editors rated insurance companies by average costs, customer satisfaction ratings, discounts and coverage options. Our experts collected 185 quotes from eight top renters insurance companies to find the best renters insurance in WI.

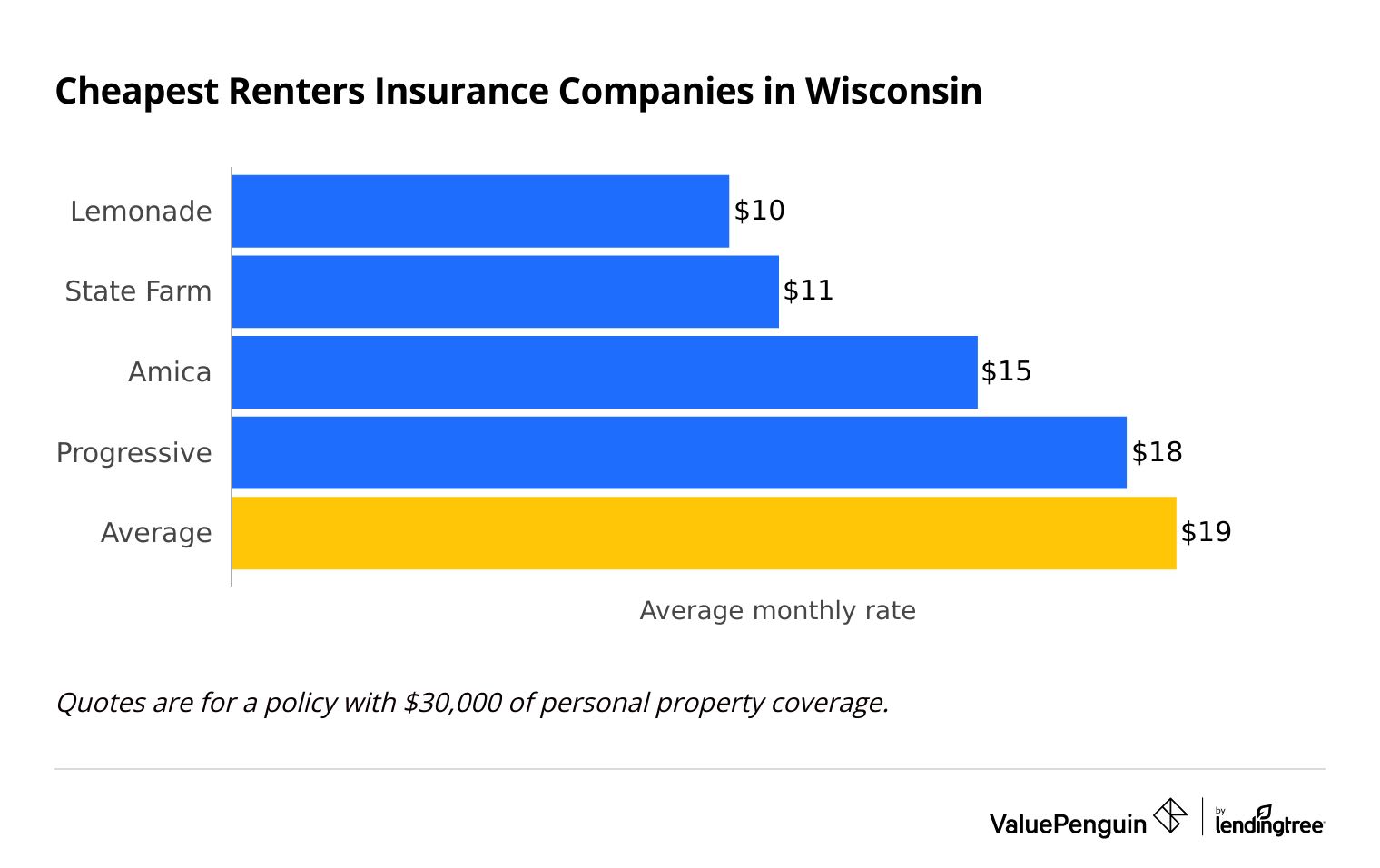

Cheapest renters insurance companies in Wisconsin

Lemonade has the most affordable renters insurance in Wisconsin, at $10 per month for $30,000 of personal property coverage.

State Farm is only slightly more expensive, at $11 per month on average.

Compare Cheap Renters Insurance Options in Wisconsin

However, Amica has the best overall coverage because of its strong customer service and cheap rates. An Amica renters policy costs $15 per month for $30,000 of personal property coverage on average.

Amica is still 22% cheaper than the Wisconsin state average.

Top renters insurance companies in Wisconsin

Company | Monthly cost | ||

|---|---|---|---|

| Lemonade | $10 | ||

| State Farm | $11 | ||

| Amica | $15 | ||

| Progressive | $18 | ||

| Allstate | $22 | ||

Best renters insurance company in Wisconsin: Amica

-

Editor's rating

- Cost: $15/mo

Amica offers cheap rates and strong customer service.

-

Gets few complaints from customers

-

Affordable rates

-

Easy claim filing

-

Many discounts and coverage extras

-

Not the cheapest option

Amica has the best combination of cheap rates and good customer service among major Wisconsin renters insurance companies.

Amica gets about a third as many complaints as an average company its size. In addition, the company ranked first for customer satisfaction on property claims handling according to a recent J.D. Power survey.

Choosing a company with a good reputation for handling claims can save you a headache down the road.

Amica also has affordable rates, with an average of $15 per month for $30,000 of personal property coverage. That's $4 per month cheaper than the Wisconsin state average.

You can lower your monthly rate even further by taking advantage of one or more of Amica's discounts for renters.

Amica renters insurance discounts

- Loyalty: Save when you keep your Amica policy for at least two years.

- Claim-free: Save after going three years without filing a claim.

- Online discount: Save when you get your policy information and bills online.

- Autopay: Save when you sign up for automatic payments.

- Bundling: Save when you bundle your Amica renters and auto policies.

Amica lets you personalize your coverage with several add-ons. You can get coverage for identity theft and major appliances you own. Amica also lets you upgrade your coverage limits for valuable items.

Best WI renters insurance for cheap rates: Lemonade

-

Editor's rating

- Cost: $10/mo

Lemonade has the cheapest renters insurance quotes in Wisconsin

-

Affordable renters policies

-

Fast online quotes

-

Simple claim process

-

Coverage add-ons available

-

Few discounts

-

Mixed customer satisfaction

Lemonade stands out for its digital-first approach to selling insurance. Getting a quote for renters insurance or filing a simple claim takes just minutes. The company's AI chatbots and online resources make it easy to answer common questions about renters insurance.

Lemonade has the cheapest renters insurance in Wisconsin.

The company charges $10 per month for $30,000 of personal property coverage on average. That's almost half the Wisconsin state average.

Unlike other companies, Lemonade only offers one discount for Wisconsin renters. You qualify for this discount if you have a burglar or smoke alarm installed in your apartment or rented home.

Lemonade scored high on a recent J.D. Power renters insurance customer satisfaction survey. However, Lemonade gets more than three times as many complaints as an average company its size.

Best Wisconsin renters insurance for bundling: State Farm

-

Editor's rating

- Cost: $11/mo

State Farm offers big savings to customers who bundle their renters and auto policies.

-

Affordable rates

-

Good customer service

-

Strong renters-auto bundling discount

-

Few other discounts

State Farm has the best renters-auto bundling discount.

On average, you'll save roughly 5% when you bundle your renters and auto policies through State Farm. That's higher than other top insurance companies like Liberty Mutual, Farmers and Allstate.

State Farm also has some of the cheapest renters insurance rates in Wisconsin. The company charges $11 per month on average for $30,000 of personal property coverage. That's 43% cheaper than the state average.

State Farm scored above average on a recent J.D. Power survey for customer satisfaction. In addition, the company gets about an average number of complaints for a company its size.

State Farm only has one other discount for Wisconsin renters. You can save on your renters policy if you have a protective device like a burglar or fire alarm installed in your apartment or rented house.

Wisconsin renters insurance cost by city

Madison, the capital of Wisconsin, has the most expensive renters insurance in the state, at $24 per month for $30,000 of personal property coverage.

Fond du Lac, a midsize city in eastern Wisconsin, has the cheapest average rate, at $18 per month.

Renters insurance costs depend in part on where you live. That's because factors like crime rates, the frequency of certain natural disasters and labor and material costs differ by area.

City | Monthly rate | % from average |

|---|---|---|

| Appleton | $18 | -5% |

| Beloit | $19 | -2% |

| Brookfield | $19 | 0% |

| Eau Claire | $19 | -2% |

| Fond du Lac | $18 | -7% |

Renters insurance in Wisconsin costs $19 per month on average. That's $4 per month cheaper than the national average and roughly the same as the cost of renters insurance in nearby Iowa and Minnesota.

However, Wisconsin has much cheaper average rates than Michigan.

Tips for getting the cheapest renters insurance in Wisconsin

Save on your Wisconsin renters policy by comparing quotes and taking advantage of discounts.

You could save $252 per year by switching from American Family to Lemonade. Comparing quotes from top companies online can take just minutes. That makes it one of the best ways to save money on your renters insurance in Wisconsin.

Higher rates don't always mean you'll get better service when it comes to renters insurance. For example, Amica has below-average rates, and it gets one-third as many complaints as an average company its size.

Most companies offer one or more discounts, many of which require little action on your part to qualify for. For example, you automatically get discounts with some companies if you renew your policy, go a certain amount of time without filing a claim or buy your policy online.

You may also be eligible for a bundling discount if you buy another type of insurance through the same company, such as renters-auto bundling discounts.

Common natural disasters in Wisconsin

A standard Wisconsin renters insurance policy will protect against tornadoes and blizzards.

Renters insurance will typically pay to replace the items you own after a tornado. Your policy will also pay to put you up in a hotel or short-term rental as long as you have loss of use coverage.

Keep in mind that your policy won't pay to repair the structure of your apartment or rented home. That's your landlord's responsibility. It's also important to remember your landlord's insurance won't pay for things you own like furniture, clothes and appliances.

Wisconsin gets a significant amount of snowfall in the winter. On average, the Badger State gets more than 50 inches of snow per year, although Wisconsin has gotten as much as double that amount in some years. Your renters insurance policy will also pay to replace spoiled food after a power outage.

While you don't have to worry about snow damage to the outside of your rented home or paying for burst pipes, you may need coverage if you lose power or if snow enters your home due to a roof collapse or broken window.

Your renters insurance will also protect you if someone injures themselves on your rented property. For example, renters insurance will cover you if a guest slips and falls on your icy driveway.

Frequently asked questions

Who has the best cheap renters insurance in Wisconsin?

Amica has the best cheap renters insurance in Wisconsin, at $15 per month for $30,000 of personal property coverage. The company gets roughly one-third as many complaints as an average company its size according to the National Association of Insurance Commissioners (NAIC), an industry group.

How much is renters insurance in Milwaukee?

Renters insurance in Milwaukee costs $23 per month on average for $30,000 of coverage to repair or replace your stuff, called personal property coverage. That's $4 more per month than the Wisconsin state average.

Can Wisconsin landlords require renters insurance?

Yes, Wisconsin landlords can require renters insurance as part of your lease agreement. Consider getting renters insurance even if you don't have to. Renters policies are typically cheap and can offer tens of thousands of dollars or more in coverage for your stuff and to protect you from getting sued.

Methodology

ValuePenguin collected 185 quotes from eight top renters insurance companies for 25 of the largest cities in Wisconsin for an unmarried 30-year-old woman with no history of claims. Coverage limits include:

- $30,000 of personal property coverage

- $9,000 for loss of use

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

Customer service ratings were created using average renters insurance rates, coverage, complaint data from the National Association of Insurance Commissioners (NAIC) and the most recent J.D. Power renters insurance customer satisfaction survey (2023).

These rates are for comparative purposes only. Your quotes will differ.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.