Best Cheapest Car Insurance Rates in Tampa, Florida

State Farm has the cheapest full-coverage policy in Tampa, at $164 per month. Geico is the cheapest for minimum coverage, at $39 per month.

Find Cheap Auto Insurance Quotes in Tampa

Best cheap car insurance companies in Tampa

To help you find the cheapest car insurance in Tampa, ValuePenguin gathered quotes for ZIP codes across the city from the top car insurance companies in Florida. Minimum-coverage quotes meet Florida's state requirements of $10,000 in personal injury protection (PIP) coverage and $10,000 in property damage coverage. Quotes for full coverage include higher liability limits than state minimums plus collision and comprehensive coverage.

In addition, we ranked the best Tampa insurance companies based on customer satisfaction, affordability and overall value.

Cheapest car insurance in Tampa: State Farm

State Farm has the cheapest full-coverage policy in Tampa, at $164 per month.

Full coverage from State Farm costs $146 less per month than the Tampa average, which is $306 per month.

Car insurance tends to cost more in densely populated areas. The city of Tampa is the third most populated in the state, so it's no surprise insurance rates are 33% higher than the average cost in Florida.

Find Cheap Auto Insurance Quotes in Tampa, FL

Cheapest full-coverage quotes in Tampa

Company | Monthly rate | |

|---|---|---|

| State Farm | $164 | |

| Geico | $179 | |

| Travelers | $234 | |

| Farmers | $330 | |

| Progressive | $347 |

Cheapest liability car insurance in Tampa: Geico

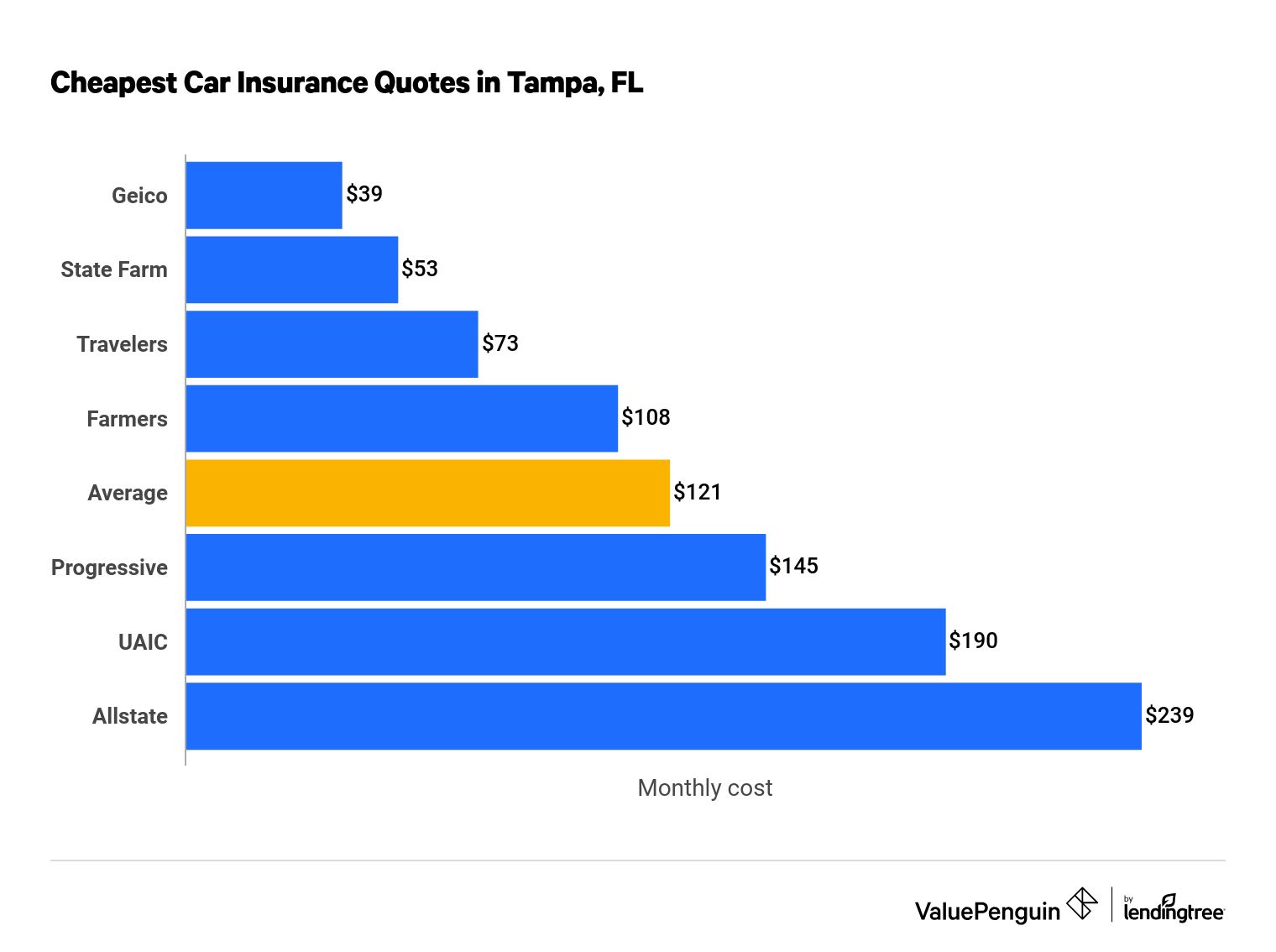

Geico has the cheapest quotes for a minimum-liability policy in Tampa, at $39 per month.

That's 68% less expensive than the citywide average and $14 less per month than the second-cheapest company, State Farm. The average cost of car insurance in Tampa is $121 per month for minimum coverage.

Find Cheap Auto Insurance Quotes in Tampa, FL

Cheap minimum-coverage insurance quotes in Tampa, FL

Company | Monthly rate | |

|---|---|---|

| Geico | $39 | |

| State Farm | $53 | |

| Travelers | $73 | |

| Farmers | $108 | |

| Progressive | $145 |

Cheapest car insurance for young drivers in Tampa: Geico

Geico has the most affordable car insurance in Tampa for teen drivers.

A minimum-coverage policy from Geico costs around $83 per month for an 18-year-old driver in Tampa. That's 70% cheaper than the city average. Geico also has the cheapest full-coverage quotes for teens in Tampa, at $416 per month, which is 53% cheaper than average.

Monthly car insurance quotes in Tampa for teens

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $83 | $416 |

| State Farm | $141 | $470 |

| Travelers | $166 | $639 |

| Progressive | $294 | $869 |

| UAIC | $444 | $881 |

Age is one of the biggest factors that affects insurance rates. If you're an 18-year-old, you'll typically pay two to three times as much for car insurance in Tampa as a 30-year-old. That's because teenage drivers are the most likely to make a mistake behind the wheel, making them more expensive to insure.

To find the best cheap car insurance quotes in Tampa, teen drivers should:

- Share a policy with parents. Rates for a combined, or multicar, policy are usually less expensive than two separate policies.

- Look for discounts. Most companies offer discounts to young drivers for getting good grades in school, taking a defensive driving course or installing anti-theft devices in their cars.

- Compare quotes from multiple companies. The difference between the cheapest and most expensive insurance companies for young Tampa drivers is more than $365 per month for minimum coverage. That's why it's always important to compare quotes to find the best price for you.

Cheapest car insurance after a speeding ticket: State Farm

State Farm has the cheapest car insurance quotes in Tampa for drivers with a speeding ticket. A full-coverage policy from State Farm costs $177 per month after a single speeding ticket, which is only half as much as average in Tampa.

Cheapest Tampa car insurance after a speeding ticket

Company | Monthly rate |

|---|---|

| State Farm | $177 |

| Geico | $283 |

| Travelers | $290 |

| UAIC | $370 |

| Farmers | $401 |

Tampa drivers can expect their car insurance rates to go up by 18%, or $55 per month, after a single speeding ticket.

Cheapest car insurance after an accident: State Farm

State Farm has the cheapest car insurance for Tampa drivers with an accident on their records, at $191 per month for full coverage. That's 57% cheaper than the citywide average and $46 less than the second-cheapest company, Geico.

Cheapest Tampa car insurance after an accident

Company | Monthly rate |

|---|---|

| State Farm | $191 |

| Geico | $237 |

| Travelers | $320 |

| Farmers | $470 |

| UAIC | $488 |

On average, car insurance quotes in Tampa go up by 46% after a single at-fault accident. However, not all insurance companies raise rates by the same amount after an accident. For example, State Farm only raises rates by 16% after an accident, while drivers insured with Allstate can expect to pay 72% more after an accident.

Cheapest car insurance after a DUI in Tampa: State Farm

State Farm has the most affordable car insurance in Tampa for drivers with a DUI. Full coverage from State Farm costs around $177 per month, which is 57% cheaper than average.

Car insurance from State Farm is also much less expensive than the second-cheapest option, Geico, which charges $295 for the same coverage.

Cheapest Tampa car insurance after a DUI

Company | Monthly rate |

|---|---|

| State Farm | $177 |

| Geico | $295 |

| Travelers | $347 |

| Farmers | $355 |

| Progressive | $413 |

Car insurance rates in Tampa increase by an average of 36% after a DUI. However, Florida drivers may have to file an FR-44 after a DUI conviction. These drivers have to have higher liability limits than the Florida state minimum, which can make their insurance rates even more expensive.

Cheapest car insurance for drivers with poor credit: Geico

Geico has the cheapest full-coverage quotes in Tampa for drivers with poor credit scores, at $321 per month. That's 37% cheaper than the city average, which is $511 per month.

Company | Monthly rate |

|---|---|

| Geico | $321 |

| State Farm | $367 |

| UAIC | $370 |

| Farmers | $460 |

| Travelers | $495 |

Tampa drivers with bad credit pay an average of 67% more for full-coverage insurance than those with good credit scores. Having a poor credit score doesn't mean that you're a bad driver, but insurance companies have found that drivers with bad credit tend to file more claims, making them more expensive to protect.

Cheapest quotes for teen drivers after a traffic violation: Geico

Geico has the cheapest car insurance for young drivers in Tampa with incidents on their records.

A minimum-coverage policy from Geico costs around $95 per month for an 18-year-old driver with a single speeding ticket. That's 69% cheaper than the city average. Teen drivers can also find the cheapest rates from Geico after an at-fault accident. Minimum coverage from Geico costs $85 per month after an accident, which is 76% cheaper than average.

Cheapest quotes for young drivers after a traffic violation

Company | Speeding | Accident |

|---|---|---|

| Geico | $95 | $85 |

| State Farm | $155 | $171 |

| Travelers | $202 | $228 |

| Progressive | $337 | $330 |

| Farmers | $443 | $469 |

Young drivers in Tampa can expect their car insurance rates to go up by 10% after a speeding ticket or 17% after an at-fault accident.

Cheapest car insurance for married drivers: State Farm

State Farm has the cheapest full-coverage quotes for a married driver in Tampa. A policy from State Farm costs $164 per month for a one car, which is the same rate that unmarried drivers pay for coverage.

Cheapest car insurance for married Tampa drivers

Company | Monthly rate |

|---|---|

| State Farm | $164 |

| Geico | $183 |

| Travelers | $234 |

| Progressive | $281 |

| Farmers | $328 |

Married drivers in Tampa pay 4% less than unmarried drivers for full-coverage car insurance, on average. Progressive offers the largest discount to married drivers — 19%. But a full-coverage policy from Progressive is still $117 more expensive per month than State Farm.

Best Tampa insurance companies

State Farm has the best car insurance in Tampa, based on its reliable customer service and affordable rates.

State Farm earned a high score on J.D. Power's annual claims satisfaction survey, which means that drivers are generally happy with the service they get from State Farm after an accident.

Best insurance companies in Tampa, FL

Company |

Editor's rating

|

|---|---|

| State Farm | |

| Geico | |

| Farmers | |

| Travelers | |

| Allstate |

It's important for Tampa drivers to consider customer service reviews when shopping for the best car insurance company.

Companies with excellent customer service can help your life get back to normal quickly after an accident with an easy claims process and fast payout. A company with poor customer service scores may have a longer, more difficult claims process that could result in you paying more after an accident.

Average cost of car insurance in Tampa, FL by ZIP code

The most expensive ZIP code in Tampa for car insurance is 33614, near the airport. Drivers living in the 33647 ZIP code, which includes the Wesley Chapel neighborhood, pay the cheapest rates.

In Tampa, full-coverage car insurance rates vary by up to $51 per month, depending on which part of the city you live in. That's because car insurance companies consider factors like population density, car theft and accident statistics and traffic congestion when determining insurance rates.

Full-coverage quotes in Tampa by ZIP code

ZIP code | Monthly cost | % from average |

|---|---|---|

| 33602 | $322 | 5% |

| 33603 | $329 | 7% |

| 33604 | $324 | 6% |

| 33605 | $327 | 7% |

| 33606 | $316 | 3% |

Auto insurance requirements in Tampa, FL

Tampa car insurance requirements are set by the state of Florida. In order to legally drive in Tampa, you have to get a minimum amount of personal injury protection and property damage liability coverage.

- Personal injury protection (PIP): $10,000 per accident

- Property damage liability (PDL): $10,000 per accident

Insurance in Florida is generally more expensive than in other states, so you could be tempted to save money and buy only the minimum amount of coverage. However, a minimum-liability policy might not be enough to protect you if you're involved in a big accident. If your car is expensive or new, you should consider a higher coverage limit or extra protection.

Florida SR-22 and FR-44 policies

Drivers caught driving under the influence (DUI or DWI) or without insurance are required to have SR-22 or FR-44 insurance. These drivers are also required to have extra car insurance coverage and higher coverage limits under Florida's financial responsibility law.

SR-22 insurance requirements

If you don't have insurance or have too many points on your driving record, you may need an SR-22 filing through your insurance company. The form acts as proof that you’ve met the minimum insurance coverage requirements:

- Bodily injury liability: $10,000 per person and $20,000 per accident

- Personal injury protection: $10,000 per accident

- Property damage liability: $10,000 per accident

You will need to have an SR-22 on file for at least three years in Florida in most cases, but you can check the length of time with your local Department of Motor Vehicles (DMV).

FR-44 insurance requirements

An FR-44 is generally required if you're found guilty of driving under the influence (DUI) or driving while intoxicated (DWI). Due to the seriousness of these offenses, you will need to have much higher coverage limits when you file for FR-44 insurance.

- Bodily injury liability: $100,000 per person and $300,000 per accident

- Personal injury protection: $10,000 per accident

- Property damage liability: $50,000 per accident

FR-44 insurance is typically required for three years in Florida, but the amount of time may vary depending on your particular situation, so it's good to confirm. Unlike SR-22 insurance, the FR-44 form needs to stay in place for the entire term, with no lapses in coverage. Otherwise, your suspended license won't be reinstated and you will need to start the process over again.

What's the best car insurance coverage in Tampa, FL?

A minimum-coverage policy comes with the lowest amount of coverage required by Florida law. That makes it the cheapest option for coverage, but it might not be the best for your needs.

Keep in mind that a minimum-coverage policy does not cover damage to your own car. If you get into an accident and wreck your car, your insurance won't help pay for repairs.

A full-coverage policy will cost you $185 more per month than minimum liability in Tampa. But it offers more protection in the form of comprehensive and collision coverage.

- Comprehensive coverage helps pay for damage caused by events out of your control, known as "acts of God." These may include natural disasters, theft, vandalism and fires.

- Collision coverage helps pay for damage after an accident with another vehicle or an object, regardless of whose fault it is.

If your car is less than 10 years old or worth more than $5,000, you should consider a full-coverage policy.

Frequently asked questions

How much does car insurance cost in Tampa, Florida?

The average cost of car insurance in Tampa is $121 per month for a minimum-coverage policy. Full-coverage car insurance in Tampa costs $306 per year, on average.

Is car insurance expensive in Tampa?

Yes, car insurance in Tampa is more expensive than average. A minimum-coverage policy in Tampa costs around $121 per month. That's twice as expensive as the national average of $58 per month and 33% more than the Florida state average.

Which car insurance is the cheapest in Tampa?

Geico has the cheapest minimum-coverage quotes in Tampa, at $39 per month. However, drivers that need full-coverage insurance can find the best rates at State Farm, where a policy costs around $164 per month.

Methodology

To find the best cheap car insurance in Tampa, ValuePenguin gathered quotes from seven of the top insurance companies in Florida. Rates are for a single 30-year-old man with a clean driving record and good credit score who owns a 2015 Honda Civic EX.

Full-coverage quotes include comprehensive and collision coverage, along with higher liability limits than the Florida state requirement.

- Bodily injury liability: $50,000 per person/$100,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection: $10,000 per accident

- Uninsured/underinsured motorist bodily injury liability: $50,000 per person/$100,000 per accident

- Comprehensive and collision deductible: $500

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only; your quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.