How Does a Lapse in Car Insurance Coverage Affect Rates?

Find Cheap Auto Insurance Quotes in Your Area

Having a lapse in your car insurance automatically pegs you as a potential risk to insurance companies. For insurers, this type of risky behavior increases your chance of getting into a car accident.

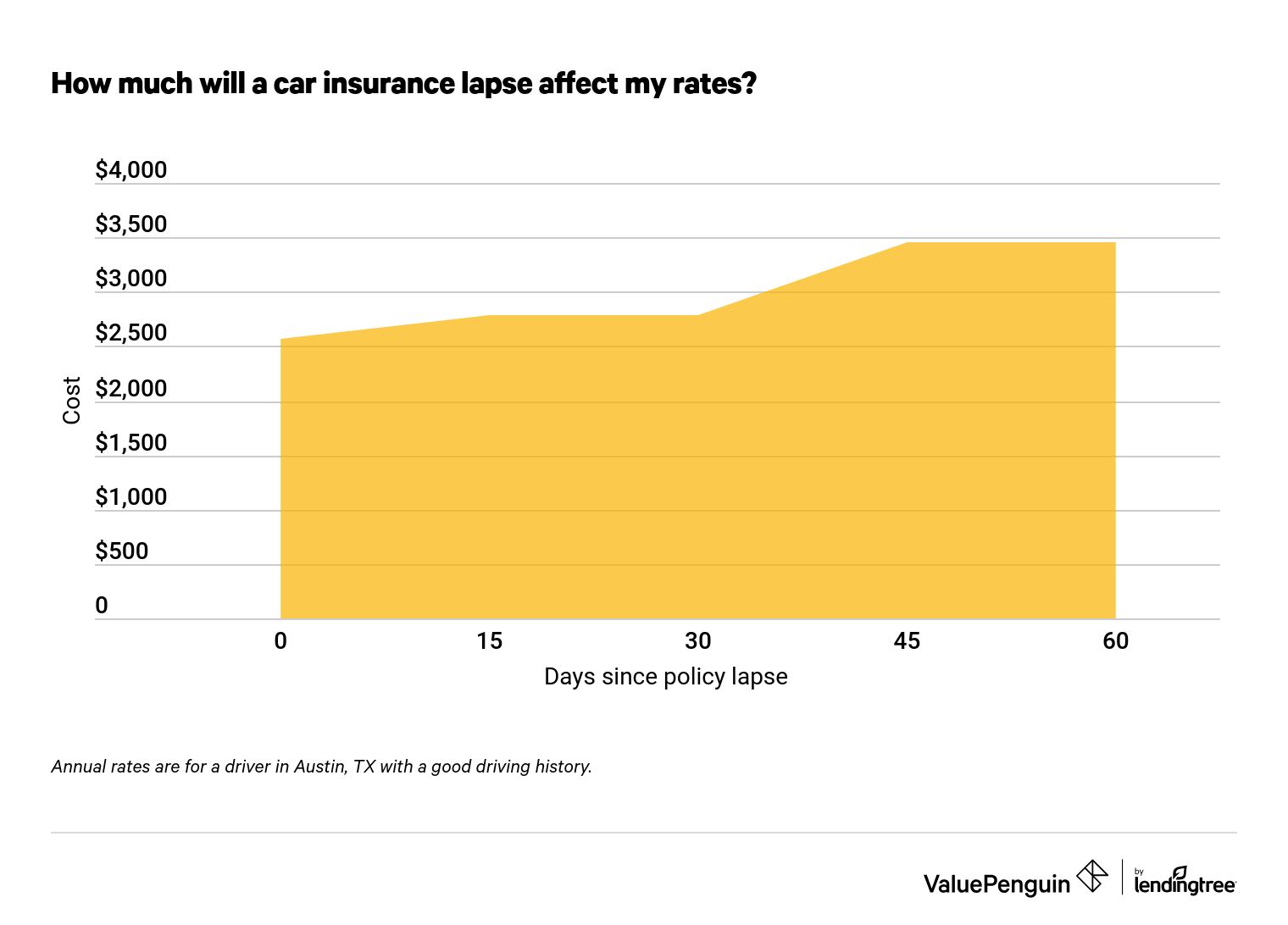

As a result of a lapse in coverage, your insurer will likely raise your rates. Based on our analysis, drivers with a coverage lapse of 30 days or less saw an 8% average car insurance rate increase. And those with a coverage lapse greater than 30 days saw an average rate increase of 35%.

Given that you'll likely pay a hefty markup for car insurance if you let your policy lapse, it's essential to avoid having a break in coverage — even if you only have the absolute minimum coverage amount.

We always recommend that drivers compare quotes from multiple insurers to find your best rates for car insurance.

How much will auto insurance rates increase after a lapse?

The penalty for a car insurance lapse is fairly small if the lapse is short (an 8% increase in rates for a lapse under 30 days) but is much higher if your lapse is longer (a 35% increase for 31 days or more).

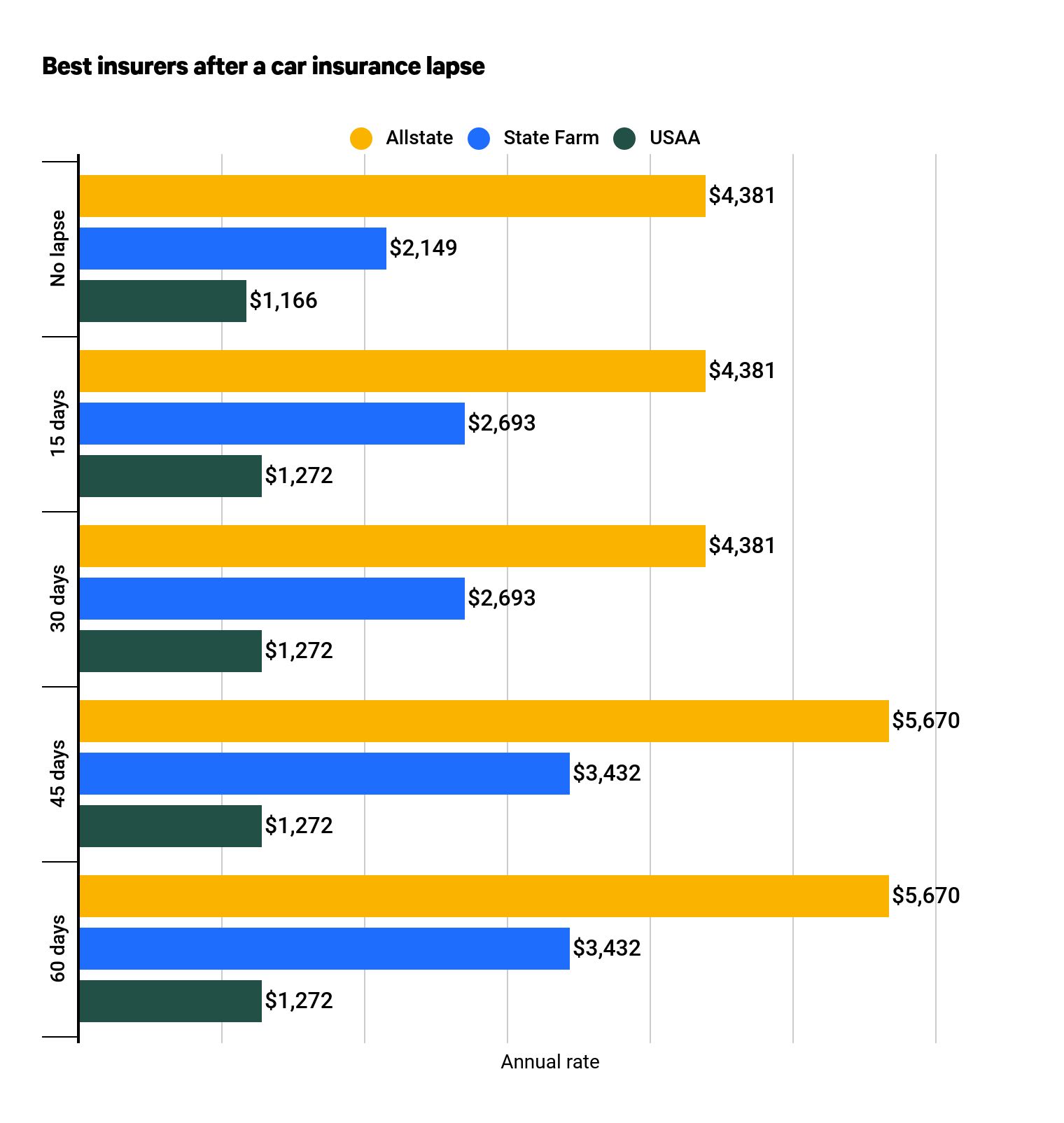

To get an idea of how much rates would increase, we collected quotes from three top national insurers: Allstate, State Farm and USAA. Our sample profiles included drivers who still have current insurance and those who have let their policy lapse in increasing 15-day increments, up to 60 days.

Find Cheap Auto Insurance Quotes in Your Area

The results show the importance of getting back on an auto insurance policy as soon as your old plan ends. Unsurprisingly, the longer you wait to put your insurance policy back into effect, the higher the penalty you'll pay.

There appears to be a small penalty for drivers with a lapsed policy of fewer than 30 days, but if you let the lapse go on for longer, the penalty can dramatically rise to an average increase of about 35% per year. That can translate to hundreds of dollars that you could overpay.

In our sample, USAA increased rates by the smallest amount, while State Farm had the largest penalty. However, the price you pay for car insurance is affected by a wide variety of factors, including where you live, your age and your driving history.

It's also possible that a longer lapse will result in an insurer denying you coverage altogether, as letting your policy lapse is a sign you may be a high-risk driver.

If you're denied coverage from an insurer after a lapse, it's worthwhile to continue to shop around at other major companies before moving on to insurers that specialize in high-risk drivers. That's because many insurers that specialize in these higher-risk drivers have fewer coverage options, discounts and extras. They also sometimes have worse service when compared with companies like State Farm and Geico.

Again, we always recommend getting quotes from multiple insurers, as comparing rates can be one of the best ways to find savings on car insurance.

What should you do if you have a lapse in coverage?

If your car insurance accidentally lapses, start by calling your current insurer. While it's not a guarantee, it's possible they can reinstate your policy with minimal consequences, especially if it's only a lapse of a few days.

If your insurer is requiring you to get a new policy, it's worth shopping around for a better price. But do so quickly — the longer you go without car insurance, the steeper the penalty will likely be once you restart it.

The one thing you should never do is drive uninsured. Driving without insurance is dangerous and illegal. Consequences vary by state, but common penalties for driving while uninsured including losing your license and having your car impounded. If you're involved in a crash while driving uninsured, you could even face jail time. If you are uninsured and need to drive your car, you need to get back onto an insurance policy.

Of course, this is easier said than done if you're unable to make your car insurance payment. We always recommend checking with multiple insurers to find an affordable rate. You may be able to save even more by qualifying for extra discounts or by lowering the amount of coverage you have.

Best insurers for lapsed car insurance coverage

We found among our sample insurers that USAA had the lowest change in rates for a driver with an insurance lapse, as well as the lowest prices overall — a driver with a 60-day policy lapse may see an increase as small as 9% with USAA.

On the other hand, Allstate, while the most expensive option overall for our sample driver, didn't raise rates at all for a 15- or 30-day lapse. This is why shopping around for the lowest rate is essential when buying car insurance.

Car insurance rates after coverage lapse

Days since lapse | 0 | 15 | 30 | 45 | 60 |

|---|---|---|---|---|---|

| Allstate | $4,381 | $4,381 | $4,381 | $5,670 | $5,670 |

| State Farm | $2,149 | $2,693 | $2,693 | $3,432 | $3,432 |

| USAA | $1,166 | $1,272 | $1,272 | $1,272 | $1,272 |

| Average | $2,565 | $2,782 | $2,782 | $3,458 | $3,458 |

What is a lapse in car insurance?

A lapse in car insurance is any period in which you have a registered car, but do not have car insurance.

A lapse can be as short as one day — if there's any period you're without car insurance, that counts as a lapse. However, some insurers may not penalize you for a short lapse of under two weeks. There may be several reasons you experience a lapse: your policy ran out, your policy was canceled because you missed a payment, you no longer drive, you were deployed and many more.

If your policy ends due to missed payment or you forget to renew the policy

A common scenario is that you missed a monthly payment or forgot to renew your policy after it expired, leading your company to cancel the policy. Once your policy is no longer in effect, your car insurance company may notify the DMV that you are uninsured.

Depending on the state, being uninsured may leave you open to fines and numerous other penalties. The longer you wait to renew your policy, the more expensive your rates will likely be as well.

If you are deployed overseas or studying/moving abroad

If you are being deployed overseas, you probably won't be using your car much. The same goes for those living or studying abroad for a period of time. Military members have a few companies — like USAA, Geico and Esurance — that allow them to suspend car insurance while they're away.

Suspending insurance is not considered a lapse and can spare you from raised rates. If you are studying or moving abroad, you will have to get an affidavit from your state's DMV stating that you will not be using the vehicle.

Not every company will allow you to suspend or pause your car insurance.

If your car is financed with a lease or loan, you may not have the option to suspend coverage. If suspension is not possible, you can remove yourself from the policy (if there are others on it) or cancel your insurance. Unfortunately, that would be considered a lapse and leave you open to raised rates from your insurance company. You may be able to avoid any DMV and state penalties, however, by filling out an exemption form from the DMV.

Which states impose a penalty for a lapse in coverage?

If you have a registered vehicle, you need car insurance in almost every state in the U.S. Some states are better than others at regulating that, going as far as having companies report to state DMVs whenever the insurance for a registered car has lapsed. When the DMV knows about your lapse, you leave yourself open to a license and/or registration suspension, civil fines and SR-22 filings, among other penalties.

Keep in mind that these fees only relate to letting your insurance lapse. If you're caught behind the wheel without proper insurance, you'll likely face even harsher consequences.

Here's what you can expect for each state:

State | Penalties |

|---|---|

|

Alabama | $200 license reinstatement penalty, then $400 second time |

|

Alaska | $100 license reinstatement penalty for first lapse |

|

Arizona | $50 license reinstatement penalty |

|

Arkansas | $100 license reinstatement penalty |

|

California | $14 registration reinstatement penalty |

|

Colorado | $40 license reinstatement penalty |

|

Connecticut | $200 license reinstatement penalty |

|

Delaware | $100 lapse penalty per vehicle, $5 per day after 30 days |

|

District of Columbia | $150 lapse penalty, $7 per day after 30 days |

|

Florida | $150 registration and license reinstatement penalty for first lapse, $250 for second, $500 for third |

|

Georgia | $25 penalty for lapse longer than 10 days, then $60 after 30 days |

|

Hawaii | $20 license reinstatement penalty |

Some states have harsher penalties than others, but the bottom line is that you should try to never let your auto insurance lapse. At the very least, you're likely to see your car insurance rates increase, and may face major legal penalties, too.

How insurers find out if your insurance lapses

When you're getting a quote for car insurance, you're usually asked if you have coverage. If you've let your insurance lapse, be honest — car insurance companies don't simply take your word for it.

Car insurers work with state DMVs to keep accurate databases of who has car insurance and when they have it. So while you might be able to get a cheaper quote by leaving out the fact that you had an insurance lapse, your insurer will find out eventually.

The best-case result is that your insurer will just increase your rates to what you would have pad had you told the truth. But it's also possible that your insurer will choose to cancel your policy, leaving you in the same situation you were in before — but with two lapses instead of one.

Methodology

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.