Will Medicare Pay for a Medical Alert System? (2024)

Compare Medicare Plans in Your Area

Some Medicare Advantage plans offer free or discounted medical alert systems.

Regular Medicare (Parts A and B) won't pay for medical alert systems. Expensive med alert systems like Life Alert typically aren't covered by Medicare Advantage plans.

AARP/UnitedHealthcare (UHC) has the best Medicare Advantage plans for medical alert systems coverage. You can get a Lifeline system for free if you enroll in a qualifying plan.

Does Medicare cover medical alert systems for seniors?

Only some Medicare Advantage plans offer free and discounted medical alert systems.

Medicare Advantage plans are an alternative to Original Medicare (Parts A and B).

Under federal law, Medicare Advantage plans have to offer at least the same level of coverage that you would get through Original Medicare. Medicare Advantage plans can also include other types of coverage, such as dental, vision, prescription drug, fitness plans and medical alert systems.

Unlike regular Medicare, which is run directly by the government, Medicare Advantage plans are sold and run by private companies. Regardless of whether you enroll in Original Medicare or a Medicare Advantage plan, you'll have to pay your Medicare Part B monthly rate. This goes directly to the government.

Keep in mind that more expensive Medicare Advantage plans tend to offer better coverage. That means if you want a free or discounted medical alert system, you may have to pay a little extra each month for a higher-quality plan.

However, you'll still probably come out ahead financially. That's because many Medicare Advantage plans cost less than most midrange med alert systems.

On top of the cost of Medicare Part B, you may pay an extra monthly rate to the company running your plan. The average cost of a Medicare Advantage plan with prescription drug coverage is $27 per month. However, you can also take advantage of a wide range of plans that don't charge a monthly rate.

How to get the best medical alert coverage through Medicare Advantage

It's a good idea to identify which medical alert systems you want before you go shopping for a Medicare Advantage plan.

You should also compare Medicare Advantage plan prices and the cost of buying a medical alert system out of pocket.

Remember, Medicare Advantage plans aren't required to offer medical alert systems. That means only some plans include med alert coverage. Plans that offer medical alert systems may only pay for a single brand or a limited range of brands.

Some plans also restrict medical alert systems to customers who have a qualifying medical condition.

Depending on your Medicare Advantage plan, you may get a discounted or free medical alert system.

For companies that only offer a discount, keep in mind that any amount you pay toward the alert system will not count toward your Medicare plan's deductible or its out-of-pocket maximum.

Best Medicare Advantage plans for medical alert systems

Many AARP/UnitedHealthcare Medicare Advantage plans offer free medical alert system coverage through Lifeline.

AARP/UnitedHealthcare has the best medical alert system coverage among Medicare Advantage companies. However, it's important to remember that coverage varies by plan and that not all AARP/UnitedHealthcare plans offer this benefit.

You can confirm that you're eligible by checking your Medicare plan's benefits or by entering your member number into the Lifeline online portal.

Medical alert systems by Medicare Advantage company

Medicare Advantage company | Medical alert system |

|---|---|

| AARP/UHC | Lifeline |

| Blue Cross Blue Shield/Anthem | Lively Mobile Plus or LifeStation |

| Humana | Lifeline |

| Kaiser Permanente | Lively Mobile Plus |

| Aetna | LifeStation |

| Wellcare | LifeStation |

Coverage varies by plan

Compare Medicare Plans in Your Area

Blue Cross Blue Shield coverage varies because it's made up of more than 30 different companies.

Discounts and other ways to save

Medicare Advantage plans aren't the only way to get low-cost or free med alert systems. For example, you may qualify for a discounted or free medical alert device if you're a veteran, you have long-term care insurance or you belong to AARP.

- Veterans benefits: The Department of Veterans Affairs (VA) provides free medical alert systems to eligible vets after the approval of a physician or occupational therapist.

- Long-term care insurance: Some long-term care policies offer discounts for medical alert systems as a part of their support for healthy aging.

- Shop at a discount retailer: Low-cost systems are offered at Walmart and other discount stores. For example, Walmart sells the MOBI support button, which costs significantly less than top-end competitors like Life Alert.

- Apple Watch fall detection: Another option is to use a smart device like the Apple Watch and enable fall detection. If it detects a fall, it will ask if you'd like to place a 911 call. It will also automatically dial 911 and contact your emergency contacts if you can't move after a fall. However, its fall detection technology is not effective for those in a wheelchair.

- AARP discount on Lifeline: If you're an AARP member, you'll get a 15% discount on the monthly cost of Lifeline and no upfront costs.

- AARP discount on Lively: If you prefer the Lively systems, your AARP membership can save you $60 per year off a service package after you buy a device.

Cost of Life Alert vs. other medical alarms

Life Alert doesn't publish its prices online. Instead, you have to call a sales agent to get a customized quote.

Some people may prefer this personalized touch. However, Life Alert's pricing model doesn't make it easy to compare costs with competitors.

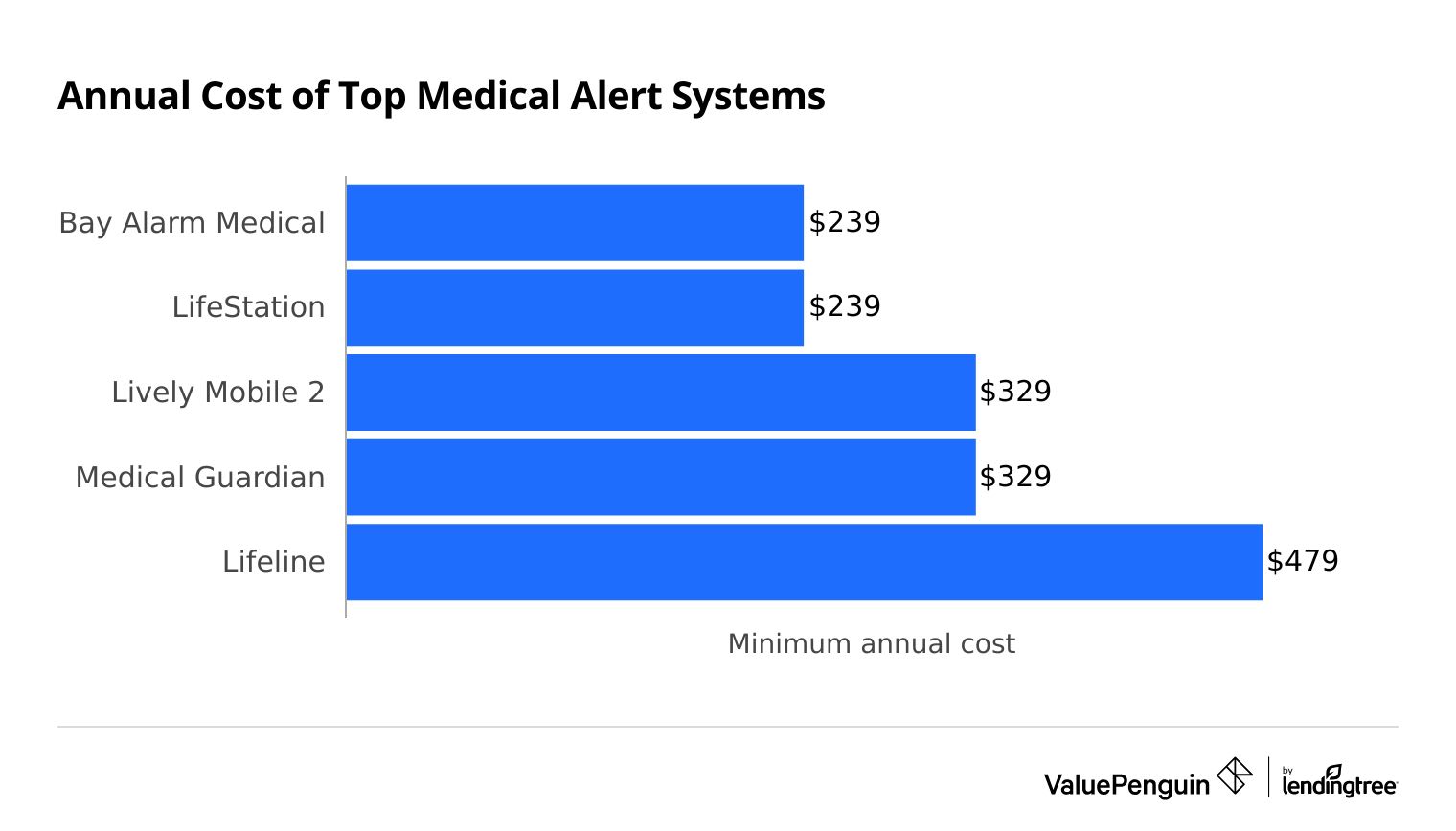

Medicare Advantage plans typically won't pay for Life Alert because of its high prices. Instead, companies will typically offer cheaper alternatives like Lifeline or LifeStation, which have middle-of-the-road prices. If you're shopping for a system, you can save money by choosing a lower-cost option.

Full-price cost without Medicare coverage

System | Minimum first-year cost |

|---|---|

| Bay Alarm Medical | $239 |

| LifeStation | $239 |

| Lively Mobile2 | $329 |

| Medical Guardian | $329 |

| Lifeline | $479 |

Life Alert only offers custom quotes over the phone.

Medical alert companies typically offer a range of devices and plans geared toward different situations and price points. Typically, the cheapest options will only work within your home. In contrast, you can use more expensive services on the go.

It's also important to note that many companies require you to buy a special device. However, some budget options are apps for your smartphone or smartwatch.

Why doesn't Original Medicare cover medical alert systems?

Original Medicare (Parts A and B) does not cover medical alert systems because it classifies the devices as medically unnecessary.

The rule of thumb is that Medicare will cover medically required products such as wheelchairs, ventilators or oxygen regulators if you meet the coverage requirements. However, Medicare will deny coverage for products that help seniors move around the house. This includes grab bars, fall detection systems or stair lifts.

Frequently asked questions

Does Medicare pay for a medical alert system?

Some Medicare Advantage (Part C) plans offer free or discounted medical alert systems. But regular Medicare (Parts A and B) won't pay for these services.

Are there free medical alert systems for seniors?

Free medical alert systems are available with some Medicare Advantage plans including AARP/UnitedHealthcare, Humana and Blue Cross Blue Shield. You may also qualify for a free or discounted medical alert system if you're a veteran, you're an AARP member or you have long-term care insurance.

Some smartwatches have fall detection features that work like medical alert systems.

Are medical alerts worth it?

A medical alert system may be worthwhile for elderly people who spend long periods of time alone. Such devices can prove lifesaving if you fall and there's no one around to help you.

Sources and methodology

Coverage information is based on the Centers for Medicare & Medicaid Services (CMS) Medicare Coverage Database. Medical alert cost details were collected from insurance companies, retailers and medical alert system companies.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.