The Cost of SR-22 Insurance in Arizona, and When You Need It

Find Cheap SR-22 Auto Insurance Quotes in Arizona

Drivers who are convicted of certain serious driving offenses in Arizona must request an SR-22 insurance document to reinstate their licenses after a suspension. This form certifies to the Arizona Motor Vehicle Division (MVD) that you meet the state requirements for liability insurance.

If you have an SR-22 filed with the state, you're often described as having "SR-22 insurance," even though it's not technically a different kind of insurance.

While the SR-22 document itself only costs a modest fee, Arizona drivers who require an SR-22 pay about 40% more for insurance than other drivers.

The average cost of Arizona SR-22 insurance

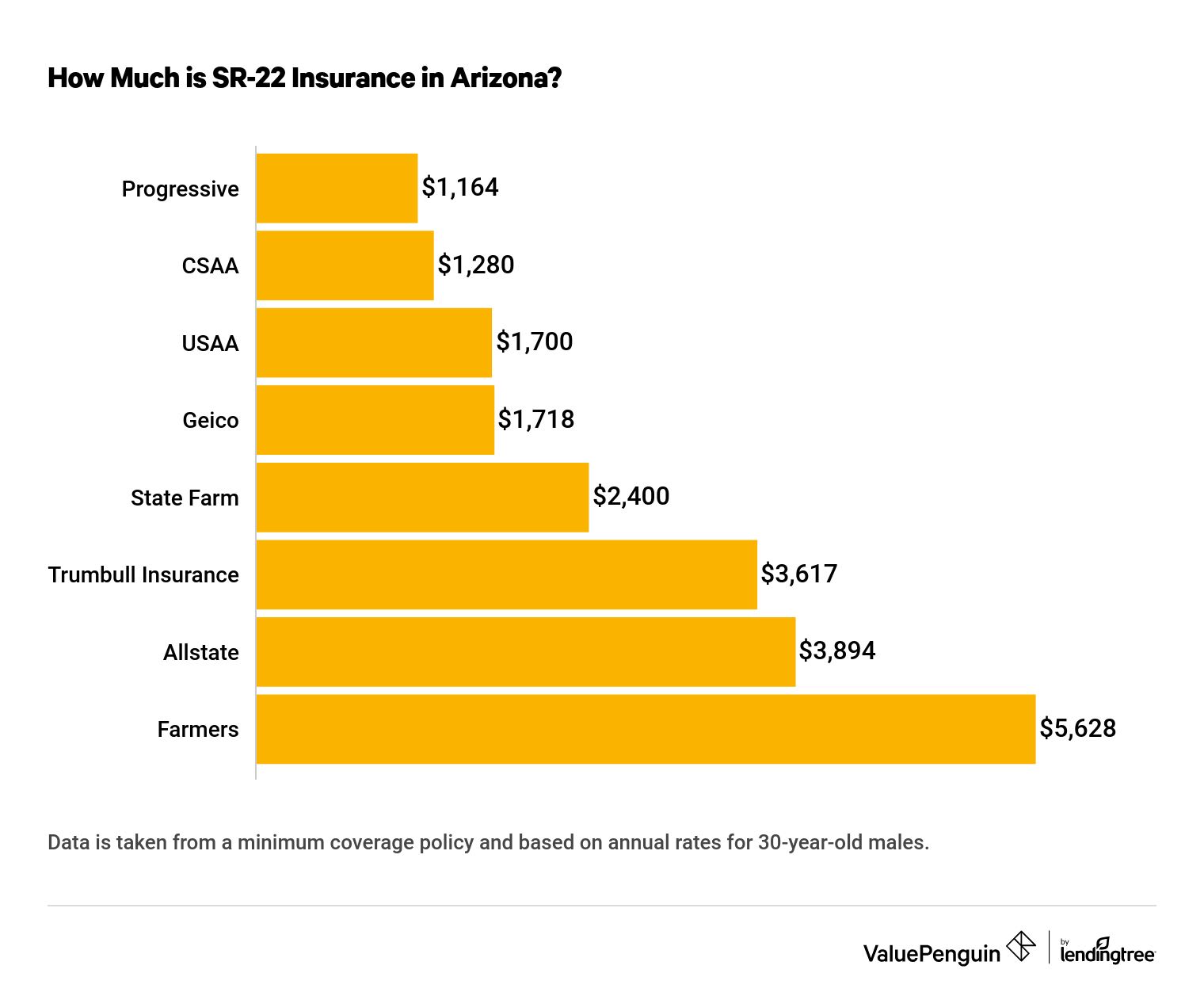

Progressive offered the lowest rates for Arizona drivers who require an SR-22, with an average annual quote of $1,164. In addition to offering the lowest price, Progressive also had the smallest percentage increase for SR-22 drivers: 33% after one DUI. USAA's rates increased by the largest percentage (166%) for a driver who needs an SR-22.

Find Cheap SR-22 Auto Insurance Quotes in Arizona

Our list of insurers below compares the average annual rates for a 30-year-old man with and without an SR-22 filing and DUI conviction. You should always compare multiple quotes between insurance companies to ensure you’re choosing the best option.

Insurer | Avg. cost per year | Avg. cost per year with SR-22 and DUI | % change | |

|---|---|---|---|---|

| Progressive | $872 | $1,164 | 33.49% | |

| CSAA | $802 | $1,280 | 59.60% | |

| USAA | $640 | $1,700 | 165.63% | |

| Geico | $1,008 | $1,718 | 70.44% | |

| State Farm | $1,440 | $2,400 | 66.67% | |

| Trumbull Insurance (AARP) | $2,332 | $3,617 | 55.10% | |

| Allstate | $2,036 | $3,894 | 91.26% | |

| Farmers | $3,223 | $5,628 | 74.62% |

The best method of finding cheap SR-22 insurance in Arizona is to compare multiple quotes from different insurers. Every insurance company has its own way of assessing risk and calculating rates, so you should shop around to find the cheapest SR-22 coverage for you.

When do I need SR-22 insurance?

In Arizona, an SR-22 is a document your insurance company sends to the state’s MVD to verify you have purchased insurance coverage that meets its minimum requirements.

Arizona requires all drivers carry car insurance providing at least $25,000 bodily-injury liability for one person and $50,000 for two or more people, plus $15,000 property-damage liability.

Your insurer is also required to notify the Arizona MVD if your insurance policy is canceled.

There are a number of serious driving offenses that can lead to you being required to file an SR-22, the most common being a DUI and driving without insurance.

These offenses both typically lead to a license suspension or revocation, and you'll need to get an SR-22 to have your license reinstated.

However, a judge may decide to require that you get an SR-22 in other situations, such as if you have too many points on your license or have too many unpaid tickets.

Reasons you may be required to file an SR-22:

- DUI

- Suspended/revoked license

- Driving without insurance

- Multiple unpaid tickets

- Repeated smaller offenses, such as speeding tickets

- Too many points on your license

Non-owner SR-22 insurance in Arizona

If you don't own a car but got a DUI while driving a vehicle that belongs to someone else, you may be required to get an SR-22 to get your license back, even if you didn't previously carry insurance. In this case, you'll need to buy non-owner SR-22 insurance.

Non-owner coverage is generally cheaper than regular car insurance because it doesn't include coverage for a vehicle. It's also cheaper because it presumes you won’t drive as often as someone who owns a vehicle and drives it regularly.

How to get SR-22 insurance

The process of getting an SR-22 for your car insurance is fairly straightforward. If you already have active coverage, you may be able to call your current insurer and ask to add an SR-22, which it will send to the AZ MVD.

However, you may need to get a new insurance policy, as many insurance companies will cancel your coverage after learning about your new SR-22 requirement. Even if your insurer doesn't drop your policy, your rates are likely to increase after a major driving incident, such as a DUI. It's a good idea to check with several Arizona insurance companies to find a cheaper rate.

When collecting quotes, be honest about your situation, and answer questions relating to your conviction. Some insurers explicitly ask whether you need an SR-22, while others only ask about the circumstances that would lead to needing one.

Insurers will likely ask about when your incident took place, how long you have been without insurance and how long you were insured before you lost coverage.

Additionally, not all insurance companies offer SR-22 policies, so you may need to check with multiple companies to find an SR-22 insurance provider. Another option to consider is the Arizona Automobile Insurance Plan, a special program that pairs high-risk drivers with willing insurers.

How long will I need the SR-22?

Generally, you'll need to keep an SR-22 on file with the Arizona MVD for three years. If you allow your insurance to lapse — or your coverage is canceled (because of nonpayment, for example) — you’ll likely need to restart the process.

Once you've reached the three-year threshold, double-check with the Arizona MVD that you’re no longer required to carry the policy. Then call your insurance company to cancel the SR-22. You must have the SR-22 on file for three continuous years — not just the three-year period after your license was revoked. If you mistakenly cancel the SR-22 too early, you could be penalized or required to renew your certificate for another three-year period.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.