Stacked vs. Unstacked Car Insurance: Which is Better?

Find Cheap Auto Insurance Quotes in Your Area

Stacking insurance is a way to raise your coverage and protection if you are in an accident with an uninsured or underinsured driver. Stacked insurance combines coverage limits either from multiple policies a driver is on or from multiple cars on the same policy.

For your auto insurance, only uninsured motorist (UM) or underinsured motorist (UIM) bodily injury coverage can be stacked. You cannot stack UM and UIM property damage coverage. A total of 32 states allow some form of stacking insurance, although companies in some states do not have to offer the option.

What is stacked vs. unstacked insurance?

Stacked insurance is a way to combine insurance coverage limits from multiple policies or multiple vehicles. The coverage that can be stacked is bodily injury uninsured or underinsured motorist coverage.

Uninsured motorist coverage pays for costs that result from an accident with a driver without insurance. Underinsured motorist coverage comes into play if the damage, which can be both injuries and property, costs more than the other driver's insurance coverage limit.

When insurance policies are stacked, their coverage limits are added together. There are two ways to stack coverages:

Stacking across multiple policies

When your name is on multiple insurance policies, you may be able to stack the uninsured motorist coverage limits. This could come into play if you have your own insurance policy and your name is also on another policy, say that of a spouse or family member. This is sometimes called vertical stacking.

For example, your insurance for your own vehicle includes a $35,000 uninsured motorist bodily injury coverage limit. Your name is also on the insurance for your parents' car, and that policy has $25,000 in uninsured motorist bodily injury coverage. For slightly higher premiums, you can stack these insurance policies for $60,000 in coverage, should you get in an accident with an uninsured driver.

Stacking within one auto insurance policy

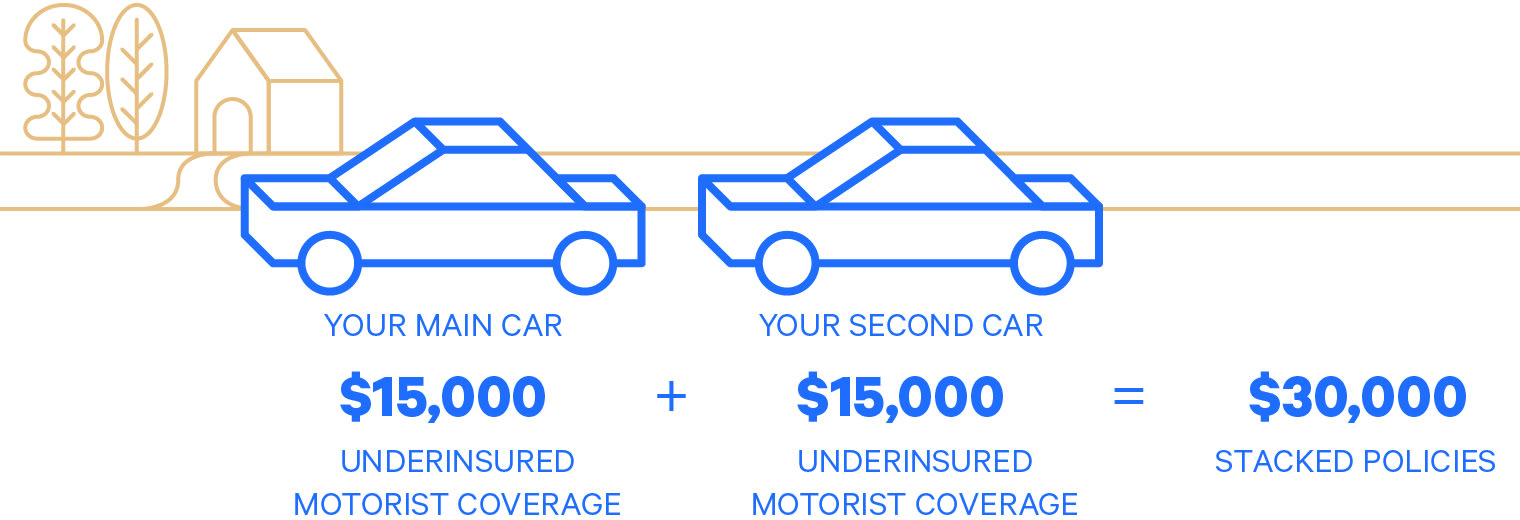

If you have multiple vehicles insured on the same policy, you can pay more and opt to stack the uninsured or underinsured coverage. Since each vehicle has its own coverage limit, those limits can be stacked. This is sometimes called horizontal stacking.

Say you own two cars, both insured on the same auto policy. You’ve insured both with $15,000 of underinsured motorist coverage. If you pay to stack the policies, you'll have $30,000 in potential coverage.

Stacking auto insurance policies is allowed in 32 states to some degree. It is also limited to coverage for injuries. Coverage for property damage cannot be stacked.

States where you can stack insurance

The laws for stacking insurance vary by state. Some states don't allow the process at all, keeping policies unstacked. Other states have certain restrictions on how policies can be stacked.

States that allow both kinds of stacking

- Alabama

- Arkansas

- Colorado

- Florida

- Hawaii

- Indiana

- Kentucky

- Mississippi

- Missouri

- Montana

- Nevada

- New Hampshire

- New Mexico

- Ohio

- Pennsylvania

- Rhode Island

- South Carolina

- Vermont

- Virginia

- West Virginia

- Wisconsin

- Wyoming

States that only allow vertical stacking

- Delaware

- Georgia

- New Jersey

- New York

- North Carolina

- Oklahoma

- Oregon

- Tennessee

- Texas

- Utah

A few states have unique rules to know about when it comes to stacking insurance. For instance, Pennsylvania and Florida allow drivers to waive the ability to stack their insurance to lower their rates. However, insurers don't necessarily default to a stacked policy, so you should confirm that you've opted in when purchasing coverage. And Wisconsin limits stacking to only three vehicles.

States that do not permit insurance stacking at all

- Alaska

- Arizona

- California

- Connecticut

- Idaho

- Illinois

- Iowa

- Kansas

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Nebraska

- North Dakota

- South Dakota

- Washington

Do all insurers offer stacked insurance?

Not all insurance companies offer stacked insurance, even in the states where it is allowed. Certain states allow insurers to add anti-stacking language into policies.

This isn't always the case — some states by law prohibit "anti-stacking language" in insurance policies. We suggest you ask about stacking opportunities and limitations when comparing insurance quotes.

You can ask specifically about your options and if you have any flexibility when it comes to raising your uninsured or underinsured motorist coverage.

Should you stack your uninsured motorist insurance?

You should only stack your car insurance if it's more affordable than buying an equivalent level of unstacked coverage. For example, a stacked $10,000 per person/$20,000 per accident limit across two cars provides the same level of coverage as an unstacked 20/40 policy. As a result, you should choose whichever is cheaper.

However, it's not always the case that stacking your insurance will be cheaper than buying an unstacked policy with equivalent coverage.

For example, we found that in Florida, the cost of a stacked 10/20 policy for two cars is often higher than an unstacked 20/40 policy.

Each provides the same level of coverage, but in this case, it makes more sense to choose the second option.

Cost of stacked vs. unstacked uninsured motorist coverage

Uninsured motorist coverage limit | Annual cost of UM coverage |

|---|---|

| Unstacked 10/20 | $235 |

| Stacked 10/20 | $403 |

| Unstacked 20/40 | $373 |

| Stacked 20/40 | $602 |

Sample rates are annual prices of uninsured motorist coverage only on a policy with two cars and one driver in Florida.

Note that Florida has more uninsured drivers than nearly all other states, so the cost of stacking uninsured motorist coverage is higher there than in other places.

More than one in 10 U.S. drivers are uninsured, and that rate is significantly higher in certain regions.

If stacking is not permitted in your state, or you are unable to stack policies, an alternative is to increase your uninsured and underinsured motorist coverage limits. This will similarly cost more, but it offers more security if you find yourself in an accident with a driver who cannot cover the damage.

Methodology

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

All sample quotes are based on statewide averages in Florida among Allstate, Geico and State Farm.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.