Who Has the Best Car Insurance Rates in Atlanta?

Auto-Owners has the cheapest rates for car insurance in Atlanta, at $113 per month for full coverage, or $41 per month for minimum coverage.

Find Cheap Auto Insurance Quotes in Atlanta

Best cheap car insurance companies in Atlanta

Cheapest car insurance in Atlanta: Auto-Owners

Auto-Owners offers Atlanta's cheapest widely-available option for full-coverage car insurance, at $113 per month.

Farm Bureau has the second-cheapest rates, followed by State Farm.

In Georgia's capital and the heart of the state's largest metro area, drivers pay considerably more for car insurance than the average resident of the Peach State. Atlantans pay 23% more for full coverage and 35% more for minimum coverage.

Find Cheap Auto Insurance Quotes in Atlanta

Cheapest full-coverage car insurance in Atlanta

Company | Monthly rate | |

|---|---|---|

| Auto-Owners | $113 | |

| Farm Bureau | $133 | |

| State Farm | $144 | |

| Allstate | $174 | |

| Geico | $199 |

*USAA is only available to current and former military members and their families.

Cheapest liability insurance quotes in Atlanta: Auto-Owners

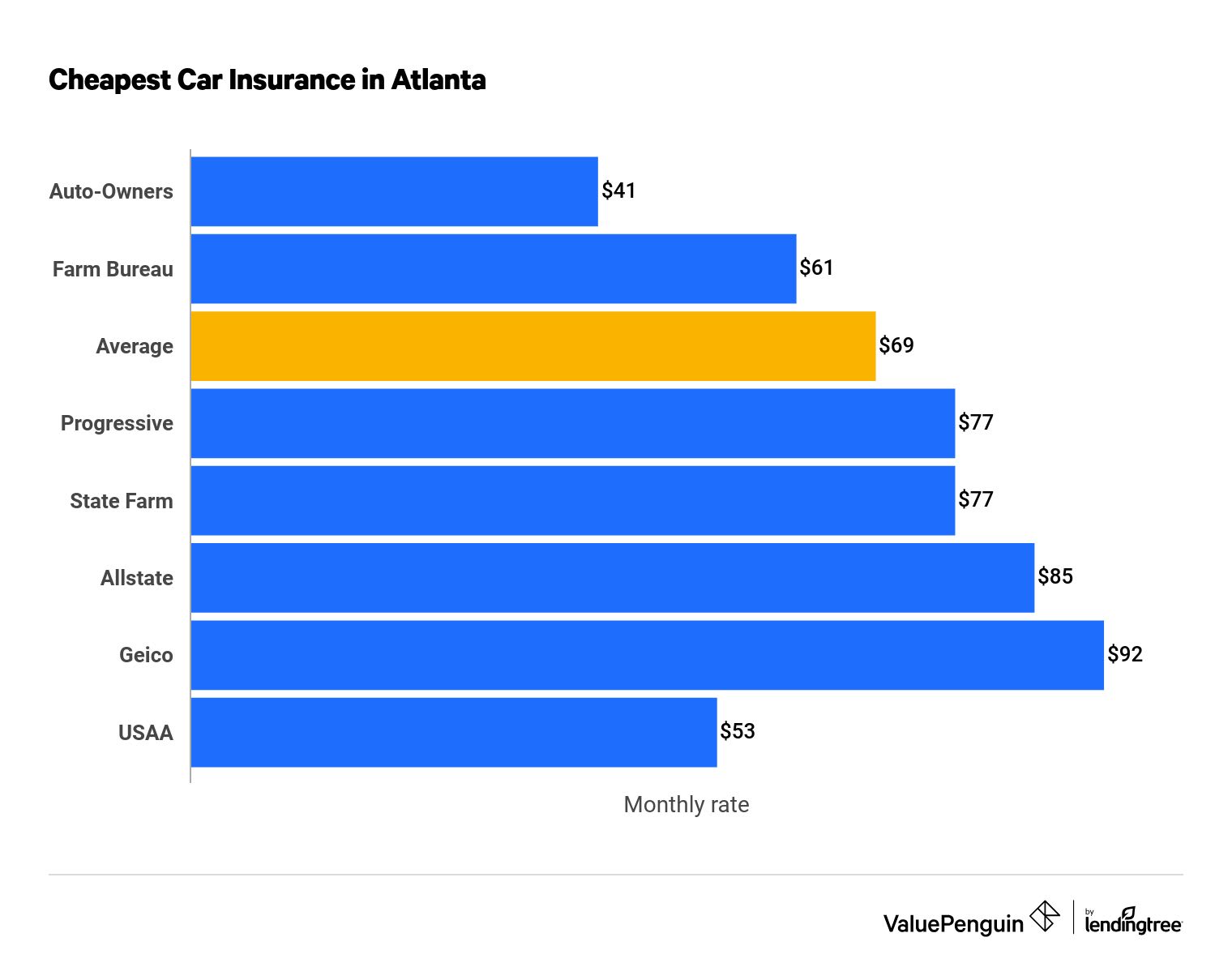

Auto-Owners has Atlanta's cheapest car insurance, at $41 per month for minimum coverage.

The average cost of car insurance in Atlanta is $69 per month, or $834 per year, for a minimum-coverage policy.

Find Cheap Auto Insurance Quotes in Atlanta

Cheapest liability insurance in Atlanta

Company | Monthly rate | |

|---|---|---|

| Auto-Owners | $41 | |

| Farm Bureau | $61 | |

| Progressive | $77 | |

| State Farm | $77 | |

| Allstate | $85 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for young drivers: Auto-Owners

In Atlanta, Auto-Owners has the cheapest rates for young drivers for both minimum and full coverage. The company's average quote for teen drivers is $153 per month for minimum coverage and $349 for full coverage.

Eighteen-year-old drivers tend to pay considerably more for auto insurance because insurers consider them to be a higher risk. On average, a younger driver pays well over twice as much as a 30-year-old for car insurance.

Company | Liability only | Full coverage |

|---|---|---|

| Auto-Owners | $153 | $349 |

| Farm Bureau | $200 | $428 |

| State Farm | $261 | $436 |

| Allstate | $321 | $678 |

| Geico | $335 | $655 |

Options for young drivers looking to lower their insurance costs include:

- Looking for discounts: Good grades, avoiding accidents and safe driving are all ways to get discounts from insurers. You should speak with your insurer about what you are eligible for and which options are available.

-

Joining a parent's car insurance policy: Although it will likely raise the price of the parent's policy, it should be considerably cheaper than having separate policies.

Cheapest car insurance for drivers with a speeding ticket: Auto-Owners

Auto-Owners has the best rates for Atlanta drivers looking for full-coverage insurance after a speeding ticket, with an average quote of $113 per month.

Cheapest after a ticket in Atlanta

Company | Monthly rate |

|---|---|

| Auto-Owners | $113 |

| Farm Bureau | $146 |

| State Farm | $154 |

| Allstate | $199 |

| Geico | $245 |

The city’s average rate after a ticket is $182 per month. Overall, speeding tickets raise the average rate by $28 per month, an increase of 18%.

Cheapest car insurance in Atlanta after an accident: Farm Bureau

Farm Bureau has the best full-coverage quote in Atlanta after an at-fault accident, charging only $146 per month for a policy.

Cheapest after an accident in Atlanta

Company | Monthly rate |

|---|---|

| Farm Bureau | $146 |

| Auto-Owners | $156 |

| State Farm | $167 |

| Allstate | $278 |

| Progressive | $345 |

Farm Bureau increases rates 9% from the cost with a clean record. On average, an accident raised Atlanta insurance rates 50%.

Cheapest car insurance for drivers with a DUI: State Farm

State Farm has Atlanta's cheapest rates for drivers after a DUI, at $153 per month for full coverage. That's at least 32% cheaper than any other major company.

Cheapest after a DUI in Atlanta

Company | Monthly rate |

|---|---|

| State Farm | $153 |

| Auto-Owners | $224 |

| Allstate | $242 |

| Farm Bureau | $259 |

| Progressive | $285 |

On average, a DUI increases the full-coverage insurance quote for an Atlanta driver by $286 per month, a jump of 85%.

Cheapest car insurance for drivers with poor credit: Farm Bureau

Farm Bureau offers the best rates for drivers with poor credit in Atlanta. The company's average cost is $133 per month.

Cheapest for poor credit in Atlanta

Company | Monthly rate |

|---|---|

| Farm Bureau | $133 |

| Allstate | $264 |

| Geico | $285 |

| State Farm | $288 |

| Auto-Owners | $298 |

Poor credit does not make you a higher risk on the road, but insurers have found drivers with poor credit tend to file more claims. Credit problems can have a major impact on your rates — moreso than a speeding ticket in Atlanta, increasing rates by $255 per month.

Cheapest car insurance for young drivers after an incident: Auto-Owners

Auto-Owners offers the cheapest coverage for 18-year-old Atlanta drivers with either an accident or speeding ticket. The company's rate after a speeding ticket is $153 per month, while teen drivers pay an average of $220 per month after an accident.

Cheapest for young drivers after an incident in Atlanta

Company | Speeding rate | Accident rate |

|---|---|---|

| Auto-Owners | $153 | $220 |

| Farm Bureau | $220 | $226 |

| State Farm | $283 | $312 |

| Allstate | $376 | $444 |

| Geico | $389 | $456 |

Monthly Rate.

Cheapest car insurance for married drivers: Auto-Owners

Auto-Owners offers the best rates for married drivers in Atlanta, with an average rate of $113 per month. Progressive offers the largest discount overall, 22%.

Cheapest for married Atlanta drivers

Company | Monthly rate |

|---|---|

| Auto-Owners | $113 |

| Farm Bureau | $133 |

| State Farm | $142 |

| Progressive | $159 |

| Allstate | $170 |

On average, married drivers in Atlanta pay 8% less than single drivers. Insurers tend to see married drivers as less risky, and as a result, they often pay lower rates.

Best auto insurance companies in Atlanta

USAA has the top-rated car insurance in Atlanta, with strong customer satisfaction and a high ranking from J.D. Power.

USAA has some of the best customer service you'll find, along with a wide range of coverage options and low rates. However, only current and former military members, as well as some of their members, can get USAA policies.

Drivers who don't qualify for a USAA policy can get good service from State Farm, Farm Bureau and Auto-Owners.

Company |

Editor's rating

|

|---|---|

| USAA | |

| Auto-Owners | |

| Farm Bureau | |

| State Farm | |

| Geico | |

| Allstate | |

| Progressive |

Customer service is an important part of your coverage because it can make your life easier during difficult times. If you have to file a claim, strong service can get you back on the road faster and complete your repairs with less hassle.

Average car insurance costs in Atlanta by neighborhood

The cheapest car insurance in Atlanta can be found in ZIP code 30327, the West Paces Ferry neighborhood, while the most expensive coverage is in 30310, just southwest of downtown.

The price of full-coverage insurance varies by $52 per month, depending on where you live in Atlanta. Rates differ because of numerous factors, such as population density, car theft trends and crime rates.

City | Average monthly rate | Percent from average |

|---|---|---|

| 30303 | $160 | 3% |

| 30304 | $174 | 13% |

| 30305 | $133 | -14% |

| 30306 | $139 | -10% |

| 30307 | $142 | -8% |

What's the best car insurance coverage in Atlanta, GA?

Minimum liability coverage offers the lowest level of protection and may not cover all costs in the event of an accident.

The key differences between minimum and full-coverage auto insurance are that full coverage has higher liability limits and includes collision and comprehensive coverages, which protect a driver's own car.

- Comprehensive coverage: covers damage due to theft, natural disasters and other events outside the driver's control, sometimes called "acts of God."

- Collision coverage: covers damage to a vehicle that results from hitting another vehicle or object.

We suggest you get more coverage if you can, especially if you have an expensive vehicle.

Methodology

Data was collected from the largest insurers in Georgia across every ZIP code in Atlanta. The driver quoted is a 30-year-old man with a 2015 Honda Civic EX. The driver has good credit, unless otherwise stated. Rates are for a full-coverage policy, unless otherwise noted.

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

The analysis uses insurance rate data from Quadrant Information Services publicly sourced from insurer filings. Rates should be used for comparative purposes only, as your rates will likely differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.