The Fastest Cars With Cheap Insurance

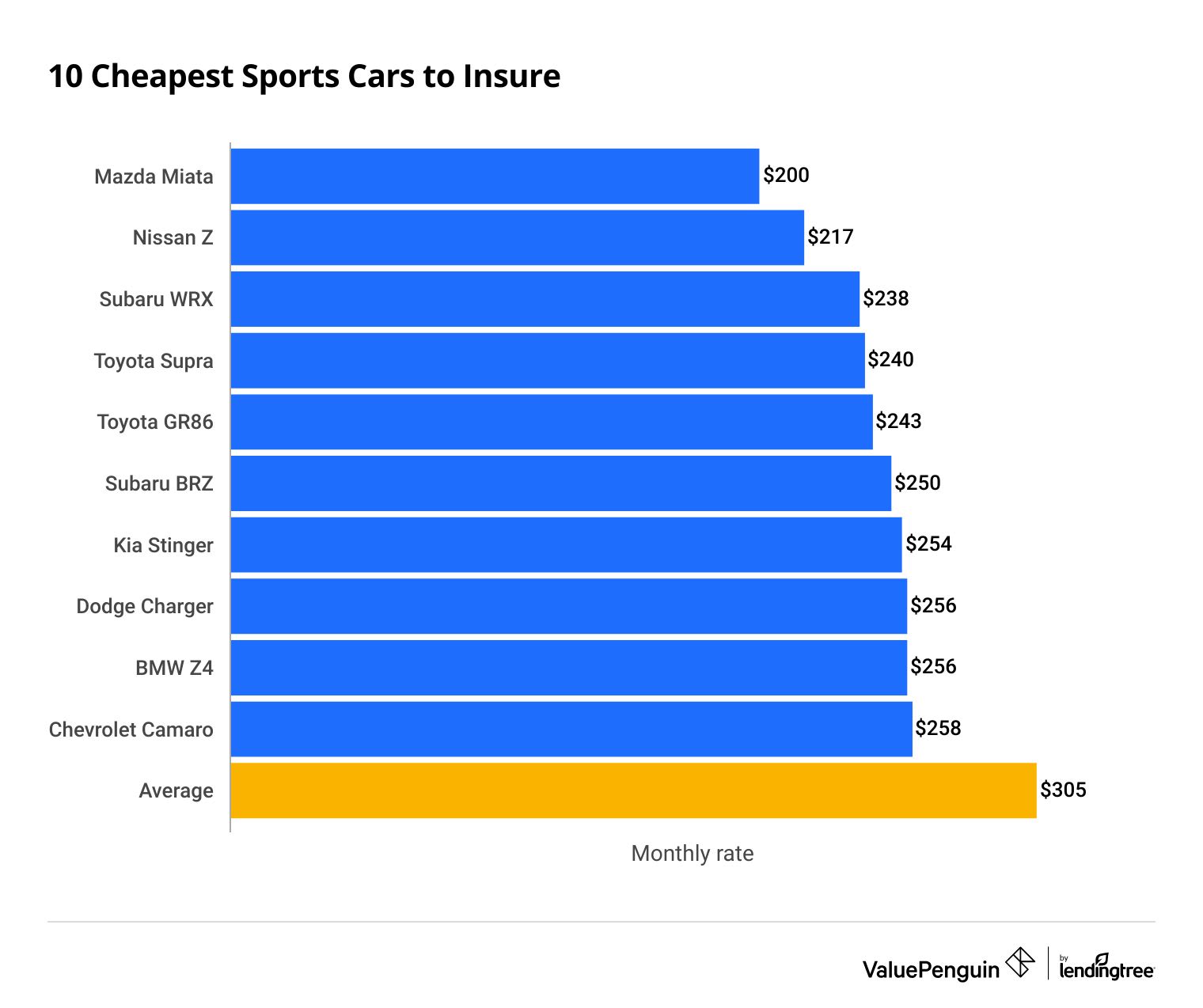

The Mazda Miata is the cheapest sports car to insure at around $200 per month.

It's also the most affordable sports car, with a starting MSRP (manufacturer's suggested retail price) of $28,050.

Progressive typically has the most affordable rates for sports cars, charging $215 per month on average.

Cheapest sports cars to insure

The Nissan Z is the best fast car with cheap insurance based on its low coverage rates and blistering speed.

The average cost of full coverage insurance for a Nissan Z is $217 per month. That's 29% cheaper than the average cost to insure a sports car. Of the five cheapest sports cars to insure, the Nissan Z is the fastest. It has a zero-to-60 time of 4.5 seconds.

The Mazda Miata is the only sports car with cheaper insurance rates than the Nissan Z. But the Miata is much slower, with a zero-to-60 time of 5.8 seconds.

Fast cars with cheap insurance

Car | 0-60 time | Monthly rate | |

|---|---|---|---|

| Mazda Miata | 5.8 | $200 |

| Nissan Z | 4.5 | $217 |

| Subaru WRX | 5.5 | $238 |

| Toyota GR Supra | 5.0 | $240 |

| Toyota GR86 | 5.4 | $243 |

Rates are for 2023 models and are based on the base-level trim package.

What is considered a sports car?

A sports car is a vehicle with a high-horsepower engine whose primary purpose is performance. Sports cars are typically smaller than sedans and usually have only two doors.

If you're looking for sporty cars with cheap insurance, you should consider a domestic model, like the Dodge Charger or Chevy Camaro.

American branded cars have lower insurance rates, on average, than foreign makes. They also have an average zero-to-60 time of 4.1 seconds. That's more than half a second faster than the average for European and Asian makes.

Vehicle type | 0-60 time | Monthly rate |

|---|---|---|

| Foreign | 4.8 | $311 |

| Domestic | 4.1 | $280 |

| All | 4.6 | $305 |

Fast cars with cheap insurance for young drivers

The Mazda Miata is also the sports car with the cheapest insurance for young drivers.

Full coverage insurance for the Miata is 34% to 35% cheaper than the average cost for a young driver to insure a sports car.

The Nissan Z is the second-cheapest sports car for young drivers to insure. Full coverage insurance for the Nissan Z is 26% to 29% less expensive than average. It's also much faster than the Mazda Miata, with a zero-to-60 time of 4.5 seconds.

Sports cars with cheap full coverage insurance for young drivers

18-year-olds

20-year-olds

25-year-olds

Car | 0-60 time | Monthly rate | |

|---|---|---|---|

| Mazda Miata | 5.8 | $449 |

| Nissan Z | 4.5 | $507 |

| Subaru WRX | 5.5 | $551 |

| Toyota GR Supra | 5.0 | $546 |

| Toyota GR86 | 5.4 | $562 |

18-year-olds

Car | 0-60 time | Monthly rate | |

|---|---|---|---|

| Mazda Miata | 5.8 | $449 |

| Nissan Z | 4.5 | $507 |

| Subaru WRX | 5.5 | $551 |

| Toyota GR Supra | 5.0 | $546 |

| Toyota GR86 | 5.4 | $562 |

20-year-olds

Car | 0-60 time | Monthly rate | |

|---|---|---|---|

| Mazda Miata | 5.8 | $323 |

| Nissan Z | 4.5 | $364 |

| Toyota GR Supra | 5.0 | $396 |

| Subaru WRX | 5.5 | $397 |

| Toyota GR86 | 5.4 | $406 |

25-year-olds

Car | 0-60 time | Monthly rate | |

|---|---|---|---|

| Mazda Miata | 5.8 | $224 |

| Nissan Z | 4.5 | $245 |

| Subaru WRX | 5.5 | $269 |

| Toyota GR Supra | 5.0 | $270 |

| Toyota GR86 | 5.4 | $275 |

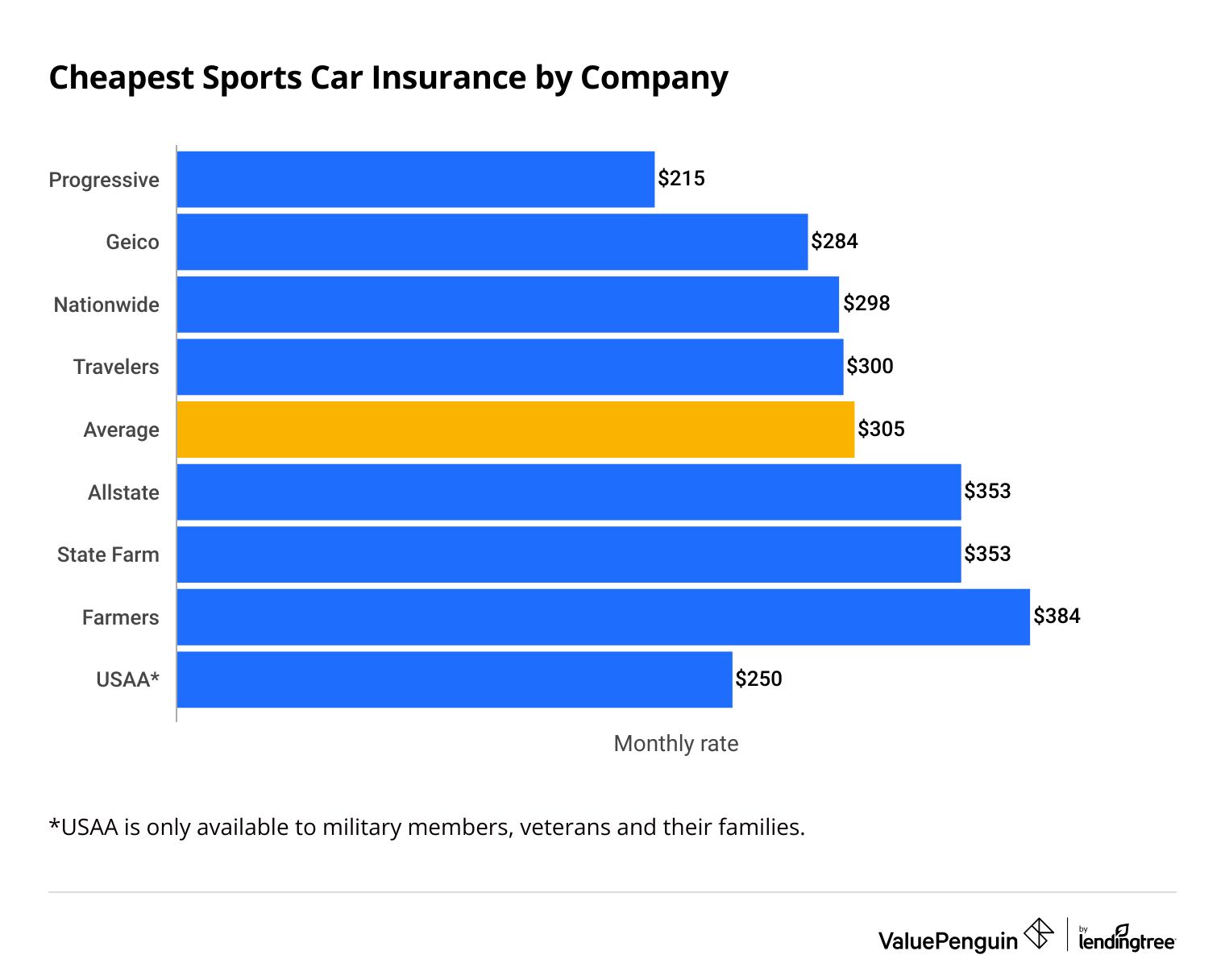

Cheapest sports car insurance companies

Progressive has the cheapest performance car insurance, averaging $215 per month for full coverage.

That's 30% cheaper than the average cost of insurance for sports cars, which is $305 per month. It's also 24% cheaper than the second-cheapest company, Geico.

However, the cheapest company varies depending on the make and model of your sports car. For example, Geico has the most affordable rates for the BMW 840i, Dodge Charger, Nissan Z and both Toyota models.

That's why it's always important to compare quotes from multiple companies to find the best car insurance.

Full coverage sports car insurance by company

Company | Monthly rate | ||

|---|---|---|---|

| Progressive | $215 | ||

| Geico | $284 | ||

| Nationwide | $298 | ||

| Travelers | $300 | ||

| Allstate | $353 | ||

*USAA is only available to military members, veterans and their families.

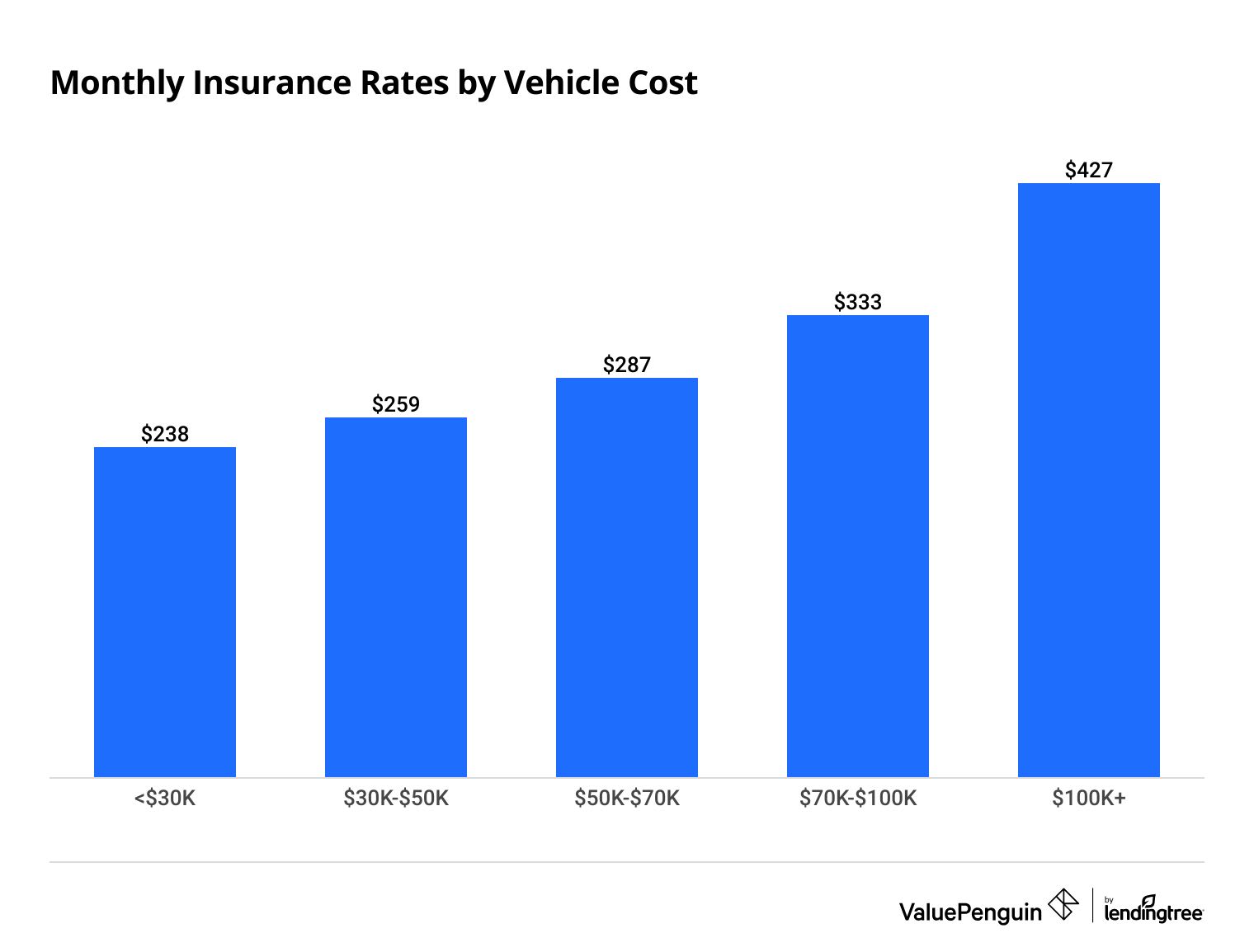

Why is insurance more expensive for sports cars?

Performance cars often have higher insurance rates because companies consider them more likely than other vehicles to get in an accident that results in an insurance claim.

When setting rates, insurance companies consider how often owners of a particular make and model file a claim. Since sports cars can accelerate quickly and reach high speeds, sports car owners are more likely to have dangerous driving habits. For that reason, these cars tend to be in more accidents than other models.

Example

Full coverage insurance costs around $336 per month for a car with a zero-to-60 time of less than five seconds. However, cars that can reach 60 mph in less than four seconds cost an average of $358 per month to insure.

Another reason fast cars often have high insurance rates is that they're typically expensive to repair and replace. This is especially true of European sports cars.

The cost of insurance for the cheapest performance cars is 44% lower than the cost of coverage for the most expensive cars.

Because insurance costs are often so high for these vehicles, the best way you can get the cheapest insurance for your sports car is to compare cheap rates from multiple insurance companies.

Most affordable sports cars

The Mazda Miata is the cheapest sports car you can buy and the cheapest to insure.

You can buy a Miata for around $28,050. However, it also has a slower zero-to-60 time than most other sports cars, at 5.8 seconds.

Cheapest sports cars

Car | MSRP | 0-60 time | Monthly rate |

|---|---|---|---|

| Mazda Miata | $28,050 | 5.8 | $200 |

| Toyota GR86 | $28,400 | 5.4 | $243 |

| Subaru BRZ | $28,595 | 5.4 | $250 |

| Chevrolet Camaro | $29,790 | 3.5 | $258 |

| Subaru WRX | $30,605 | 5.5 | $238 |

Cost is for a base-level 2023 model.

Drivers looking for a fast but affordable car should consider the Chevy Camaro.

The base-level Camaro starts at $29,790 and has a zero-to-60 speed of 3.5 seconds. It's also one of the cheapest models to insure, at $258 per month for full coverage. That's 15% cheaper than the average cost to insure a sports car.

Frequently asked questions

How much is insurance for a sports car?

The average insurance cost for a sports car is $305 per month for full coverage. However, rates vary depending on the type of sports car you get. Insurance for a Mazda Miata costs around $200 per month, while an Audi R8 costs $481 per month to insure.

Are sports cars expensive to insure?

Yes, sports cars are often more expensive to insure than other types of vehicles, like sedans or SUVs. This is because sports cars are typically faster than other cars, which can lead to more severe accidents. Sports cars also tend to be more expensive to fix or replace than other vehicles.

How can I lower my sports car insurance?

The best way to find cheap insurance for your sports car is to compare quotes from multiple companies. You should also research discounts to ensure you take advantage of any savings opportunities.

Lastly, you could raise your deductible to lower your monthly payments. Just remember to choose a deductible you can easily pay after an accident.

Methodology

ValuePenguin gathered quotes from eight top companies for all ZIP codes across California to find the cheapest sports car insurance. Rates are for a 30-year-old single man with good credit and a clean driving record. He drives a 2023 vehicle with the base-level trim package.

Quotes are for a full coverage policy with higher liability limits than the state requirement and comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision deductible: $500

Vehicle specs — such as zero-to-60 time — and MSRPs were gathered from manufacturer websites.

Quadrant Information Services supplied ValuePenguin with the rate data used in this analysis. Quotes were publicly sourced from insurer filings and are for comparative purposes only. Your quotes will likely differ.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.