Citizens Property Insurance Review: Low Rates but Limited Coverage

Citizens offers cheap rates to Florida homeowners who can't get affordable coverage elsewhere. But private insurance is a better option most of the time.

Find Cheap Homeowners Insurance in Florida

Is Citizens Insurance good?

If Citizens homeowners insurance is your only option, it's better to have coverage than be uninsured.

Citizens offers basic coverage for an affordable price. However, homeowners complain about its difficult customer service, especially during the claims process.

You may pay higher rates with a private insurance company, but they typically have more coverage options and may offer better value for your money.

Pros and cons

Pros

Available to people that can't get coverage elsewhere

Cheapest quotes for homeowners who qualify

Cons

No coverage for homes worth more than $700,000

Low liability coverage limits

Difficult claims experience

Only available in certain situations

What is Citizens Insurance?

Citizens Property Insurance is a nonprofit company run by the state government of Florida.

You can only get a Citizens policy if you live in Florida and a private company won't offer you a policy at an affordable rate.

If you want a quote for Citizens home insurance, you'll need to meet one of two conditions.

- You can't get coverage from a Florida-authorized insurance company.

- Quotes from Florida-authorized insurance companies are more than 20% higher than similar coverage from Citizens.

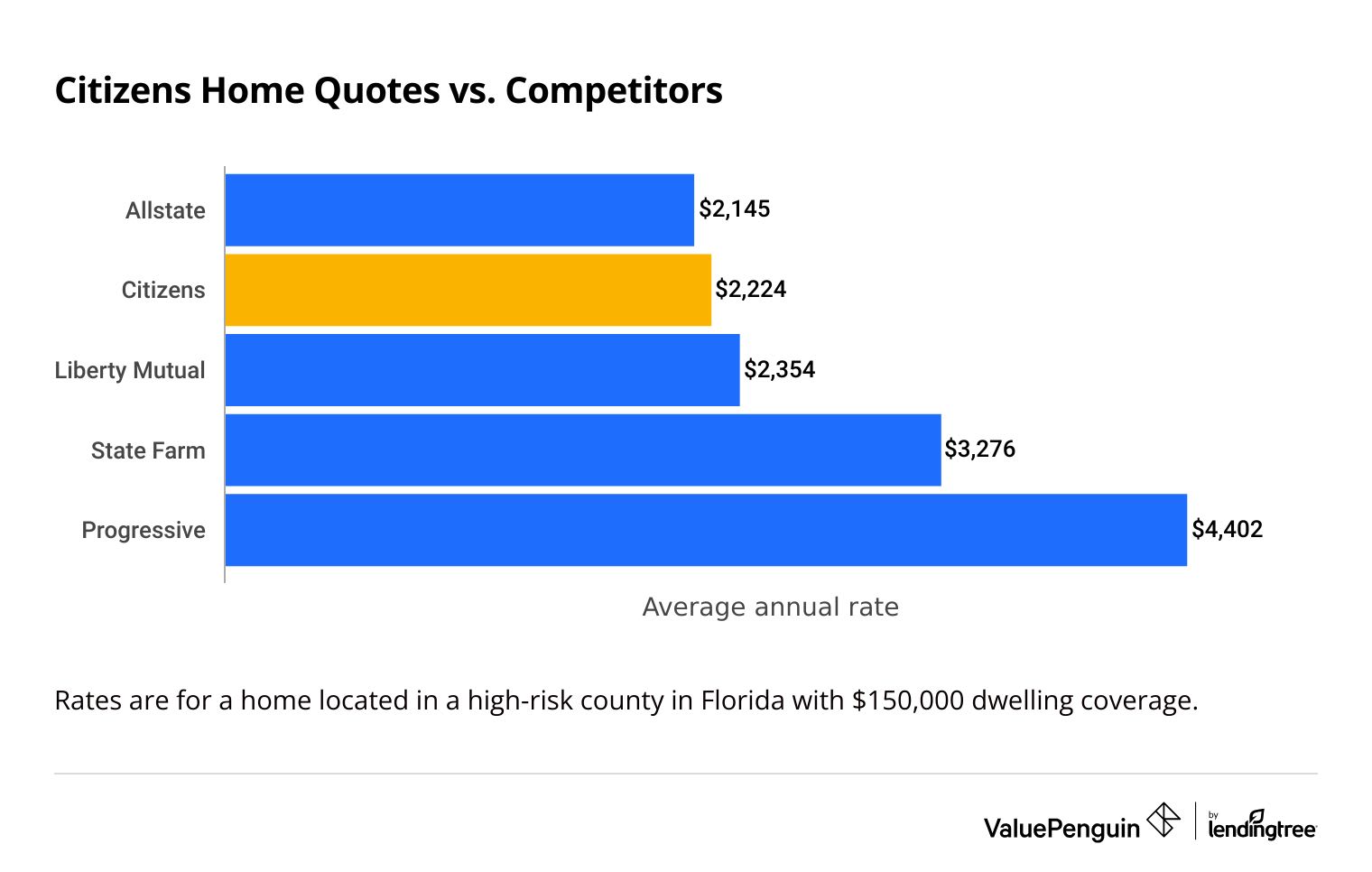

Citizens home insurance quotes

Citizens quotes are among the cheapest in the state.

However, you can only buy Citizens home insurance if other options cost at least 20% more than Citizens' price.

Find Cheap Homeowners Insurance in Florida

You can only buy coverage through a Citizens Insurance agent.

To find out if you qualify, your Citizens agent must enter your info into the Citizens Clearinghouse program. The Clearinghouse gives you a rate for Citizens Insurance and quotes from any private companies that will offer you coverage. The Clearinghouse rates will act as proof that you're eligible for a Citizens home insurance policy.

Compare Citizens Insurance quotes by dwelling coverage amount

$150,000

$300,000

Company | Annual rate | ||

|---|---|---|---|

| Citizens | $4,299 | ||

| Allstate | $4,345 | ||

| Liberty Mutual | $4,685 | ||

| State Farm | $5,537 | ||

| Security First | $6,983 | ||

Rates are for a home located in a high-risk county in Florida. The home was built before 2001 with no wind mitigation features, such as storm shutters.

$150,000

Company | Annual rate | ||

|---|---|---|---|

| Citizens | $4,299 | ||

| Allstate | $4,345 | ||

| Liberty Mutual | $4,685 | ||

| State Farm | $5,537 | ||

| Security First | $6,983 | ||

Rates are for a home located in a high-risk county in Florida. The home was built before 2001 with no wind mitigation features, such as storm shutters.

$300,000

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $3,448 | ||

| Farm Bureau | $3,938 | ||

| Citizens | $4,880 | ||

| State Farm | $4,964 | ||

| Liberty Mutual | $5,184 | ||

Rates are for a newly built home located in a high-risk county in Florida.

Citizens home insurance discounts

Citizens only gives discounts for adding safety features to your home. This can include hurricane shutters or an alarm system.

Citizens doesn't have many discounts compared to most insurance companies. However, its wind mitigation discount for homes with storm safety features can save you a lot of money.

Get a cheaper rate if you have a centrally monitored fire or burglar alarm.

Save money if your home was built after Jan. 1, 2002, or has a new roof that meets the 2002 building code.

Homeowners can get a discount for having features like storm shutters and hip roofs that lower the risks of wind damage. You must have a wind mitigation inspection to be eligible for this discount.

The wind mitigation discount can make a big difference in your rates. For example, insurance on a home with $150,000 of dwelling coverage costs around half as much as if the home has wind mitigation features.

Save money based on the shape of your roof and its building materials. You may have to have a roof or wind mitigation inspection to qualify. And you can only get this discount if you don't qualify for the building code compliance discount.

Citizens only sells property insurance, which means you can't get a discount by bundling your home policy with other policies, like car or umbrella insurance.

Florida Citizens Insurance coverage

Citizens Insurance offers the basic coverage you would expect from a homeowners insurance policy. However, there are a few exceptions.

Citizens gives homeowners a few ways to customize their coverage. But these add-ons are only available to some people.

Replacement cost coverage pays to rebuild your home after a major emergency, like a fire, even if it costs more than your policy limits.

In comparison, most policies will pay you based on the home's value taking wear and tear into consideration. This is called the actual cash value.

Ordinance or law coverage pays to update your home to comply with current building codes and regulations if damaged or destroyed.

Personal property replacement cost pays to replace your belongings with brand new items if they're destroyed or stolen.

With personal property replacement cost, Citizens won't factor wear and tear into your claim payout. In comparison, a basic policy will usually only pay enough for you to buy used items.

Sinkhole loss coverage pays for damage to your home from the sinking or settling of the ground's surface.

The deductible is 10% of your dwelling coverage limit. That means filing a sinkhole claim will only make sense if you have major damage.

In addition, some Citizens policies include extra coverage, like debris removal and identity theft coverage. But Citizens doesn't provide any info about who is eligible for these upgrades.

Citizens hurricane insurance

Citizens includes coverage for hurricane damage in its basic homeowners insurance policy.

Citizens also has a separate deductible for hurricane damage. That means you may have to pay more if you make a claim related to hurricane damage. This is typical for hurricane coverage from other insurance companies, too.

However, hurricane coverage doesn't pay for flood damage. You'll need to buy a separate flood insurance policy to protect against flood water.

Citizens Property Insurance deductible options

- Hurricane deductible: Either $500 or 2%, 5% or 10% of your dwelling coverage limit

- All other damage: $500, $1,000 or $2,500

Citizens flood insurance requirement

All Citizens customers must have flood insurance by 2027.

This is the case even if you don't live in a high-risk area. Citizens is rolling out this requirement in stages. Not all homeowners will have to buy flood insurance right away.

- April 1, 2023: New customers with homes in a special flood hazard area (SFHA). This includes flood zones that start with an "A" or "V," like AO or VE.

- July 1, 2023: Homes in an SFHA flood zone with wind coverage

- Jan. 1, 2024: Homes insured for $600,000 or more

- Jan. 1, 2025: Homes insured for $500,000 or more

- Jan. 1, 2026: Homes insured for $400,000 or more

- Jan. 1, 2027: All Citizens customers

Citizens doesn't sell flood insurance, so you'll have to buy flood insurance from either the National Flood Insurance Program (NFIP) or from a private flood insurance company.

The average cost of flood insurance in Florida is $910 per year for a policy from the National Flood Insurance Program.

Private flood insurance is usually the best option because it tends to offer higher coverage limits and cheaper rates. However, private companies may not cover homes in risky areas, like those on the coast.

Citizens Insurance home inspections

Citizens may require a Florida-licensed inspector to check out your home. Whether you'll need an inspection depends on several factors.

- Coverage you need

- Age and location of your home

- Discounts you qualify for

There are five types of inspections that Citizens may require you to get.

Citizens Insurance requires a four-point inspection for all homes over 30 years old. The four points refer to your home's electrical system, plumbing, heating and cooling system and roof.

If your home would cost $650,000 or more to rebuild, you may need a high-value inspection. This is because Citizens only covers homes that cost a maximum of $700,000 to rebuild. If the inspector determines that your home would cost more than $700,000 to rebuild, you'll need to get home insurance elsewhere.

Citizens requires a roof inspection if you have an older roof. You may need this inspection if:

- You have a tile, slate, clay, concrete or metal roof over 50 years old

- You have a shingle or other type of roof over 25 years old

Your roof must have at least three years of remaining useful life before Citizens will sell you a home insurance policy.

Citizens offers a discount for storm shutters, roof clips, and other features that protect your home against wind damage. If you're looking for a discount on your policy, you'll have to get an inspection to document the features.

If you want to add sinkhole loss coverage to your policy, you'll have to get an inspection to see if your home is eligible.

Citizens insurance reviews and ratings

Citizens gets a lot of customer complaints, especially when it comes to the claims experience.

The company gets more than four times as many complaints as similar insurance companies, according to the National Association of Insurance Commissioners (NAIC).

However, that's about average for a major home insurance company in Florida. Tower Hill is the only company that gets fewer complaints than expected.

Company | Complaints |

|---|---|

| Tower Hill | Half as many as expected |

| First Protective | 3 times more than expected |

| Allstate | 4 times more than expected |

| Citizens | 4 times more than expected |

| State Farm | 5 times more than expected |

As a government-backed nonprofit company, Citizens has excellent financial stability.

That's partially because it can increase rates for all customers in an emergency. This means Citizens will likely be able to pay your claim because it can raise money after a disaster. The downside is that it raises this money by charging you higher rates.

How to file a claim and pay bills with Citizens Property Insurance

Citizens customers can file a claim online or by phone.

- Online: Go to the Citizens Property Insurance website and log in to myPolicy. You can also use this platform to view your policy and pay your bill online.

- Phone: Call Citizens' property insurance 24/7 phone number at 866-411-2742.

You can pay your bill online, by phone or by mail.

If you want to pay your bill by mail, you can pay using personal and cashier's checks mailed to the Citizens Property Insurance Corp. address in Jacksonville, Florida.

Citizens rate increase

As a Citizens customer, you could see your home insurance rates go up after a statewide disaster.

Citizens says it is confident that it can handle a 1-in-100-year and a 1-in-28-year storm without charging customers extra.

Citizens saves a certain percentage of its income, called reserves, to pay for future storm claims.

A major storm, or many storms over a short period, could wipe out those reserves. Florida law requires Citizens to increase its rates until its storm reserves return to normal. This increase is called an assessment.

The first increase could raise your home insurance rates by up to 45%. This means that a Citizens customer who pays $1,000 per year for coverage could see a $450 increase. In extreme scenarios, Citizens could charge emergency assessments on top of this over multiple years.

Citizens Insurance predicts that customers will see rate increases each year.

People living in at-risk areas near the southern coast, like Miami, may see rates increase by about 10% each year. On the other hand, customers in inland areas outside of South Florida may see rates go down.

Private market insurance has its risks, too. Companies can stop offering coverage in high-risk areas or raise rates to cover losses.

Can Citizens Insurance drop me?

Citizens has recently started canceling policies with more than $700,000 of dwelling coverage.

So far, this has affected less than 1% of policies in some Florida counties. If the cost to rebuild your home has increased to close to the maximum coverage level, you should start shopping for a new Florida home insurance company.

Citizens also helps homeowners find private insurance coverage in a process called "depopulation."

When it finds private companies willing to cover you, you will get a Citizens depopulation letter. In this case, you should review all your options, including potentially staying with Citizens.

If you get a depopulation letter but want to stay with Citizens Insurance, you can submit an opt-out form.

Other types of insurance from Citizens

In addition to standard homeowners insurance, Citizens offers a few other types of property insurance.

It also sells wind-only policies for eligible homeowners. It's only available in some regions of Florida.

You can find out if your home is eligible for wind-only coverage on Citizens' website.

Additionally, you may be able to get what's called modified homeowners insurance from Citizens. This is a cheaper type of homeowners policy with less coverage for some types of damage, like water damage.

Frequently asked questions

Who owns Citizens Property Insurance?

The state of Florida runs Citizens Insurance. Citizens is an "insurer of last resort", so its purpose is to offer coverage to homeowners who can't find affordable protection elsewhere.

Is Citizens Insurance good?

Citizens Insurance is a good option for Florida homeowners who can't find cheap coverage elsewhere. Citizens may be the only way to protect a home for some people. But its coverage is limited, and Citizens gets a lot of complaints about its claims process.

Is Citizens Insurance leaving Florida?

No, Citizens Insurance is not leaving Florida. The state of Florida owns Citizens Insurance. It's an "insurer of last resort" for Floridians who can't find affordable coverage elsewhere.

Is Citizens requiring flood insurance in Florida?

Yes, Citizens Insurance requires all new customers to buy flood insurance. All Citizens customers must have flood insurance by 2027, even if you don't live in a high-risk area.

Methodology

ValuePenguin gathered rates from the Florida Office of Insurance Regulation to compare Citizens Insurance quotes. Quotes are for three different home types:

- A $150,000 home with no wind mitigation features, built before 2001

- A $150,000 home with wind mitigation features, constructed before 2001

- A $300,000 newly built home

Rates are for the five Florida counties with the largest number of Citizens Insurance policies, according to Citizens.

- Miami-Dade

- Broward

- Pinellas

- Palm Beach

- Hillsborough

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.