Cheap Car Insurance Quotes: Charlotte, NC

Geico has the cheapest car insurance in Charlotte, at $34 per month for minimum coverage or $78 per month for full coverage.

Find Cheap Auto Insurance Quotes in Charlotte

Best cheap car insurance companies in Charlotte

In Charlotte, the state's largest city, drivers pay much more for insurance than the average North Carolina driver. Charlotte residents pay 19% more than the state average of $1,506 for full coverage and 33% more for minimum coverage ($445 state average).

Cheapest car insurance in Charlotte: Geico

Geico delivered the best deal for full-coverage car insurance in Charlotte. It was considerably cheaper than second-place Erie Insurance and third-place NC Farm Bureau Insurance.

The monthly rate for Geico was $78, which was $33 less than Erie Insurance. NC Farm Bureau's rate was $115. Geico's rate was 48% cheaper than the city average.

Compare Car Insurance Rates in Charlotte, NC

Cheapest full coverage in Charlotte

Company |

Rating

| Monthly rate | |

|---|---|---|---|

| Geico | $78 | ||

| Erie Insurance | $111 | ||

| NC Farm Bureau Insurance | $115 | ||

| Progressive | $118 | ||

| State Farm | $130 |

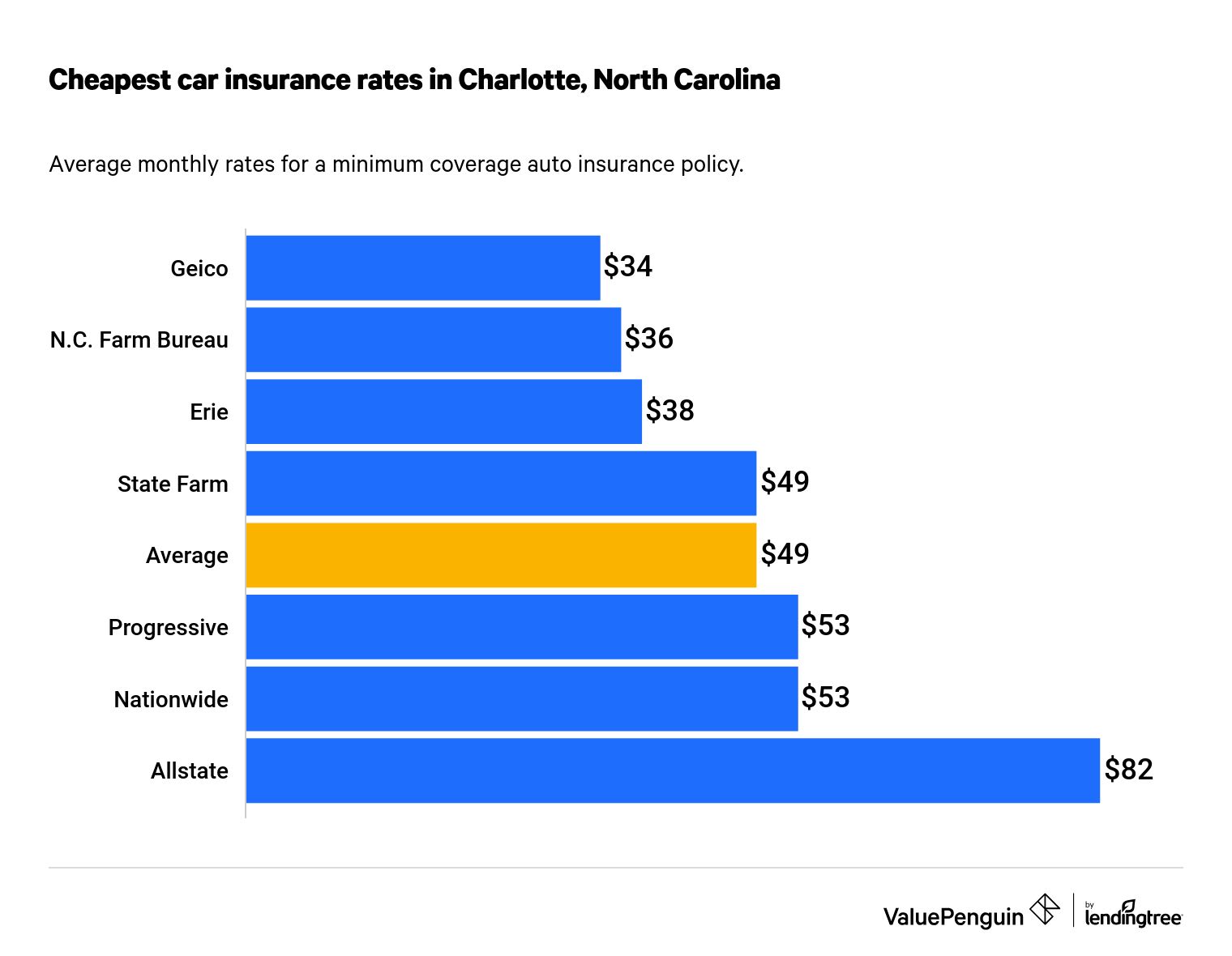

Cheapest liability insurance in Charlotte: Geico

The cheapest options for minimum liability coverage in Charlotte are Geico, North Carolina Farm Bureau Insurance and Erie Insurance. Each has rates that are at least $132 less per year than the city's average.

Geico's annual rate (the cheapest) of $408 was $183 less than the city average. At $34 a month for minimum coverage, it was slightly cheaper than NC Farm Bureau Insurance ($36), and Erie Insurance ($38).

Compare Car Insurance Rates in Charlotte, NC

Cheapest minimum-coverage car insurance rates in Charlotte, NC

Company |

Rating

| Monthly rate | |

|---|---|---|---|

| Geico | $34 | ||

| NC Farm Bureau Insurance | $36 | ||

| Erie Insurance | $38 | ||

| State Farm | $49 | ||

| Progressive | $53 |

Cheapest car insurance for young drivers: Geico

Young drivers in Charlotte can save the most with Geico, with rates of $196 per month for an 18-year-old. That is $477 cheaper annually than the next best rate.

Insurance companies consider younger drivers much riskier on the road, which raises rates.

Erie Insurance charged the second least, at $236 per month. NC Farm Bureau Insurance was third, at $240. On average, younger drivers paid $3,301 annually, which is $1,504 more than their 30-year-old counterparts. That's an increase of 84%.

Company | Monthly rate |

|---|---|

| Geico | $196 |

| Erie Insurance | $236 |

| NC Farm Bureau Insurance | $240 |

| Progressive | $246 |

| State Farm | $253 |

| Nationwide | $479 |

| Allstate | $738 |

Options for young drivers looking to cut insurance costs include:

- Joining a parent's car insurance policy: This option is drastically cheaper than separate policies, but it will likely raise the price of your parent's policy.

- Searching for discounts: Offers may include discounts for good grades, avoiding accidents and safe driving. You should check with your insurance company and review your options.

Cheapest car insurance for drivers with a speeding ticket: NC Farm Bureau Insurance

The best car insurance rates in Charlotte for drivers with a speeding ticket were from NC Farm Bureau Insurance. Next were Geico (second) and Erie Insurance (third).

On average, a speeding ticket increased insurance rates 38% in Charlotte, or $685 total per year.

After a speeding ticket, the average monthly rate for NC Farm Bureau Insurance was $154. Geico ($156) and Erie Insurance ($157) were close behind.

Cheapest car insurance after a speeding ticket

Company | Monthly rate |

|---|---|

| NC Farm Bureau Insurance | $154 |

| Geico | $156 |

| Erie Insurance | $157 |

| Progressive | $158 |

| State Farm | $182 |

| Nationwide | $226 |

| Allstate | $415 |

Cheapest car insurance in Charlotte after an accident: Erie Insurance

The lowest rates for drivers in Charlotte who have caused an accident came from Erie Insurance, with a monthly price of $116. That's cheaper than NC Farm Bureau Insurance ($184) and Progressive ($189).

On average, an accident in Charlotte raised rates 54%, which is an annual increase of $970. Erie Insurance's increase was only $67 annually for a driver with an accident. No other company's increase was less than $631.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| Erie Insurance | $116 |

| NC Farm Bureau Insurance | $184 |

| Progressive | $189 |

| State Farm | $221 |

| Nationwide | $239 |

| Geico | $257 |

| Allstate | $408 |

In North Carolina, accidents raise rates more than 53% overall.

Cheapest car insurance for drivers with a DUI: NC Farm Bureau Insurance

A DUI on your record in Charlotte will cost an extra $5,495 per year for full-coverage car insurance, an increase of 305%. NC Farm Bureau Insurance had the best rates in the city, at an average annual rate of $5,428 ($452 per month). That's $80 less than Erie and $130 less than Geico.

A DUI caused rates to jump $4,051, or 294%, at NC Farm Bureau Insurance. Allstate had a very large bump, to $16,006 per year.

Cheapest car insurance with a DUI

Company | Monthly rate |

|---|---|

| NC Farm Bureau Insurance | $452 |

| Erie Insurance | $459 |

| Geico | $463 |

| Progressive | $464 |

| Nationwide | $519 |

| State Farm | $558 |

| Allstate | $1,334 |

Cheapest car insurance for drivers with poor credit: Geico

Poor credit may raise your insurance costs, but not as much as a speeding ticket or accident would. The best rates for drivers with poor credit in Charlotte were offered by Geico, with an average monthly premium of $115.

On average, poor credit added $322 to the average annual price of a policy in Charlotte.

Cheapest car insurance for poor credit

Company | Annual rate |

|---|---|

| Geico | $115 |

| Progressive | $118 |

| Erie Insurance | $118 |

| NC Farm Bureau Insurance | $132 |

| Nationwide | $206 |

| State Farm | $224 |

| Allstate | $324 |

Average car insurance costs in Charlotte by neighborhood

Charlotte is in the middle of a metro area of more than 2.6 million residents. The city itself has around one-third of that population across 36 ZIP codes.

Charlotte's cheapest ZIP code for auto insurance is 28269, an area north of downtown, near Huntersville. The city's most expensive ZIP code for insurance is 28212, a spot east of the center of the city that includes the North Sharon and Idlewild Farms neighborhoods.

Rates may vary a lot, with more than $500 separating the cheapest and most expensive ZIP codes in Charlotte.

ZIP code | Average annual rate |

|---|---|

| 28105 | $144 |

| 28202 | $141 |

| 28203 | $141 |

| 28204 | $141 |

| 28205 | $174 |

Auto theft statistics in Charlotte

Charlotte and parts of Mecklenburg County rank 14th out of the 15 largest cities in the state for the number of cars stolen per 100,000 residents. In 2019, there were 354 cars stolen for every 100,000 inhabitants.

A total of 3,340 cars were stolen in Charlotte in 2019. Of the 15 cities, Apex had the lowest rates of car theft

Rank | City | Population | Car thefts | Thefts per 100,000 |

|---|---|---|---|---|

| 1 | Apex | 56,276 | 16 | 28 |

| 2 | Cary | 172,525 | 77 | 45 |

| 3 | Chapel Hill | 61,457 | 36 | 59 |

| 4 | Concord | 96,138 | 99 | 103 |

| 5 | Huntersville | 58,512 | 65 | 111 |

Motor vehicle theft data was pulled from the FBI 2019 North Carolina Crime Report.

What's the best car insurance coverage in Charlotte, NC?

With only minimum coverage, you could face a huge financial loss if you're in an accident. Although minimum coverage satisfies legal requirements, medical costs are usually more expensive than state minimums. So is car damage.

protects your car with .

- Comprehensive coverage: Covers damage caused by something other than a car crash, such as natural disasters, hail or theft

- Collision coverage: Covers damage to your own vehicle after a crash, regardless of who was at fault. Collision also covers damage from single-car accidents and collisions with objects.

Methodology

Data came from seven of North Carolina's largest insurance companies. Rates were pulled for a 30-year-old man with a 2015 Honda Civic EX. Rates were for a full-coverage policy and average credit, unless otherwise stated.

Insurance rate data in this analysis came from Quadrant Information Services. Rates were publicly sourced from insurance company filings. These rates should be used for comparative purposes only.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.