Car Insurance Refund: 3 Times When You're Eligible

Find Cheap Auto Insurance Quotes in Your Area

If your car insurance policy is canceled in the middle of your term, you can typically get a refund for the remaining time in your policy.

But how much you can get back depends on whether you or your insurance company canceled the policy, how much time you have left on your policy and the company's rules about refunds.

How to get a refund if:

You've chosen to cancel your car insurance policy

One of the most common reasons for a car insurance refund is if you cancel your policy in the middle of your term. You may have found a better rate elsewhere, sold your car or moved to another state.

Should I cancel my insurance policy?

You can cancel your car insurance whenever you want, and there are a few good reasons to do so.

- You're getting rid of your car

- You're moving

- You found a cheaper rate elsewhere

Unless you're no longer driving, you must buy a new policy before canceling your old one.

Canceling your insurance policy can lead to higher rates if you don't have another policy in effect. This is because insurance companies may consider you a high-risk driver if you have gaps in your insurance coverage.

When you cancel your policy, you should get a refund for the remaining time in your policy.

Whether insurance companies require you to pay a cancellation fee depends on their rules and the laws in your state.

For example, South Carolina allows companies to charge a $20 fee at the beginning of your policy term. This fee is generally not refunded.

Some companies don't charge a cancellation fee. You'll need to contact your insurance company directly to find out what you're entitled to.

There's one more exception to be aware of. While a company might not charge you a fee to cancel a policy, it can "short-rate" your policy. This could happen if your insurance company considers the first part of your policy term more expensive because of setup costs. Setup costs include putting together your quote and sending you new paperwork. As a result, you may get back less than you expect.

Example

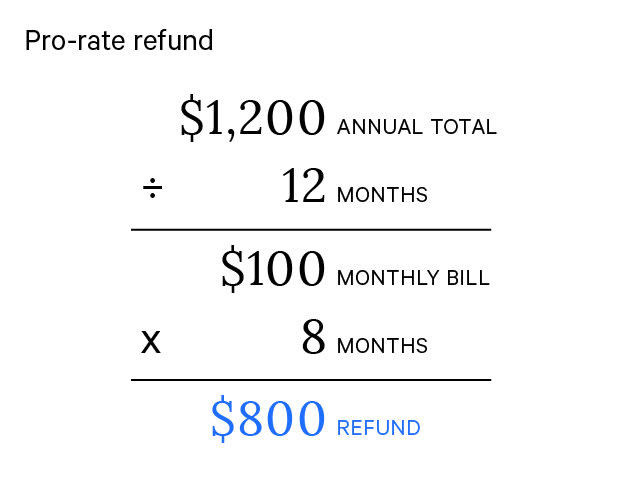

Suppose your annual insurance bill is $1,200. You pay the entire bill up front but cancel after four months. If your insurance company divides the cost of your policy evenly over the year, you'll get $800 back.

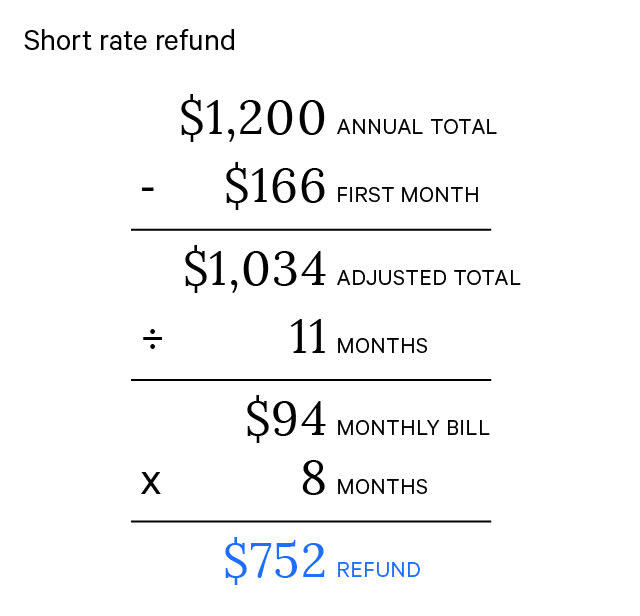

But if your insurance company short-rates your policy, it could consider the first month to cost 66% more, or $166 total. Then, the remaining months would cost $94 each. In this case, you'd only get $752 back.

This can have the same effect as a cancellation fee, but it's not allowed in every state.

Getting a refund for paying in full vs. installments

One thing that can impact your refund is whether you pay for your insurance in installments or a lump sum.

Many companies give you a cheaper rate if you pay the total six-month or one-year bill all at once.

You'll still be eligible for a refund if you pay your bill up front. You could get a lot more money back, especially if you cancel after just a few months. But refunds can take time, so if you think you may need to cancel in the middle of your policy period, consider how long it might take to get your money back.

You've made a change to your policy

You may also get a car insurance refund after you change your policy. This could happen if you lowered your coverage limits or took a teenage driver off your policy.

If you make a change that lowers your bill, your insurance company will give you the money back for the remaining time in your policy.

Some insurance companies may keep the extra money and automatically apply it to your next bill. But if you'd like the cash back now, call your insurance company and request a refund.

Your insurance company canceled your policy

It only happens sometimes, but insurance companies can cancel your policy midway through the term. You may be entitled to a partial refund if this happens to you.

Am I eligible for a refund if my insurer cancels my policy?

Whether you'll get a refund depends on why the insurance company canceled your policy. There are two main reasons why a company will cancel your policy in the middle of the term.

-

The first is for nonpayment. If you're behind on your insurance bill, your insurance company may cancel your policy.

-

Will I get a refund? No, you won't be eligible for a refund. In fact, you could owe the company money.

-

-

The other reason is if your insurance company believes you've become too risky to cover. This could happen after you get a serious ticket, like a citation for reckless driving or a DUI. Or you may have let your car's registration expire.

-

Will I get a refund? Yes, you are almost always entitled to a refund if the insurance company cancels your policy due to a risk change.

-

Your insurance company canceling your policy is different from a car insurance nonrenewal.

Nonrenewal means your insurance company has chosen not to renew your contract at the end of the policy period. In that case, you wouldn't be eligible for a refund because you had coverage for the entire policy period that you paid for.

How to get a car insurance cancellation refund

Getting a car insurance refund is as simple as calling your insurance company.

When you call, ask how the insurance company will send your refund. The company may refund your money by check, by direct deposit or via the original payment method.

Frequently asked questions

If I cancel my insurance, do I get a refund?

Yes, if you cancel your car insurance policy before the end of the term, you will typically get a refund. If you pay your bill in advance, you'll get a refund based on how many months you used the policy. Similarly, if you make monthly payments, your refund will be based on how many days you have left in your billing cycle.

How long does it take for insurance to refund you?

The time it takes to get your money back depends on how you choose to get your refund. For example, a direct deposit typically takes around two weeks to show up in your account. It may take longer if the insurance company sends a check since you'll have to wait for it to arrive.

Are insurance refund checks taxable?

No, insurance refunds aren't taxable. The insurance company is simply refunding the money you paid for coverage that you haven't received, so a refund check doesn't count as income.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.