The Cheapest SUVs to Insure

The cheapest SUV to insure is the Honda CR-V. On average, it costs $2,346 per year for full coverage. That's 21% cheaper than the average price for the most popular SUVs:$2,975. In general, small, low-cost SUVs have the lowest insurance rates.

Find Cheap Auto Insurance Quotes

SUV insurance rate comparison

The Honda HR-V and Chevrolet Traverse rank close behind the Honda CR-V for cheapest insurance. The average policy cost across these three SUVs is $2,703 per year for full coverage — 10% less than the average across all of the vehicles considered here.

Rank | Annual insurance cost | MSRP (2021) | |

|---|---|---|---|

| 1 | Honda CR-V | $2,669 | $25,350 |

| 2 | Honda HR-V | $2,681 | $21,220 |

| 3 | Chevrolet Traverse | $2,760 | $29,800 |

| 4 | Mazda CX-5 | $2,792 | $25,370 |

| 5 | Honda Pilot | $2,811 | $32,550 |

| 6 | Ford Escape | $2,840 | $25,555 |

| 7 | Chevrolet Equinox | $2,842 | $23,800 |

| 8 | Volkswagen Tiguan | $2,904 | $25,245 |

| 9 | Subaru Outback | $2,910 | $26,795 |

| 10 | Subaru Forester | $2,913 | $24,795 |

| 11 | Jeep Wrangler | $2,969 | $29,370 |

| 12 | Toyota RAV4 | $3,015 | $26,350 |

Smaller SUVs are less expensive to insure

Insurance costs for smaller SUVs are $198 less per year than for larger ones. SUVs under 106.5 inches long (the median among vehicles considered here) have an average insurance cost of $2,893, while longer ones average $3,091 per year.

Also, two out of three SUVs with the highest premiums (the Jeep Grand Cherokee and Toyota 4Runner) are "standard-sized" SUVs, according to the size classifications of the Environmental Protection Agency (EPA). The third is the Tesla Model Y, which is expensive to insure for other reasons, including the fact that it's an electric vehicle.

Cheaper SUVs have lower auto insurance rates

The SUVs with the lowest 2021 MSRPs also have more affordable insurance. This analysis found that insurance rates for the five cheapest SUVs are 11% lower than they are for the five most expensive ones.

5 most expensive SUVs

Annual insurance cost | MSRP | Average insurance cost among the 5 SUVs | Average MSRP among the 5 SUVs | ||

|---|---|---|---|---|---|

| 1 | Tesla Model Y | $4,296 | $39,990 | $3,269 | $35,463 |

| 2 | Toyota 4Runner | $3,153 | $36,765 | ||

| 3 | Toyota Highlander | $3,046 | $35,085 | ||

| 4 | Ford Explorer | $3,037 | $32,925 | ||

| 5 | Honda Pilot | $2,811 | $32,550 |

5 cheapest SUVs

Annual insurance cost | MSRP | Average insurance cost among the 5 SUVS | Average MSRP among the 5 SUVs | ||

|---|---|---|---|---|---|

| 1 | Honda HR-V | $2,681 | $21,220 | $2,875 | $23,752 |

| 2 | Hyundai Tucson | $3,037 | $23,700 | ||

| 3 | Chevrolet Equinox | $2,842 | $23,800 | ||

| 4 | Subaru Forester | $2,913 | $24,795 | ||

| 5 | Volkswagen Tiguan | $2,904 | $25,245 |

The main reason cheaper SUVs have lower auto insurance premiums is that comprehensive and collision insurance claims are less expensive. This type of coverage pays for repairs and replacement of your vehicle, which are typically more expensive for costlier SUVs.

What's the most expensive SUV to insure?

Among the most popular SUVs for sale in the United States, the three costliest to insure are the Tesla Model Y, Toyota 4Runner and Jeep Grand Cherokee.

These vehicles are all larger and more expensive than an average SUV, which may lead to higher insurance costs.

The most expensive SUVs to insure

Tesla Model Y | $4,296 |

|---|---|

| Toyota 4Runner | $3,153 |

| Jeep Grand Cherokee | $3,090 |

The Tesla Model Y is notably an electric vehicle. Unlike the 4Runner and Grand Cherokee, which have been available for decades, the Model Y has only been for sale for a few years. That means replacement part availability for the Model Y is very low, compared with more established vehicles.

The Model Y also has a high degree of technology built into it, from the 15-inch touch screen to advanced driving-assist features, which increases the cost of repairs.

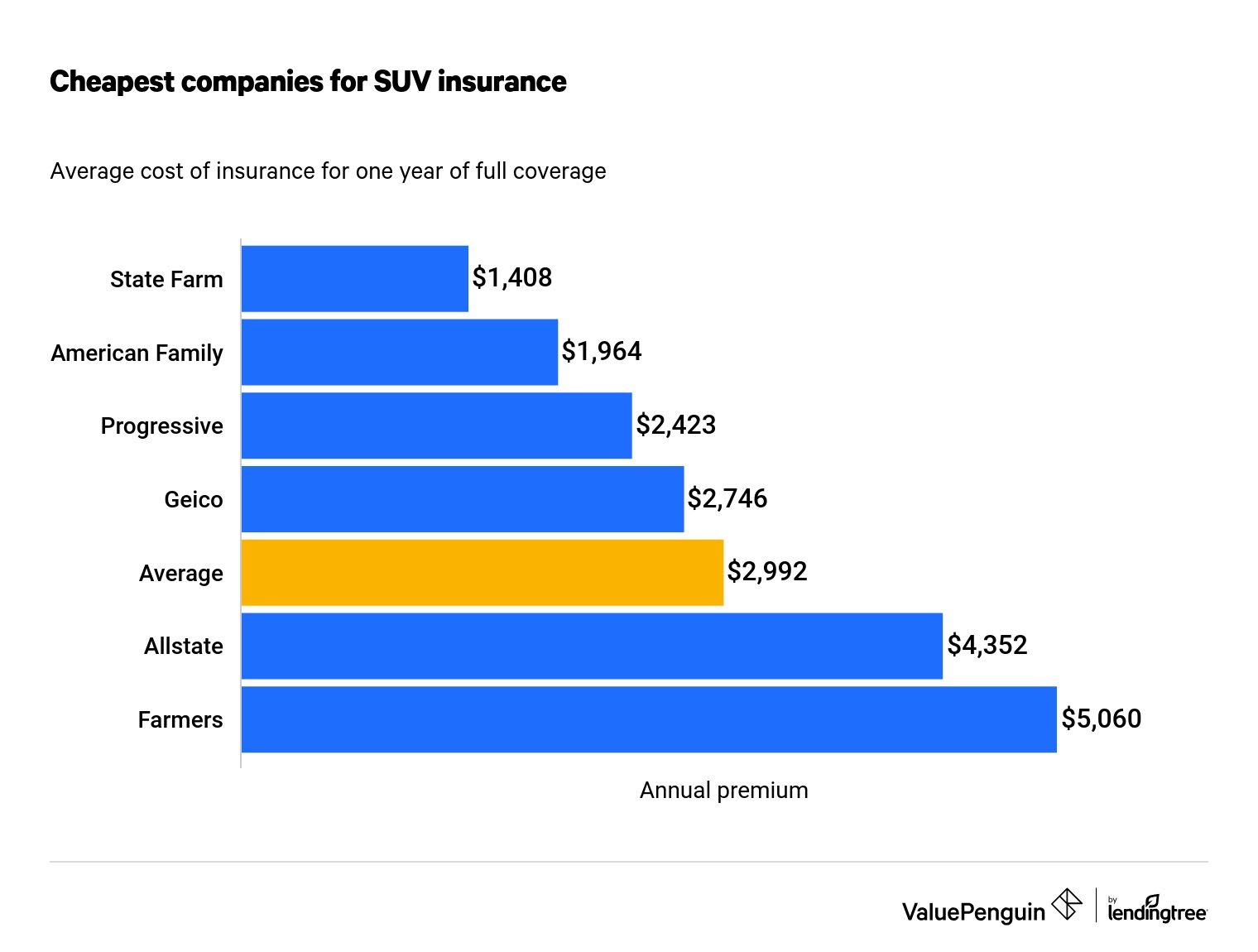

Best insurance companies for SUV drivers

State Farm consistently provided the cheapest rates for SUV insurance. Insurance quotes from this company are 53% cheaper than the average car insurance cost across all of the companies surveyed.

Insurance companies tend to evaluate the safety factors of vehicles similarly, but it's still worth comparing quotes. Every driver's quote is based on their driving history and other personal details.

Find Cheap Auto Insurance Quotes in Your Area

Shopping around for SUV coverage could save you an average of 40% on your premiums. Given that the average insurance company offered SUV rates of $2,984 per year, this adds up to an annual difference of $1,194.

Cheapest auto insurance companies by SUV

SUV | Cheapest company | Cheapest insurance cost | Difference from average |

|---|---|---|---|

| Chevrolet Equinox | State Farm | $1,316 | −56% |

| Chevrolet Traverse | State Farm | $1,390 | −53% |

| Ford Escape | State Farm | $1,361 | −54% |

| Ford Explorer | State Farm | $1,423 | −52% |

| Honda CR-V | State Farm | $1,265 | −58% |

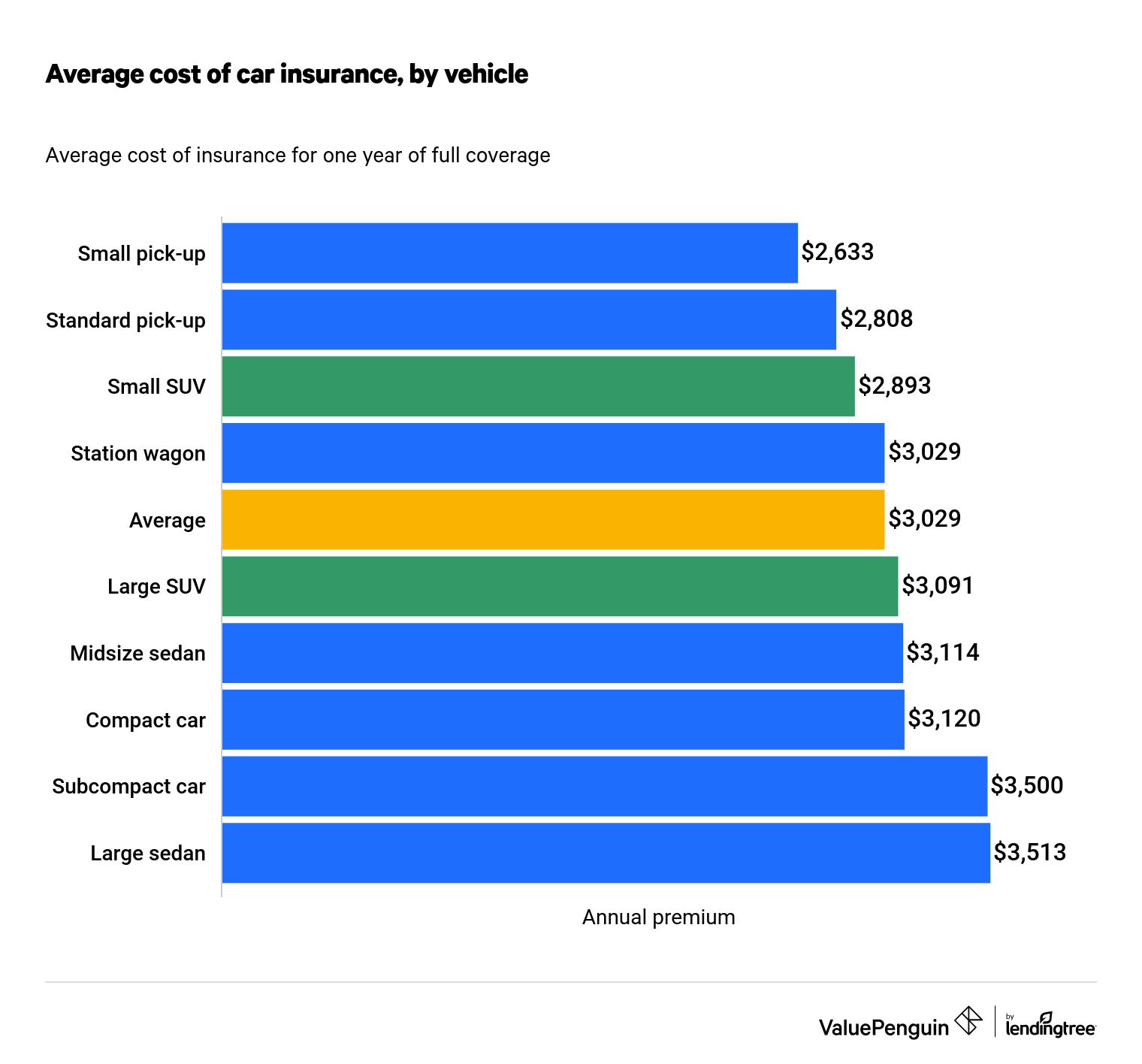

Are SUVs more expensive to insure than other vehicles?

The conventional wisdom is that big vehicles, such as SUVs and trucks, are more costly to insure. But small, crossover SUVs have some of the cheapest insurance rates of any vehicle type — including compact cars. Larger SUVs, on the other hand, have higher rates for coverage.

While they may be safer for their passengers, standard-size SUVs pose an increased risk to other motorists. Because of this, the liability portion of the insurance premiums for standard-size SUVs is typically more expensive.

Methodology

Quotes were gathered from six major companies — Allstate, American Family Insurance, Farmers, Geico, Progressive and State Farm — for a 30-year-old man in Illinois with a clean driving record. All of the quotes are state averages.

The insurance prices represent the total cost for full coverage, with liability limits above the state minimums. MSRPs were obtained from CarGurus, and vehicle types are based on the EPA's size designations.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used only for comparative purposes. Your quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.