How Does Personal Injury Protection (PIP) Work in Kentucky?

Find Cheap Auto Insurance Quotes in Kentucky

Personal injury protection (PIP) insurance in Kentucky provides coverage if you're involved in a motor vehicle accident. Because Kentucky is a no-fault state, PIP pays for medical expenses, lost wages and other costs related to your injuries, no matter which party was at fault for the accident.

At least $10,000 of PIP insurance is mandatory for all drivers, except motorcyclists, but you can typically purchase up to $50,000 from your insurer.

Note that you can choose to reject PIP by submitting a document to the state, which means you're giving up your PIP benefits.

How does PIP insurance work in Kentucky?

Personal injury protection in Kentucky will provide coverage if you're injured due to a motor vehicle accident so long as:

- The accident was not work related.

- You have not rejected PIP coverage.

- You have PIP insurance in place, if you were operating the vehicle.

You would be covered by PIP if you had almost any role in an accident, whether you were operating a vehicle involved in the accident or were a passenger in a vehicle, a pedestrian or a bicyclist.

You can opt to purchase higher levels of coverage, but the minimum level of personal injury protection pays for:

- Up to $10,000 of medical expenses per person in an accident

- 85% of lost wages due to injury (up to $200 per week) from an accident

- Other related costs, such as in-home health services

Deductible for PIP Insurance

Unlike some forms of insurance coverage, PIP in Kentucky doesn't always come with a deductible. If you want a policy with one, you can choose a deductible of $250, $500 or $1,000. The benefit of adding a deductible is decreased premium costs. Following an accident, you would pay only one deductible to cover everyone listed on your insurance policy.

For example, say you and your spouse share an auto insurance policy with a $1,000 deductible and you're both injured in a collision. Medical expenses above $1,000 would be covered for both you and your spouse.

Though adding a deductible to your personal injury protection will lower your premiums, you should understand that you will have to pay that amount out of pocket. You won't be able to reclaim a deductible from the other party, even if they're at fault.

Out-of-state PIP coverage

If you're a Kentucky resident covered by PIP when driving within the state, you will continue to have PIP coverage when driving in other states. This applies whether you're the driver or a passenger in an accident outside of Kentucky.

On the other hand, if you're not a resident of Kentucky and are simply driving through the state, your liability insurance limits determine whether or not you're treated as having PIP coverage.

The minimum liability insurance requirements in Kentucky are:

- $25,000 person/$50,000 per accident in bodily injury liability coverage

- $25,000 per accident in property damage liability coverage

Personal injury protection law and tort limitations

The personal injury protection law in Kentucky has a tort limitation. That means if you have PIP coverage, you give up your right to recover the first $10,000 in medical expenses, lost wages and other related costs from an at-fault driver. Instead, these costs need to be paid by your own PIP insurance or other applicable PIP insurance. This limitation also applies to motorcycle operators, even though personal injury protection coverage is optional.

In addition, you can't file a claim for additional compensation for personal injury unless your medical expenses exceed $10,000. The only exceptions to this limitation are if the injury:

- Was a fracture or broken bone

- Was permanently disfiguring (partial or whole)

- Caused death

- Was permanent

- Caused a permanent loss of bodily function

Kentucky car owners can choose to reject their tort limitations by filing a form with the state's department of insurance. By doing so, you also reject your PIP coverage, which is why this option is often referred to as rejection of personal injury protection insurance.

Each individual on a policy has the option to carry PIP or reject coverage. If all members of a household reject PIP, you will have to pay for "guest PIP coverage," which pays to cover passengers other than those from your household and pedestrians involved in an accident.

In addition, if you reject PIP, your bodily injury liability coverage premiums will increase. This is to account for the increased risk to your insurer, as other drivers will be able to sue for injuries that wouldn't otherwise meet the minimum thresholds.

These limitations only apply to vehicle owners and drivers. Bicyclists, pedestrians and motorcycle passengers can recover the first $10,000 in expenses since they haven't declined their tort liability.

How and when to file a PIP claim in Kentucky

Personal injury protection claims must be filed within four years of an accident occurring, or within two years if it's determined that you should have been aware of the loss.

Which insurer a PIP claim should be filed with in Kentucky is determined by your role in the incident.

- If you were a passenger or nonowner driver of the car, and the owner has insurance, you should file a claim with the insurer of the vehicle you were in.

- If you're the owner of the vehicle, you should file a claim with your own insurer.

- If you were a passenger in the car, and it's not insured, you would file a claim with the other driver's insurer or your own insurer (if you have coverage).

- If you were a pedestrian or bicyclist, you would file a claim with the vehicle owner's insurer. If the vehicle was not insured, you can make a claim for basic PIP from the Kentucky Assigned Claims Plan.

When filing a claim, it's important to make sure you collect payment for all associated medical expenses, lost wages and other costs tied to the accident. Make sure to maintain detailed records of bills, time away from work, your payment history and receipts for other costs related to the accident.

How much does PIP insurance cost in Kentucky?

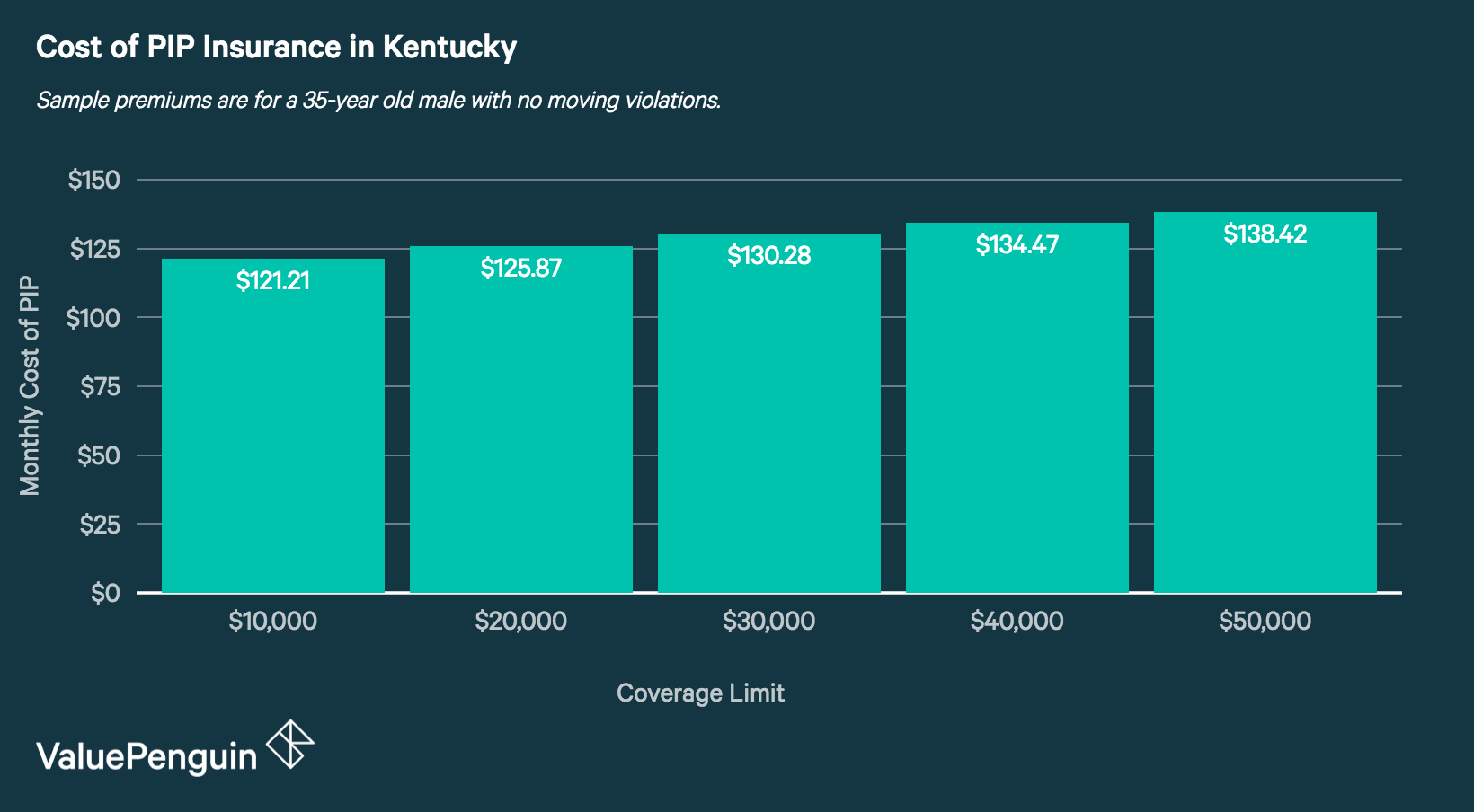

The cost of PIP insurance in Kentucky varies depending on factors such as your coverage limits, whether you've added a deductible and the city where you live. Below are sample rates for a driver who has accepted limitations on their tort rights.

As you can see, the rates don't vary significantly based on your coverage limits, but the minimum PIP is fairly expensive, starting at $121 per month.

If you reject your tort limitations and don't purchase PIP, you are still likely to face increased rates for the bodily injury liability portion of your insurance.

This is because other drivers can sue you for injuries that wouldn't otherwise meet the threshold. You'll also have to pay a premium for "guest PIP coverage" for passengers and pedestrians who may be in an accident that involves your car. For a sample driver with the state minimum liability limits, having no PIP coverage increased premiums by a total of $40 per month, including the cost of guest PIP insurance.

Health insurance vs. PIP

While health insurance is an alternative to personal injury protection, we recommend that you first use the entirety of your PIP coverage on expenses related to a car accident before turning to your health insurance.

Most health plans require that you reimburse the insurer for the treatment of injuries due to a motor vehicle accident, but you do get to reimburse them at the reduced rate the insurer has negotiated with the health care provider. However, since you do have to pay for medical costs, health insurance should be used after your PIP insurance.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.