Cheapest Auto Insurance Quotes in Wichita, Kansas

State Farm has the best car insurance rates in Wichita, KS, with average rates of $31 for minimum coverage and $89 for full coverage.

Find Cheap Auto Insurance Quotes in Wichita

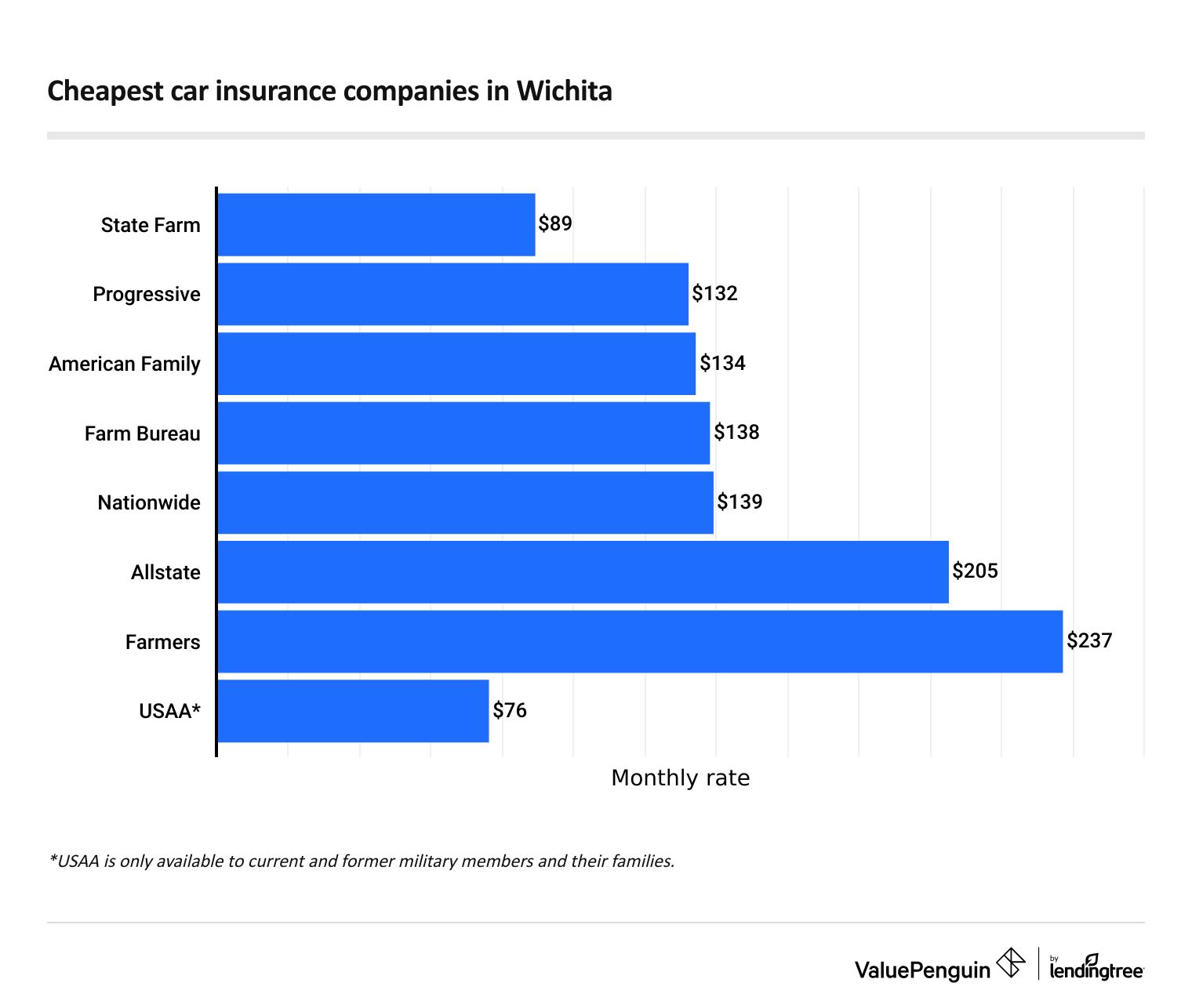

Cheapest car insurance companies in Wichita

Drivers in Wichita — the most populous city in Kansas — pay a little more for full coverage than the state average, 4% more. The difference is more stark for minimum coverage, which is 23% more expensive in Wichita.

Cheapest car insurance in Wichita: State Farm

State Farm has the lowest full-coverage car insurance prices, $89 per month. That's 38% less than average in the city and $43 per month cheaper than the second-cheapest option, Progressive.

Only current military members, former military members or their eligible family members can get USAA policies, but their rates are routinely the cheapest in Wichita and elsewhere.

Find Cheap Auto Insurance Quotes in Wichita

Cheapest full-coverage car insurance in Wichita

Company | Monthly rate | |

|---|---|---|

| State Farm | $89 | |

| Progressive | $132 | |

| American Family | $134 | |

| Farm Bureau | $138 | |

| Nationwide | $139 |

*USAA is only available to current and former military members and their families.

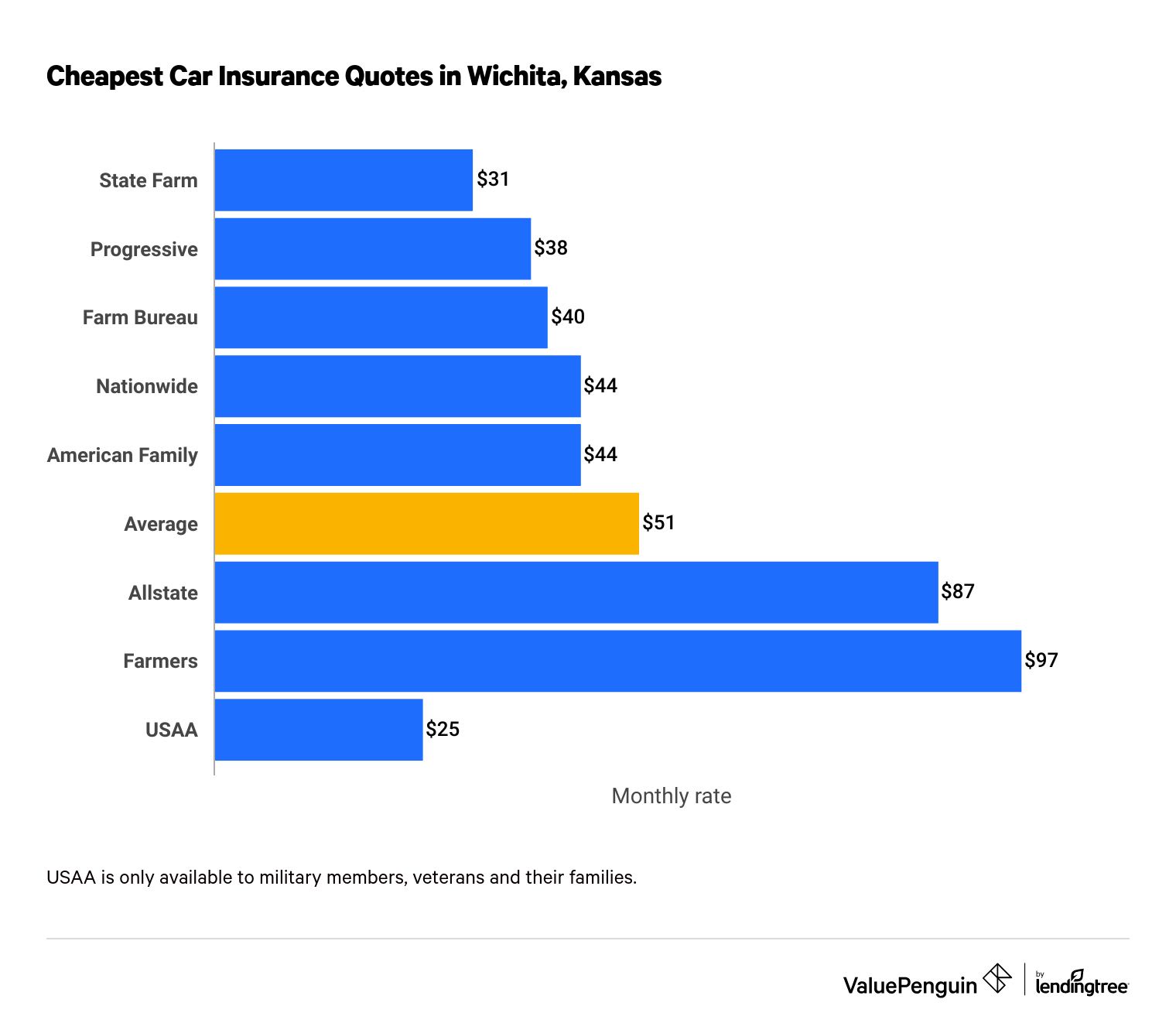

Cheapest liability insurance quotes in Wichita: State Farm

State Farm is the cheapest option for minimum liability coverage in Wichita, followed by Farm Bureau and Progressive.

State Farm's average rate is $31 per month, while Farm Bureau and Progressive come in at $40 per month or less. The average overall rate in the city is $51 per month.

Find Cheap Auto Insurance Quotes in Wichita

Cheap minimum coverage car insurance quotes in Wichita, Kansas

Company | Monthly rate | |

|---|---|---|

| State Farm | $31 | |

| Progressive | $38 | |

| Farm Bureau | $40 | |

| Nationwide | $44 | |

| American Family | $44 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for young drivers in Wichita: Farm Bureau

Farm Bureau has the absolute lowest prices for Wichita's young drivers, with an average rate of $107 per month for minimum coverage. State Farm is the cheapest option for full coverage, at $262 per month.

At 18 years old, drivers in Wichita pay more than three times as much, on average, as 30-year-old drivers. Younger drivers are considered a much higher risk by insurance companies, which raises their rates.

Cheapest car insurance for young drivers

Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $108 | $262 |

| American Family | $127 | $308 |

| Farm Bureau | $107 | $333 |

| Nationwide | $145 | $422 |

| Farmers | $281 | $589 |

Options for young drivers looking to cut their insurance costs include:

- Searching for discounts: Check with your insurance company and review your options to see if you qualify for discounts. Those can include breaks for good grades, avoiding accidents and safe driving, among other things.

- Joining a parent's car insurance policy: This option will likely raise the price of a parent's policy but is drastically cheaper than maintaining separate policies.

Cheapest Wichita car insurance for drivers with a speeding ticket: State Farm

State Farm has the best auto insurance rates for drivers with a speeding ticket in Wichita, at $94 per month. American Family, at $134 per month, and Progressive, at $165 per month, offer the second- and third-best rates in the city, respectively.

Cheapest car insurance for drivers with a speeding ticket

Company | Speeding rate |

|---|---|

| State Farm | $94 |

| American Family | $134 |

| Progressive | $165 |

| Nationwide | $170 |

| Farm Bureau | $174 |

On average, a ticket meant a 19% increase, or $26 per month, for insurance rates in Wichita.

Cheapest car insurance in Wichita after an accident: State Farm

State Farm offers the lowest rates in Wichita for drivers with an at-fault accident, with average rates of $101 per month.

Cheapest car insurance after an accident

Company | Accident rate |

|---|---|

| State Farm | $101 |

| American Family | $152 |

| Progressive | $210 |

| Farm Bureau | $210 |

| Nationwide | $221 |

An accident in Wichita raised rates an average of $64 per month, an increase of 45%. The increase with an accident was $12 per month for State Farm customers and $17 per month for American Family customers.

Cheapest car insurance for Wichita drivers with a DUI: State Farm

State Farm offers Wichita's best rates after a DUI at an average of $94 per month, $40 cheaper per month than the next-closest competitor.

Having a DUI on your record in Wichita costs an average $75 more per month for car insurance, an increase of 52%.

Cheapest car insurance with a DUI

Company | Monthly rate |

|---|---|

| State Farm | $94 |

| American Family | $134 |

| Progressive | $145 |

| Allstate | $271 |

| Nationwide | $286 |

Cheapest Wichita car insurance for drivers with poor credit: Nationwide

Nationwide offers the best rates for drivers in Wichita who have poor credit, with an average price of $204 per month.

Nationwide's rate comes in at $19 per month less than State Farm’s. Progressive is the third-cheapest at $225 per month. On average, poor credit raises prices for a Wichita driver by 70%.

Cheapest car insurance for poor credit

Company | Monthly rate |

|---|---|

| Nationwide | $204 |

| State Farm | $223 |

| Progressive | $225 |

| American Family | $240 |

| Farm Bureau | $256 |

more than a speeding ticket or DUI in Wichita. This is not because your credit score has anything to do with your driving, but insurance companies say drivers with poor credit file claims more often.

Cheapest quotes for teens with traffic citations: State Farm

State Farm offers the cheapest car insurance in Wichita for young drivers with issues on their driving records.

The company charges 18-year-olds $119 per month after a speeding ticket, which is 39% cheaper than average. If a young driver has an at-fault accident, rates are $123 per month, 45% less than average.

Monthly minimum-coverage quotes for teens with traffic citations

Company | Speeding rate | Accident rate |

|---|---|---|

| State Farm | $119 | $123 |

| American Family | $127 | $144 |

| Farm Bureau | $140 | $174 |

| Nationwide | $158 | $162 |

| Progressive | $213 | $236 |

Cheapest car insurance for married drivers: State Farm

State Farm has the cheapest car insurance for married drivers in Wichita, at $89 per month. That's the lowest rate despite State Farm not offering a discount for married drivers.

Progressive offers the largest discount for married drivers, 20% in Wichita. Married drivers tend to get better rates than unmarried drivers because they're considered less risky by insurance companies.

Company | Monthly rate |

|---|---|

| State Farm | $89 |

| Progressive | $105 |

| Nationwide | $124 |

| American Family | $134 |

| Farm Bureau | $139 |

Best car insurance companies in Wichita

USAA has the best-rated car insurance in Wichita because of a strong blend of customer service, coverage options and cheap rates.

USAA ranks at the top of the J.D. Power claims satisfaction study and has a low rate of customer complaints, according to the National Association of Insurance Commissioners. These are good indicators USAA customers are happy with their service, but you must be a current military servicemember, veteran or military family member to purchase a policy.

If you don't qualify for USAA, Farm Bureau and State Farm are top options that are available to most drivers.

Best car insurance companies in Wichita, KS

Company |

Editor's rating

|

|---|---|

| Farm Bureau | |

| State Farm | |

| USAA | |

| Nationwide | |

| American Family | |

| Farmers | |

| Allstate | |

| Progressive |

Customer service is a crucial part of your experience with your insurance company if you have to file a claim, so you should consider it when you shop for a new policy. Good service can get your life back to normal faster and even save you money with a smoother, quicker process.

Average car insurance costs in Wichita, by neighborhood

Wichita's cheapest ZIP code for auto insurance is 67232, a rural spot east of McConnell Air Force Base. The city's priciest ZIP code for insurance is 67214, on the northeastern side of the city.

The rates are within a relatively narrow range, with $13 per month separating the most expensive area from the cheapest.

Full-coverage car insurance rates in Wichita, KS

City | Average monthly cost | Difference from average |

|---|---|---|

| 67202 | $150 | 4% |

| 67203 | $150 | 4% |

| 67204 | $145 | 1% |

| 67205 | $140 | -3% |

| 67206 | $141 | -2% |

What's the best car insurance in Wichita, KS?

Minimum liability coverage could still leave you facing a considerable financial burden if you get into an accident. This level of coverage satisfies legal requirements, but after an accident, drivers may wind up with bills higher than their coverage limits, because of either damage to an expensive vehicle or another driver's medical costs.

Full coverage auto insurance includes protection for a driver's own car with collision and comprehensive coverages.

- Collision coverage covers damage to a driver’s own vehicle resulting from a crash, regardless of who was at fault. Also covers damage from collisions with objects or single-car accidents.

- Comprehensive coverage covers damage to a driver’s own vehicle caused by something other than a crash, such as a natural disaster or theft.

We suggest most drivers choose a full-coverage policy.

Methodology

Rate data was collected from the largest insurance companies in Kansas. Quotes are for a 30-year-old man with a 2015 Honda Civic EX and good credit. Rates are for a full-coverage policy, unless otherwise stated. Minimum-coverage policies match the state minimums in Kansas.

Coverage | Full-coverage limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

These quotes should be used for comparative purposes only. Our analysis used insurance rate data from Quadrant Information Services that were publicly sourced from insurer filings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.