Who Has the Cheapest Renters Insurance Quotes in Austin?

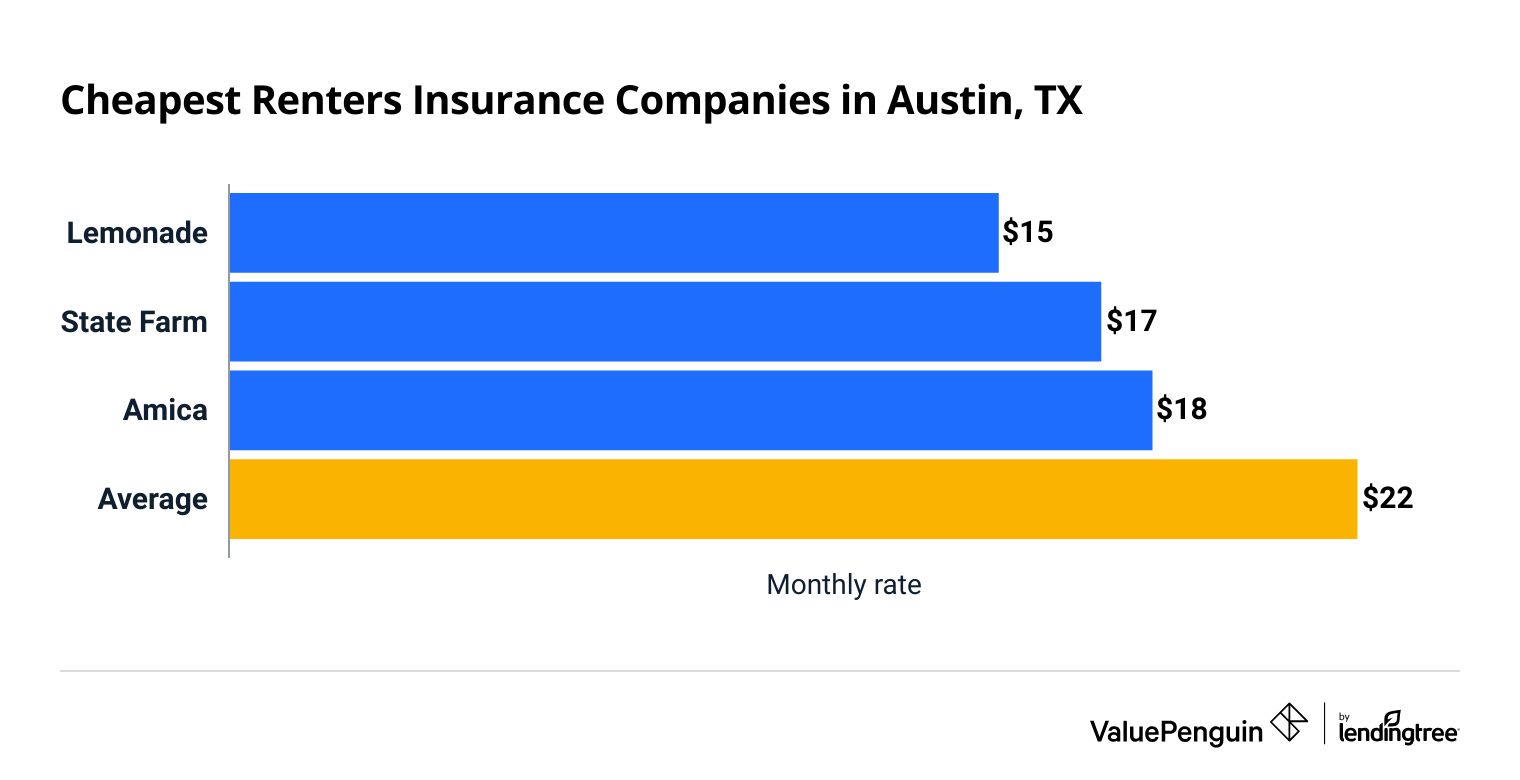

Lemonade has the cheapest renters insurance in Austin, at an average of $15 per month.

However, the cheapest option isn't always the best choice for renters insurance.

Austin renters should also consider State Farm. It costs only $2 per month more than Lemonade and offers more reliable customer service.

Compare Cheap Renters Insurance in Austin

Best Cheap Renters Insurance in Austin

To find the best renters insurance in Austin, our editors evaluated each company's rates, coverage options and customer service. To determine company rates, ValuePenguin collected quotes from seven top insurance companies that offer coverage in the city.

Quotes include $30,000 of personal property coverage with a $500 deductible and $100,000 in liability protection.

Cheapest Austin renters insurance

Lemonade is the cheapest renters insurance company in Austin.

An average policy from Lemonade costs $15 per month, which is $7 per month less than the citywide average.

The average cost of insurance in Austin is $22 per month. That's $3 per month cheaper than the cost of renters insurance in Texas overall.

Compare Cheap Renters Insurance in Austin

Cheap renters insurance quotes in Austin

Company | Monthly rate | ||

|---|---|---|---|

| Lemonade | $15 | ||

| State Farm | $17 | ||

| Amica | $18 | ||

| Allstate | $23 | ||

| Progressive | $24 | ||

Best company for most Austin renters: State Farm

-

Editor's rating

- Cost: $17/mo

State Farm's cheap rates and great customer service make it the best choice for most Austin renters.

-

Affordable rates

-

Reliable customer service

-

Great for bundling with car insurance

-

Some people have to call an agent to buy a policy

-

Few discounts available

State Farm has the second-cheapest renters insurance in Austin, at $17 per month. That's $5 per month less than the city average. And it's only $2 per month more than the cheapest option, Lemonade.

With State Farm, renters don't have to sacrifice great customer service for affordable coverage.

The company earned a good score on J.D. Power's customer satisfaction survey. State Farm also gets one-third as many complaints as an average company its size, according to the National Association of Insurance Commissioners (NAIC). That means you can count on State Farm to repair or replace damaged items quickly.

Additionally, State Farm is an excellent choice if you're looking to bundle your renters and auto insurance policies. Not only can you earn a multi policy discount, but State Farm has some of the cheapest car insurance rates in Texas.

However, the only other renters insurance discount State Farm offers is a safety discount. You can get this discount by having fire, smoke or burglary alarms.

Best cheap renters insurance in Austin, TX: Lemonade

-

Editor's rating

- Cost: $15/mo

Lemonade has the cheapest renters insurance quotes in Austin.

-

Best prices in Austin

-

Easy to manage your policy online

-

Mixed customer service reviews

-

Limited discounts

Lemonade is the cheapest option for Austin renters, at $15 per month. Lemonade also makes it easy to buy and manage your policy online. Renters can compare quotes online or through Lemonade’s highly-rated app. You can also use the app to pay your bill, change your coverage or file a claim.

The biggest downside to choosing Lemonade is that it can be difficult to get in touch with a person.

This could be one reason for Lemonade's mixed customer service reviews. The company earned a great score on J.D. Power's customer satisfaction survey. But it gets three and a half times more complaints than an average company its size, according to the NAIC.

Although Lemonade's app should make the claims process easier, many customers complain about a long, difficult claims process. So it may take longer to replace your stuff after an emergency if you choose Lemonade.

Best renters insurance discounts in Austin: Amica

-

Editor's rating

- Cost: $18/mo

Amica has more renters insurance discounts than other top companies along with excellent service.

-

Lots of discounts

-

Great customer service

-

Not the cheapest option

At $18 per month, Amica isn't the cheapest renters insurance company in Austin. However, it's still $4 per month less than the citywide average. And Amica offers lots of ways to lower your bill, including discounts for:

- Signing up to make automatic payments

- Bundling your renters and car insurance policies with Amica

- Agreeing to get bills and policy documents via email

Amica also offers discounts for renters who have had a policy with their current company for at least two years. And you can save money if you've gone three years or longer without filing a claim.

Amica customers are typically very happy with the company's customer service. Amica gets about one-third as many complaints as a typical company, according to the NAIC. National Association of Insurance Commissioners. It also earned the highest score on J.D. Power's claims satisfaction survey.

What renters insurance coverage do I need in Austin?

There are many reasons for needing renters insurance, and Austin renters are especially likely to face a few.

In 2022, homes in Austin experienced over $55 million in fire damage, according to the Texas Department of Insurance. An apartment fire can destroy your furniture, bed, clothes and appliances. That's why fire claims can be very expensive.

Renters insurance almost always covers fire damage. A policy ensures you'll be able to replace your stuff if your apartment catches on fire.

Austin tends to have more property crime than other large cities, according to the Austin Police Department.

Renters insurance policies protect you from both robbery inside your home and theft of your belongings while away from home, like if someone steals your purse. Having a renters insurance policy means you won't have to worry about whether you can afford to replace stolen belongings.

Water damage is a common and very costly claim for Austin renters. Whether you leave your bathtub running or a pipe bursts, water can ruin all of your belongings. Renters insurance covers these types of flood damage.

However, renters insurance doesn't cover weather-related flooding. Renters living near Lake Austin, Ladybird Lake or Travis Lake should consider getting a separate flood insurance policy. Flood insurance is the only way to protect your stuff from rising waters.

Frequently asked questions

How much is renters insurance in Austin, TX?

Austin renters insurance costs an average of $22 per month. That's $3 per month less than the Texas state average.

Is renters insurance required in Austin?

The city of Austin doesn't require renters to have insurance. However, your landlord or property management company can require you to buy a policy as part of your lease agreement.

What is the cheapest renters insurance in Austin, Texas?

Lemonade has the cheapest renters insurance in Austin, at $15 per month. However, renters shouldn't buy a policy based on cost alone.

State Farm only costs a little more, at $17 per month, but it has much better customer service reviews. That makes State Farm a better choice for most people.

Methodology

To find the best renters insurance in Austin, ValuePenguin collected rates from seven of the top insurance companies available in the city. Rates are for a 30-year-old unmarried woman living alone with no prior insurance claims.

Quotes are for the following coverage limits:

- Personal property: $30,000

- Personal liability: $100,000

- Medical payments: $1,000

- Loss of use: $9,000

- Deductible: $500

To evaluate quality, we considered each company's National Association of Insurance Commissioners complaint score, as well as its ratings by J.D. Power and ValuePenguin editor's ratings, if available.

Sources:

- Fire statistics: Texas Department of Insurance

- Property crime rates: Austin Police Department Annual Crime and Traffic Report

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.