How Much Does Jeep Wrangler Insurance Cost?

The average cost of car insurance for a Jeep Wrangler is $1,858 per year.

Geico has the cheapest car insurance for Jeep Wranglers, costing about $1,562 per year for full coverage. That's 16% cheaper than average.

Find Cheap Jeep Wrangler Insurance Quotes

Cheapest insurance company for Jeep Wranglers

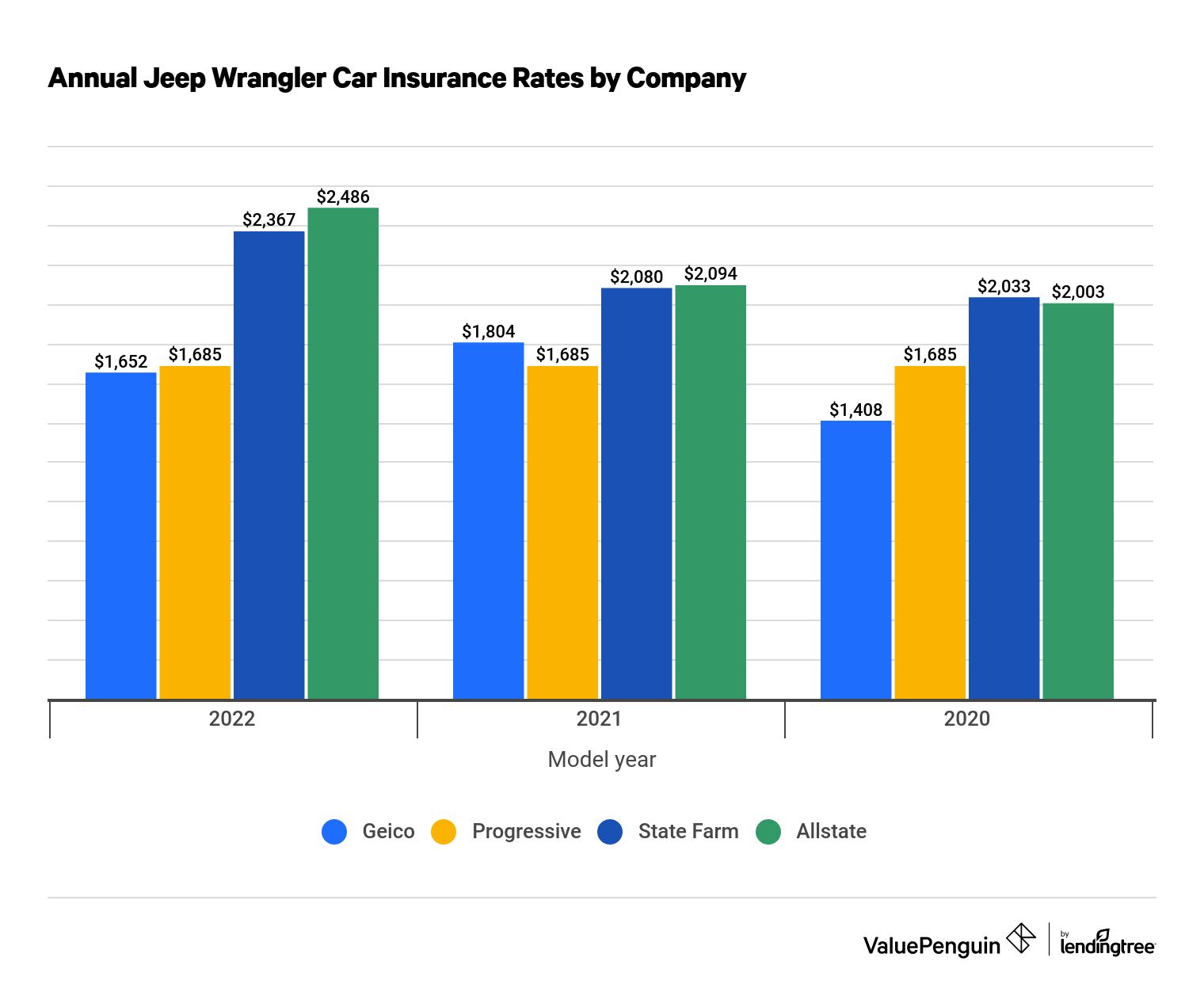

Geico offers the cheapest full-coverage auto insurance quotes for a Jeep Wrangler. The insurer's average annual rate across the four model years is $1,526 per year, or $127 per month. That's $296 per year lower than the average rate across all insurers.

Find Cheap Jeep Wrangler Insurance Quotes

Though Geico usually provides the cheapest auto insurance quotes for Wrangler owners, Progressive also offers them low-cost car insurance. Progressive's quotes are 13% lower than the average, amounting to an annual cost difference of $41.

Jeep Wrangler insurance rates

Company | Average annual rates |

|---|---|

| Geico | $1,562 |

| Progressive | $1,626 |

| State Farm | $2,118 |

| Allstate | $2,125 |

Rates are based on average cost of insurance for six Jeep Wrangler models.

Older Wranglers are cheaper to insure than newer models, on average. For example, a full-coverage policy for a 2019 Jeep Wrangler costs $362 per year less than insurance for a 2022 model. That's because insurance rates are typically higher for more expensive vehicles, which include electronic components that cost a lot to repair or replace.

Cost of Jeep Wrangler insurance by model

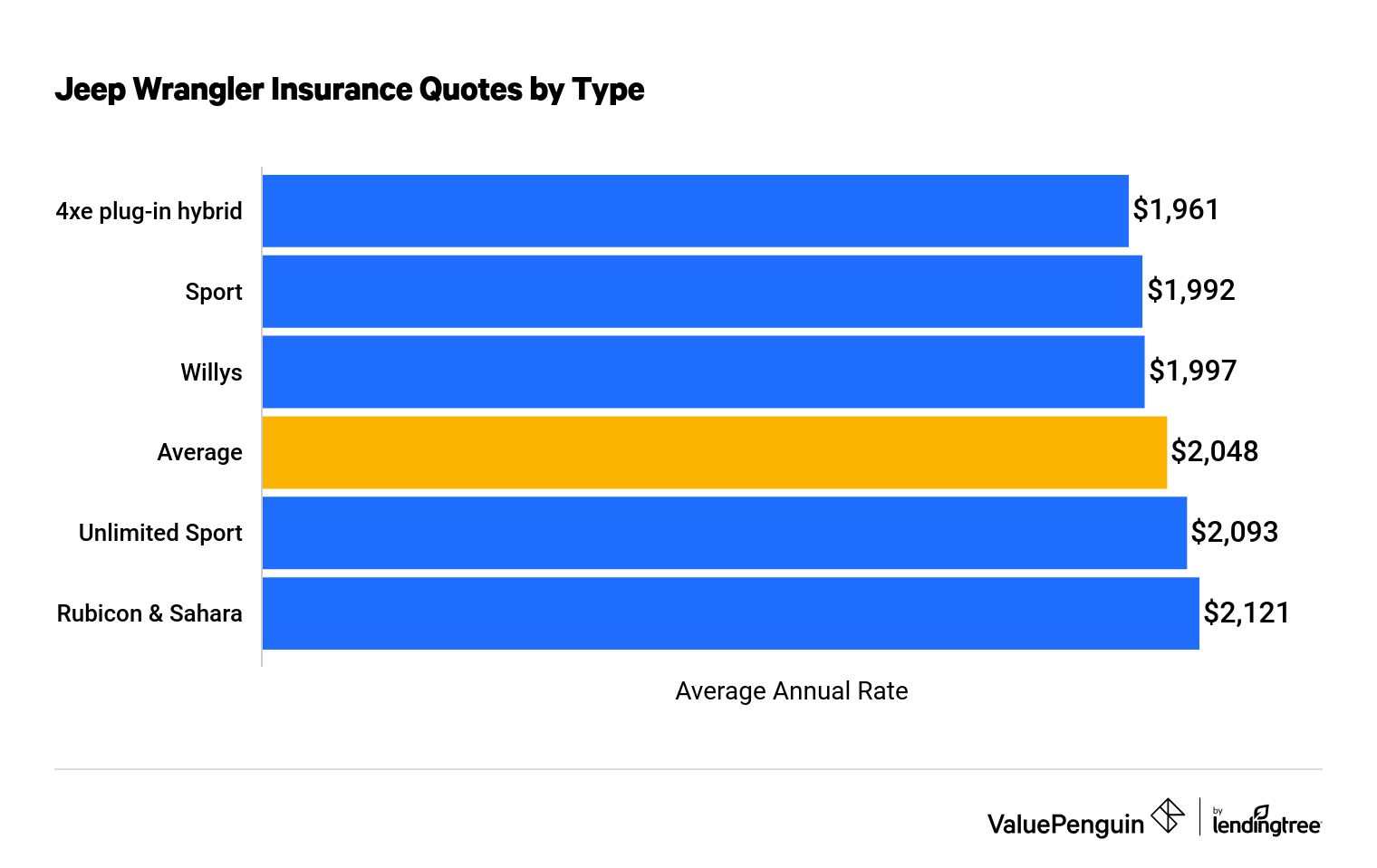

Jeep Wrangler car insurance prices vary based on which trim level you have. One of the main reasons is that trim level has a big impact on the value of your vehicle, which affects auto insurance quotes.

More expensive trim levels will typically have higher insurance costs, so Wrangler Rubicon or Sahara owners can expect to pay more for insurance than Wrangler Sport drivers, as the Sport is the cheapest trim version.

Average Jeep Wrangler car insurance cost by trim

Trim level | Monthly rate | Annual rate |

|---|---|---|

| 4xe plug-in hybrid | $163 | $1,961 |

| Sport | $166 | $1,992 |

| Willys | $166 | $1,997 |

| Unlimited Sport | $174 | $2,093 |

| Sahara | $177 | $2,121 |

| Rubicon | $177 | $2,121 |

Rates are based on 2022 models.

Jeep Wrangler hybrid insurance

The Jeep Wrangler 4xe is the manufacturer's first plug-in hybrid car. It can operate on electric power for an estimated 49 miles and has a 370-mile total driving range.

Hybrid cars generally cost more to insure than their traditional counterparts because the technology onboard can be expensive to repair or replace if you're involved in an accident. However, the 4xe is the least expensive Jeep to insure — at $1,961 per year, a policy costs $87 less than the average 2022 model.

Jeep Wrangler insurance costs vs. other vehicles

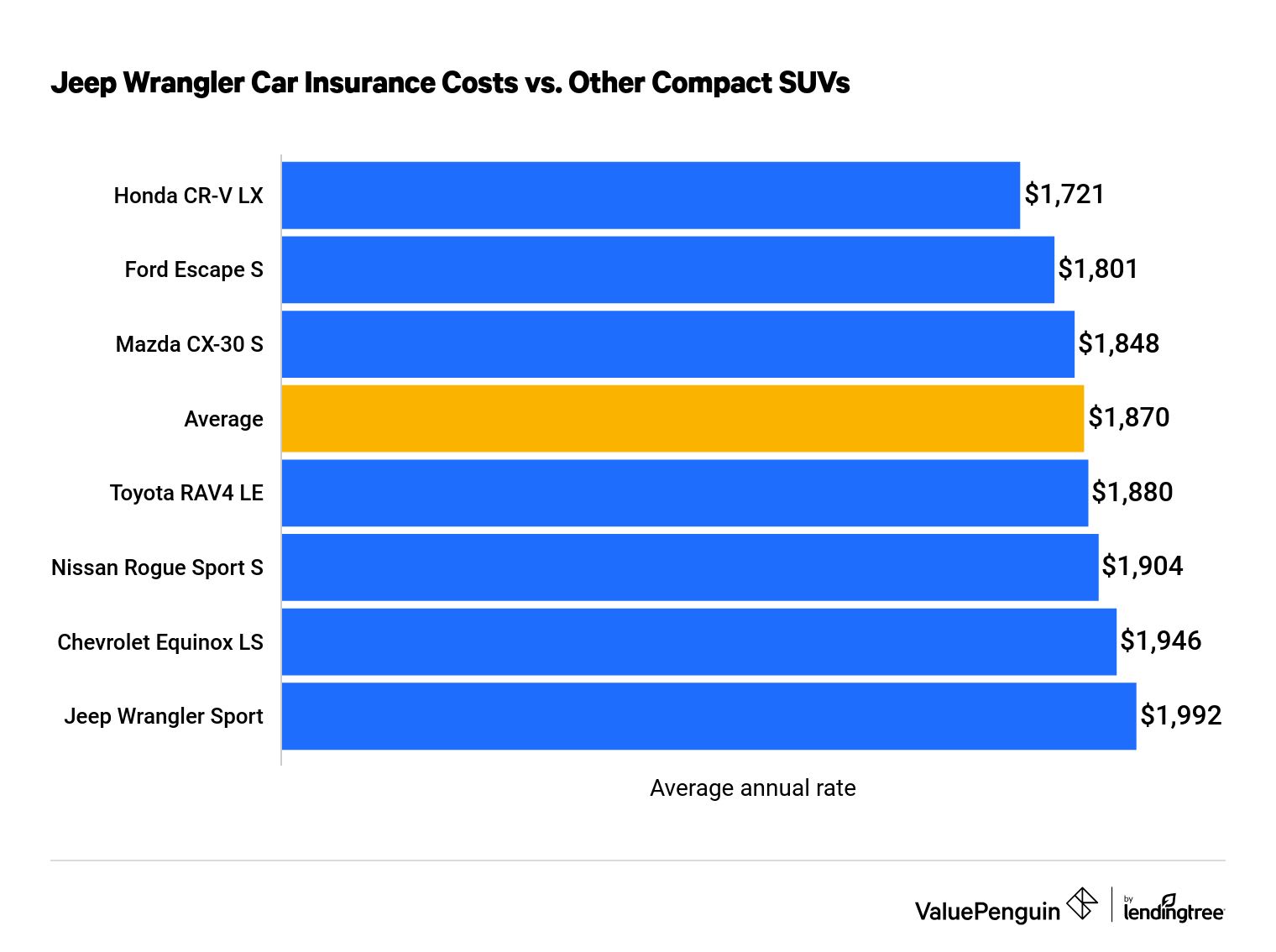

The 2022 Jeep Wrangler costs more to insure than other compact SUVs.

The average cost of car insurance across some of the most popular small SUV models of 2022 is $1,870 per year. However, the Wrangler's rates are 7% more expensive than average and 16% more expensive than the SUV with the most affordable rates, the Honda CR-V.

Jeep Wrangler auto insurance rates vs. competitors

Vehicle model | Monthly rate | Annual rate |

|---|---|---|

| Honda CR-V LX | $143 | $1,721 |

| Ford Escape S | $150 | $1,801 |

| Mazda CX-30 S | $154 | $1,848 |

| Average | $156 | $1,870 |

| Toyota RAV4 LE | $157 | $1,880 |

| Nissan Rogue Sport S | $159 | $1,904 |

| Chevrolet Equinox LS | $162 | $1,946 |

| Jeep Wrangler Sport | $166 | $1,992 |

Rates are based on 2022 models.

Frequently asked questions

How much is insurance on a Jeep Wrangler?

On average, full-coverage car insurance for a Jeep Wrangler costs $1,858 per year, or $155 per month.

Are Jeep Wranglers expensive to insure?

No, Jeep Wranglers are not expensive to insure, despite being a larger vehicle. The average cost to insure a Wrangler is $200 less per year than the average cost of full-coverage car insurance nationally.

Where can I get cheap insurance for a Jeep Wrangler?

Geico offers the cheapest quotes for Wrangler owners. A full-coverage policy costs $1,562 per year, which is $296 less expensive than average.

Methodology

We compiled quotes from the four largest auto insurers: State Farm, Progressive, Geico and Allstate. The quotes were for a 30-year-old man with no traffic tickets or accidents living in California. The rates listed represent the cost of a full-coverage policy with the following coverage limits:

Coverage | Limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

This analysis used insurance quote data from Quadrant Information Services. Quotes were publicly sourced from insurer filings and should only be used for comparison purposes. Actual rates for your Jeep Wrangler may differ.

Car prices were obtained from Kelly Blue Book. Unless otherwise noted, the most affordable trim level was selected.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.