NJM Insurance Review: Auto, Home & Renters

NJM is an excellent choice for car, home and renters insurance. But it's only available in a few states.

Find Cheap Auto Insurance Quotes in Your Area

Is NJM a good insurance company?

New Jersey Manufacturers (NJM) Insurance offers very affordable auto, home and renters insurance. It also has some of the best-rated customer service in the insurance industry,

NJM is an excellent option for drivers shopping for a full coverage policy. That's because you can get extra perks like rental car reimbursement without paying more. It also offers lots of protection add-ons you can get for an extra cost.

Owners of higher-value homes can also find great prices and coverage with NJM.

The main downside to NJM is you can only get its insurance in Connecticut, Maryland, New Jersey, Ohio or Pennsylvania.

Pros and cons

Pros

Cheap quotes

Lots of extra coverage options

Outstanding customer service

Cons

Only available in Connecticut, Maryland, New Jersey, Ohio or Pennsylvania

NJM auto insurance review

NJM is an excellent choice for full coverage car insurance, regardless of your driving history.

New Jersey Manufacturers auto insurance is very affordable, even for drivers with an accident or DUI. And full coverage from NJM comes with added protection at no extra cost.

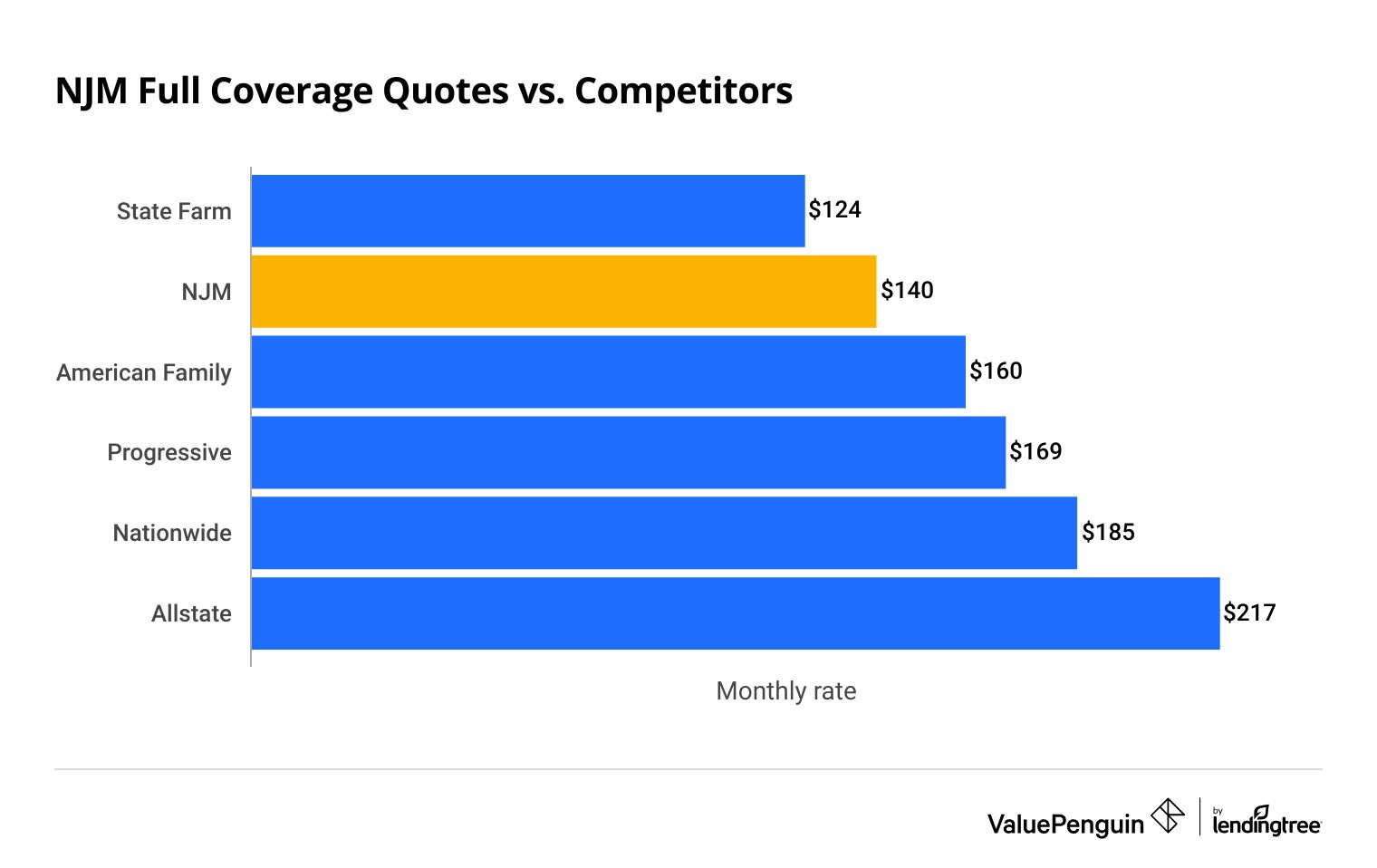

NJM auto insurance quotes

NJM offers very affordable full-coverage car insurance. At $140 per month, full coverage from NJM is 15% cheaper than the national average.

Although State Farm has cheaper rates for full coverage, drivers may find NJM's extra coverage perks worth the additional $16 per month.

Find Cheap Auto Insurance Quotes in Your Area

However, minimum coverage from NJM isn't as good of a deal. At around $73 per month, NJM quotes for minimum coverage are 14% more expensive than average.

NJM insurance quotes vs. competitors

Full coverage

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $124 | ||

| NJM | $140 | ||

| American Family | $160 | ||

| Geico | $161 | ||

| Progressive | $169 | ||

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $124 | ||

| NJM | $140 | ||

| American Family | $160 | ||

| Geico | $161 | ||

| Progressive | $169 | ||

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $50 | ||

| American Family | $61 | ||

| Geico | $61 | ||

| Progressive | $66 | ||

| NJM | $73 | ||

NJM car insurance quotes are typically very affordable for high-risk drivers. This is especially true if you have a recent accident on your record.

Rates after an accident

$153/mo

$244/mo

Rates after a ticket

$188/mo

$202/mo

Rates after a DUI

$188/mo

$302/mo

Rates for drivers with poor credit

$246/mo

$308/mo

NJ Manufacturers car insurance discounts

NJMs rates are already affordable for most drivers. But the company's range of discounts means many people could reduce their car insurance bill even further.

You can get a discount from NJM insurance company if you:

- Take a defensive driving course

- Add comprehensive and collision coverages to your policy

- Bundle home and auto insurance with NJM

- Insuring multiple cars with NJM

- Own a car that's less than two years old

- Sign up for automatic payments or paying your annual bill in full

- Sign up for paperless billing

- Install an anti-theft or vehicle recovery device in your car

- Go to school full time and have a GPA of at least 3.0

- Are over the age of 65 and take a driving course

NJM discounts vary by state, so some may not be available to you.

NJ manufacturers auto insurance coverage

NJM offers extra coverage perks for drivers who get a full coverage policy with comprehensive and collision coverage.

Full coverage insurance from NJM automatically includes:

- New car replacement, which pays for a brand-new car if your new car is totaled in an accident.

- Pet coverage, which helps pay your pet's medical bills if you're in an accident while they're riding in your car.

- Transportation expense reimbursement pays up to $20 or $30 per day for a rental car while your vehicle is in the shop after a covered loss.

Most companies charge extra for these coverages, so NJM is a great option for people needing full coverage insurance.

Besides the liability coverages required by law, NJM Insurance offers extra protection you can add for an additional fee. NJM's coverage add-ons vary by state, but may include:

NJM accident forgiveness is only available in Pennsylvania.

It's a free perk that ensures your rate won't go up after your first at-fault accident. You can earn this perk after five years of no paid claims and three years without a ticket.

Gap insurance pays the difference between the balance on your loan or lease and your car's current value if it's totaled.

Classic car insurance protects special vehicles for an agreed-upon value determined by the owner and car insurance company. This is important because classic cars can be more expensive to fix or replace.

In comparison, car insurance typically pays claims based on a car's actual cash value.

NJM rental car coverage pays for you to rent a car, use a rideshare service or hire a taxi while your car is in the shop after an accident.

Drivers with comprehensive and collision coverage automatically get $20 or $30 per day of coverage. You can buy extra coverage to increase your limit to $100 per day, with a $4,000 maximum.

Rideshare insurance fills the gap between your car insurance policy and the commercial policy provided by your rideshare company.

NJM roadside assistance pays for emergency services such as towing, lost or damaged keys and refueling. NJM pays up to $75 or $125 per covered emergency.

NJM offers liability coverage for campers and trailers while towed by an insured vehicle.

Some companies include this as part of your base policy. But you'll need to buy extra coverage from NJM to protect yourself while towing your trailer or camper.

NJM auto insurance reviews and ratings

NJM has some of the best customer service reviews in the car insurance industry.

In general, you can expect NJM to help get you back on the road quickly after an accident.

NJM gets 81% fewer customer complaints than similar auto insurance companies, according to the National Association of Insurance Commissioners (NAIC). That means NJM customers are typically happier with their experience at the company than other drivers.

In addition, NJM earned the third-highest score on J.D. Power's annual claims satisfaction survey.

NJM customers don't have to worry about the company's ability to pay claims. NJM has an A+, or Superior, financial strength rating from AM Best. That means NJM should have enough money to pay customer claims, even in tough economic situations.

NJM home insurance review

NJM is an excellent choice for home insurance, especially if you own a high-value home or need extra coverage.

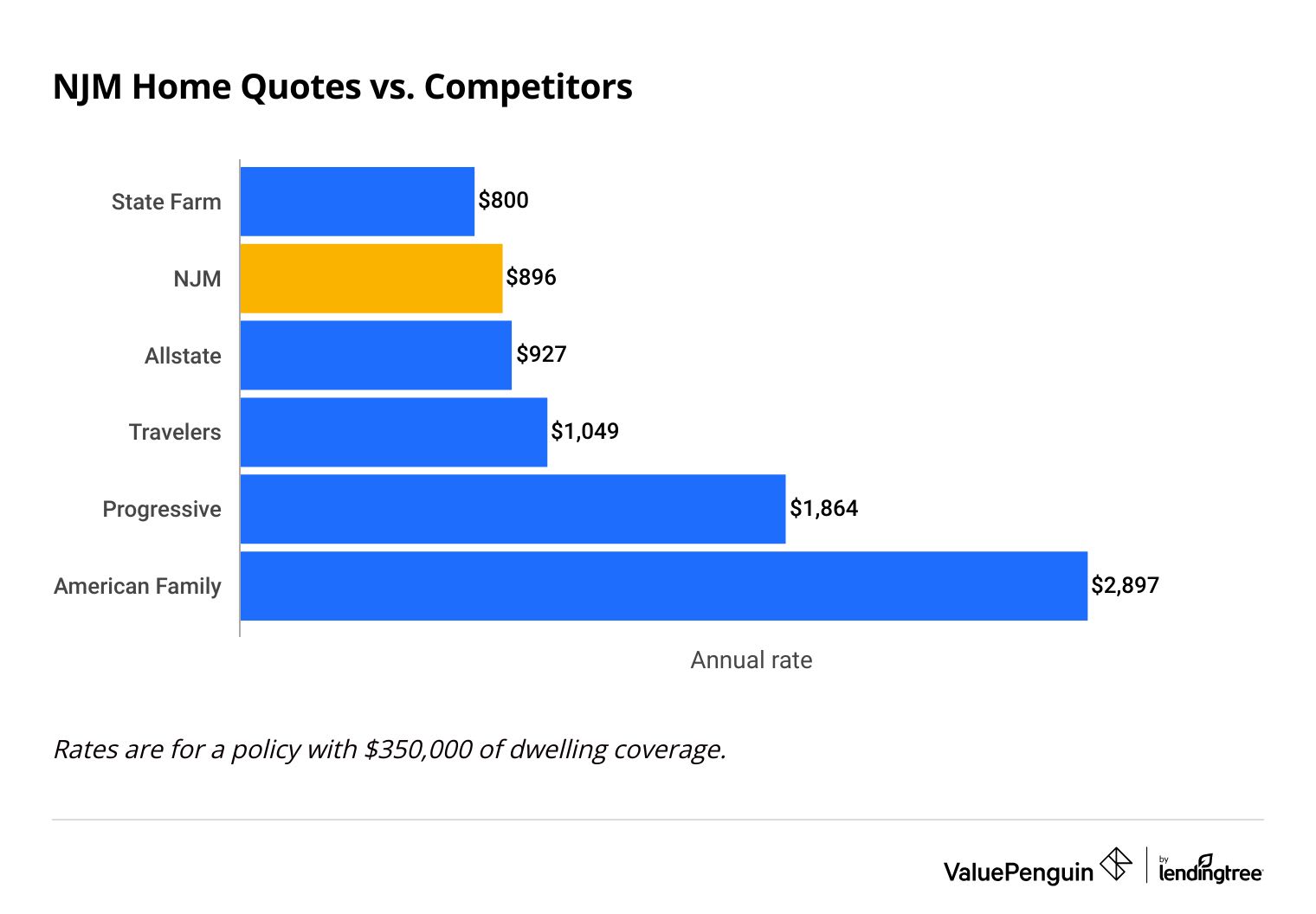

NJM home insurance quotes

Homeowners insurance from NJM is 21% to 25% cheaper than average.

NJM's home insurance is an excellent deal for higher-value homes. A policy with $350,000 of dwelling coverage costs $896 per year. That's $510 less expensive than average. And $500,000 of dwelling coverage from NJM costs $1,129 per year, which is $775 less than average.

Find Cheap Homeowners Insurance Quotes in Your Area

However, NJM might not be the best choice if you need less dwelling coverage.

NJM's rates for $200,000 of dwelling coverage are cheaper than average. But State Farm, Allstate and Traveler's all offer more affordable rates.

Homeowners insurance quotes by dwelling coverage amount

$200,000

$350,000

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $602 | ||

| Allstate | $710 | ||

| Travelers | $784 | ||

| NJM | $841 | ||

| Progressive | $1,459 | ||

| American Family | $2,012 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $602 | ||

| Allstate | $710 | ||

| Travelers | $784 | ||

| NJM | $841 | ||

| Progressive | $1,459 | ||

| American Family | $2,012 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $800 | ||

| NJM | $896 | ||

| Allstate | $927 | ||

| Travelers | $1,049 | ||

| Progressive | $1,864 | ||

| American Family | $2,897 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,065 | ||

| NJM | $1,129 | ||

| Allstate | $1,303 | ||

| Travelers | $1,513 | ||

| Progressive | $2,331 | ||

| American Family | $4,081 | ||

NJ manufacturers home insurance discounts

NJM offers a handful of discounts to help homeowners reduce their rates. NJM discounts vary by state. You may be able to get a home insurance discount from NJM if you:

- Bundle your home and car insurance with NJM

- Protect your home with smoke alarms or a sprinkler system

- Install a generator, storm shutters or hurricane glass

- Pay your annual bill in full or sign up for automatic payments

- Sign up to get bills and policy documents via email

- Are a non-smoker

- Are over the age of 65

NJM homeowners insurance coverages

NJM offers many ways for homeowners to upgrade their protection. NJM coverage add-ons vary by state but may include:

This coverage offers protection to a relative living in an assisted care facility. That means NJM will cover your relative against property damage or personal liability claims.

NJM's basic home insurance policy includes $500 worth of credit card fraud protection. This add-on expands that coverage to include up to $50,000 of forgery and counterfeit money coverage.

This coverage protects your home and belongings from earthquake damage. It's only available to homeowners in Maryland, New Jersey, Ohio and Pennsylvania.

An NJM home insurance policy covers up to $1,000 if someone sues your homeowners association (HOA). This add-on allows you to raise that limit if you're concerned about paying HOA assessments.

This coverage pays for the testing and removal of fungi, like mold. It also covers repairs for any damage caused by trying to access the fungi.

NJM identity fraud coverage pays up to $15,000 to cover expenses related to identity fraud.

A basic NJM policy covers belongings in a storage facility at up to 10% of your personal property limit, or $1,000, whichever is greater.

Adding this coverage allows you to upgrade to a higher limit if you have valuable belongings in storage.

This coverage pays for water damage due to backed-up plumbing and sump pump discharge or overflow.

Scheduled personal property provides coverage for expensive items, like jewelry and artwork. A basic homeowners insurance policy limits the amount of coverage for these items. Adding this protection ensures you can replace them if they're damaged, stolen or lost.

NJM also offers all of the standard coverages you would expect from a home insurance policy. That includes protection for your home's structure and your belongings.

NJM homeowners insurance reviews and ratings

NJ Manufacturers Insurance has excellent customer service reviews for its home and renters insurance.

NJM gets 86% fewer customer complaints than similar-sized home insurance companies, according to the National Association of Insurance Commissioners (NAIC). That means homeowners can expect NJM to have a quick and easy claims process.

In addition, the New Jersey Manufacturers Insurance Company earned an A+, or Superior, financial strength rating from AM Best. So, you don't need to worry about NJM's ability to pay claims, even in difficult economic times.

NJM renters insurance review

NJM renters insurance is affordable and offers many more coverage add-ons and discounts than most other companies.

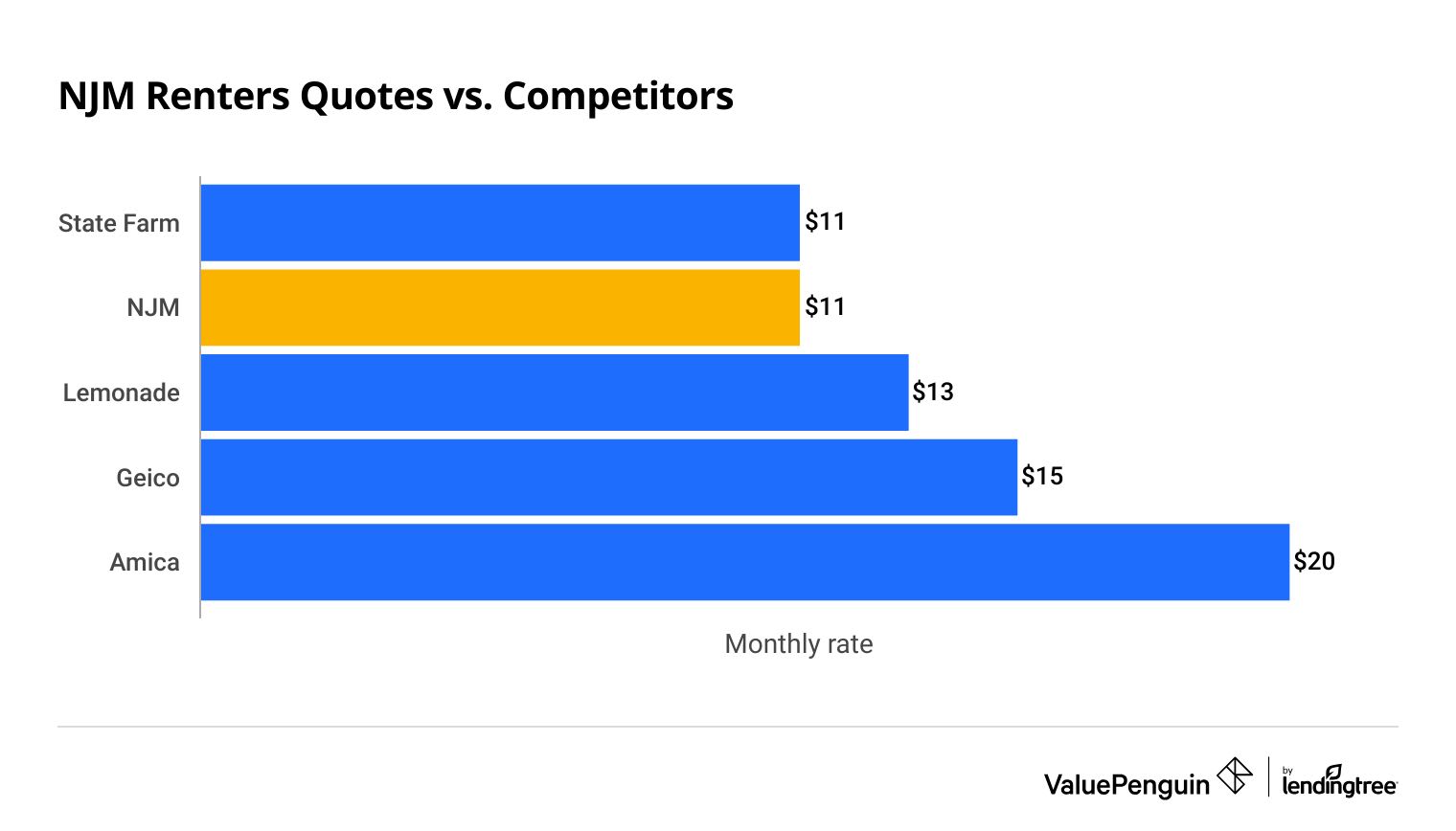

NJM renters insurance quotes

NJM renters insurance costs an average of $11 per month, making it one of the cheapest options for renters.

Find Cheap Renters Insurance Quotes in Your Area

The only company that's typically cheaper than NJM is State Farm. A policy from State Farm costs $5 less per year.

However, NJM offers many more coverage options than State Farm. The extra cost could be worth it if you need more protection than a basic policy offers.

NJM renters insurance rates vs. competitors

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $11 | ||

| NJM | $11 | ||

| Lemonade | $13 | ||

| Geico | $15 | ||

| Amica | $20 | ||

NJM renters insurance discounts and coverages

Most renters insurance companies offer few discounts. However, NJM is an exception. You can earn up to seven discounts to help make your renters insurance more affordable.

- Generator discount

- Multi-policy discount

- Non-smoker discount

- Paid-in-full or automatic payment discount

- Paperless billing discount

- Safety discount

- Senior discount

The renters insurance coverages offered by NJM are the same as its home insurance offerings.

In addition, NJM gives you the ability to extend your renters insurance coverage to roommates.

About NJM insurance group

New Jersey Manufacturers Insurance, or NJM, was founded in New Jersey in 1913. It is the 27th largest car insurance company in the country, despite only being available in 5 states.

In addition to auto, home and renters insurance, NJM offers:

Contact NJM Insurance customer service

The best way to contact NJM is by phone.

- Call NJM customer service at (800) 232-6600 to buy a policy, ask questions or contact roadside assistance.

- Call the NJM claims phone number at (800) 367-6564 to file a car, home, or renters insurance claim.

You can also email NJM via the form on its website.

Frequently asked questions

What does NJM Insurance stand for?

NJM stands for New Jersey Manufacturers Insurance.

Is NJM good insurance?

Yes, NJM is a great option for auto and home insurance. It has excellent customer service, affordable rates, and many extra coverage add-ons.

How much is full coverage insurance at NJM?

A full coverage policy from NJM costs $140 per month, on average. That's 15% cheaper than the national average.

Is NJM only for NJ residents?

No, NJM Insurance is available in Connecticut, Maryland, New Jersey, Ohio and Pennsylvania.

Does NJM raise rates after an accident?

NJM raises full coverage rates by around 9% after an at-fault accident. That's a much smaller increase than most other companies. The average rate increase after a car accident nationally is 49%.

Is NJM cheaper than Geico?

NJM car insurance can be cheaper than Geico, depending on the coverage you need and your driving history.

Full coverage from NJM costs $140 per month, which is $21 per month less than coverage from Geico. But minimum coverage from NJM costs $73 per month, which is $12 per month more than a policy from Geico.

Methodology

Auto insurance

ValuePenguin gathered quotes from thousands of ZIP codes across the U.S. to compare car insurance rates. Rates are for a single 30-year-old man with a clean driving record and good credit who owns a 2015 Honda Civic EX.

Quotes are for a full coverage policy with comprehensive and collision coverage and higher liability limits than each state requires.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per person

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: State requirement

- Comprehensive and collision deductible: $500

Home insurance

To compare homeowners insurance rates, ValuePenguin gathered quotes from ZIP codes across New Jersey based on a 45-year-old married man with average credit living in a home built in 1977. We compared quotes with dwelling coverage limits of $200,000, $350,000 and $500,000. Quotes policies also include the following coverage limits:

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Renters insurance

To compare renters insurance quotes, ValuePenguin compiled quotes from five of the largest cities in New Jersey. Quotes are for a 25-year-old man who lives alone, has no history of claims and is a non-smoker. Quotes are for the following coverage limits:

- Personal property: $30,000

- Personal liability: $100,000

- Medical payments: $5,000 or highest available

- Deductible: $500

ValuePenguin uses Quadrant Information Services to collect auto and home insurance rates. These rates were publicly sourced from insurance company filings; you should use them only for comparative purposes. Your quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.