The Best Cheap Renters Insurance in Tennessee (2024)

Lemonade has the cheapest renters insurance in TN, at $17 per month for $30,000 of personal property coverage, on average.

Compare Cheap Renters Insurance in Tennessee

Best Cheap Renters Insurance in TN

ValuePenguin editors found the best cheap renters insurance companies in Tennessee by looking at rates, customer satisfaction, coverage options and discounts.

Our experts calculated average renters insurance rates by gathering quotes from six top companies across 25 major TN cities.

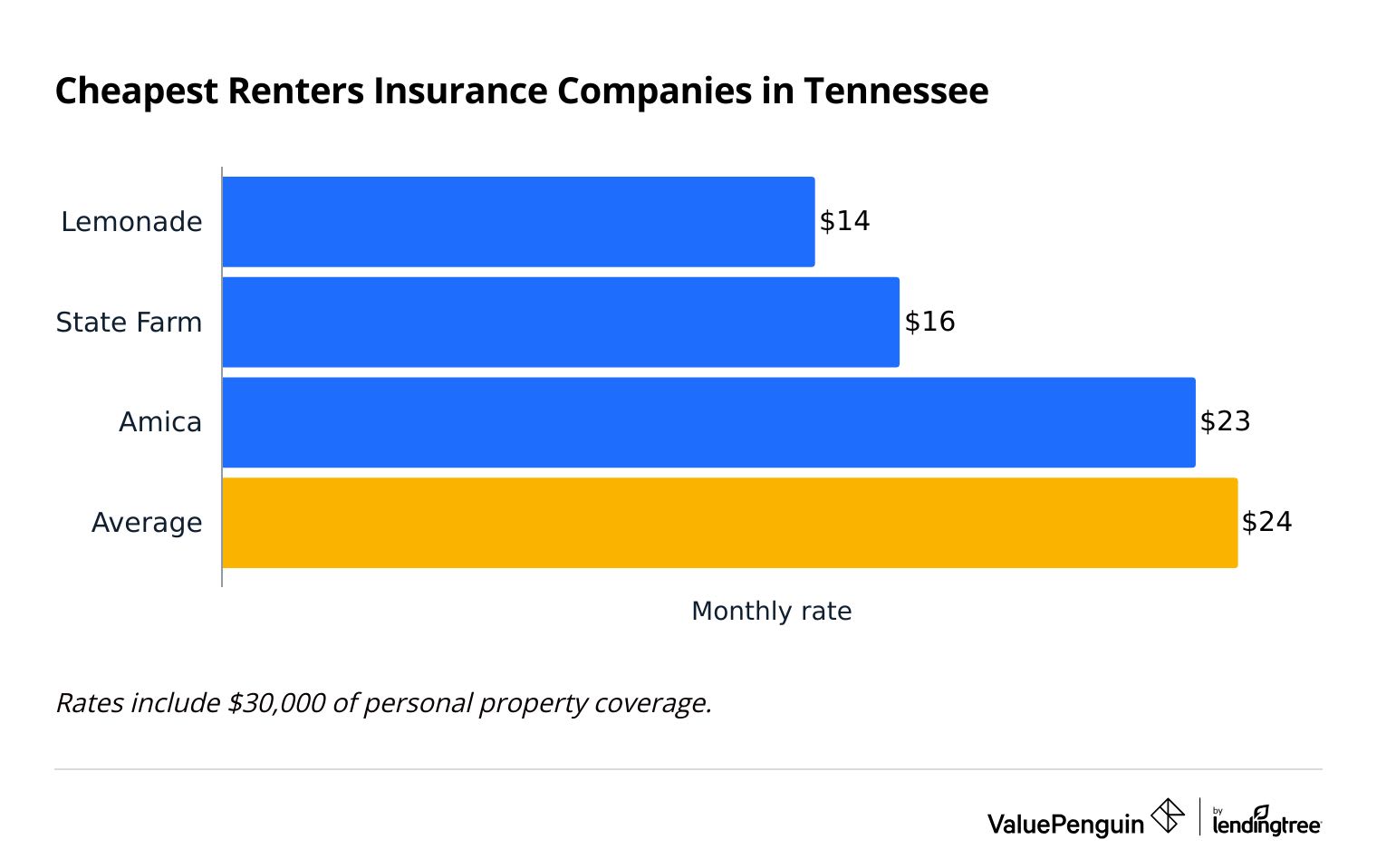

Cheapest renters insurance companies in Tennessee

Lemonade has the cheapest renters insurance in Tennessee, at $14 per month for $30,000 of personal property coverage. That makes it 40% cheaper than the Tennessee state average.

Compare Cheap Renters Insurance Quotes in TN

Renters insurance in Tennessee costs $24 per month for $30,000 of personal property coverage , on average. That's about a dollar each month more than the national average of $23 per month.

Tennessee renters pay slightly less than renters in neighboring states. States to the south of TN, like Arkansas and Alabama, have higher costs, while North Carolina has much cheaper renters insurance prices, at just $17 per month.

Top renters insurance companies in Tennessee

Company | Monthly cost | ||

|---|---|---|---|

| Lemonade | $14 | ||

| State Farm | $16 | ||

| Amica | $23 | ||

| Progressive | $24 | ||

| Assurant | $33 | ||

Best renters insurance for most Tennesseeans: Lemonade

-

Editor's rating

- Cost: $14/mo

Lemonade has the best prices in Tennessee, plus an easy-to-use mobile app and website.

-

Cheap quotes

-

Replacement cost always included

-

Many extra coverage options

-

Easy online shopping experience

-

Few discounts

-

High number of customer complaints

-

Hard to speak with a person

The best renters insurance in Tennessee comes from Lemonade, which offers coverage at affordable prices with useful coverage options. Coverage from Lemonade costs $14 per month, or 40% less than average.

Lemonade's online platform is easy to use. Renters can buy a policy or file a claim very quickly.

The company gets mixed reviews from its customers, however. It got a high score in a renters insurance customer survey by J.D. Power. Customers highlighted the quick signup process and ease of managing your policy.

On the other hand, Lemonade receives far more customer complaints than a typical insurance company, according to the National Association of Insurance Commissioners (NAIC). These complaints generally involve claims service, suggesting Lemonade may sometimes struggle to pay claims efficiently.

All Lemonade renters insurance policies include replacement cost coverage, which pays to replace your things with brand new items, regardless of wear and tear.

Lemonade allows customers to customize its basic renters insurance coverage by increasing their personal property coverage for high-value items. It also offers added protection against water damage due to backed-up plumbing.

Best renters insurance in Tennessee for in-person service: State Farm

-

Editor's rating

- Cost: $16/mo

State Farm has affordable prices and offers in-person service if you need it.

-

Affordable quotes

-

In-person service

-

Good renters-auto bundling discount

-

Flood insurance available

-

Few discounts

Prices at State Farm are well below the state average. State Farm costs $16 per month, while the typical price across Tennessee is $24 per month.

State Farm's standout feature is how easy it is to get in-person service. Unlike most renters insurance companies, State Farm has a network of agents across the state to help you manage your policy or file a claim. You're automatically assigned a nearby insurance agent when you buy a policy, or you can choose one near you.

State Farm has a good renters-auto bundling discount, and it's one of the cheapest car insurance companies in Tennessee. If you already have State Farm car insurance, consider State Farm for your renters insurance, too.

State Farm has a strong reputation for customer service. The company scored above average on a recent customer satisfaction survey by J.D. Power. It's important to choose a renters insurance company with good service because you're less likely to have problems when you file a claim.

State Farm lets you personalize your policy with coverage extras. Tennessee renters can protect themselves against common like floods and earthquakes with add on coverage.

Best renters insurance for customer service: Amica

-

Editor's rating

- Cost: $23/mo

Amica provides top-notch customer service to its customers.

-

Reliable customer service

-

Lots of discounts available

-

Average rates

-

Few options to customize coverage

Amica's dependable customer service is hard to beat.

If you're willing to spend a bit more for renters insurance with excellent service, consider Amica for coverage.

Amica has some of the best-reviewed service in the industry. It receives only one-third as many complaints as an average company, suggesting customers usually like the service they receive — especially when making a claim.

The average cost of renters insurance from Amica is $23 per month, which is about the Tennessee state average. However, the company offers lots of discounts to help renters to save money on their insurance, including:

- Automatic payment discount

- Claim-free discount

- Loyalty discount

- Multi-policy discount

- Paperless discount

Amica's renters insurance coverage is fairly standard. While it meets the basic needs of many renters, those looking for extra protection might prefer another insurer. And while Amica has great customer service, it doesn't have any offices in Tennessee.

Tennessee renters insurance: Costs by city

Memphis has the most expensive renters insurance among major TN cities, at $34 per month.

That's 43% higher than the average in the state.

Lebanon, east of Nashville, has the cheapest rates, averaging $19 per month.

How much you pay for renters insurance will depend on where you live. Factors like the crime rate in your city, the frequency of certain natural disasters like tornadoes or flooding, and labor and materials costs can all impact your monthly rate.

City | Monthly rate | % from average |

|---|---|---|

| Bartlett | $29 | 20% |

| Brentwood | $23 | -3% |

| Chattanooga | $25 | 3% |

| Clarksville | $24 | -1% |

| Cleveland | $27 | 13% |

Tips for getting cheap renters insurance in Tennessee

Compare quotes, use discounts and find your coverage needs to get the lowest price on your Tennessee renters insurance policy.

Add up the cost of the items you own to find out how much coverage you need. You need enoughpersonal property coverage so that if all your belongings are destroyed, you can afford to replace all of it. But you don't have to overpay for coverage. Having the correct amount of property coverage will have a big impact on your monthly rate.

You can save hundreds of dollars per year without sacrificing coverage by comparing quotes. The most expensive renters insurance company in Tennessee, Farmers, costs $230 per year more than the cheapest company, Lemonade, for the same level of coverage.

Every renter should compare quotes each year because rates can change over time. The cheapest company today might not have the best rates the next time you renew your policy.

Every Tennessee renters insurance company offers discounts to help you lower your rates.

It's important to consider which discounts you might qualify for when comparing quotes. That's because discounts can lower your final costs significantly.

Common renters insurance discounts in Tennessee

- Renters-auto bundling

- Claims free discount

- Automatic payments

- Pay in full

- Loyalty

- Home protection device

Natural disasters in Tennessee

Wind and floods are the most common disasters in Tennessee.

Damage to your home caused by wind is almost always covered by renters insurance, while damage from flooding usually isn't.

Does renters insurance cover flooding in Tennessee?

Some renters insurance companies may offer an optional flood add-on for your policy, or sell separate flood insurance backed by the National Flood Insurance Program, but a basic renter insurance policy won't cover rainwater that got into your home.

Tip: Keep in mind that insurance companies think of "flooding due to rain" and "flooding due to plumbing" as separate issues. Many renters insurance companies sell policies that cover water backup, but those won't help you if the flooding is from a rainstorm.

Is wind damage covered by renters insurance in TN?

Yes, wind damage is usually covered by renters insurance. It's covered by renters insurance whether it's a tornado, a tropical storm or simply a strong wind.

Keep in mind that your renters insurance doesn't cover wind damage to the structure of your home, or your car. Damage to your vehicle is covered under your comprehensive insurance, if you carry it.

And unlike homeowners insurance, your renters insurance policy only covers your stuff — not your roof, windows or walls. It's your landlord's responsibility to protect your home's structure, and pay to fix wind damage, if it occurs.

Frequently asked questions

How much is renters insurance in Tennessee?

The average cost of renters insurance in Tennessee is $24 per month. People shopping for cheap renters insurance in Tennessee should consider Lemonade, where a policy costs around $14 per month.

Does Tennessee require renters insurance?

Renters insurance is not legally required in Tennessee. However, your landlord or property management company is allowed to ask you to buy a policy as a part of your rental contract.

How much does renters insurance cost in Nashville?

Renters insurance in Nashville costs about $24 per month, which is the average cost of renters insurance in Tennessee. In comparison, renters insurance in Memphis costs an average of $34 per month.

Methodology

ValuePenguin collected more than 180 quotes from across 25 major Tennessee cities for a single 30-year-old woman who has never filed a renters insurance claim. Coverage limits include:

- $30,000 of personal property coverage

- $9,000 for loss of use

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

Customer service ratings were created using cost data, information from the National Association of Insurance Commissioners (NAIC) complaint index scores and J.D. Power's 2023 renters insurance customer satisfaction study rankings.

These rates should be used for comparative purposes only. Your quotes will likely differ.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.