Freedom Health Medicare Advantage Review (2024)

Freedom Health has cheap, high-quality Medicare Advantage plans.

Compare Medicare Plans in Your Area

Most Freedom Health plans cost $0 per month and have low limits for how much you'll spend on health care each year. The company also scores well for plan quality, according to the Centers for Medicare & Medicaid Services (CMS), a government agency.

However, Freedom Health only sells a limited selection of Medicare Advantage plans in certain parts of Florida. So you won't have a lot of options for your coverage.

Pros and cons

Pros

High-quality plans

Good customer service

Cheap rates

Extra benefits available

Cons

Few plan choices

Small network of doctors

Only available in parts of Florida

How much do Freedom Health Medicare Advantage plans cost?

Freedom Health Medicare Advantage plans cost $6 per month on average.

That's less than half the Florida state average of $15 per month. In addition to its cheap quotes, Freedom Health has an average star rating of 4.5 out of 5, according to the Centers for Medicare & Medicaid Services (CMS). That makes it one of the best companies in Florida for high-quality Medicare Advantage plans.

Freedom Health currently only sells plans in 24 Florida counties located along the state's central and southern coastline. It's important to check that Freedom Health plans are available where you live before you get too far along in the buying process.

Freedom Health has a low average cap on how much you'll pay for medical care in a single year of $2,794. That's $1,959 per year less than the Florida state average.

Freedom Health plans don't require you to pay anything before your prescription drug coverage starts. This is called a $0 drug deductible. In Florida, the average drug deductible is $128 per year. However, you'll still have to pay a flat fee every time you get your prescription filled.

Most Freedom Health Medicare Advantage plans have no monthly cost. The only Freedom Health plan with a monthly cost is the Freedom Platinum Plus Plan Rx (HMO), which is $38 per month on average. This plan will pay a large part of your medical costs, leaving you with low bills.

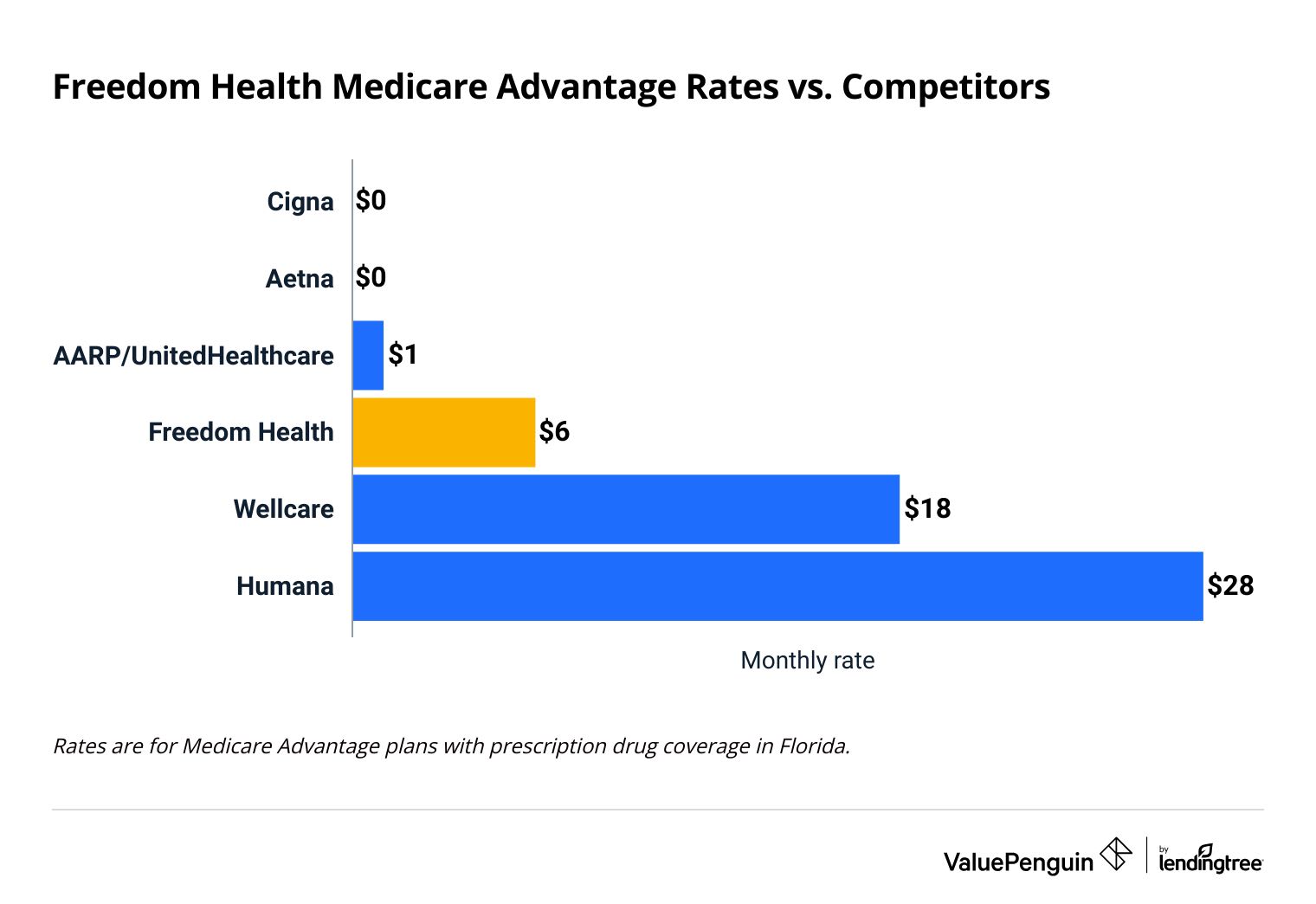

Freedom Health Medicare Advantage plan cost and quality rating vs. top competitors

Average monthly cost |

Star rating

| |

|---|---|---|

| Cigna | $0 | 4.0 |

| Aetna | $0 | 3.8 |

| AARP/UnitedHealthcare | $1 | 3.9 |

| Freedom Health | $6 | 4.5 |

| Wellcare | $18 | 3.2 |

| Humana | $28 | 4.2 |

Averages are based on 2024 Medicare Advantage plans with prescription drug coverage in Florida.

Freedom Health Medicare Advantage plan options

Most Freedom Health plans are HMOs (health maintenance organizations). With an HMO, you need a referral from your primary care doctor before you can see a specialist and you can only visit doctors in your network. HMOs offer less flexibility than other plan types, but they tend to cost less.

Freedom Health sells one HMO-POS (point of service) plan, the Freedom Maximo. A POS plan lets you visit doctors outside of your network, although you still need a referral from your primary care doctor.

Company | Monthly rate |

Out-of-pocket max

|

|---|---|---|

| Freedom Platinum Plan Rx (HMO) | $0 | $2,247 |

| Freedom Maximo (HMO-POS) | $0 | $2,800 |

| Freedom Medicare Plan Rx (HMO) | $0 | $2,875 |

| Freedom Platinum Rewards Plan Rx (HMO) | $0 | $3,400 |

| Freedom Savings Plan (HMO) | $0 | $3,400 |

| Freedom Platinum Plus Plan Rx (HMO) | $38 | $1,625 |

Average monthly rates are for a 65-year-old woman in Florida.

Freedom Health doesn't sell PPO (preferred provider organization) plans. PPOs don't require that you choose a primary care doctor or get referrals before you see specialists. You can also see doctors outside of your network for a higher price.

Consider Humana if you want a PPO plan. The company has the best PPO plans in Florida.

Freedom Health Medicare Advantage add-on benefits

Many Freedom Health Medicare Advantage plans come with extra coverage and benefits like enrollment in fitness programs and in-home care.

- Over-the-counter drug allowance: Get $35 to $125 per month to pay for your over-the-counter medications.

- SilverSneakers fitness program: Many Freedom Health plans offer free SilverSneakers memberships or a SilverSneakers Steps home fitness kit. SilverSneakers is a popular fitness program tailored to the needs of older adults. The SilverSneakers Steps home fitness kit is an exercise program that can be performed at home. It may be ideal for those who have mobility issues.

- Active Fitness: Some Freedom Health plans come with $500 per year in reimbursement for activities such as golf, tennis and swimming.

- Part B premium refund: Get $20 to $164.90 per month in reimbursement for your Medicare Part B monthly rate.

- Personal emergency response system (PERS): This device that hangs around your neck lets you alert emergency services 24 hours a day if you can't reach a phone.

- In-home support: With some plans, you can get up to 30 hours per year of in-home help through a program called Papa Pals. Your Papa Pals offer companionship, help around the house and medical assistance.

- Everyday Options Allowance: Some special needs plans offer between $85 and $175 per month to spend on food, utilities and supplies for your home and pets.

These benefits aren't available through Original Medicare that you get through the government. Private companies that sell Medicare Advantage plans often offer extras to make their plans more appealing.

Keep in mind that not all of these benefits are available with every Freedom Health Medicare Advantage plan option. Check your plan details before you buy to make sure that you have access to the services you need.

You should never pick a Medicare Advantage plan only based on its extra benefits. Use coverage add-ons along with factors like plan cost and quality to choose the plan that best fits your unique needs.

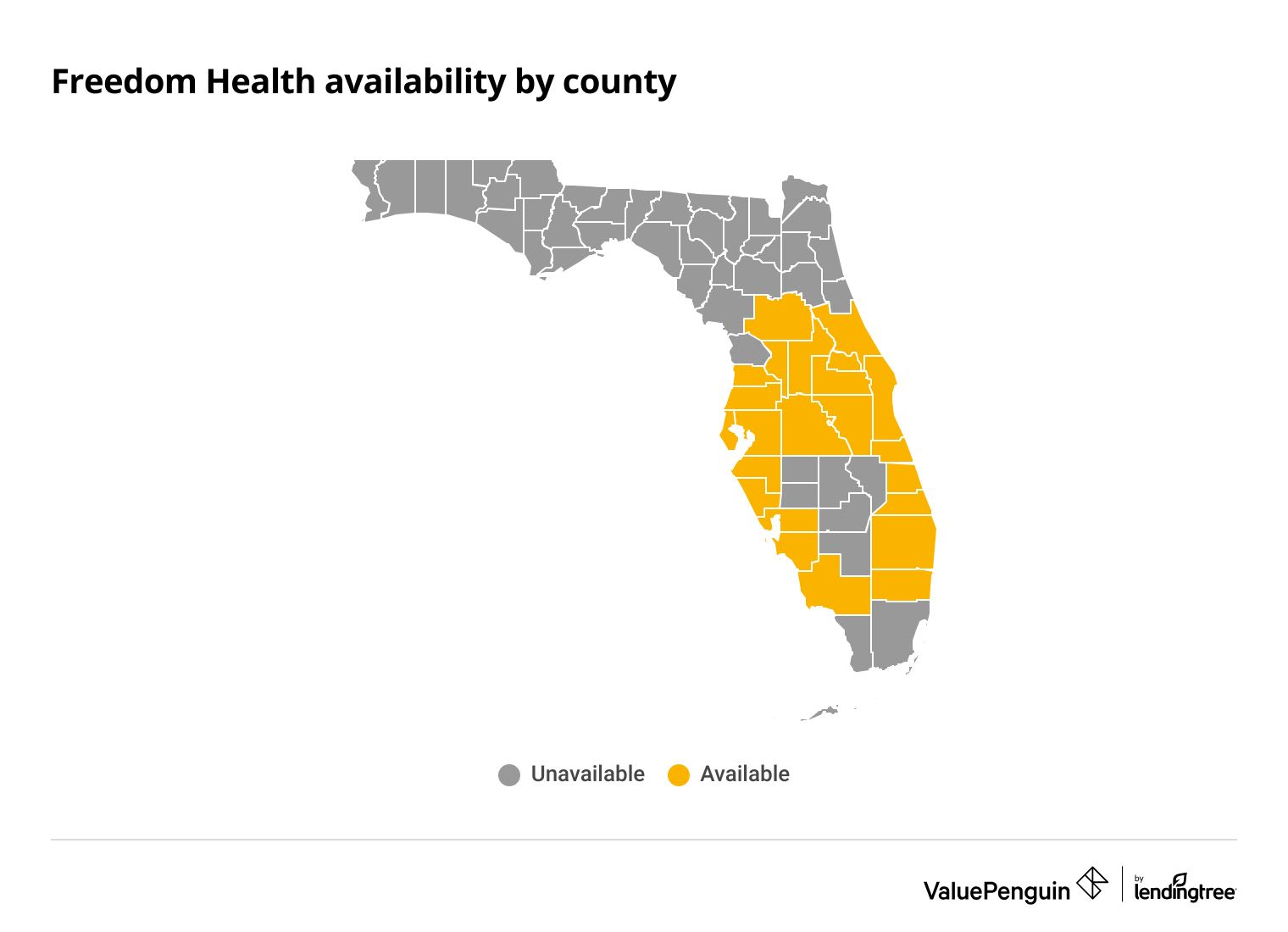

Where does Freedom Health sell Medicare Advantage plans?

Freedom Health sells plans in 24 Florida counties. They're mostly in Florida's more populous central, southern and coastal areas, and include major cities like Tampa, Orlando and Fort Lauderdale.

Roughly 3 in 4 Florida residents have access to Freedom Health Medicare Advantage plans.

Freedom Health has a relatively small enrollment. Only 67,000 people have Freedom Health Medicare Advantage plans.

That is 0.3% of the Florida Medicare Advantage market.

Florida counties where Freedom Health sells Medicare Advantage plans

- Brevard

- Broward

- Charlotte

- Citrus

- Collier

- Hernando

- Hillsborough

- Indian River

- Lake

- Lee

- Manatee

- Marion

- Martin

- Orange

- Osceola

- Palm Beach

- Pasco

- Pinellas

- Polk

- Sarasota

- Seminole

- St. Lucie

- Sumter

- Volusia

Freedom Health plan quality and customer service

Freedom Health gets significantly fewer complaints compared to an average company its size, according to the National Association of Insurance Commissioners (NAIC). This is a recent change for the company. In 2021 and 2022, Freedom Health got far more complaints than average.

The company has a high CMS star rating score of 4.5 out of 5. Only a small number of plans in Florida earn a 4.5 out of 5 or above, meaning Freedom Health offers some of the best Medicare Advantage plans in Florida. Despite earning high scores for medical care, Freedom Health only got a rating of 3 out of 5 for customer service.

Freedom Health has a rating of 4 out of 5 stars from the National Committee for Quality Assurance (NCQA), a nonprofit organization. The star rating measures patient experience, prevention, equity and treatment quality.

Frequently asked questions

Does Freedom Health have good Medicare Advantage plans?

Freedom Health has good Medicare Advantage plans with low rates. Freedom Health's small network of doctors is a major downside because you may have a difficult time getting care if you travel frequently.

Where can I use my Freedom Health grocery card?

Check your plan details to see which grocery stores in your area accept your Freedom Health grocery card, also called an Everyday Options Allowance. Keep in mind that only some plans offer this extra benefit.

Who owns Freedom Health?

Freedom Health is owned by Elevance (formerly Anthem), a Blue Cross Blue Shield company. However, Freedom Health customers do not have access to the Blue Cross Blue Shield network.

That means customers can only get nonemergency medical care in the parts of Florida where Freedom Health operates.

Sources and methodology

Rate cost data and plan star ratings came from the Centers for Medicare & Medicaid Services (CMS). Plan quality information is from the National Association of Insurance Commissioners (NAIC) and the National Committee for Quality Assurance (NCQA).

Extra coverage benefits and Medicare Advantage plan availability are from the Freedom Health website.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.