Car Insurance Rates for 30-Year-Olds

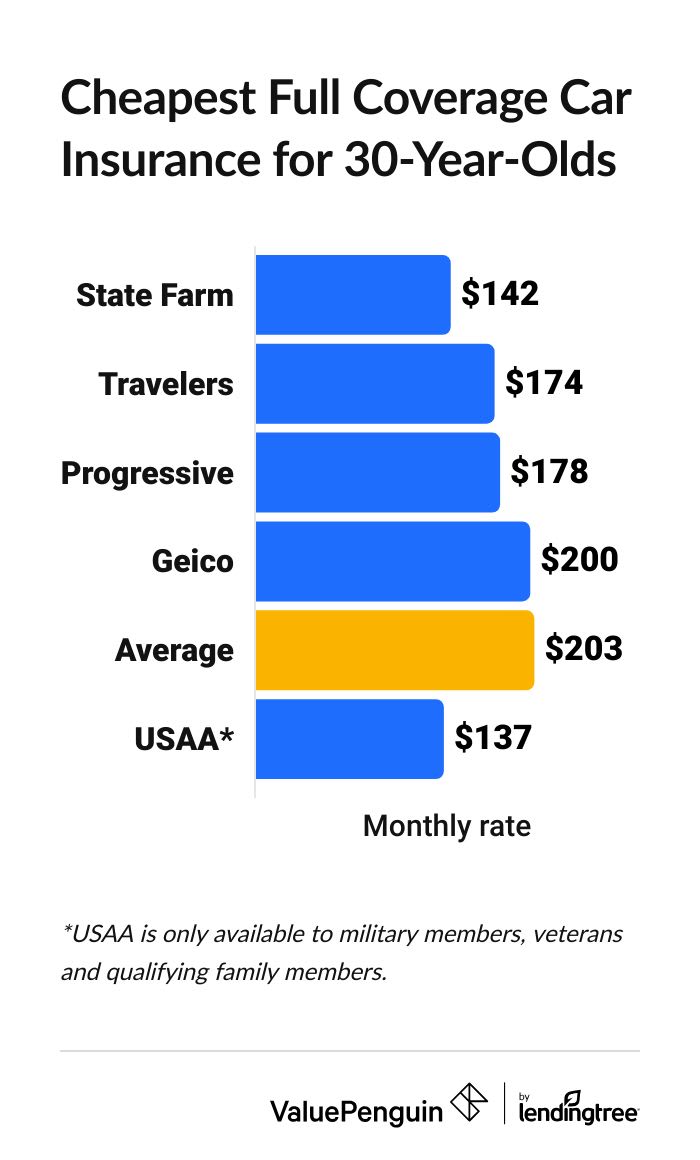

The average cost of car insurance for 30-year-olds is $203 per month for full coverage and $146 per month for minimum liability car insurance.

Find Cheap 30-Year-Old Auto Insurance Quotes

State Farm has the cheapest full and minimum coverage rates for 30-year-olds.

Minimum coverage is much cheaper than full coverage but doesn't include coverage for damage to your car. If you can afford more coverage, it's usually a good choice to go with full coverage.

How much is car insurance for a 30-year-old?

The average rate for a 30-year-old is $203 per month for full coverage car insurance.

Minimum coverage costs $146 per month, on average, for a 30-year-old.

State Farm has the cheapest full and minimum coverage rates for most people. If you're 30, full coverage from State Farm costs $142 per month, while minimum coverage costs $61 per month.

Full coverage

Minimum coverage

Find Cheap 30-Year-Old Auto Insurance Quotes

USAA has the absolutely lowest rates for 30-year-olds with full coverage. A policy costs $137 per month, on average. But you can only get USAA if you're associated with the military.

Cheap full coverage car insurance companies for 30-year-olds

Company | Editor's rating | Monthly rate | |

|---|---|---|---|

| State Farm | $142 | ||

| Travelers | $174 | ||

| Progressive | $178 | ||

| Geico | $200 | ||

| Allstate | $313 | ||

*USAA is only available to military members, veterans and their families.

Car insurance rates can vary by dozens or even hundreds of dollars per month depending on the company you choose. For example, full coverage from State Farm is $58 cheaper each month, on average, compared to Geico. Even though the coverage is the same, State Farm could save you an average of about $700 per year.

Does car insurance go down at 30?

Full coverage car insurance at age 30 costs $329 per month less than the same coverage at age 18.

Car insurance rates drop as you get older, as long as you haven't filed any claims or had tickets. The longer you've had your license, the more experience you have on the road. That makes you less likely to get into accidents, so insurance companies charge you less.

Cheap car insurance for new drivers at 30

If you get your license at 30 instead of when you're younger, you'll pay an average of 52% more for full coverage. That's because, even though you're older, you still don't have much driving experience. But you'll pay less than a teenager, no matter how long they've been licensed.

How much is car insurance for a 30-year-old male vs. female?

By age 30, men and women pay the same amount for car insurance.

At younger ages, men usually pay more than women. That's because younger men are more likely to engage in risky driving behaviors, like speeding and drunk driving, than women.

But by age 30, men don't pay any more for car insurance than women. The gap in rates stays narrow until drivers are in their 70s, when men start to pay more for coverage again.

Company | Male | Female | |

|---|---|---|---|

| State Farm | $142 | $$142 | |

| Travelers | $175 | $172 | |

| Progressive | $178 | $178 | |

| Geico | $199 | $202 | |

| Allstate | $310 | $317 | |

*USAA is only available to current and former military members and their families.

In seven states, car insurance companies are banned by law from using your gender to set car insurance rates. That means, as long as everything else is the same, men and women should pay the same amount for coverage.

- California

- Hawaii

- Massachusetts

- Michigan

- Montana

- North Carolina

- Pennsylvania

Best car insurance companies for 30-year-olds by state

Where you live changes how much you'll pay for car insurance.

That's because the cost for vehicle repairs is higher in some areas, and so is the risk of getting into an accident. In Texas, for example, a 30-year-old pays $233 per month, on average, for full coverage. But in Pennsylvania, the average rate for the same coverage is $175 per month.

- Illinois: $187

- New York: $216

- Pennsylvania: $175

- Texas: $233

Find the Cheapest Insurers for Drivers in Your State

How to find the cheapest car insurance for a 30-year-old

The best way to get cheap car insurance is to shop around and compare quotes from different companies.

Car insurance companies all charge different rates, so shopping around can help you get the coverage you need at the best price.

You might also get a lower rate by:

- Driving safely. Safe driving won't likely reduce your rate immediately, but it can help keep your rates from increasing over time. Your rate goes up when you get tickets or cause accidents. Safe driving helps you avoid these jumps in price. Some companies even have discounts if you go through a safe-driver program.

- Bundling policies. Bundling your car and home or renters insurance is one of the best ways to save money on both insurance policies. Bundling just means buying both plans from the same company, and it's usually one of the best discounts you can get.

- Adding discounts. In addition to bundling, most car insurance companies have discounts that can help you get a cheaper rate. You might save by paying your six-month or annual rate in full, going paperless or not driving often.

Frequently asked questions

How much is car insurance for a 30-year-old?

Full coverage car insurance costs $203 per month, on average, for a 30-year-old. Minimum coverage costs $146 per month, on average. Your rate depends on where you live, the car you drive, your driving history and more.

Does car insurance get cheaper at 30?

Car insurance is cheaper at 30 than it is at younger ages. Teen drivers pay the highest rates, and rates go down as you get older and get more experience on the road. But if you get tickets or cause accidents, your rate will go up.

What is the cheapest car insurance for a 30-year-old?

State Farm has the cheapest average rates for 30-year-olds, at $142 per month for full coverage and $61 per month for minimum coverage. USAA is often cheaper, but you can only get it if you're a veteran, military member or qualifying family member.

What's the best car insurance for a 30-year-old?

State Farm is a good choice for most 30-year-olds because it's cheap and comes with great service. However, there isn't just one company that is the best for everyone. The best company for you depends on what you need from your car insurance, so shop around and compare quotes and companies to find the right option.

Methodology

ValuePenguin calculated the average car insurance rates for 30-year-olds by getting quotes from seven of the largest car insurance companies in four of the most populated states in the U.S. Not all the companies were available in every state.

Average rates are for 30-year-old men and women who own a 2015 Honda Civic EX, have good credit and have no accidents or tickets. Minimum coverage rates represent only the state-required car insurance coverage.

Full coverage rates are for higher liability limits, as well as comprehensive and collision coverage:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection (PIP): Minimum, when required by state

- Medical payments: $5,000

- Comprehensive and collision deductible: $500 deductible

All rates are from Quadrant Information Services data, which uses publicly available insurance company filings. The rates shown here are for comparison purposes only. Your rates will likely be different.

About the Author

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.