Best Cheap Car Insurance for College Students

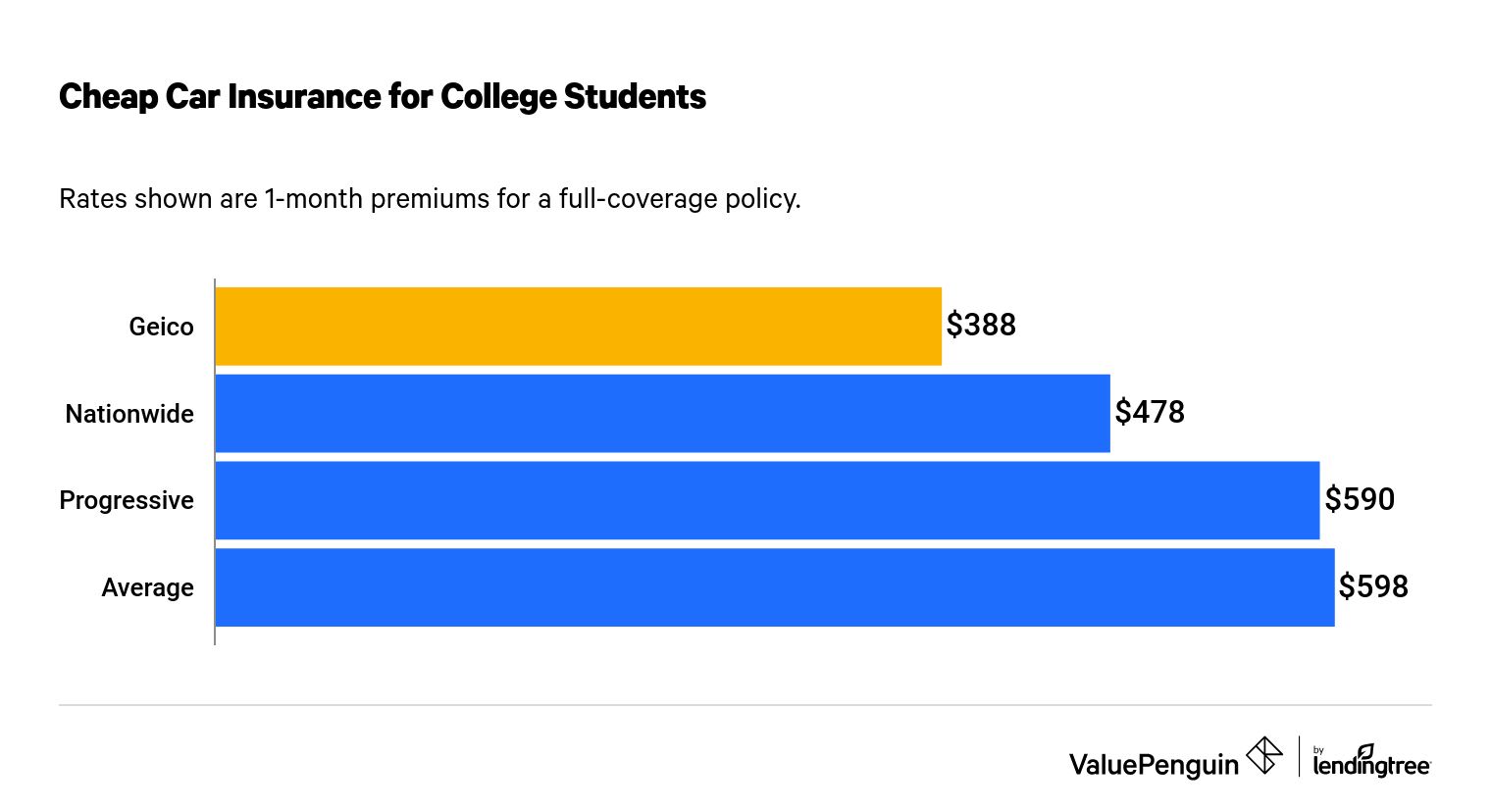

Geico has the cheapest car insurance for college students, averaging $388 per month. College students can save hundreds of dollars on car insurance by comparing rates.

Find Cheap Auto Insurance Quotes in Your Area

Cheapest car insurance for college kids

We collected thousands of quotes from 23 car insurance companies, across the 10 most populous states in the U.S. Rates are for 18-year-old men and women who are single, have a clean driving record and drive a 2015 Honda Civic EX. Full methodology

Cheapest college student car insurance: Geico

-

Editor rating

-

Monthly rate

$388 ?

Why it's great

Geico's low rates and several discounts make it the best cheap car insurance for students.

Quotes vary depending on where you live. But Geico consistently offers college-age drivers low auto insurance rates.

Geico also offers discounts to members of college groups, like fraternities and sororities. So if you're a college student involved on campus, chances are you can get discounted auto insurance rates.

Find Cheap Auto Insurance Quotes in Your Area

Cost of full-coverage car insurance for college drivers

Company | Monthly rate | |

|---|---|---|

| Geico | $384 | |

| Nationwide | $480 | |

| Progressive | $588 | |

| State Farm | $644 | |

| Allstate | $872 |

Best for discounts: State Farm

-

Editor rating

-

Monthly rate

$644 ?

Why it's great

State Farm offers a long list of auto insurance discounts — and some of its best discounts are for student drivers.

State Farm's good-student discount can save you up to 25% on a car insurance policy.

Eligibility requirements vary by state. Typically the driver must be a full-time student and have a grade point average of at least 3.0 (out of 4.0).

Plus, the discount lasts until drivers turn 25 years old, even if they graduate from college before then.

State Farm's student-away-at-school discount is great for college students who live on a campus where a car isn't necessary. You're eligible if you live more than 100 miles from home, keep your car at home and only drive your car when home on vacation or during a holiday.

State Farm's Steer Clear program offers all drivers under the age of 25 the chance to save money on their auto insurance. The program allows drivers to review and improve their driving skills through a training program. If you complete the course within six months, you'll qualify for a discount.

Best college student car insurance for low-mileage drivers: Metromile

-

Editor rating

-

Monthly rate

Depends on mileage ?

Why it's great

Metromile is a great insurance company for college students who don't drive often but still want the convenience of having their car at school.

Metromile rates are based on how many miles you drive, called a per-mile fee. That means you'll pay less if you drive less.

Metromile claims that if you drive fewer than 12,000 miles per year, which is the national average, you will save money with its insurance.

You can also enter your current insurance costs on their website to see if you'll pay less with Metromile.

Metromile doesn't charge you for driving more than 250 miles per day, depending on the state. This cap on your daily costs can help you avoid paying more for a road trip or driving home from college. In New Jersey, Metromile doesn't charge drivers for more than 150 miles per day.

The company's biggest drawback is its limited availability.

Currently, Metromile is only available in eight states: Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia and Washington.

If Metromile isn't available where you live, ask your insurance company about a low-mileage discount, which most providers offer.

Best mobile app: Allstate

-

Editor rating

-

Monthly rate

$872 ?

Why it's great

Allstate's mobile app helps college students stay on top of their car insurance plan without paperwork or phone calls.

Allstate Mobile lets you access plan info, pay your bill, get roadside assistance and connect to an insurance agent.

You can file a claim right from the app, which we consider the best part. This saves you from long phone calls during what is usually a stressful time.

In addition to the app, Allstate's agents provide good customer service. This can be a huge benefit for college students who may be unfamiliar with how their auto insurance policy works.

For college students who are on a budget, keep in mind that Allstate's policies can be expensive. Student drivers should carefully consider how they prioritize service quality versus cost.

Car insurance for college students: how to save money

If you're a college student with a car on campus, or the parent of one, consider the tips listed below as ways to save money on student car insurance.

Keep in mind that college freshmen and high school seniors will likely pay more for insurance than college seniors. That's because car insurance rates usually drop between ages 18 and 25.

Keep the student on the parents' policy

Having a college student on their parents' policy is typically much cheaper compared to buying the student a separate policy. This is especially true if the other members of the family have good driving records. Auto policies under a parent's name tend to be less expensive because the parents likely have a longer history with the insurance company.

The downside is that having a college student on the family policy will raise rates for the parents. Compare prices for an individual policy for the student versus having them on the family policy.

If a student's family home is no longer their permanent address, an insurance company may require the student to have an individual policy.

Some companies are more flexible for young drivers staying on their parents' policy, and it's important to be upfront. If a student files a claim on their parents' policy and the company doesn't know they moved away, it may deny your claim or even cancel coverage. As a result, it's usually best to discuss your options beforehand.

Explore discounts for a student who will drive less while away

If your child is going to college more than 100 miles from home without the car, you could either qualify for an away-from-home discount or remove the student from the family policy for the time they're away.

The student can still drive the car during spring and winter breaks, provided they don't drive for more than a certain number of days in a row, as required by the insurance company. Also, with the student now driving the car less or not at all, you may be eligible for more savings based on the reduced mileage.

Be sure to confirm with your carrier which features are available for your policy.

Get a discount for good grades

Good students drive better, according to insurance companies. This means that most large insurance companies give discounts for full-time high school or college students who:

- Have grades at or above a B or 3.0 GPA.

- Rank in the top 20% of their class.

- Rank in the top 20% of standardized test scores from the past 12 months.

Ask your insurance company about discounts for college students with good grades.

Compare quotes from multiple companies to save on student car insurance

One of the best ways to save money on auto insurance is to shop around and compare rates.

Many insurance companies likely operate in your area, and they're competing for your business. So it's best to take your time in gathering quotes to ensure you're getting a fair deal.

You can compare the quotes you get to the average cost of auto insurance in your state to get a sense of the prices.

Find Cheap Auto Insurance Quotes in Your Area

Frequently asked questions

Who has the best car insurance for college students?

Geico has the best average rate for college-age drivers, at $388 per month. But State Farm has the best discounts, including discounts for good grades and driver training, as well as an away-at-school discount.

What is the cost of car insurance for an 18-year-old college student?

A typical 18-year-old student pays about $598 per month for car insurance if they have their own policy and keep their car on campus. But you can reduce your rates by sharing a policy with your parents or qualifying for discounts, like one for having good grades.

Methodology

Car insurance quotes are based on thousands of ZIP codes across the 10 most populous states in the U.S.

Rates are for 18-year-old men and women who are single, have a clean driving record and drive a 2015 Honda Civic EX.

Costs are for a full-coverage policy, including liability insurance, with coverage that's slightly higher than the state's minimum coverage requirements:

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

| Personal injury protection (PIP) | Minimum, when required by state |

The analysis included 23 insurance companies, but rates were only added to our list of average prices and recommendations if their policies were available in at least three of the 10 states.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.