United Automobile Insurance Company (UAIC) Review

UAIC specializes in car insurance for high-risk drivers. But it's typically a poor choice because of limited coverage and lots of customer complaints.

Find Cheap Auto Insurance Quotes from Companies like UAIC

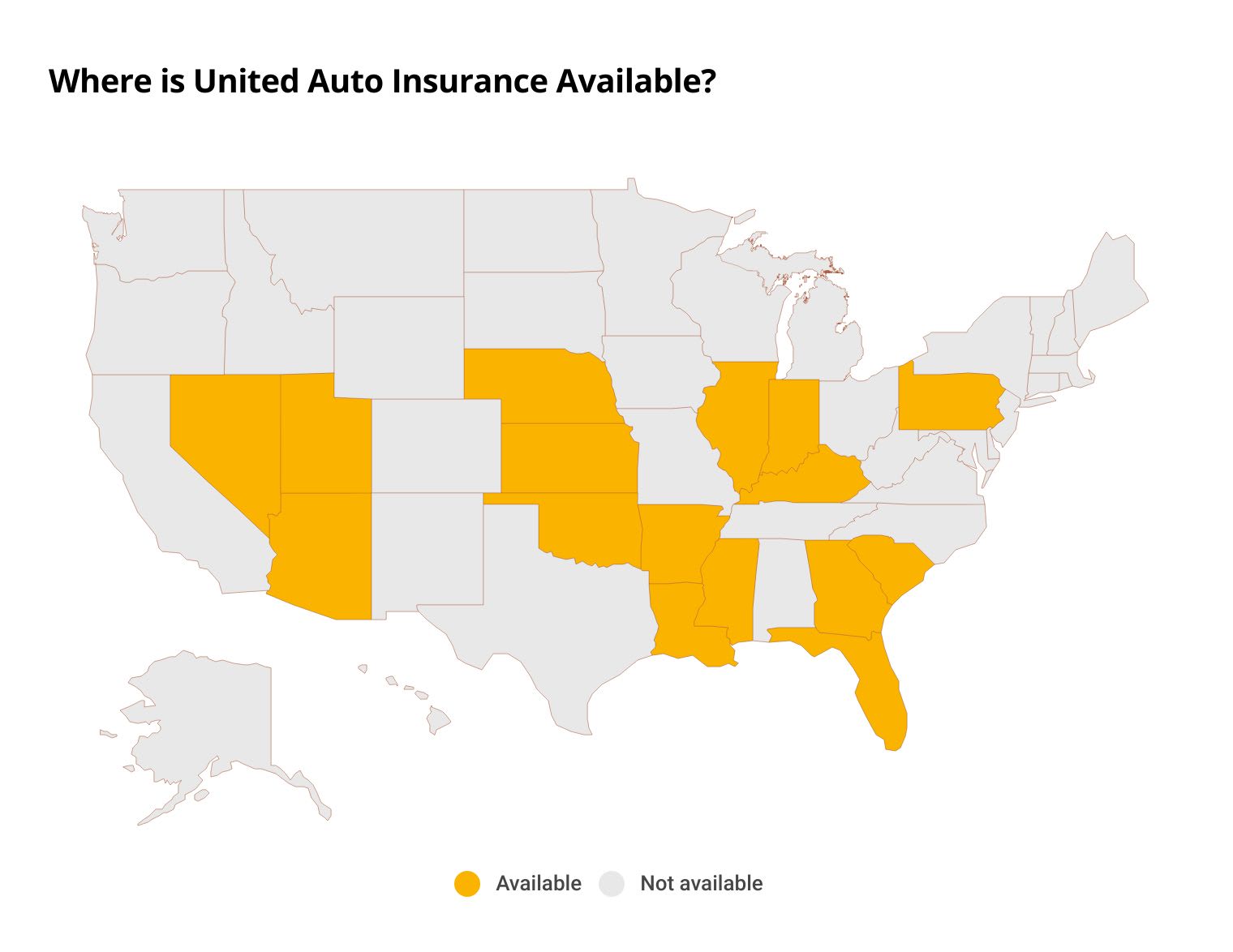

United Automobile Insurance Company (UAIC) is a regional company serving mostly high-risk drivers in 16 states.

UAIC has affordable rates after a speeding ticket or accident, but most people can find cheaper coverage elsewhere. In addition, the company has hundreds of complaints about its poor customer service and claims support. For these reasons, we recommend most drivers buy car insurance from another company.

Pros and cons

Pros

Insures high-risk drivers

Offers SR-22 and FR-44 filings

Cons

Lots of customer complaints

Limited availability

Few coverage options

United Auto Insurance quotes

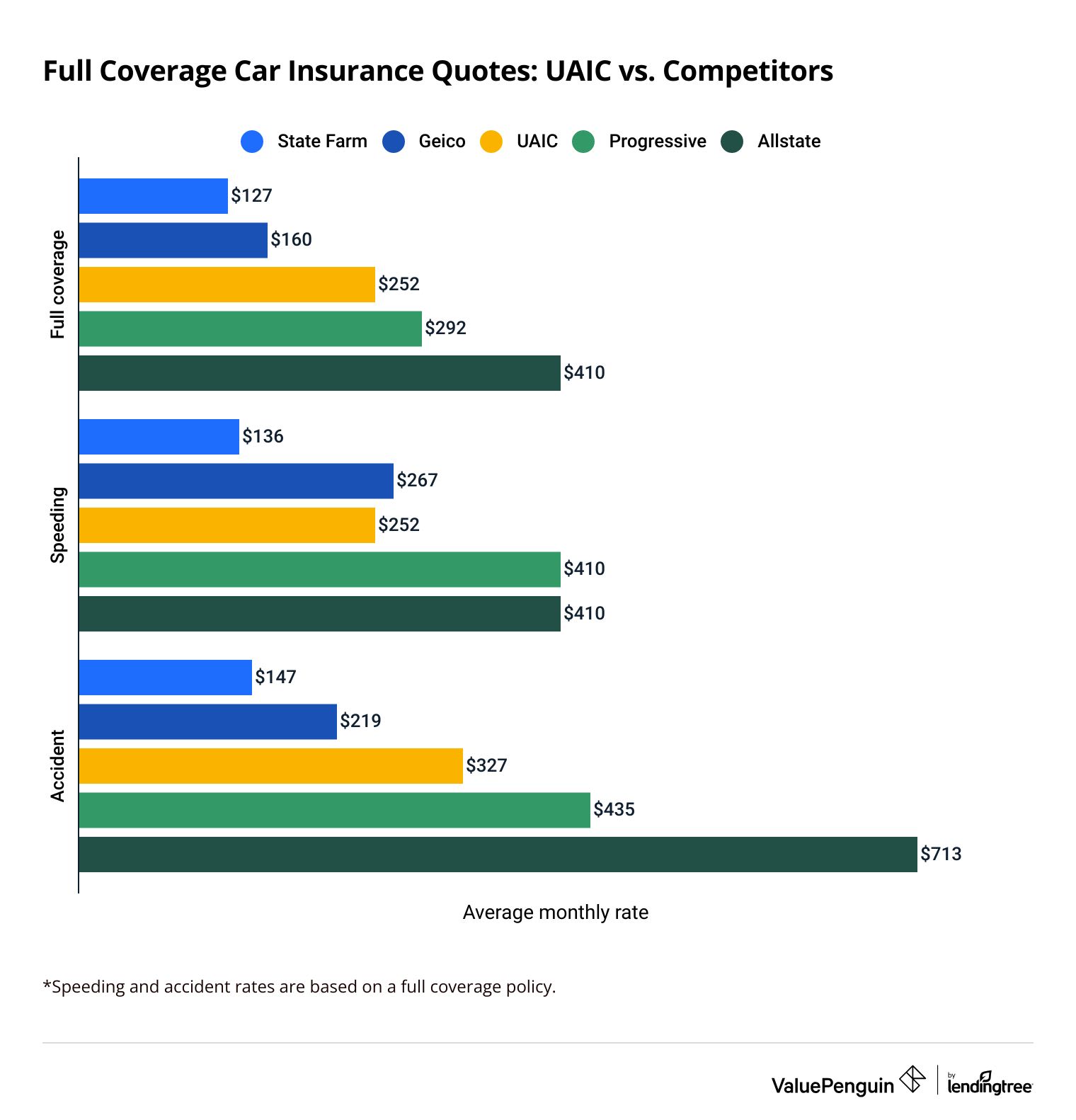

United Automobile Insurance has affordable rates for drivers with a speeding ticket or accident on their record.

Full coverage quotes from UAIC are 14% cheaper than average for drivers with a recent speeding ticket, and 11% cheaper than average after an at-fault accident.

Most drivers can find cheaper rates from another company, regardless of driving record. In most cases, State Farm and Geico offer more affordable rates than UAIC.

Find Cheap Auto Insurance Quotes in Your Area

United Auto Insurance isn't a good choice for people with a clean driving record.

Both full coverage and minimum coverage rates from UAIC are more expensive than average for these drivers.

United Auto Insurance quotes vs. competitors

Full coverage

Speeding

Accident

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $127 | ||

| Geico | $160 | ||

| UAIC | $252 | ||

| Progressive | $292 | ||

| Allstate | $410 | ||

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $127 | ||

| Geico | $160 | ||

| UAIC | $252 | ||

| Progressive | $292 | ||

| Allstate | $410 | ||

Speeding

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $136 | ||

| UAIC | $252 | ||

| Geico | $267 | ||

| Progressive | $410 | ||

| Allstate | $410 | ||

Speeding ticket rates are for a full coverage policy.

Accident

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $147 | ||

| Geico | $219 | ||

| UAIC | $327 | ||

| Progressive | $435 | ||

| Allstate | $713 | ||

Accident rates are for a full coverage policy.

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| Geico | $36 | ||

| State Farm | $38 | ||

| UAIC | $125 | ||

| Progressive | $125 | ||

| Allstate | $180 | ||

UAIC discounts

UAIC doesn't advertise any discounts on its website. You'll have to call an agent to find out which discounts you may be eligible for.

United Automobile Insurance coverage

United Automobile Insurance offers very basic car insurance coverage.

In addition to the coverage required by your state, UAIC offers standard comprehensive and collision coverage to protect your own car against damage. Otherwise, there are only a few add-ons you can choose from:

- Rental car reimbursement, which helps cover the cost of a rental while your car is in the shop after an accident.

- Towing coverage, which helps pay for your car to be towed to a mechanic if you break down on the side of the road.

UAIC's website has very little information about the coverage it offers. You have to contact an agent to find out what options are available in your state.

United Automobile Insurance Company reviews

UAIC's negative customer reviews and unstable financial outlook are both concerning.

Most of UAIC's customer reviews center around its extremely long claims process and claim denials.

The company gets 24 times as many complaints as competitors of a similar size, according to the National Association of Insurance Commissioners (NAIC). Customers noted support reps didn't return calls promptly or at all. Many claims were denied, delayed for months or not settled in a satisfactory way.

United Automobile Insurance has been Not Rated with A.M. Best since 2016, when it withdrew from A.M. Best's financial scoring. However, its Financial Strength Rating was graded "Weak" with a "Negative" outlook from 2013 to 2015. This means UAIC might have a difficult time paying out future claims.

We recommend that drivers choose a company with an "Excellent" or "Superior" Financial Strength Rating from A.M. Best, like State Farm, Geico, Progressive or Allstate.

These companies have the funds to pay customer claims, so you don't have to worry about your insurance company running out of money in an emergency.

About United Automobile Insurance Company

UAIC began underwriting auto insurance policies in Miami, in 1989. It has hundreds of local agents in Florida, Georgia and Texas. The company has since expanded and is licensed in 16 states.

UAIC provides car insurance in:

To get in touch with UAIC, you'll have to contact customer service in your state during standard business hours in the Eastern Standard time zone. There's no agency or broker locator tool on the UAIC website.

- Florida: (305) 940-5022

- Georgia: (770) 209-9710

- Texas: (866) 223-0668

- All other states: (305) 940-5022

The UAIC phone system isn't very easy to use. There isn't a general customer service line, so it may be hard to find someone to answer basic questions about your policy.

How to file a claim with UAIC

To file a claim with United Automobile Insurance, you can use the online claims portal, available 24/7. Or you can call the claims department, which is typically available from 8 a.m. to 5 p.m. Eastern for claim updates, and 8 a.m. to 6 p.m. Eastern for new claims.

- Florida: (305) 940-7299

- Georgia: (770) 209-9710

- Texas: (800) 450-8247

- All other states: (800) 344-2150

Frequently asked questions

Is UAIC auto insurance legit?

United Auto Insurance is a legitimate company. However, its financial situation is concerning. It hasn't earned a Financial Strength Rating from A.M. Best since 2016, which means it may have trouble paying out claims in the future. Most drivers can find cheaper rates and better customer service elsewhere.

Does United Automobile Insurance have good customer service?

No, UAIC has very poor customer service. The company gets hundreds of complaints each year about its slow claims process. And many customers also complain about their claims being denied. Most drivers can get better car insurance from another company.

How much does car insurance from United Auto Insurance cost?

A full coverage car insurance policy from UAIC costs around $252 per month, which is fairly average. The company offers competitive rates to drivers with an accident or speeding ticket. But most people can still find cheaper car insurance elsewhere.

Methodology

To compare the costs of UAIC auto insurance, ValuePenguin collected quotes from ZIP codes across the state of Florida. Rates are based on a 30-year-old single man with good credit and a clean driving record who owns a 2015 Honda Civic EX.

Quotes are for a full coverage policy with comprehensive and collision coverage, along with higher liability limits than the state minimum requirement.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist coverage: $50,000 per person and $100,000 per accident

- Personal injury protection: $10,000

- Comprehensive and collision deductibles: $500

Minimum coverage quotes are for the minimum liability insurance required in Florida.

Rates were collected using insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.