Fred Loya Insurance Review

Fred Loya has cheap rates for high-risk drivers but poor customer service and limited coverages.

Find Cheap Auto Insurance Quotes in Your Area

Fred Loya offers exceptionally cheap rates to its customers — sometimes less than half of what competitors charge. You'll pay for those cheap rates in other ways, however. The company receives nearly twice as many complaints as a typical insurer, and it only offers basic coverage options to its customers.

Pros and cons

Pros

Cheap rates

Affordable quotes after an accident

Cons

Poor customer service

Poor online experience

Lack of unique coverages

Our thoughts on Fred Loya

Fred Loya has some of the cheapest rates around, but those cheap rates likely won't make up for substandard service.

Fred Loya has nearly twice as many complaints as expected for an insurer of its size, and the company has been fined for failing to act in customers' best interest.

Additionally, the company does not offer a particularly strong digital experience. The company's website is dated and hard to navigate.

You can make a car insurance payment and view your Fred Loya policy details online, but you can't get a quote or file a claim; instead, you must call the claims department or customer service number.

Compare Fred Loya to other top auto insurance companies | |

|---|---|

| |

| Read review |

| Read review |

| Read review |

| Read review |

Where is Fred Loya Insurance available?

Fred Loya is mostly available in the South and the Southwest, primarily around major cities, such as Los Angeles, Las Vegas and San Antonio. Insurance shoppers can buy a policy over the phone or online.

Fred Loya Insurance is available in 12 states:

How much is Fred Loya vs. other insurance companies?

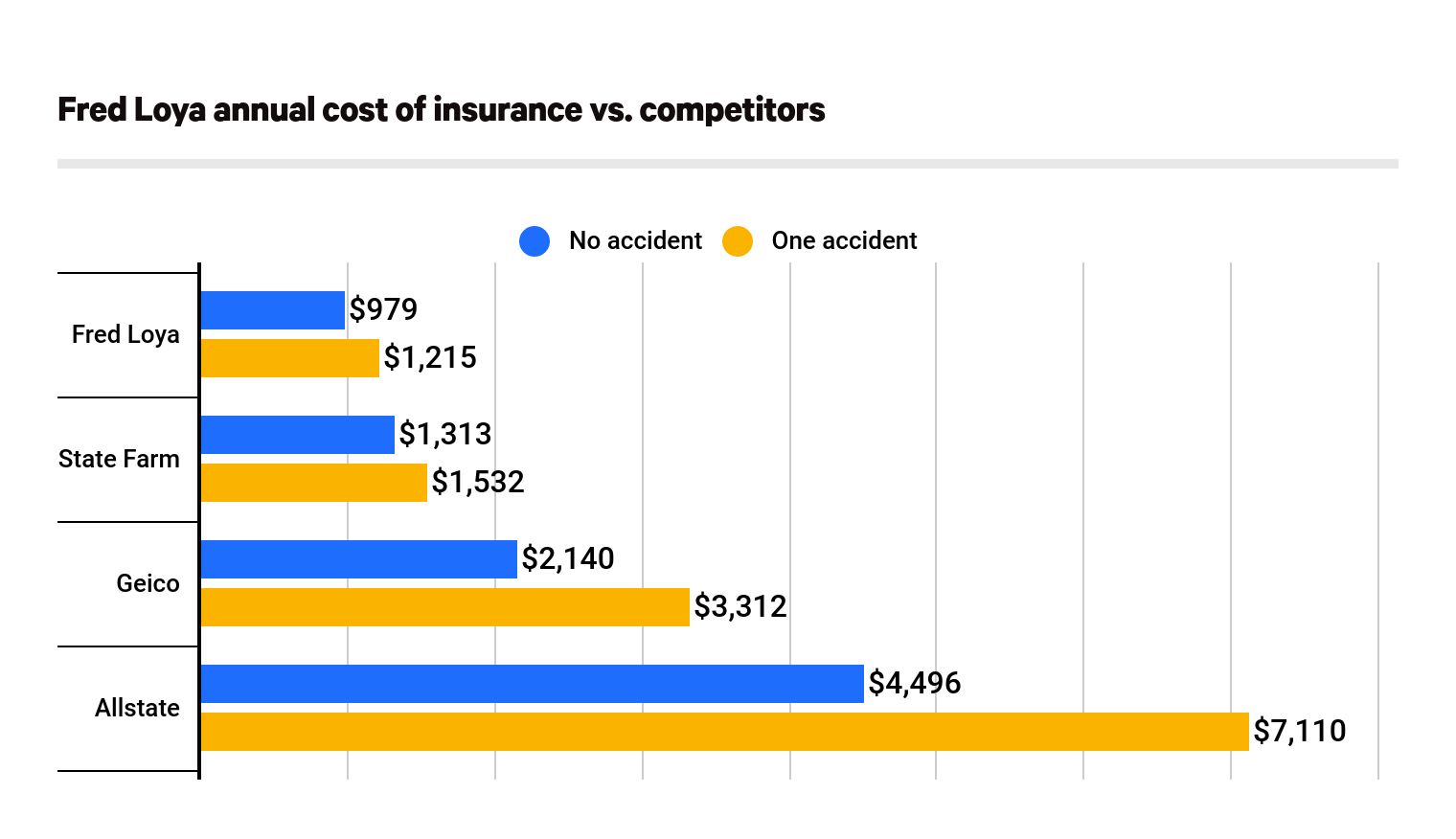

If Fred Loya stands out for anything, it's cheap insurance rates. Full coverage car insurance from Fred Loya costs 56% less than average for drivers with a clean history. Drivers with one accident on their record pay 63% less than average for full coverage from Fred Loya.

Find Cheap Auto Insurance Quotes in Your Area

Fred Loya car insurance rates vs. competitors

Insurer | Clean record | One accident | Increase after accident |

|---|---|---|---|

| Fred Loya | $979 | $1,215 | 24% |

| State Farm | $1,313 | $1,532 | 17% |

| Geico | $2,140 | $3,312 | 55% |

| Allstate | $4,496 | $7,110 | 58% |

Another benefit of Fred Loya is that insurance prices do not go up too much after an accident. Our analysis found that Loya only increases rates by 24% — far less than the 55% increase imposed by Geico and the 58% increase imposed by Allstate. Only State Farm, the second-cheapest insurer, raises rates by less.

Before you call Fred Loya for a free car insurance quote, however, remember that you'll have to put up with very poor customer service to secure these cheap rates. If possible, you should compare car insurance from other companies.

Fred Loya Insurance customer service reviews

Fred Loya has a poor reputation for its customer service.

The company receives 86% more complaints than a typical company of the same size, according to the National Association of Insurance Commissioners (NAIC). This suggests a Fred Loya customer is likely to be unhappy with the company's service.

Among the complaints, common issues include poor service from claims adjusters and payment delays.

The company was fined in 2012 for not adhering to underwriting guidelines for customer discounts that it had filed with the Texas Department of Insurance, instead imposing other requirements that kept premiums higher.

Coverages from Fred Loya

Fred Loya offers an extremely limited number of coverages. In addition to mandatory liability insurance coverage, policyholders can add the following coverages to their Fred Loya policy:

Rental reimbursement

Roadside assistance

Covers the cost of a tow truck for a flat tire, a fuel delivery or another need — regardless of whether it's related to a crash.

Collision coverage

Other than collision (comprehensive)

Pays for damage that results from something other than a collision, such as animal or weather damage, theft and vandalism.

Personal injury protection (PIP)

Covers your own injuries, lost wages and caregiving or funeral expenses after an accident.

Medical payments (MedPay)

Covers your own injuries, no matter who is at fault.

Uninsured motorist

Covers medical bills or damage to your car when the other driver is at fault in an accident but doesn't have enough coverage to pay for the damage.

Additionally, Fred Loya does cover rental cars. You can purchase rental reimbursement coverage, and your liability coverage will extend to a rental car that you use while your own car receives repairs.

Fred Loya contracts with a number of mechanic shops, which it calls Direct Repair Facilities (DRPs), and auto repairs completed at these shops are guaranteed for as long as you own or lease the car.

About Fred Loya: Contact and leadership

Fred Loya has limited online functionality, so you'll likely need to contact the company via email, by phone or in person during business hours to get a quote or manage your insurance policy. If you're just looking to pay your bill, you can do that online: simply log in to your Fred Loya Insurance account.

Contact Fred Loya Insurance by calling the following company telephone numbers:

- Claims phone number: 800-880-0472

- Customer service phone number: 800-444-4040

Fred Loya's business hours are from 7 a.m. to 8 p.m. Monday through Friday and 7 a.m. to 4 p.m. on Saturday; the company is not open on Sundays.

If you prefer to conduct business via post, you can also send your claim information to the company's mailing address:

Fred Loya Insurance P.O. Box 972450 El Paso, TX 79997

Who owns Fred Loya Insurance?

Fred Loya Jr. is the chief executive officer of EP Loya Group, the private company of which Fred Loya Insurance Agency is a subsidiary. The Fred Loya Insurance headquarters is located in El Paso, Texas.

Subsidiaries of the EP Loya Group franchise include:

- Fred Loya Insurance Agency

- Rodney D. Young Insurance Group

- Loya Insurance Co.

- Loya Casualty Insurance Co.

- Young America Insurance Co.

Frequently asked questions

Is Fred Loya car insurance cheap?

Yes, Fred Loya auto insurance is extremely cheap, often even cheaper than coverage from bigger companies like Geico and State Farm. Furthermore, Fred Loya raised our sample driver's rates by only 24% after a crash, which is lower than typical.

Is Fred Loya a good insurer?

Fred Loya has cheap rates but very badly rated customer service. It receives 86% more complaints than a typical car insurance company of the same size, suggesting customers are fairly likely to be unhappy with the service they receive.

How do I contact Fred Loya?

Fred Loya's main customer service phone number is 800-444-4040. Or, you can email [email protected].

Where does Fred Loya sell insurance?

Fred Loya is available in 12 states: Alabama, Arizona, California, Colorado, Georgia, Illinois, Indiana, Nevada, New Mexico, Ohio, Oklahoma and Texas.

Methodology

ValuePenguin collected quotes for a full coverage policy in ZIP codes across Texas. Our sample drivers were both 30-year-old men who drive a 2015 Honda Civic EX. One has a clean driving record; the other has an at-fault accident on his record.

We gave our sample drivers the following coverages:

Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person; $100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage liability | $25,000 per accident |

| Uninsured or underinsured motorist bodily injury | $50,000 per person; $100,000 per accident |

| Comprehensive and collision | $500 deductible |

Quotes for this study were provided by Quadrant Information Services. Quotes were publicly sourced from insurer filings. They are intended solely for comparative purposes, as your own rates will likely differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.