Blue Cross Blue Shield Medigap Review

Blue Cross Blue Shield (BCBS) Medicare Supplement insurance plans are a good option because they generally provide quality coverage at an average cost.

Compare Medicare Plans in Your Area

You can buy any Medigap plan from Blue Cross Blue Shield in all 50 states and Washington, D.C. Thirty-four different companies make up BCBS. That means prices and services vary considerably from affiliate to affiliate and from region to region. Blue Cross Blue Shield writes a quarter of all Medigap policies in the United States, making it one of the top providers nationwide.

Pros and cons

Pros

Lets you change plans

Sells most Medigap plans

Has a few discounts

Cons

Some plans have high rates

Service varies by location

How much does Blue Cross Blue Shield Medicare Supplement cost?

Blue Cross Blue Shield's rates are average for most Medigap plans.

The most popular choices, Plans F and G, cost an average of $214 and $155 per month, respectively. You can usually find a cheaper plan with another company. But Blue Cross Blue Shield might still be worth it if you live where the company has good customer service.

Plan | BCBS monthly cost | National average |

|---|---|---|

| Plan F | $214 | $184 |

| Plan G | $155 | $148 |

| Plan N | $141 | $111 |

| Plan K | $91 | $77 |

| Plan G (high-deductible) | $52 | $48 |

Compare Medicare Plans in Your Area

The rates for a few plans stand out. Plan B from Blue Cross Blue Shield is 40% more expensive than the national average, while its Plan D is 8% cheaper.

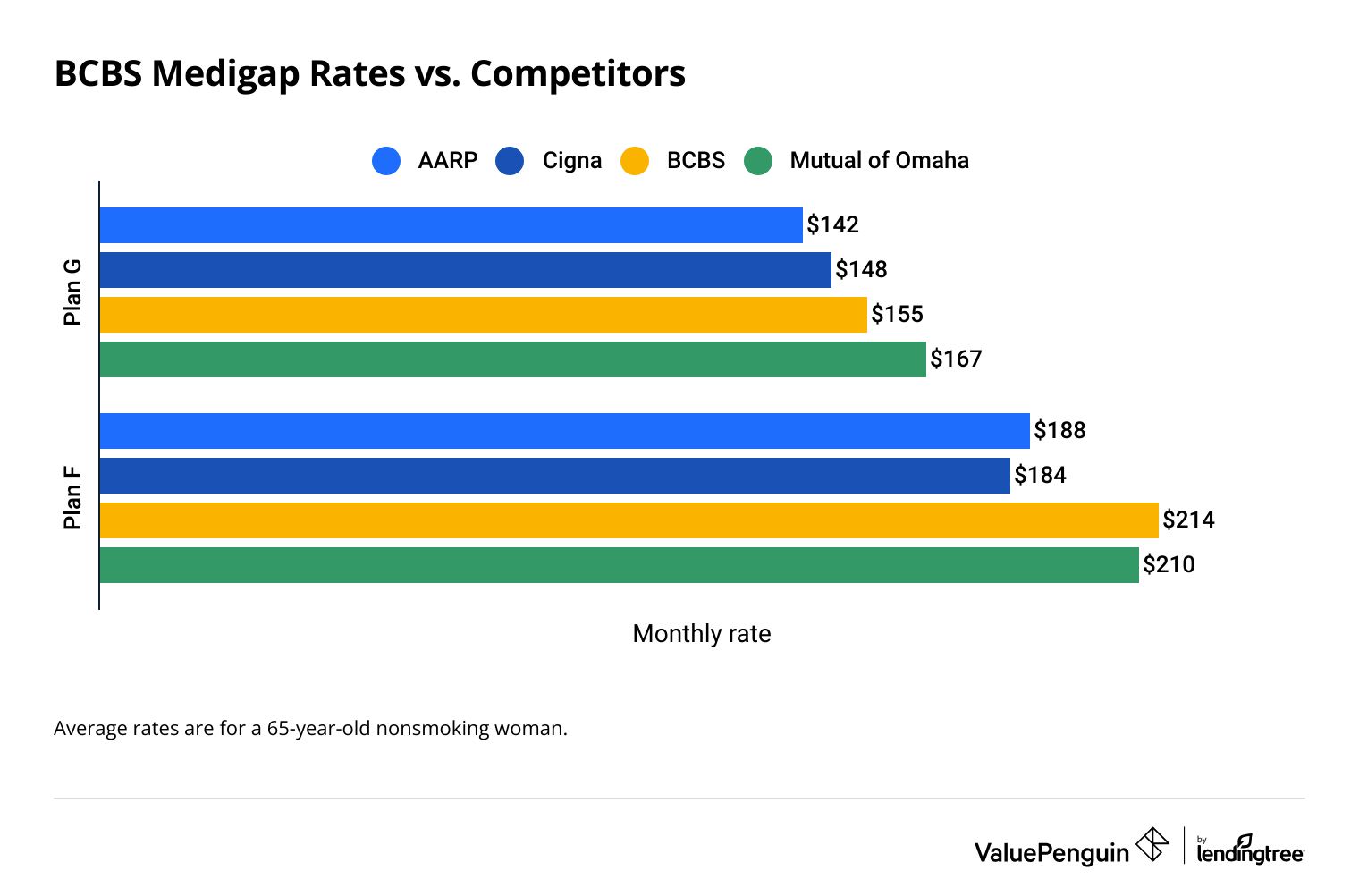

Blue Cross Blue Shield rates vs. major competitors

Blue Cross Blue Shield is cheaper than many major Medicare Supplement plan providers. The company's average rates for the popular Plan G option are lower than rates from Cigna, Mutual of Omaha and AARP/UnitedHealthcare.

Compare Medicare Plans in Your Area

AARP/UnitedHealthcare and Cigna both have cheaper rates for Plan G than Blue Cross Blue Shield. BCBS also has more expensive Plan F rates compared to other large health insurance companies.

But Blue Cross Blue Shield can still be a good option, especially if the BCBS company in your area has good customer service.

Blue Cross Blue Shield Medigap rates vs. competitors

Company | Plan G | Plan F | |

|---|---|---|---|

| AARP/UHC | $142 | $188 | |

| Cigna | $148 | $184 | |

| BCBS | $155 | $214 | |

| Mutual of Omaha | $167 | $210 |

All rates are for a 65-year-old woman who doesn't smoke.

Coverage features and benefits

Medicare Supplements plans have the same coverage no matter what company you choose.

Plan G from Blue Cross Blue Shield covers the same things as Plan G from Cigna, for example. This makes it easier to compare Medigap plans. But most companies have extra perks that help their plans stand out.

The perks on a Blue Cross Blue Shield Medigap plan are different depending on the BCBS company in your area.

- The Blue-to-Blue program, which is available with some BCBS companies, lets you switch between Medigap plans at certain times of the year. You might be able to get a cheaper plan, because the process doesn't use your medical history to determine rates.

- Discounts are available for automatic payments and having more than one plan in your household.

- Same Age Forever is a benefit that keeps your rates steady if you join at 65. Your monthly price won't go up as you get older.

Plans might also cover SilverSneakers, dental care, vision care, telemedicine and wellness programs.

Customer reviews and complaints

Before you buy a Blue Cross Blue Shield Medicare Supplement plan, research the customer service ratings for the BCBS company in your area.

In general, BCBS's service is average. But the level of customer service you get depends on where you live. Some BCBS companies have great service, while some have a high rate of complaints.

Blue Cross Blue Shield

- Number of BCBS companies: 34

- Largest companies: Anthem, HCSC, GuideWell

- Medigap market share: 27%

- Financial strength: AM Best rating B++ to A+

- Quality of care: 3.1/5 (NCQA ratings)

For example, Blue Cross Blue Shield of Michigan typically has good service, with about 30% fewer complaints than normal for a company its size. But Blue Cross Blue Shield of Arizona gets 28 times the expected number of complaints about its Medigap plans.

As a whole, Blue Cross Blue Shield Medicare plans scored an average of 3.1 out of 5 stars, just below average, for plan quality and experience from the National Committee for Quality Assurance (NCQA). However, individual BCBS member company scores range from a low of 2.5 out of 5 to a high of 3.5 out of 5.

Which Medigap plan is best for you?

The two most popular Medigap plans are F and G. These plans pay for more than other Medigap plans, which lets you pay for less of your medical bills. They account for 73% of all Medigap policies. Plan F has the best benefits, but you can only get it if you were eligible for Medicare before 2020. If you're newer to Medicare, Plan G is the best option.

Other plans are cheaper but give you fewer benefits. Plans F and G give you the best coverage.

Plan F and Plan G are the most popular because they have the most coverage. Both plans have essentially the same coverage with one exception: Plan F pays your Medicare Part B deductible, while Plan G doesn't. Because Plan G has slightly less coverage, it's usually cheaper than Plan F.

Plan F and G coverage

- Medicare Parts A and B coinsurance and copays

- Medicare Part A deductible

- Hospital costs

- Extra medical charges not covered by Medicare

- Blood transfusions (up to three pints)

- Skilled nursing facility coinsurance

Another popular choice is Plan N, which covers your Part A deductible, coinsurance for Parts A and B, blood transfusions up to three pints and 80% of your medical expenses outside the U.S. However, you're responsible for a $20 copay each time you visit the doctor and a $50 copay if you visit the emergency room (ER) and don't require hospitalization.

Some BCBS companies offer Medicare Select plans. They are cheaper, but you have to use in-network care for nonemergency services.

Frequently asked questions

How can I buy a Blue Cross Blue Shield Medicare Supplement plan?

You can buy a Blue Cross Blue Shield Medigap policy online or over the phone. To call BCBS, look up what branch is in your state and go to their website for contact info.

Is Blue Cross Blue Shield Medigap good?

Blue Cross Blue Shield is a good choice when buying a Medicare Supplement policy. BCBS usually has good service, but it depends on where you live.

How much does Blue Cross Blue Shield Medigap cost?

Blue Cross Blue Shield Medigap plans typically cost around the national average. The two most popular plans, F and G, cost an average of $214 and $155 per month, respectively.

Sources and methodology

ValuePenguin used actuarial data from private insurance companies to determine average rates for 2024 Medigap plans. All rates are for a 65-year-old woman who does not smoke and who bought her policy when she first became eligible. Our experts also used publicly available info taken from the Centers for Medicare & Medicaid Services (CMS) to gather coverage data. ValuePenguin also used the NCQA and the NAIC for info about plan quality and customer satisfaction.

The ValuePenguin star rating for Blue Cross Blue Shield is based on its price, coverage quality, customer satisfaction and unique features.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.