What to Do if You Can't Stay on Your Parent's Health Insurance

You should enroll in a health insurance plan through your state or federal marketplace if you no longer have coverage through your parent's insurance.

In most states, adults lose health coverage through their parents after turning 26. Fortunately, you can take advantage of several affordable or free health insurance options depending on where you live and your income level.

Cheap health insurance for young adults

Young adults who can't stay on their parent's health plan should consider private health insurance through HealthCare.gov or their state health exchange if they don't have workplace coverage.

Private health insurance includes any plan offered by a company rather than the government. Most Americans get group coverage through their jobs. However, you can buy an individual health plan if your workplace doesn't offer this benefit.

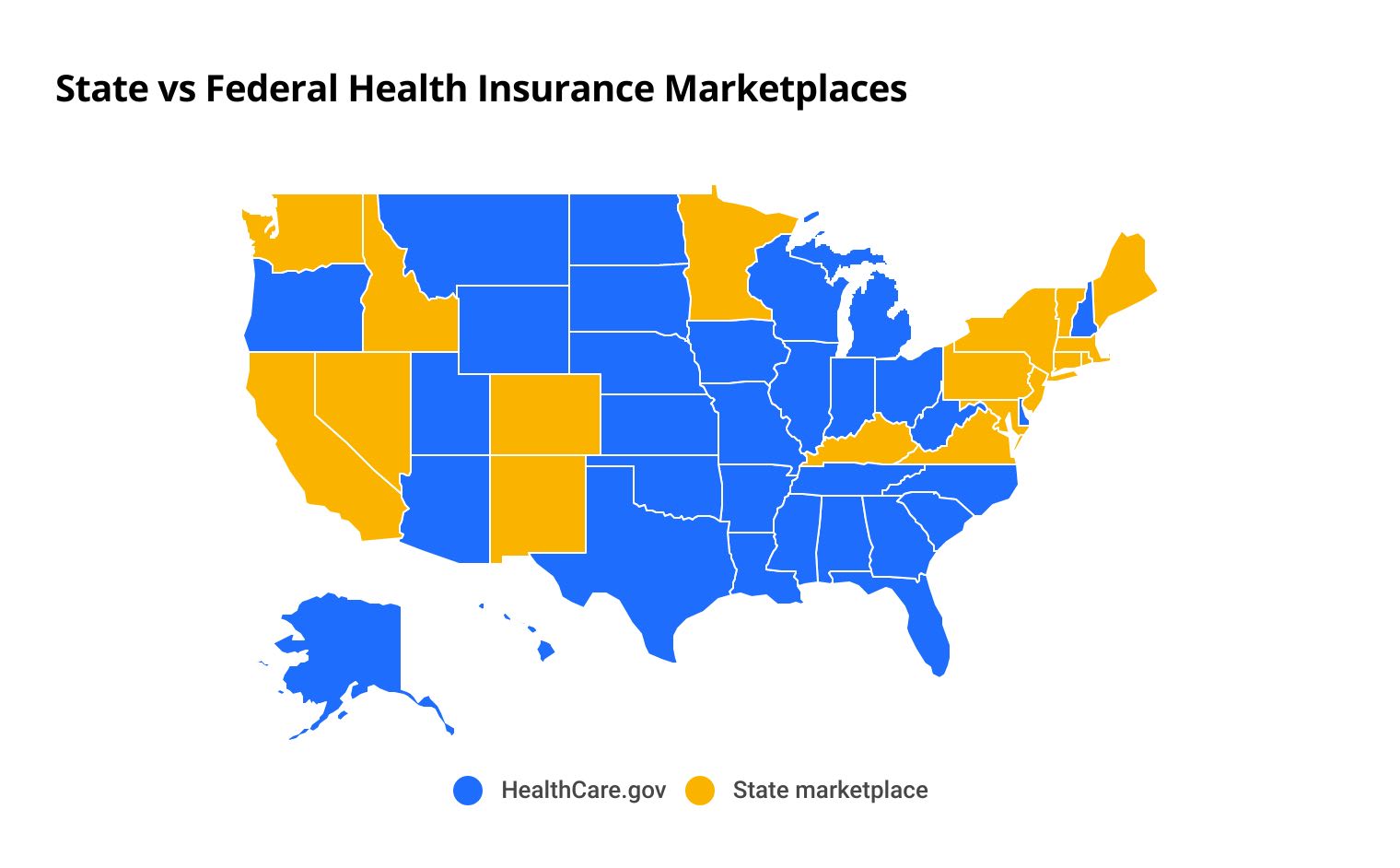

It's a good idea to get your health insurance through HealthCare.gov or your state's health exchange. Currently, 18 states and Washington D.C. run their own health insurance marketplaces.

Affordable Care Act (ACA) health exchanges let you easily compare and shop for health plans in your area online. In addition, all ACA health plans have to follow certain coverage rules. For example, they must pay for mental health services and maternity care.

State vs federal health insurance marketplaces

State | Health insurance exchange |

|---|---|

| California | Covered California |

| Colorado | Connect for Health Colorado |

| Connecticut | Access Health CT |

| Idaho | Your Health Idaho |

| Kentucky | Kynect |

The government will pay for some or all of the cost of your health insurance if you earn a low income. ACA subsidies, also called premium tax credits, reduce the amount you pay each month for your health plan.

You can also qualify for cost-sharing reductions if you buy a Silver health plan. Cost-sharing reductions (CSRs) help pay for the costs that you're responsible for paying, such as your deductible , copay and coinsurance.

In some parts of the country, you can qualify for a free Silver ACA plan if you meet certain income requirements. That makes a Silver health plan the best choice for most young adults who no longer qualify for their parent's health insurance and meet those income requirements.

It's important to compare health insurance quotes when shopping for coverage to get the best price. You should also compare health insurance companies to ensure you're getting high-quality care. You should also find out how often preapprovals and doctor referrals are required — you don’t want to need a PCP referral to get a broken arm X-rayed.

The best health insurance companies typically get fewer complaints than their competitors. It's important to choose a company that has a high level of customer satisfaction, such as Blue Cross Blue Shield (BCBS) or Kaiser Permanente since you'll likely have a smoother experience when you file a claim.

Obamacare plan tiers

You can choose between five different health insurance plan tiers: Catastrophic, Bronze, Silver, Gold and Platinum. Cheaper plan tiers like Catastrophic and Bronze usually have low monthly rates, but you'll have a larger deductible and a larger copay.

Gold and Platinum plans typically have the highest rates, but you'll pay less when you visit the hospital or get your prescription filled. Silver plans usually have middle-of-the-road monthly rates and moderate costs that you're responsible for paying.

Silver plans usually make the most sense if you're a young person and you have a low income. That's because you can only qualify for subsidies that help pay your out-of-pocket costs, called cost-sharing reductions if you have a Silver plan.

Plan tiers don't have anything to do with what services you can access. In other words, a Bronze and a Platinum plan will both cover the same set of services.

The only difference between plan tiers is how much you'll pay for your monthly rate vs how much you'll pay for out-of-pocket costs, such as your deductible , copay and coinsurance .

You can only buy a Catastrophic plan if you're under the age of 30 or if you qualify for a special hardship exemption. Although these plans tend to cost very little, they're usually not a good deal. That's because you'll have to pay a high deductible before your plan will cover most non-preventative services.

In addition, catastrophic plans aren't eligible for premium tax credits, which can make them a bad deal compared to Bronze and Silver plans.

Types of health insurance

When shopping for health insurance, you'll have to choose between a PPO and an HMO plan. PPOs tend to have higher rates, but you'll have more flexibility when it comes to choosing your doctor. HMOs cost less, but you can only see doctors in your plan's network.

Medicaid

You may qualify for free government health insurance, called Medicaid if you earn about $20,000 or less as a single person (roughly $41,000 or less for a family of four ). Keep in mind that 10 states require that you meet additional requirements before you can sign up for Medicaid. In these states, you can only qualify for Medicaid if you have a low income and you belong to one of the following groups.

- Pregnant women

- Those aged 65 and up

- Families with minor children

- People with qualifying disabilities

How long does Medicaid last after you turn 18?

You can continue your Medicaid coverage after turning 18 if you meet the program's eligibility requirements. In most states, that means you can keep your Medicaid coverage as long as you earn about $20,000 or less as a single person.

In states without expanded Medicaid, you'll have to meet an additional coverage requirement, such as being pregnant or having a qualifying disability.

How long can you stay on your parent's insurance?

You can stay on your parent's health insurance until you turn 26 in most states.

After you turn 26, you can still stay on your parent's health insurance until the end of the calendar year. That means if you turn 26 in March, you'll still have coverage through your parent's plan until January 1 of the following year.

In eight states , you can stay on your parent's health insurance plans after your 26th birthday, although you may need to meet additional requirements to qualify.

Each state has different eligibility requirements. For example, in some states, you must be unmarried and enrolled in college to keep your parent's coverage after the age of 26. In addition, each state has a different end date for when you'll lose your parent's coverage.

New Jersey residents can stay on their parent's insurance until they turn 31, while in Wisconsin the age limit is 27.

Dependent coverage to age 26 exceptions

You may be able to keep your parent's health coverage past the age of 26 if you have a disability that prevents you from supporting yourself financially. To qualify, the mental or physical disability must exist before you turn 26 to qualify, and you'll need to meet other criteria.

Can you have two health insurance plans?

Yes, you can have coverage from more than one health insurance plan at once.

That means you can keep your parent's health insurance if you also have coverage through your job or a spouse.

A process known as coordination of benefits will determine which health insurance plan pays first and which pays second.

Keep in mind that your secondary insurance won't pay for your primary insurance's deductible, copay or coinsurance. You also can't get double reimbursement or two payments for the same service. However, your secondary insurance may pay for a service that isn't covered by your primary insurance.

What's the birthday rule for health insurance?

The birthday rule for health insurance determines which of your parents' health plans pays first when you have coverage through both. The parent whose birthday comes earlier will be your primary health insurance regardless of the year in which your parents were born.

For example, you would have primary insurance through your mom if she was born on April 1, 1979, and your dad was born on May 10, 1977.

Frequently asked questions

How can you get coverage if you can’t stay on your parent’s health insurance?

The best way to get coverage if you can't stay on your parent's health insurance is to buy a private health plan through an ACA health exchange. You may qualify for subsidies that can lower your monthly rate and your out-of-pocket costs if you earn a low income.

How long can you stay on your parent's insurance?

You can stay on your parent's insurance until you turn age 26 in most states. However, in Florida, Illinois, Nebraska, New Jersey, New York, Pennsylvania, South Dakota and Wisconsin you can stay on your parent's health insurance past the age of 26.

Can I stay on my parents' insurance if I file taxes independently?

Yes, you can stay on your parent's health insurance if you file taxes independently. How you file taxes has no bearing on your health coverage.

Can you have more than one health insurance policy?

Yes, you can have coverage through more than one health plan at the same time. Keep in mind that even with two health plans, you'll still have to pay your deductible, copay and coinsurance.

Sources and methodology

Information regarding Medicaid expansion rules and geographic availability came from the Kaiser Family Foundation (KFF). Guidelines concerning exceptions to the age 26 rule were taken from the National Institute of Health (NIH) and the U.S. Office of Personnel Management (OPM).

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.