10 Largest Life Insurance Companies

Find Cheap Life Insurance Quotes in Your Area

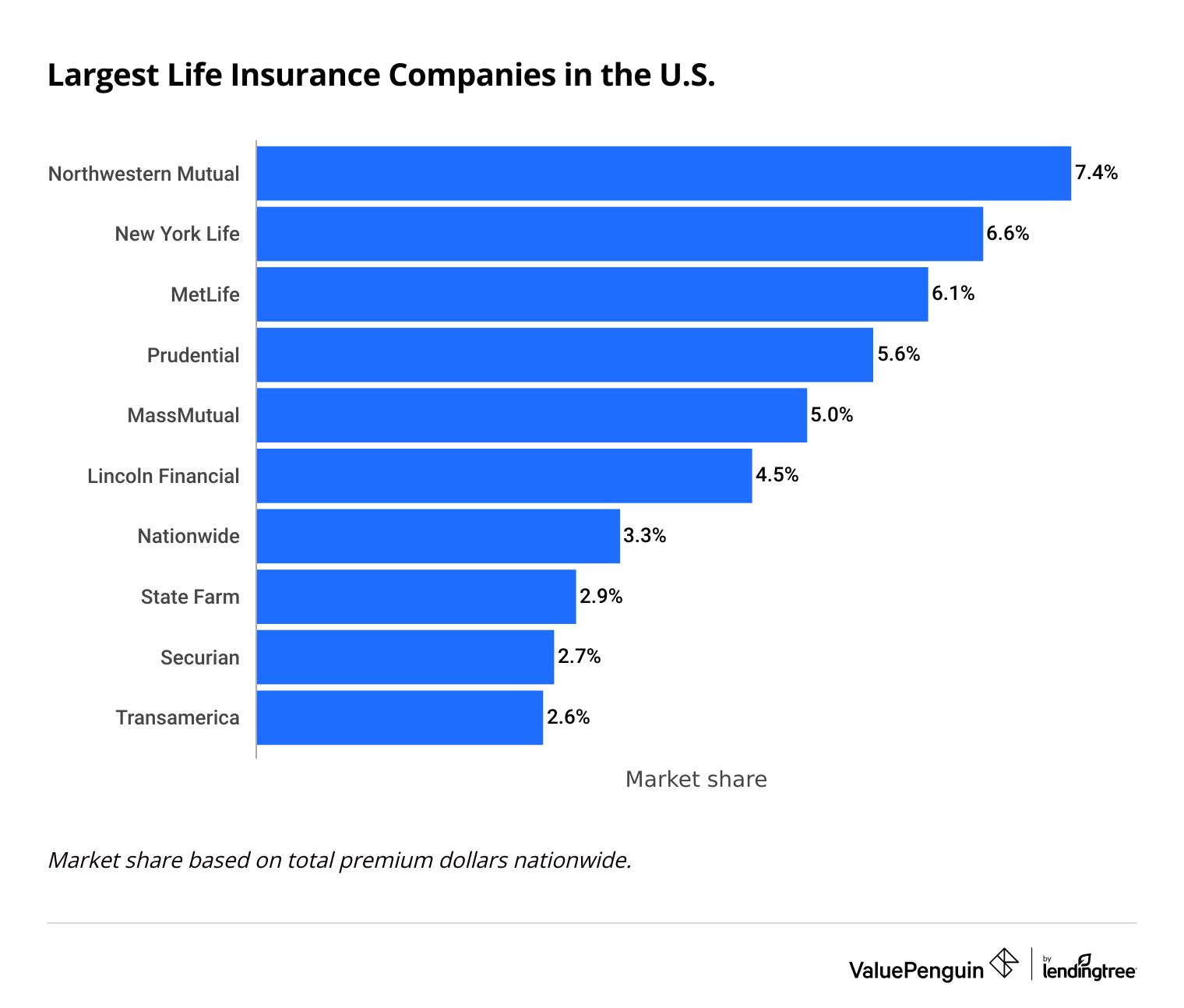

The largest life insurance company in the U.S. is Northwestern Mutual, which has 7% of the market.

Other large companies include New York Life, Prudential and Nationwide. The 10 largest life insurers make up slightly less than half the market in the U.S.

There are hundreds of life insurance companies in the United States. But about 60% of all life insurance is sold by the 15 largest companies. The largest companies are widely available across the country, are financially stable, and have a wide variety of coverage options.

What are the largest life insurance companies?

Northwestern Mutual is the biggest life insurance company in the country, with 7.4% of the total market. New York Life, MetLife and Prudential are the next biggest companies.

Find Cheap Life Insurance Quotes in Your Area

Northwestern Mutual overtook New York Life in 2020 to become the largest life insurance company in America. Both companies are dependable and high-quality options, but Northwestern's affordable rates have helped it become the biggest life insurer in the U.S.

Largest life insurance companies by market share

Company | Premiums in billions | Market share | |

|---|---|---|---|

| Northwestern Mutual | $13.9 | 7.4% | |

| New York Life | $12.4 | 6.6% | |

| MetLife | $11.4 | 6.1% | |

| Prudential | $10.5 | 5.6% | |

| MassMutual | $9.4 | 5.0% | |

Largest life insurance companies by state

Besides being the biggest life insurance company overall, Northwestern Mutual is the most popular insurer in 22 states. New York Life is the largest provider in 10 states, and MassMutual is the top option in three.

State | Top company | Market share |

|---|---|---|

| Alabama | Northwestern Mutual | 8% |

| Alaska | Lombard International | 35% |

| Arizona | Prudential | 8% |

| Arkansas | Northwestern Mutual | 5% |

| California | New York Life | 9% |

What is life insurance?

Life insurance is a type of insurance policy that helps cover expenses for your loved ones if you pass away. These policies usually have a set dollar amount for coverage, which can be anywhere from a few thousand dollars to over $1 million. Larger life insurance policies might be used to replace your income, pay off a mortgage or cover the cost of college for a child. A life insurance policy with a smaller coverage amount could pay for funeral or burial expenses, or it could be used for a loan.

The cheapest and most common type of life insurance is term life insurance.

Term life insurance has a set monthly price and an expiration date — usually 10, 20 or 30 years after the policy starts.

Permanent life insurance lasts for as long as you keep paying the premiums, and it sometimes includes an investment element as well. However, these policies are much more expensive than term life policies for equivalent coverage. Whole life and universal life are both types of permanent life insurance.

Methodology

To determine the largest life insurance companies in the United States, ValuePenguin gathered 2022 life insurance premium data for all 50 states and the District of Columbia from the National Association of Insurance Commissioners and S&P.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.