How Much Does It Cost to Insure a Land Rover Discovery?

Find Cheap Land Rover Auto Insurance Quotes

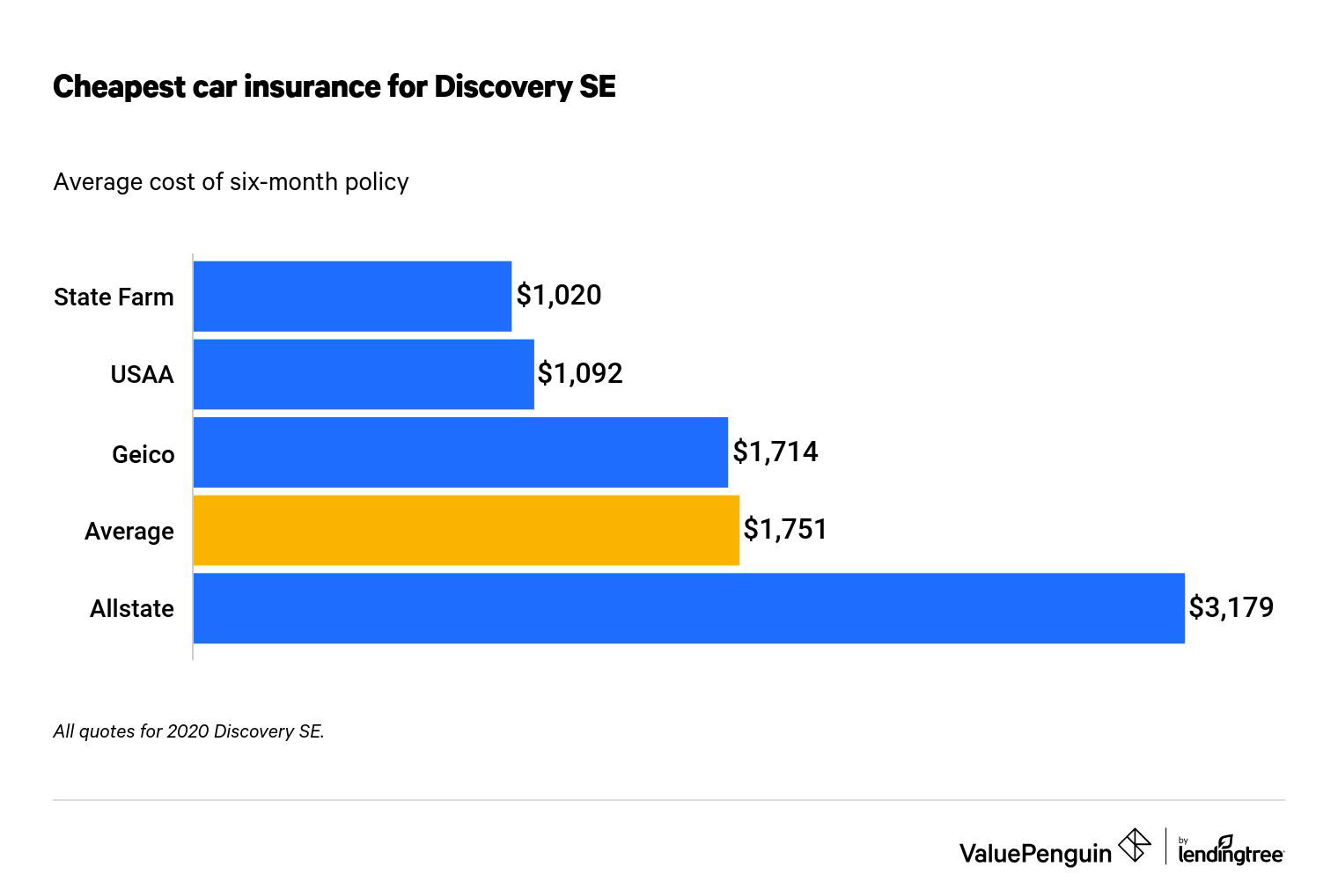

The average cost of full-coverage car insurance for a Land Rover Discovery is $1,751 for a six-month policy. Our review of Land Rover Discovery quotes found that State Farm offers the most affordable car insurance policy for this car, asking 42% less than the average insurance company.

The Land Rover Discovery is an expensive car to insure, as might be expected of a luxury SUV. The average cost of a car insurance policy is $937 for a full year — far less than the average cost of insuring a Land Rover Discovery for six months.

These quotes reflect the expense of the vehicle itself: The manufacturer's suggested retail price (MSRP) for a 2020 Land Rover Discovery SE is $52,300.

Which auto insurance company has the cheapest policy for a Discovery SE?

State Farm offers the best insurance rate for a Discovery model. The company charges $1,020 on average for a six-month auto insurance policy, which is 42% less than what people typically pay to insure this vehicle.

Find Cheap Land Rover Auto Insurance Quotes

USAA offers the second-most affordable car insurance policy for the Land Rover Discovery SE. USAA customers pay $1,092 on average to insure their Land Rover Discovery — 38% less than the overall average of $1,751. However, USAA only works with military members, veterans and their families. Those who don't meet eligibility requirements will need to look elsewhere for a policy.

Cheapest car insurance for Discovery SE

Company | Average cost of a six-month policy | |

|---|---|---|

| State Farm | $1,020 | |

| USAA | $1,092 | |

| Geico | $1,714 | |

| Allstate | $3,179 | |

| Average | $1,751 |

All quotes for 2020 Land Rover Discovery SE.

The most expensive six-month auto insurance policy for a Discovery SE comes from Allstate. Customers pay $3,179 on average to insure a Land Rover Discovery SE for six months — 82% more than the overall average cost. This huge range in costs shows why it's important to shop around for an auto insurance policy to get your best rates.

Which Land Rover is most expensive to insure: the Discovery SE, the Discovery Sport or the Range Rover?

Car owners who want a break on insurance costs should consider the 2020 Discovery Sport. A compact SUV, the Discovery Sport has an MSRP of $37,800 and an average insurance cost of $1,346 for a six-month policy. That makes it $14,500 cheaper to buy and $405 cheaper to insure than the 2020 Discovery SE.

Model | Average cost of six-month policy | MSRP |

|---|---|---|

| Discovery SE | $1,751 | $52,300 |

| Discovery Sport | $1,345 | $37,800 |

| Range Rover Evoque S | $1,663 | $42,650 |

| Range Rover Velar S | $1,828 | $56,300 |

Insurance data only available for hybrid version of 2020 Evoq S.

Most Range Rover models have a higher MSRP than the Discovery SE or the Discovery Sport, which means they are more expensive to insure. Land Rover released four different versions of the Range Rover in 2020, and our research included quotes from the two most affordable base models: the Range Rover Evoque S and the Range Rover Velar S.

On average, it costs $1,663 to insure the Range Rover Evoque S and $1,828 to insure the Range Rover Velar S for six months. If you want to buy a Range Rover but keep your insurance costs down, we recommend these two models.

How does model year impact auto insurance costs for a Land Rover Discovery?

Land Rover Discovery insurance costs change according to model year. It costs $1,139 on average to insure a 2017 Land Rover Discovery, making this older model 35% less expensive to insure than the 2020 Land Rover Discovery SE.

Model year | Average cost of six-month policy |

|---|---|

| 2017 Land Rover Discovery | $1,139 |

| 2019 Land Rover Discovery SE | $1,665 |

| 2020 Land Rover Discovery SE | $1,751 |

All cars are the base model. No insurance data was available for the 2018 Discovery. That's why it is not included in this table.

The difference between the 2019 and 2020 Discovery models is smaller: It only costs 5% less to insure a 2019 Discovery SE versus a 2020 model.

If you already have an older model of the Discovery and you're shopping for cheap insurance, State Farm is still your best bet. The company offers the lowest rates of the companies we considered not only for the 2020 Discovery, but for the 2017 and 2019 models as well.

How much is car insurance for a Land Rover Discovery vs. other luxury SUVs?

The Land Rover Discovery is one of the more expensive luxury SUVs to insure. Competitors offer more affordable SUVs to drivers looking to reduce their upfront and insurance costs.

Model | Average cost of six-month policy | 2020 MSRP |

|---|---|---|

| 2020 Land Rover Discovery SE | $1,751 | $52,300 |

| 2020 Jeep Grand Cherokee Laredo E | $1,043 | $34,000 |

| 2020 Ford Explorer | $1,280 | $32,765 |

| 2020 Audi Q7 2.0T Quattro Premium | $1,954 | $54,800 |

All cars except Jeep include turbo engine.

The Land Rover Discovery SE and the Audi Q7 2.0T Quattro Premium are both made overseas — a factor that drives up both their MSRP and insurance costs. The Jeep Grand Laredo E and the Ford Explorer, by contrast, are both made in the United States. This makes it easier for insurance companies to cover the cost of repairs, so monthly rates are lower.

State Farm offers the best deal for all of these cars, offering far lower average rates than the other companies in our study.

It costs 36% less than average to insure a Jeep Grand Cherokee with State Farm and 40% less than average to insure a 2020 Audi Q7 2.0 Quattro Premium. If you're in the market for a luxury SUV, consider insuring your car with State Farm.

Methodology

We collected quotes from four major national insurance companies, looking at the average insurance costs for the base model of the 2020 Land Rover Discovery in model years 2017, 2019 and 2020. To compare the Discovery to another popular Land Rover, we looked at 2020 quotes for the Range Rover Evoque S and the Range Rover Velar S, since these were the two most affordable Range Rovers released in 2020.

We also gathered quotes for the 2020 base model of several competitor cars, including the Audi Q7 2.0T Quattro Premium, the Ford Explorer and the Jeep Grand Cherokee Laredo E.

Our sample driver was a 30-year-old man who started driving at age 16. He has a clean driving record and a fair credit score. Quotes were drawn from all available ZIP codes in Texas.

All car insurance quotes include the following coverages:

Coverage | Limit |

|---|---|

| Liability, bodily injury | $50,000 per person; $100,000 per accident |

| Liability, property damage | $25,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person; $100,000 per accident |

| Uninsured/underinsured motorist property damage | Not included |

| Comprehensive | $500 deductible |

| Collision | $500 deductible |

| Personal injury protection (PIP)/medical payments | Not included |

| All other coverages (e.g., towing and loss of use) | Not included |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.