Cost of Flood Insurance in Florida and How Coverage Works

Flood insurance in Florida costs an average of $853 per year for a policy from the National Flood Insurance Program (NFIP).

If you have a mortgage and live in an area prone to flooding, you'll have to buy a policy. And if you have Citizens Insurance, you need flood insurance no matter where you live. Even if you aren't required to buy a policy, flood insurance is a good idea. You can often get flood insurance from the same company you have home insurance with.

Find Cheap Homeowners Insurance Quotes in Florida

How much is flood insurance in Florida?

Florida flood insurance from the National Flood Insurance Program can cost up to $3,600 per year.

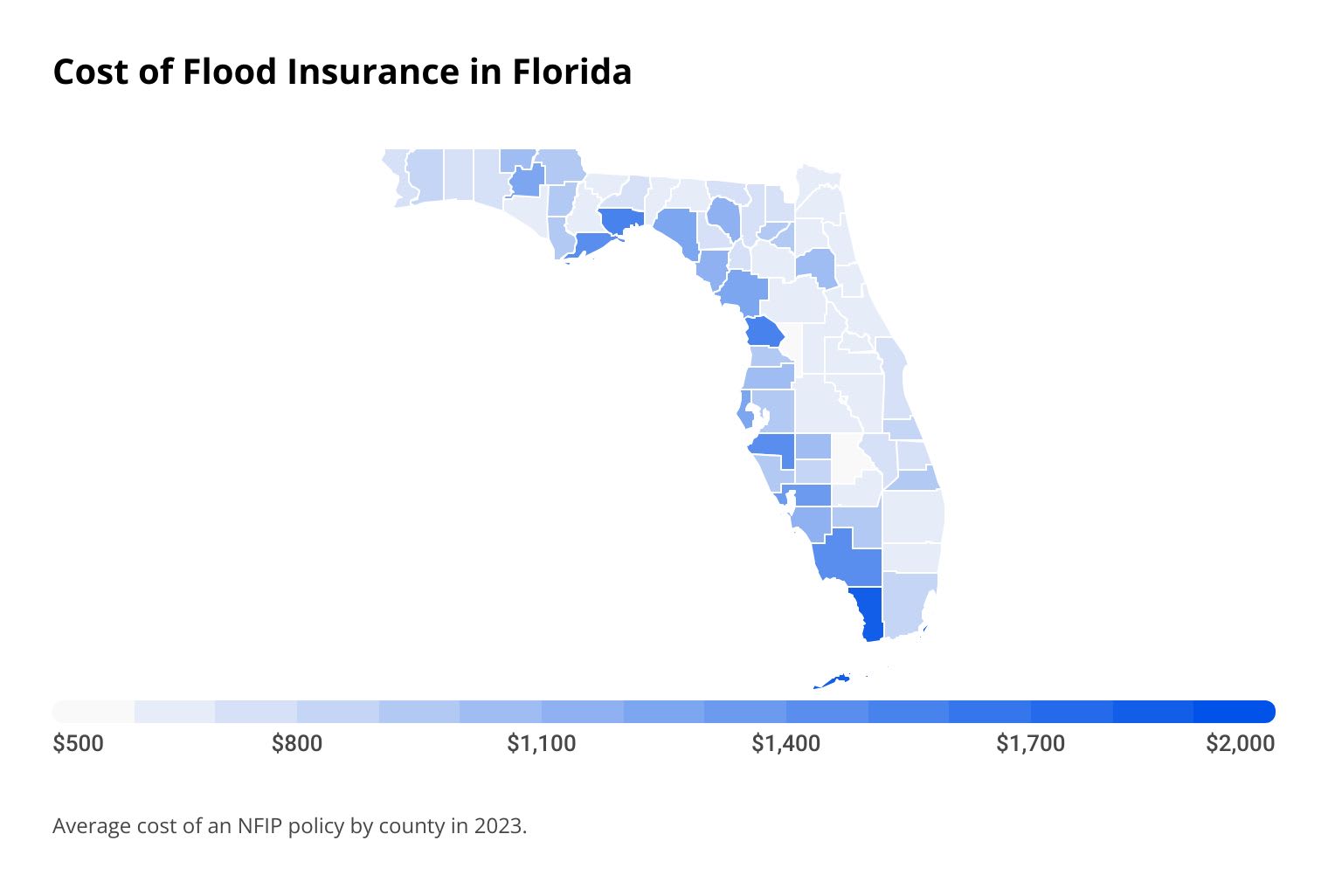

The cost of a policy depends on if your home is elevated, how it's built and how much coverage you need. But the biggest thing that impacts Florida flood insurance rates is where you live. The Gulf Coast of Florida tends to have the highest flood insurance rates.

Sumter County, in the middle of the state and home to The Villages, has the lowest average rates for flood insurance. This is likely because its inland position protects it from most hurricane flooding. Monroe County, on the southwestern tip of the state, has the highest average rates. Even just a few inches of rain can cause minor flooding in the area.

If you need a flood insurance policy, check with your home insurance company. Many companies sell flood insurance from the National Flood Insurance Program. Some companies even sell their own flood insurance that might be cheaper and give you more coverage than an NFIP policy.

Find Cheap Homeowners Insurance Quotes in Florida

Cost of Florida flood insurance by city

Even within a county, flood insurance rates can differ widely. If you're closer to the coast, you're likely going to have higher rates. Belleair Shore has the highest flood insurance rates of any city in Florida, with a policy costing over $3,600 per year. The city sits on a thin strip of land called a barrier island, leaving it vulnerable to flooding.

City | Average annual rate |

|---|---|

| Alachua | $854 |

| Alachua County | $596 |

| Alford | $577 |

| Altamonte Springs | $563 |

| Anna Maria | $2,680 |

Counties shown in the City column are for homes outside of the city limits.

You may pay more for flood insurance if your house is used as a rental property or if you live there less than half the year.

If you need flood insurance on the home you live in, you'll pay a $25 fee on top of the cost of coverage. That fee jumps to $250 per year if you don't live in the home full-time.

What does flood insurance cover in Florida?

Flood insurance covers your home and your personal belongings.

Dwelling coverage pays to repair or rebuild your home if it's damaged by flood water. If you get a policy from the NFIP, you can only insure your house for up to $250,000.

Personal property coverage pays for your things, like furniture and clothing, if they're damaged in a flood. With an NFIP policy, you can get up to $100,000 in coverage for your stuff.

Dwelling coverage protects:

Contents coverage protects:

If your home would cost more than $250,000 to rebuild or you have valuable belongings, you may want to get a flood insurance quote from a private company. You might be able to get more coverage with private flood insurance than you can through the National Flood Insurance Program. You might also be able to add extra coverage for more protection, including coverage to live somewhere else after your home is damaged in a flood.

What's not covered by NFIP insurance?

- Decks

- Fences

- Landscaping

- Pools and hot tubs

- Cash and stock certificates

- Precious metals

In addition, NFIP flood insurance doesn't pay for the cost to live somewhere else after a flood or loss of income if your home becomes uninhabitable.

Do I need flood insurance in Florida?

You have to buy flood insurance in Florida if you have a mortgage and live in a moderate- or high-risk flood zone.

You also need a policy if your home insurance is from Citizens, Florida's state-run home insurance company. But if you live in Florida, it's a good idea to get a quote for flood insurance, no matter how close you are to the water.

- You typically need flood insurance if your home is in a "Special Flood Hazard Area (SFHA)." These are areas where your home has about a one-in-four chance of flooding during a 30-year period. These flood zones start with the letters A or V. They're usually near the coast or a large body of water, like a river or lake.

- Flood insurance isn't required if you're located in what are called X, C or B flood zones. That's because your home has a lower risk of flooding.

You can check your home's flood zone using the FEMA flood map tool. Enter the address and a map will pop up showing your house and the flood risk in your area.

Even if you don't live near the water, you might want to think about buying flood insurance.

About a quarter of all floods happen in areas that you might not expect. And it only takes an inch of water in your home to cause $25,000 in damage. Home insurance never covers flood damage, so it's a good idea to get flood quotes and think about buying a policy even if you're in a low-risk area.

If you don't have flood insurance, you will only get money from FEMA if a federal emergency is declared. Even if you do get assistance, a federal grant is usually between $3,000 and $6,000. That's not usually enough to cover the full cost of repairing or rebuilding your home after a flood. Without flood insurance, you would have to pay for most of the damage yourself.

Flood insurance for Citizens Insurance customers

All homeowners who have a policy with Citizens Insurance will need to buy flood insurance by 2027.

This requirement was a part of a bill passed by the Florida legislature in December 2022. The requirement is rolling out in stages, so some people will need coverage sooner than others.

The first group of homeowners who will need flood insurance is those living in a Special Flood Hazard Area (SFHA). These are usually areas close to the coast or a body of water. Those flood zones start with A or V. If you're in one of these areas, you probably already have a flood policy if you have a mortgage.

If you're with Citizens now and you don't want to buy flood insurance, you will need to find a different home insurance company before the flood insurance deadline. Citizens is usually a last-resort company. It may be difficult or impossible to find another option to avoid the flood insurance requirement.

When do I need flood insurance?

Date | Who needs it? |

|---|---|

| April 1, 2023 | New customers with homes in a SFHA |

| July 1, 2023 | Homes in SFHAs with policies that include wind coverage |

| Jan. 1, 2024 | Homes insured for $600,000+ |

| Jan. 1, 2025 | Homes insured for $500,000+ |

| Jan. 1, 2026 | Homes insured for $400,000+ |

| Jan. 1, 2027 | All homes |

How to get flood insurance in Florida

If you need flood insurance, check with your current homeowners or renters insurance company. Most Florida home insurance companies and agents can sell you a policy from the National Flood Insurance Program (NFIP). Because the NFIP is a government-backed program, its rates are the same no matter what company you buy from.

It's easier to file a claim for storm damage if your home and flood insurance policies are with the same company.

Largest NFIP flood insurance companies in Florida

Company | Market Share |

|---|---|

| Wright National Flood | 38% |

| Assurant | 10% |

| Allstate | 10% |

| The Hartford | 7% |

| Progressive | 6% |

*Flood insurance from USAA is only available to members of the military, veterans and their families.

Private flood insurance in Florida

In the last few years, more insurance companies have started to offer their own private flood insurance as an alternative to the National Flood Insurance Program. "Private flood insurance" just means that your policy comes directly from an insurance company, and the coverage isn't part of the NFIP.

You might be able to get cheaper rates and higher levels of coverage with private flood insurance.

Some private flood insurance companies also offer coverage more quickly. Coverage may start within just a few days after you buy a policy. In comparison, an NFIP policy typically has a 30-day waiting period before coverage kicks in.

However, private flood insurance companies can cancel your policy if they decide your home is too risky to protect.

How to find cheap flood insurance quotes in Florida

To find the best flood insurance rates, compare quotes from the National Flood Insurance Program and private flood insurance companies.

You can also make some changes to your quote, policy or home to save money on Florida flood insurance.

Increase your deductible. The deductible is the amount you have to pay before your flood insurance kicks in. A higher deductible means lower rates. But make sure you choose a deductible you can afford to pay.

Get an elevation certificate. An elevation certificate shows important details about your property, like your flood zone and the height of your lowest floor. It can help you get a lower rate by showing that your home is high enough that flood waters won't reach it.

Upgrade your home to prevent flooding. This can include installing hurricane shutters, grading your property so water moves away from your home and raising your HVAC unit above ground level. Because these things make damage less likely, you could get a lower rate on flood insurance.

Frequently asked questions

What is the cost of flood insurance in Florida?

Florida flood insurance from the National Flood Insurance Program costs $853 per year. Your rates might be higher or lower depending on where you live and the details of your house. Private health insurance rates might be cheaper.

Can everyone in Florida get flood insurance?

Yes, everyone in Florida can buy flood insurance from the National Flood Insurance Program (NFIP). However, you might not be able to get private flood insurance if you live in an area with a very high flood risk.

Do Floridians need flood insurance?

You only need flood insurance if your home is insured with Citizens, or if you live in a high-risk flood area and have a mortgage. But everyone in Florida should at least get a flood insurance quote and consider buying a policy. Flood insurance is the only way to protect your home and stuff from flood damage, which is common in Florida. Even if you're not located in a high-risk flood zone, there's still a chance you can experience flooding, especially during hurricane season.

What is the new flood insurance law in Florida?

Starting on Jan. 1, any home insured with CItizens for more than $600,000 has to have flood insurance. That's because the Florida legislature passed a bill in December 2022 that requires all homeowners insured by Citizens Insurance to have flood insurance by 2027. The requirement is rolling out gradually, and people who are in high-risk flood areas and those who own expensive homes will be impacted first.

Methodology and sources

To find the average cost of flood insurance in Florida, ValuePenguin studied data from the National Flood Insurance Program (NFIP).

Market share data for the largest flood insurance companies in Florida is from S&P Global, a financial data resource for the insurance industry.

Other sources include the Federal Emergency Management Agency (FEMA), Florida Division of Emergency Management, HelpWithMyBank.gov and the National Flood Insurance Program (NFIP).

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.