What You Need To Do After a Car Accident: A Complete Guide

Find Cheap Auto Insurance Quotes in Your Area

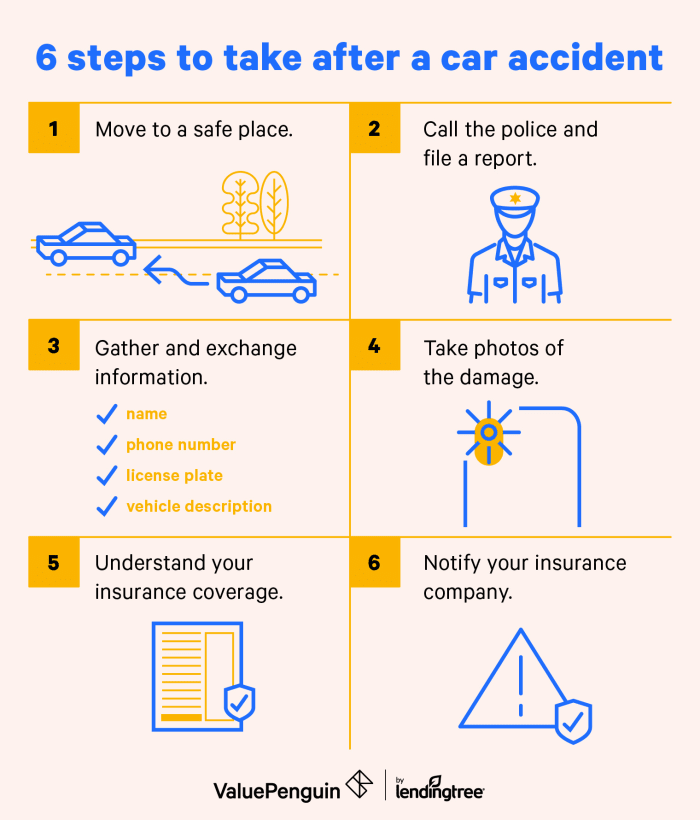

It's normal to feel frazzled after a car accident, even a minor one. But if you're not prepared to handle such an event, you may not end up taking the proper steps to deal with the damage. That's why we've compiled the ultimate checklist, to help you stay safe, document the incident properly and work with your insurance company afterwards.

1. Move to a safe place

Before doing anything else, check to see if anyone in the vehicle is injured and call 911 immediately if someone needs urgent medical care.

Then, If you can do so safely, move your vehicle to the side of the road and out of traffic. If you're still in close proximity to passing cars, turn on your emergency lights to warn other drivers. If it's dark, find a flashlight to help you see.

2. Call the police and file a report

Once you're safe, call the police to file an official report. Even if there are no major injuries or damage to the cars, you'll need the report if you decide to file an insurance claim later.

When talking with the police, keep in mind that a police report is only used to capture facts. Don't admit fault or put blame on the other parties involved, and don't assume any details about the accident.

3. Gather and exchange information

Next, you'll need to gather information for your own records. Many auto insurance companies have created smartphone apps to help you document the right details, which can help when you file a claim.

In addition to noting the date and time of the accident, and gathering the contact information for any witnesses, you'll need to get this information from the other driver:

- Name, address and phone number

- Insurance company and policy number

- License plate number

- Vehicle description, make and model

Even if a police officer documents some of the facts, make sure you have them for your own records.

If the other driver was responsible for the accident, you should also contact their insurer, since motorists who are at fault may not want to report the accident for fear of raising their insurance rates or concerns about other financial or legal repercussions.

4. Take photos of the damage

Next, take photos of both vehicles, as well as any injuries. This documentation can act as proof when you file your insurance claim. Make sure the photo quality is clear enough to observe the damage, or lack of damage, and take photos of the following:

- All four sides of each vehicle involved

- The damaged parts of your vehicle (from multiple angles)

- Your vehicle’s VIN and odometer reading

If you have a dashcam, download the footage and send it to your insurance company. This will be especially helpful if the other party refuses to assume responsibility, since live video footage can demonstrate the sequence of events.

5. Understand your insurance coverage

Next, you'll need to deal with the insurance. If you're not sure already, take a look at your insurance policy to see what it covers before calling your insurance company. The two types of liability coverage that you'll want to review include property damage and bodily injury.

If applicable, you should also try to determine if the other driver's insurance will cover these.

If the accident was your fault... | If the accident was the other driver's fault... |

|---|---|

| After you pay a deductible (which you choose when you buy the policy), collision insurance will pay to repair damage to your own vehicle. | The other driver's property damage liability coverage will cover damage to your vehicle, up to their policy limits. |

| If you, your passengers, or the other driver are injured in the accident, bodily injury liability insurance will cover your medical bills. | The other driver's bodily injury liability coverage will cover your medical bills, up to their limits. While this coverage is required in most states, the "no-fault" states also require PIP, or personal injury protection. |

What about no-fault states?

If you live in a no-fault state, and you are at fault in an accident, your insurer will still reimburse you for accident-related damage and medical bills. If the other driver is at fault, you must make a third-party claim through that driver's insurer. Puerto Rico and the following 12 states are no-fault states:

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New York

- New Jersey

- North Dakota

- Pennsylvania

- Utah

These states also require personal injury protection (PIP), which compensates you for lost wages or medical expenses caused by the accident. However, you must file a claim with your own insurance company.

PIP is generally more expensive than other states’ coverage plans, so be sure to understand the higher costs in these no-fault states.

6. Notify your insurance company

Many insurance companies require you to report accidents immediately. If possible, call your insurer at the scene, or right after you leave, to ensure you provide the most accurate information.

Also remember: Reporting an accident to the insurer is not the same as filing a claim, so this will not automatically increase your rates.

If you do move forward with a claim, you'll need to pay a deductible first. Note that your monthly rates will usually increase after filing a claim, even if the accident was not your fault. Different insurance companies raise their rates by varying amounts. However a study by the Consumer Federation of America (CFA) found that Progressive and Geico are more likely to increase your rates after not-at-fault accidents.

After processing your claim, the insurer will send you an offer with the payout amount. But depending on the insurer, your plan may require you pay your costs out-of-pocket, and then reimburse you for your bills.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.