Bright HealthCare Stops Selling Health Insurance Policies

Bright HealthCare doesn't sell health insurance or Medicare Advantage policies anymore, so you'll need to find coverage with another company.

Find Cheap Health Insurance Quotes in Your Area

Bright HealthCare no longer sells health insurance or Medicare Advantage policies. Most of the company's coverage ended on Dec. 31, 2022. Bright HealthCare maintains Medicare Advantage plans in California, but the company is selling the plans to Molina Healthcare. The sale is expected to be done in early 2024. Once its California business is officially sold, Bright HealthCare will no longer be a health insurance company and will instead focus on operating its network of medical care offices.

Alternatives to Bright HealthCare

Original review (2021)

Good for

- Those looking for low-cost insurance.

Bad for

- Those who want broad choices of which doctors to see.

- Those who prefer frustration-free interactions.

Bright HealthCare: Our thoughts

Bright HealthCare insurance is best for those who are willing to save money on health insurance by having access to a smaller network of providers and no out-of-network access.

Plans are usually affordable, and in some states, they may be the cheapest plans available. However, the trade-off is that the insurer only works with a limited number of affiliated doctors and health care facilities in each market it serves. Before signing up, it's important to check if there are medical providers in your region that are covered by the insurance company.

Bright HealthCare also has a very high rate of dissatisfied members, which could mean you'll be frustrated when managing your health care. According to the National Association of Insurance Commissioners (NAIC), the rate of complaints for Bright HealthCare is seven times higher than the national average, and on the Better Business Bureau (BBB), customers rated the company 1.44 out of 5. Common complaints include poor customer service and denial of claims.

Plan options and costs

Bright HealthCare offers health insurance plans for individuals, families, small businesses and seniors. Policies are available through a state health insurance marketplace, HealthCare.gov and Medicare.gov, or you can purchase insurance directly from the company.

Individual and family health plans

Because the plans are compatible with the Affordable Care Act (ACA), they have the standard features of free preventive care, coverage for preexisting conditions and free pediatric dental and vision.

The main difference between Bright HealthCare and larger insurance companies is its narrow network of providers. Bright has what it calls a "carefully curated" network of "Care Partners." This means that rather than trying to provide a broad selection of in-network providers, it strategically selects affiliate providers and facilities in each market. Insurance benefits are limited to these in-network providers, and out-of-network health care services are not covered.

Choosing a plan with a narrow network of providers isn’t a good fit for those who want to have maximum choices about which doctors and facilities to use. Also, if you have special medical conditions, it's important to check the provider list to make sure you'll have easy access to the specialized care you need.

If you prefer a larger network of providers, review the cheapest health insurance companies in each state to see if there's an affordable alternative.

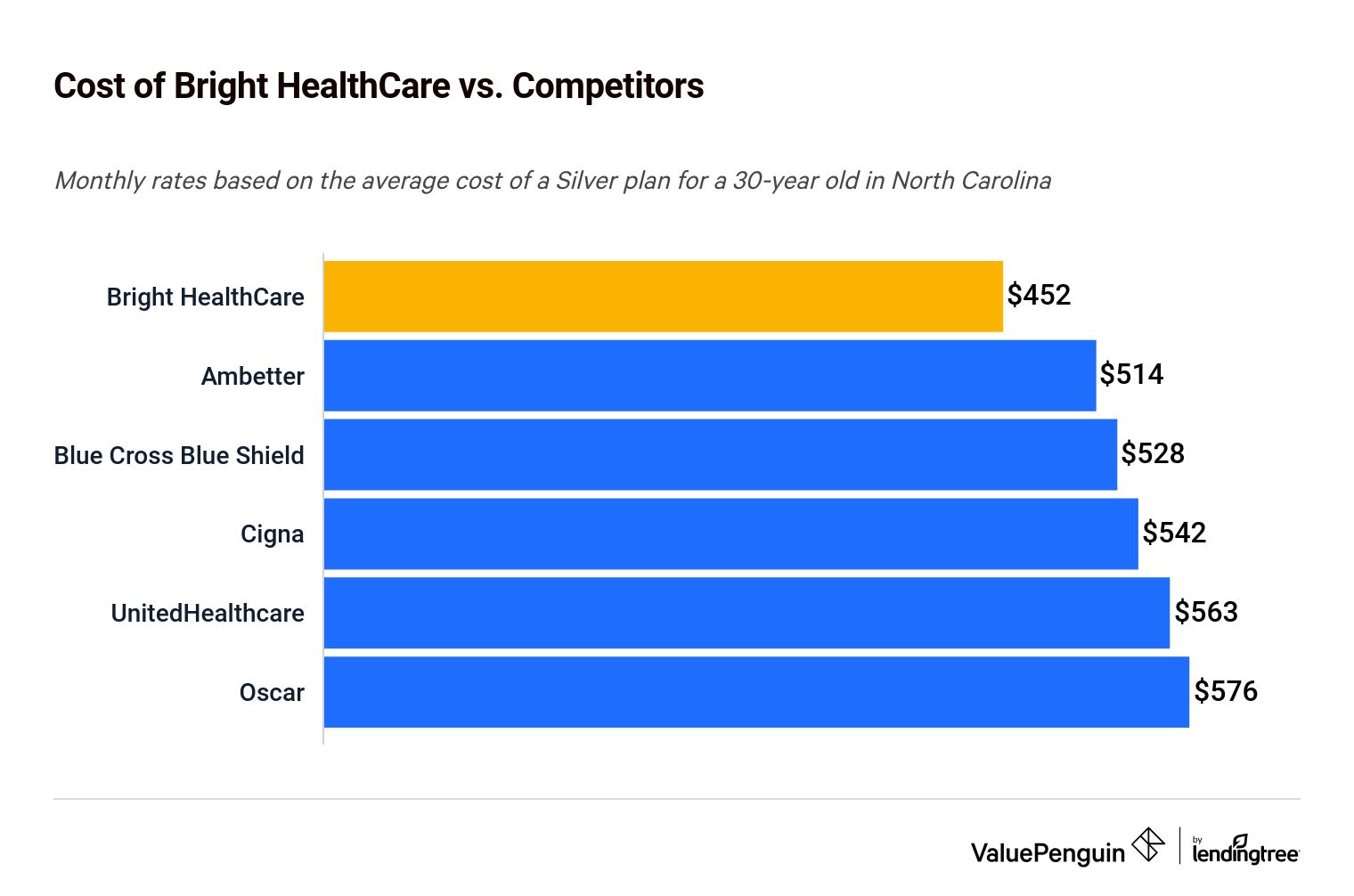

The monthly cost for Bright HealthCare is about 14% cheaper than average for Catastrophic, Expanded Bronze and Silver plans in North Carolina. For Gold plans, Bright insurance plans are 5% cheaper, on average.

Another key aspect of Bright HealthCare is its affordable plans. Not only are there low monthly costs, but some plans also have zero deductible, helping to reduce the total amount you spend on medical care.

For example, a 30-year-old could pay about $452 per month for a Silver plan from Bright HealthCare. That's $71 less than the statewide average for Silver plans of $523. That's also $62 less than a Silver plan from Ambetter, another low-cost insurer.

Find Cheap Health Insurance in Your Area

Like most health insurance plans, the monthly cost increases based on age and the number of people covered. For example, an Expanded Bronze plan from Bright has an average cost of $388 for a 40-year-old and $824 for a 60-year-old.

Monthly costs also increase based on coverage level. A 40-year-old could pay about $244 for a Catastrophic plan and $508 for a Silver plan. With a family plan, two adults and two children could be covered for $779 to $2,019 per month.

Average monthly cost of Bright HealthCare insurance

Plan tier | Age 21 | Age 40 | Age 60 |

|---|---|---|---|

| Catastrophic | $191 | $244 | $518 |

| Expanded Bronze | $304 | $388 | $824 |

| Silver | $398 | $508 | $1,080 |

| Gold | $494 | $631 | $1,341 |

Based on available policies in North Carolina.

Medicare Advantage

Bright offers both HMO and PPO Medicare Advantage plans. All of the plans have a narrow network of providers, but the PPO plans allow for some out-of-network coverage.

The plans have a $0 copay for in-network care, and there's no need for specialist referrals. When looking at sample policies in New York City, the monthly cost for Bright's Medicare Advantage plans ranges from $0 to $95, in addition to the $148.50 standard cost for Part B.

Bright HealthCare availability

Bright HealthCare is a young company and still has limited availability throughout the country. It's currently available in 14 states, but coverage isn't always statewide. Because of the narrow network of providers, some regions of a state may have better access to care than others. Within the 14 states where it operates, the company operates in 99 markets.

Below are some of the major regions where Bright HealthCare insurance policies are available. Check to see if your preferred medical providers are part of the Bright HealthCare network by checking the directory of providers in your state or searching for medical facilities near you.

State | Individual plans | Medicare Advantage plans |

|---|---|---|

| Alabama | Birmingham | Birmingham |

| Arizona | Phoenix, Tucson | Phoenix |

| California | Southern California (Brand New Day and Central Health Plan of California) | |

| Colorado | Denver, Summit, Dolores and San Juan counties | Denver |

| Florida | Palm Beach, Daytona Beach, Orlando, Pensacola, Jacksonville, Tampa, Miami-Dade and Broward counties | Palm Beach, Daytona Beach, Orlando, Miami-Dade and Broward counties, Central Florida |

| Illinois | Chicago | Chicago |

| Nebraska | Omaha, Statewide | Omaha |

| New Mexico | Statewide (True Health) | |

| New York | New York City | |

| North Carolina | Asheville, Charlotte, Greensboro, Raleigh-Durham, Winston-Salem | |

| Ohio | Cleveland, Cincinnati, Springfield, Toledo, Youngstown | |

| Oklahoma | Oklahoma City |

Member resources and unique features

Bright insurance plans offer some valuable member services. Not all features are available with all health care plans or in all states. However, these highlighted benefits can improve the value you get from your insurance plan.

- Telehealth

- Mental health coverage

- Free visits to a primary care doctor

- Some free generic prescriptions

- A national network of urgent care centers

- Rewards for healthy actions

- Prescription delivery and rides to the doctor for Medicare enrollees

Customer reviews and complaints

Bright HealthCare insurance has a high rate of dissatisfied policyholders. In the complaint database from the NAIC, the national company of Bright HealthCare has a complaint rate that's nearly seven times higher than the industry average. It scored an overall 6.76 on the complaint index, where 1.0 is the average rate of complaints. About 52% of complaints were about claim handling, including denial of service and unsatisfactory settlements. Another 39% of complaints were about policyholder service, including coverage questions, unresponsiveness or access to care.

When state-level data is available, North Carolina and South Carolina have four times as many complaints as average. Tennessee has about twice as many complaints as average, and Arizona is slightly above average.

Even though the company has an A+ rating from the Better Business Bureau (BBB), its customer review average is 1.44 out of 5. Members share their frustrations across multiple online review platforms, and common complaints include poor customer service, frustrations about the limited network, billing problems, an outdated list of provider networks and more.

The financial strength of an insurance company is another important factor when considering if it will be able to pay claims. The company doesn't have financial ratings available from AM Best. However, after a recent IPO in June 2021, Bright HealthCare raised $925 million, resulting in a $10.4 billion company valuation.

Frequently asked questions

Is Bright HealthCare insurance good?

Bright HealthCare insurance is no longer available for purchase, but when it was available, the company wasn't highly rated. The low-cost insurance provider had a large number of unsatisfied members, and the rate of complaints was seven times higher than the national average.

What is Bright health insurance?

Bright HealthCare is a company that once sold insurance products in 14 states but no longer sells policies. It offered plans for individuals, small businesses and Medicare Advantage. Individual insurance plans were cheaper than average, but members could only use a small network of medical providers.

How do you cancel Bright HealthCare insurance?

If you have an existing Bright HealthCare policy still, you'll contact the company directly to cancel. However, most Bright HealthCare health insurance policies ended on Dec. 31, 2022. People with health insurance policies in Texas have until July 31, 2023, to replace their coverage. Most Medicare Advantage policies also ended on Dec. 31, 2022. Bright HealthCare still has Medicare Advantage policies in California, but the company is searching for another company to purchase them. If you have a California Medicare Advantage policy from Bright HealthCare, watch for communication from the company about how to handle the situation.

Who accepts Bright HealthCare insurance?

Bright HealthCare insurance was accepted by a limited network of providers, and going out of network meant you would pay full price for health care services. Because Bright HealthCare is leaving the health insurance market, you'll need to find another company and look for network providers accepted by your new coverage.

Sources and methodology

Cost data for Bright HealthCare and competitor insurance policies was sourced from the Centers for Medicare and Medicaid Services (CMS), HealthCare.gov and Medicare.gov in 2021. Individual health insurance comparisons sampled costs in North Carolina because Bright HealthCare served multiple markets within the state. Costs for Medicare Advantage plans were based on available policies in New York City. Averages were calculated based on the insurance company, location, plan tier, age and family size.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.