Aetna Medicare Advantage Plan Review (2024)

Aetna's Medicare Advantage plans have cheap rates and impressive benefits. But you can find better service with other companies.

Compare Medicare Plans in Your Area

Aetna is a good option for Medicare Advantage, especially if you want a cheap plan. The company estimates that 84% of people eligible for Medicare in the country can get a $0-per-month Aetna plan. All plans have hearing, dental and vision coverage, too. But Aetna's customer satisfaction is slightly lower than some other companies, like UnitedHealthcare and Humana.

Pros

Cons

Cost of Aetna Medicare Advantage plans

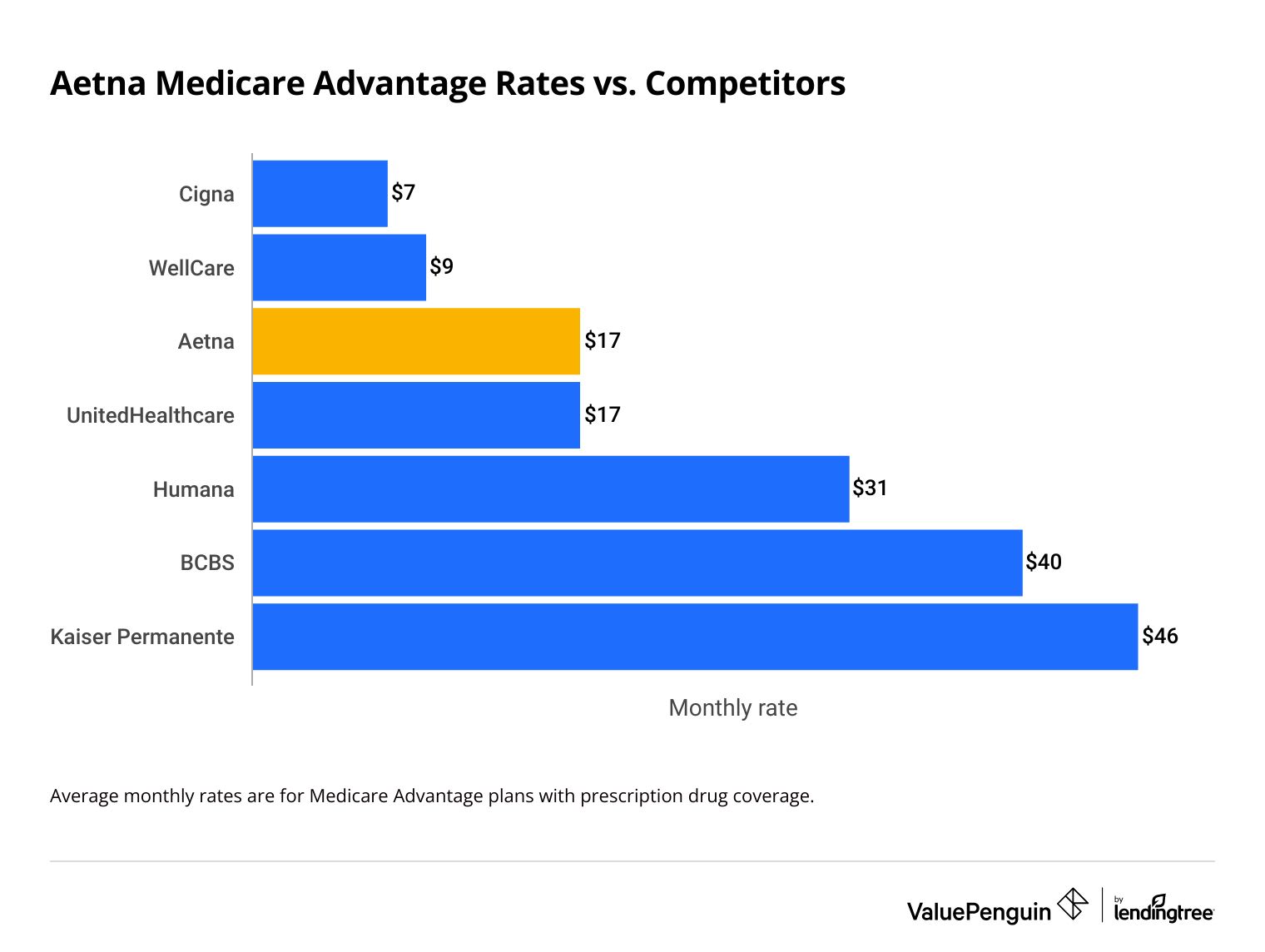

Aetna Medicare Advantage plans with prescription drug coverage cost an average of $17 per month.

That's $10 cheaper per month than the national average cost of Medicare Advantage plans, which is $27 per month. Cigna and Wellcare sell cheaper plans, but they aren't available in as many states and the coverage isn't as high-quality as Aetna's plans.

Compare Medicare Plans in Your Area

If you have access to both Aetna and UHC, it's worth getting a quote from both to compare rates and coverage. Aetna and UnitedHealthcare (UHC) are both good, cheap options. Both companies sell plans with good coverage and perks.

But UnitedHealthcare's plans have a slightly higher quality rating from the Centers for Medicare & Medicaid Services (CMS). Aetna's plans have an average score of 3.75 out of 5, while UHC's plans average 4 out of 5 stars.

Aetna Medicare Advantage plan rates vs. other top companies

Rates differ depending on where you live. Aetna sells plans in most states, but its average rates are higher than normal in Delaware, Maine, New Jersey, Ohio and Washington, D.C. If you live in one of these states, Aetna probably isn't a cheap option for you.

Aetna Medicare Advantage benefits and perks

Aetna's Medicare Advantage plans come with impressive extra benefits, including good prescription drug coverage, a nurse line and fitness perks.

One of Aetna's most impressive perks is that all of its Medicare Advantage plans cover hearing, dental and vision care. You don't need to sort through the plans to make sure you get these coverages. No matter what plan you choose, you'll be covered.

You'll also have immediate coverage for most generic drugs with any Aetna Medicare Advantage plan. That's because all plans have a $0 deductible for most cheap generic drugs, called "Tier 1" and "Tier 2" drugs. Some plans have a $0 deductible for more expensive drugs, like name-brand or specialty medications.

Some of Aetna's other perks include:

- 24/7 nurse line: If you have questions about your health, you can call and speak to a registered nurse any time of day and any day of the week. Aetna's nurse line phone number is 800-556-1555.

- Care management: Aetna offers several tools to manage health care needs, ranging from helping you prepare for doctor appointments to providing help with managing medical conditions. For example, the National Medical Excellence program provides case managers who can help guide you through the organ or stem-cell transplant process.

- Healthy Home Visit: All Aetna Medicare Advantage plans cover one home visit per year through a company called Signify Health. The visit includes a physical exam and health assessment. And the medical professional can help you find ways to stay healthy at home, like installing handrails and other safety devices.

- Prescription home delivery: If you have a prescription that you fill often, you may want to consider the CVS Caremark Mail Service Pharmacy, which allows you to fill up to a 100-day prescription when you have an Aetna Medicare Advantage plan with prescription drug coverage.

- Resources For Living: This connects you to someone who can help you handle your health care needs or the needs of a loved one. Resources For Living can help you with meal services, home modifications, finding support groups or fitness classes, securing backup caregiver support and more. The program is a part of all Aetna Medicare Advantage plans.

- Fitness: Aetna Medicare Advantage plans come with free access to SilverSneakers, which offers virtual and in-person fitness classes geared toward those 65 and older. You can also get Apple Fitness+, which gives you access to virtual workouts and guided meditations, for free.

You shouldn't buy a plan just because of the perks. But if you're torn between two companies, the perks could help you decide which to choose.

Aetna Medicare Advantage plan options and types

You can buy an Aetna Medicare Advantage plan with or without drug coverage. And every Aetna Medicare Advantage plan has dental, vision and hearing coverage. The specifics of your coverage, including your monthly cost deductible and out-of-pocket maximum will depend on the plan you choose.

The main difference between Aetna Medicare Advantage plans is the provider networks. Aetna sells HMO, HMO-POS and PPO Medicare Advantage plans.

- HMO plans require you to have a primary care doctor and use in-network doctors except in emergencies. You may also need a referral to see a specialist.

- PPO plans don't require you to have a primary care doctor and you don't need a referral to see a specialist. You can seek care outside of the network of preferred providers, but it will still likely be at a higher cost.

- HMO-POS plans still have a provider network, but you can get out-of-network care at a higher cost. Like HMOs, HMO-POS plans require a primary care doctor and may require referrals to see specialists.

Each network type comes with its own pros and cons. For example, Aetna's HMO plans tend to cost less but limit your options for care to in-network offices. PPO plans let you get out-of-network care, but you'll likely pay a higher monthly rate for the flexibility.

Other Aetna Medicare Advantage plans

Aetna also offers the Medicare Eagle plan for veterans. All Aetna Medicare Eagle plans have a $0 monthly rate and let you see your primary doctor or go to a walk-in location without a copay. But Eagle plans don't have prescription drug coverage, so they might not be good if you take medications.

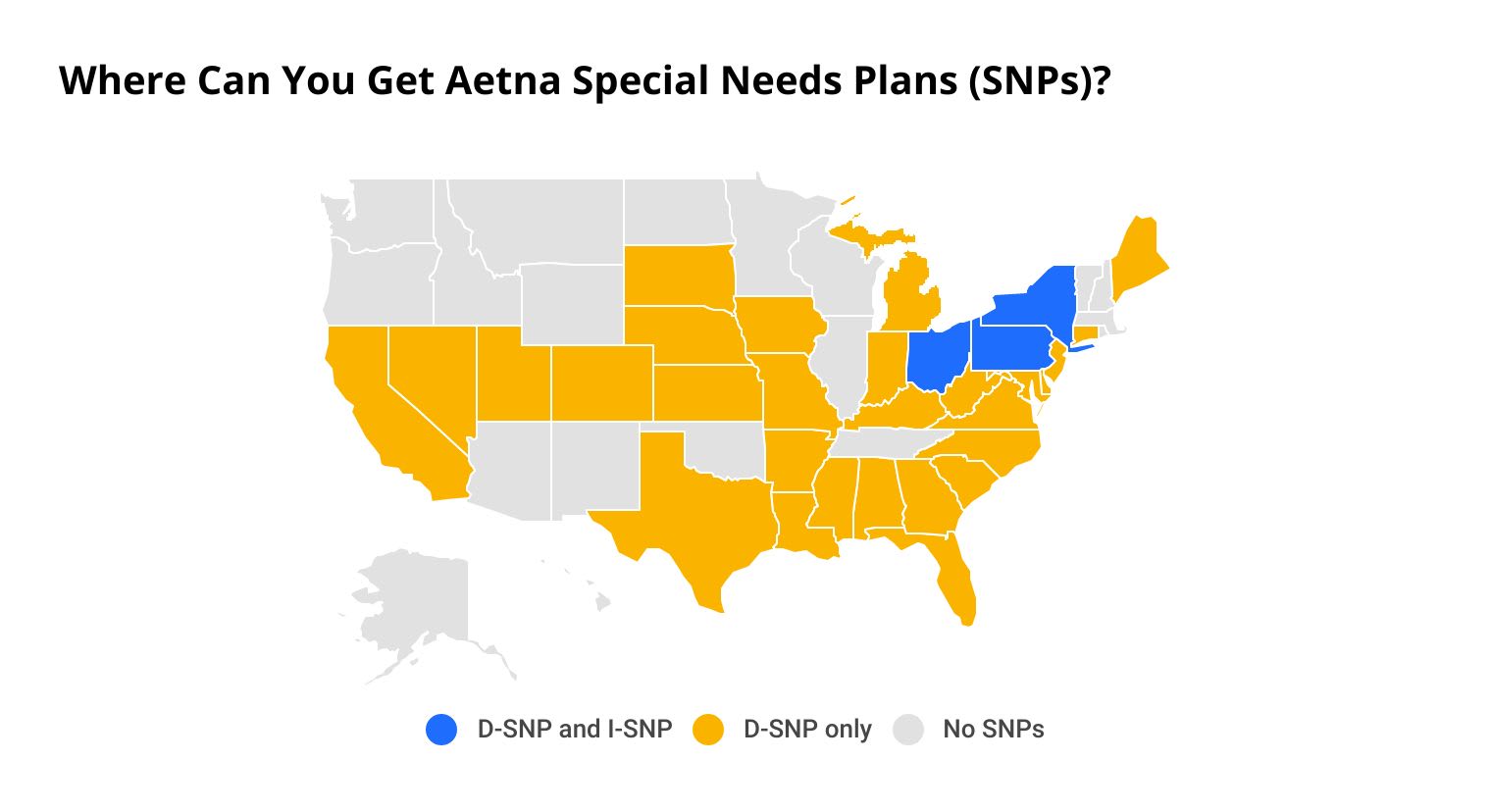

And Aetna offers two kinds of Medicare Special Needs Plans, or SNPs. These plans are Medicare Advantage plans geared toward groups of people with more specific healthcare needs.

- D-SNP: Also called a Dual-Eligible Special Needs Plan, this plan helps people who qualify for both Medicare and Medicaid get the most out of their coverage.

- I-SNP: This plan is also called an Institutional Special Needs Plan. It's for people who are in nursing homes or rehab facilities for more than 90 days straight. People who need the same level of care at home can also get an I-SNP.

Where can I buy Aetna Medicare Advantage plans?

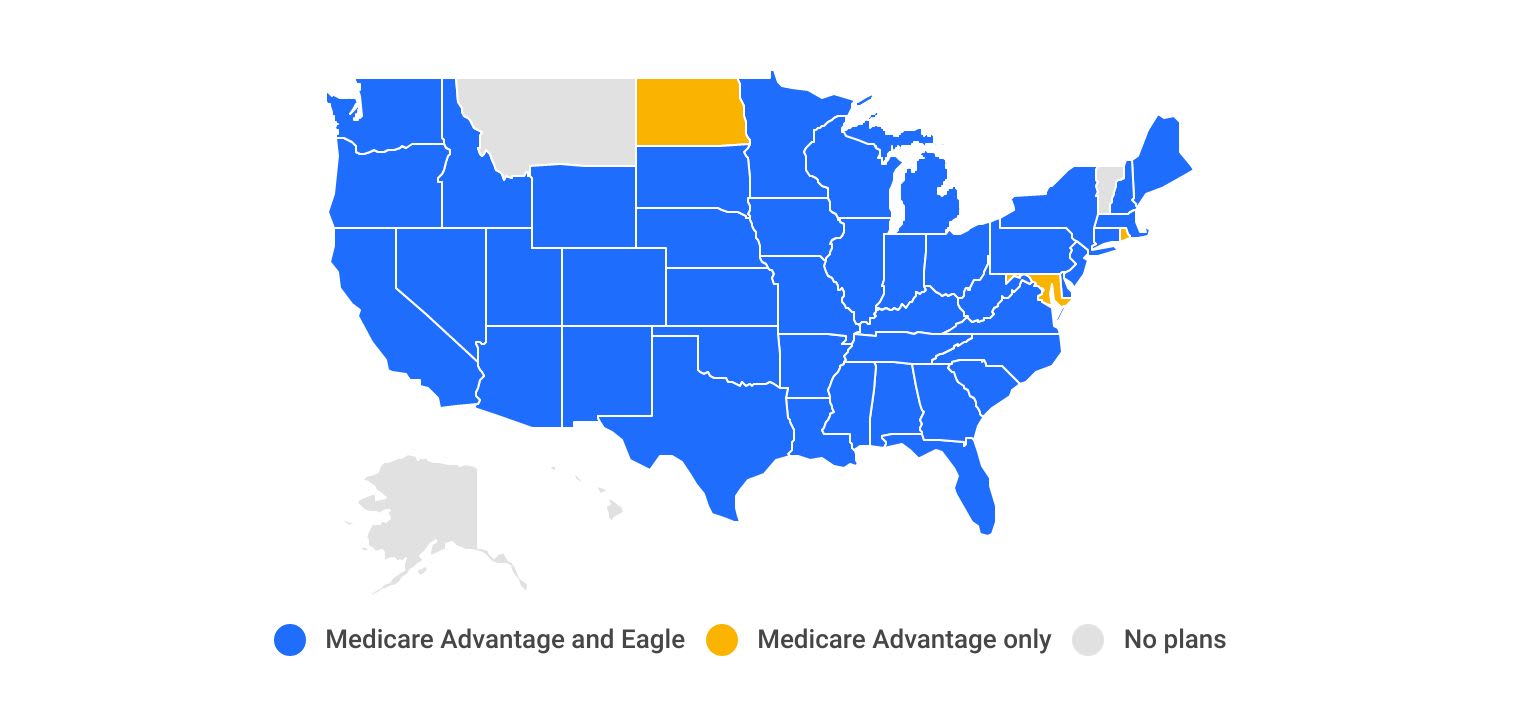

Aetna sells Medicare Advantage plans in nearly every state.

Alaska, Hawaii, Montana, and Vermont are the only states where you can't buy an Aetna Medicare Advantage plan with prescription drug coverage.

Aetna's Medicare Eagle option for veterans is available in 43 states. Only seven states and Washington D.C. don't have access to these plans:

- Alaska

- Hawaii

- Maryland

- Montana

- North Dakota

- Rhode Island

- Vermont

- Washington, D.C.

Aetna's Dual-Eligible Special Needs Plan (D-SNP) is available in 31 states.

Aetna introduced the Aetna Medicare Longevity Plan, which is an Institutional Special Needs Plan (I-SNP) in 2023. At the time, coverage was only available in Pennsylvania. For 2024, Aetna offers I-SNP plans in New York, Ohio and Pennsylvania.

Aetna Medicare Advantage customer reviews and complaints

Overall, Aetna has average service and quality reviews. Its service isn't bad, but you can probably find a company that has better customer experience and equally good plans.

Aetna's overall Medicare Advantage plan star rating is 3.75 out of a possible 5, which is on par with the national average. Aetna's score for customer service is 4 out of 5. But Aetna has issues in a few important categories, including getting appointments quickly and getting the care you need.

But Aetna scored slightly below average for customer satisfaction in J.D. Power's 2023 U.S. Medicare Advantage Study. The company was rated below average in three of the four states that it was ranked in.

Frequently asked questions

Is Aetna Medicare Advantage good?

Aetna's Medicare Advantage plans are a good choice for most people. The plans are cheap and have good coverage and perks. But the company has average customer service, and you can probably find a good plan with better service elsewhere.

Is Aetna Medicare the same as Original Medicare?

No. Original Medicare refers to Parts A and B, which are sold by the federal government. Aetna sells Medicare Advantage plans, also called Medicare Part C, which are bundled Medicare insurance plans that combine hospital coverage, outpatient coverage and, usually, drug coverage into one plan. Medicare Advantage coverage is at least as good as buying Parts A and B separately, and you may get extra benefits like vision, dental and hearing coverage.

How do I pick an Aetna Medicare Advantage plan?

First, decide what kind of coverage you need. If you take medications, for example, look for a plan that has good drug coverage. Next, make sure that the doctors and hospitals you want to use are in the plan's network. If you want a cheap plan and don't mind having less flexibility in the doctors you see, choose an HMO. If you want to be able to see specialists without a referral, look at PPO plans. Finally, compare the rates and perks of the plans that fit your needs.

Methodology

Medicare Advantage rates are from Medicare.gov and the Centers for Medicare & Medicaid Services (CMS). Rates are for Medicare Advantage plans that include prescription drug coverage. Special Needs Plans, Part-B-only plans, sanctioned plans, PACE plans, prepayment plans (HCPPs), Medicare savings account (MSA) plans, Medicare-Medicaid plans and employer-sponsored plans are not included in our analysis.

Medicare Advantage star ratings were sourced from the public use files provided by CMS. The ratings include all 2024 Aetna Medicare Advantage plans, including plans sold by CVS Health and Allina Health.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.