ResidentShield Renters Insurance Review

ResidentShield renters insurance tends to cost more than other major companies, and customer service varies depending on where you live.

Find Cheap Renters Insurance Quotes in Your Area

ResidentShield is a renters insurance company owned by Yardi Systems, which offers property management software to landlords. If your landlord or property management company partners with Yardi Systems, they may suggest you buy a ResidentShield policy. Even if your landlord requires you to buy renters insurance, you don't have to buy a policy from a specific company.

ResidentShield quotes are more affordable for renters who live in one of its partner properties, but you can usually find cheaper coverage elsewhere.

However, ResidentShield quotes may be more competitive for renters with poor credit. The company doesn't check your credit score when you buy a policy. That means your credit won't affect your insurance rate.

Pros and cons

Pros

No credit check

Multiple roommates can share a policy

Lots of extra coverage options

Cons

Expensive rates

Difficult claims process in some states

ResidentShield quotes

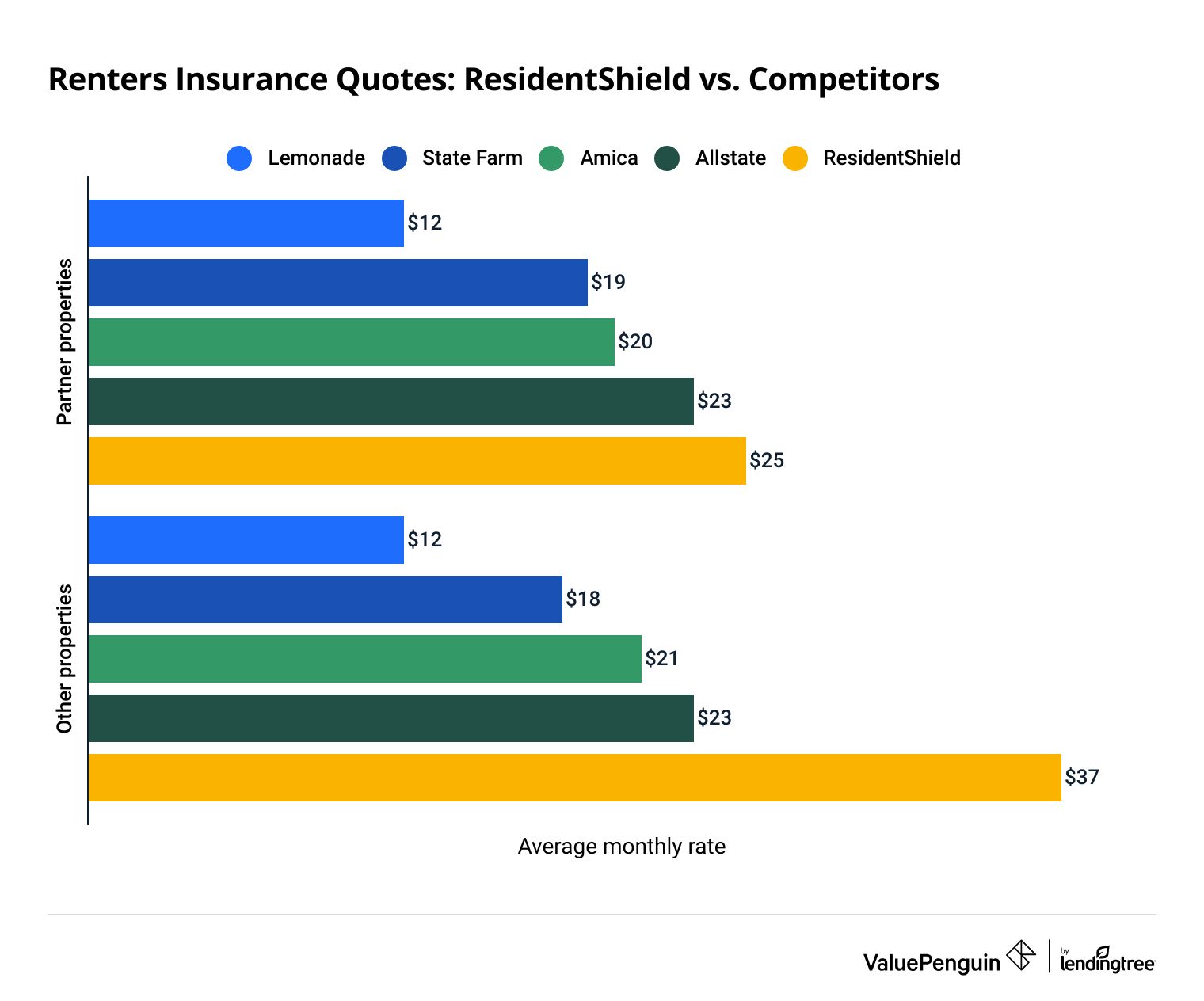

ResidentShield renters insurance tends to cost more than other companies.

ResidentShield renters insurance costs an average of $25 per month if you live at one of its partner properties. That's 27% more than the average price from other major renters insurance companies.

If your property isn't a ResidentShield partner, you can expect its renters insurance rates to be more expensive. ResidentShield insurance costs an average of $37 per month for non-partner properties, which is 66% more than average.

Find Cheap Renters Insurance Quotes in Your Area

A policy from ResidentShield is between two and three times more expensive than the cheapest option, Lemonade. Renters living in ResidentShield partner properties who choose Lemonade pay $13 less per month for the same coverage.

ResidentShield renters insurance rates vs. competitors

Partner properties

Other properties

Company | Monthly rate | ||

|---|---|---|---|

| Lemonade | $12 | ||

| State Farm | $19 | ||

| Amica | $20 | ||

| Allstate | $23 | ||

| ResidentShield | $25 | ||

Partner properties

Company | Monthly rate | ||

|---|---|---|---|

| Lemonade | $12 | ||

| State Farm | $19 | ||

| Amica | $20 | ||

| Allstate | $23 | ||

| ResidentShield | $25 | ||

Other properties

Company | Monthly rate | ||

|---|---|---|---|

| Lemonade | $12 | ||

| State Farm | $18 | ||

| Amica | $21 | ||

| Allstate | $23 | ||

| ResidentShield | $37 | ||

ResidentShield renters insurance coverages

ResidentShield offers basic renters insurance coverages, plus a few optional add-ons for renters looking for extra protection.

However, the company's online quote tool doesn't allow you to customize your personal liability coverage limits. So, if you want more liability coverage, you'll have to get a quote over the phone.

Bed bug coverage pays for an exterminator to get rid of bed bugs from your home.

The equipment protection program pays to fix or replace a damaged laptop, cell phone, TV or other electronics.

This coverage has a $250 deductible.

Pet damage liability covers up to $500 in damage caused by your pet. This coverage kicks in if the damage costs more to fix than your rental deposit and pet deposit can cover.

Tenant damage coverage will pay to fix any damage you accidentally cause to the home you're renting.

Renters can get up to $300,000 of tenant damage coverage from ResidentShield.

Unlisted additional insured coverage will cover people living in your home who aren't listed on your policy.

Water and sewer overflow coverage will replace your damaged things after water from a sewer or sump pump backs up into your home. This does not include flooding due to natural causes, like hurricanes.

This coverage has a $250 deductible.

ResidentShield allows you to add up to four non-related roommates to a policy. That can be useful for younger renters and college students.

You can also protect your belongings with replacement cost coverage. However, this option isn't available through ResidentShield's online quote tool. You'll have to call to get a quote for replacement cost coverage.

In addition, ResidentShield's standard policy includes:

- Loss of use coverage

- Guest medical payments

ResidentShield also offers earthquake coverage to renters in California.

Does ResidentShield offer discounts?

The only discount ResidentShield offers is for senior living residents, who can save up to 20% on coverage.

It also offers cheaper coverage for people whose landlords use software from its parent company, Yardi Systems. However, this savings is automatically included in your quote, so you won't get an additional discount.

Sometimes, insurance companies consider factors like past claims or alarm systems when setting rates without identifying them as discounts.

That's not the case with ResidentShield. It doesn't ask about your claims history, building materials, fire safety or other factors that typically lower your rates. So, these things won't help you save money with ResidentShield.

ResidentShield customer service reviews and ratings

Renters may get very different levels of customer service based on where they live.

That's because four companies underwrite ResidentShield renters insurance: Century-National Insurance, Cypress Property & Casualty, Praetorian Insurance and Spinnaker Insurance.

If you need to file a claim, you'll work directly with the company that underwrites your policy. Some companies have good customer service, while others have poor reviews.

You can't choose which company underwrites your policy because it's based on where you live. So renters won't know whether their insurance company is reliable until after buying a policy.

ResidentShield underwriter reviews

NAIC complaints

| Financial strength | |

|---|---|---|

| Century-National | 59% fewer than expected | A+ (A.M. Best) |

| Cypress | 359% more than expected | A (Demotech) |

| Praetorian | 50% fewer than expected | A (A.M. Best) |

| Spinnaker | 9% more than expected | A- (A.M. Best) |

For example, Praetorian only gets half as many complaints as expected based on its size, according to the National Association of Insurance Commissioners (NAIC). But Cypress gets three and a half times more complaints than its competitors.

If Century-National or Praetorian is the underwriter in your area, you'll probably have a good customer service experience.

But you may get poor service if you're working with Cypress or Spinnaker. That means it could take longer to replace your stuff after you file a claim.

All of ResidentShield's underwriting companies have positive financial strength ratings from A.M. Best. That means each company can pay out claims, even if there are a large number of them at the same time.

About ResidentShield renters insurance

A property management software developer called Yardi Systems Inc. owns ResidentShield. Your property manager may recommend ResidentShield because it works together with the Yardi software platform. That makes it easy for your landlord to verify that you have coverage.

One of the main benefits of ResidentShield compared to other companies is that your landlord will automatically be named as an interested party on your policy. That means ResidentShield will let your landlord know if your policy lapses or is canceled.

However, signing up your landlord or management company as an interested party is an option almost every renters insurance company provides. The process typically only takes a few minutes. The convenience of having this done automatically isn't worth the extra cost of getting a policy from ResidentShield.

Frequently asked questions

How much does renters insurance from ResidentShield cost?

Renters insurance from ResidentShield costs around $25 per month if you live in a building that partners with the company. But rates average $37 per month for other renters. Most renters can find cheaper renters insurance elsewhere.

Does ResidentShield sell car insurance?

No, ResidentShield does not offer car insurance. Renters looking to

How do I contact ResidentShield?

Renters can contact ResidentShield customer service at (800) 566-1186, or at [email protected]. You can also submit claims through the ResidentShield website.

How do you cancel a ResidentShield policy?

Renters need to call ResidentShield customer service at (800) 566-1186 to cancel their policy. If your landlord requires you to have proof of insurance, make sure that you get a new policy before canceling with ResidentShield.

Methodology

To compare renters insurance rates, ValuePenguin gathered 250 quotes across 25 of the largest cities in Texas. Rates are for a 25-year-old single man with no history of claims who lives alone.

Quotes are for basic renters insurance coverage with personal property, liability, loss of use and medical payments coverage.

- Personal property coverage: $30,000

- Personal liability coverage: $100,000

- Medical payments: $1,000

- Loss of use: $9,000, or base limit

- Deductible: $500

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.