Bristol West Auto Insurance Review

Multiple policy options and discounts can make Bristol West a good choice for high-risk drivers. But good drivers can find better rates elsewhere.

Find Cheap Auto Insurance Quotes in Your Area

Bristol West provides car insurance to high-risk drivers who struggle to get coverage elsewhere.

For most drivers, Bristol West's combination of expensive rates and poor customer satisfaction means you should consider other car insurance companies.

However, Bristol West can be a good option for risky drivers who need a nonstandard insurance company because of a DUI or multiple accidents. Discounts and benefits are more generous at Bristol West than at a typical high-risk insurance provider, so drivers may find perks they can't get elsewhere.

Pros and cons

Pros

Great for high-risk drivers

Offers SR-22 insurance

Cons

High rates

Poor customer service

Bristol West insurance: Our thoughts

Bristol West is a nonstandard insurance company that can be a good option for:

- Drivers with poor credit or no credit

- New drivers who haven't had insurance before

- Those who've had multiple traffic violations, accidents or a DUI

- Drivers who need an SR-22

If you are having problems finding coverage at another company, Bristol West may issue you a policy. However, all drivers should watch out for the company's expensive rates and poor reviews. Current policyowners are unhappy with their coverage, and the company has received four times as many complaints as a similarly sized company.

Bristol West has helpful coverage options that are not usually available to high-risk drivers who are using a nonstandard company. This includes ridesharing coverage and nonowner policies. Discounts are also available to help you lower your rates.

Bristol West sells car insurance in most states, and the company is a subsidiary of Farmers Insurance.

Bristol West auto insurance quotes

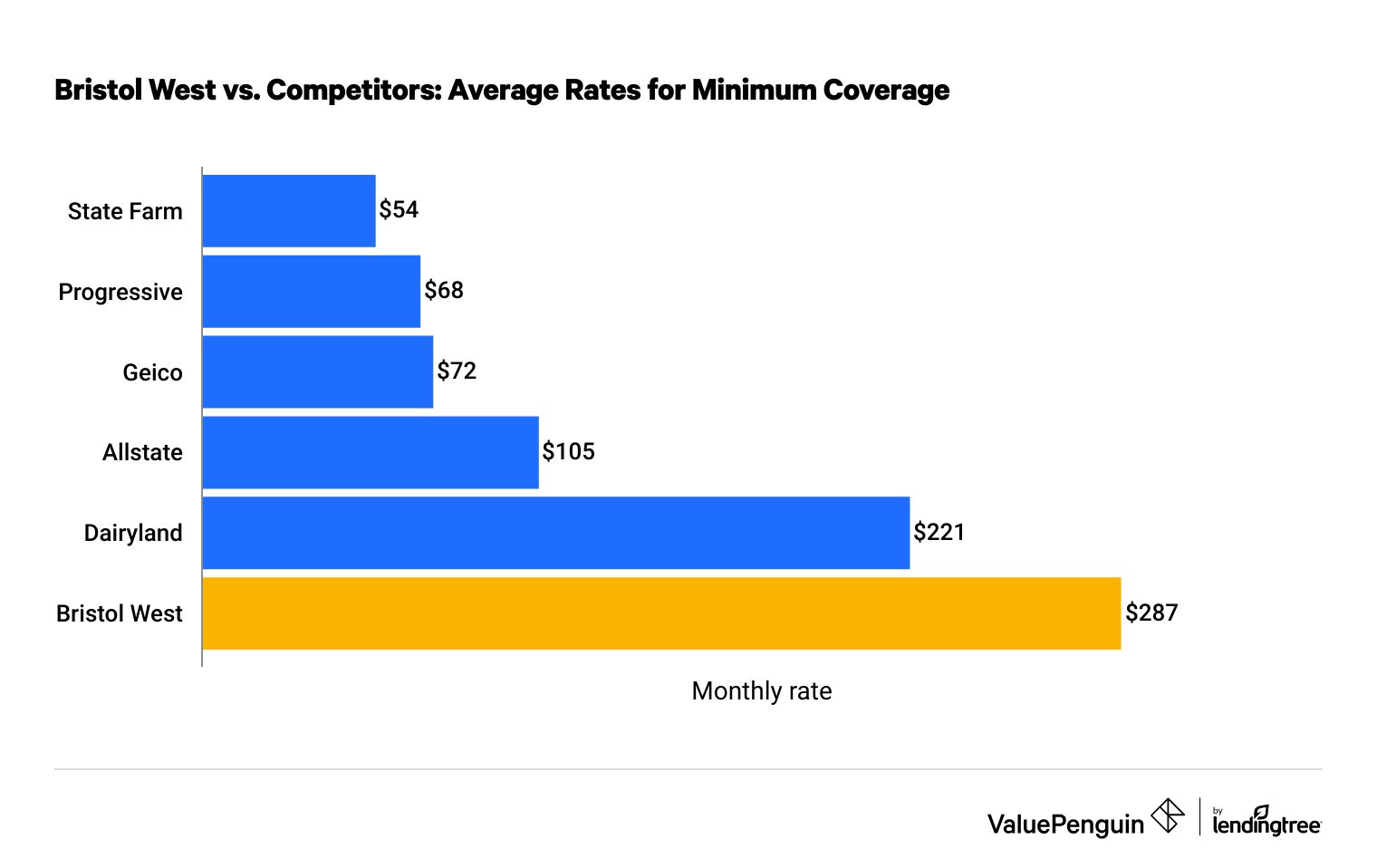

Bristol West's car insurance costs an average of $287 per month for minimum coverage with a clean driving record.

Car insurance quotes at Bristol West are consistently more expensive than quotes from top competitors.

Nonstandard insurance companies, which cater to drivers with past violations, often charge higher rates than major insurance companies. So if you're able to get a policy with a standard company, you'll usually pay less.

For high-risk drivers who are struggling to find coverage, it's a good idea to compare quotes at several nonstandard insurance companies, including Dairyland, which is cheaper than Bristol West.

Find Cheap Auto Insurance Quotes in Your Area

For a driver with a clean record, Bristol West is at least five times more expensive than State Farm, one of the cheapest car insurance companies.

Bristol West car insurance cost vs. competitors

Company | Minimum coverage | Full coverage | |

|---|---|---|---|

| State Farm | $54 | $123 | |

| Geico | $72 | $176 | |

| Progressive | $68 | $205 | |

| Allstate | $105 | $214 | |

| Dairyland | $221 | $447 | |

| Bristol West | $287 | $725 | |

Monthly rates

Bristol West vs. competitors: Cost after driving incidents

Bristol West can cost more than $900 per month for full coverage after a driving violation such as a speeding ticket or a DUI.

Bristol West's rates are much more expensive than other companies' rates, which are typically between $100 and $300 per month.

Company | Speeding ticket | DUI |

|---|---|---|

| State Farm | $130 | $130 |

| Progressive | $259 | $247 |

| Allstate | $278 | $297 |

| Geico | $176 | $414 |

| Dairyland | $708 | $447 |

| Bristol West | $939 | $902 |

Monthly rates for full coverage

For drivers who have poor credit, full coverage from Bristol West costs an average of $725 per month. That's also higher than what major insurance companies charge.

Bristol West insurance discounts

Bristol West has a basic set of car insurance discounts available. The company does not advertise how much you can save, but you can lower your rates with the following discounts.

- Setting up automatic payments

- Going paperless

- Having a good driving record for three years

- Bundling policies for multiple vehicles (two or more cars, mobile home, motorcycle)

- Bundling Bristol West car insurance with a policy from Farmers or Foremost, such as home insurance

Bristol West car insurance coverage

Bristol West has car insurance coverage options that are not always available with a nonstandard insurer. This can give you more choices beyond the standard benefits so you can customize the policy to your needs.

For example, you can get ridesharing and food delivery insurance so you'll be covered if you use your car for Uber, Lyft, Uber Eats or other apps.

There's also the option to get a nonowner car insurance policy if you don't have a car but need car insurance because you're borrowing a car or you need to show proof of insurance for an SR-22.

Bristol West coverage options

- Liability for bodily injury and property damage: Liability insurance is a required part of car insurance in most states. It pays for the damage and injuries that you cause to others.

- Comprehensive and collision: Collision will pay to repair your car no matter who causes the accident. Comprehensive will cover damage to your car from something like a fallen tree limb, or if it's stolen. Because of the high cost of car repairs, we recommend getting comprehensive and collision coverage if your car is worth more than $5,000. These standard parts of full coverage car insurance are required if you have a car loan or lease.

- Uninsured and underinsured motorists: This coverage will pay for your car repairs and medical bills if they're caused by someone who was driving without insurance or who didn't have enough insurance to cover your costs. It's required in 20 states and the District of Columbia.

- Medical payments: Coverage for medical payments helps to pay the medical bills for you and your passengers after a car accident. Bristol West offers coverage up to $10,000.

Bristol West car insurance add-ons and unique coverages

- Towing and roadside assistance: If you add on coverage for roadside assistance, Bristol West will cover the cost of a tow truck or other roadside help if you break down. The policy will specify how many miles or how many assistance calls will be covered.

-

Rental reimbursement: With this add-on option, your insurance will help pay for alternative transportation if your car is in the shop after an accident. Bristol West's coverage includes up to $50 per day for up to 30 days.

- Nonowner policies: A nonowner policy is a way to get insurance if you don't have a car but still need insurance because you often borrow cars or need to show proof of insurance after a major driving violation such as a DUI.

- Rideshare coverage: Adding on rideshare coverage will give you protection if you earn money with your car. Bristol West's rideshare coverage applies to both if you're driving passengers in your car and if you're using your car for deliveries.

- Trailer coverage: With Bristol West, you'll get liability coverage for trailers automatically included in your policy. So if you're using your car to tow a trailer you own, you'll have coverage for up to $500 in property damage.

Customer service reviews and ratings

Bristol West has poor customer satisfaction and a high rate of complaints.

Bristol West receives more than four times as many formal complaints as an average company of its size, according to the National Association of Insurance Commissioners (NAIC).

This means that Bristol West is one of the worst-performing subsidiaries of Farmers Insurance, which generally has a good customer service reputation.

Additionally, many customers are vocal online about the different types of problems they've had with Bristol West insurance. Customers have shared issues with billing, claims, customer service and more.

However, Bristol West has a strong financial footing, earning an A rating from AM Best. This means that the company has "excellent" financial strength and is very likely to have enough funds to pay out its claims.

Frequently asked questions

Is Bristol West expensive car insurance?

Yes, Bristol West is expensive for most drivers. Minimum coverage costs an average of $287 per month, which is five times more expensive than State Farm.

What is Bristol West good for?

Bristol West is good for drivers who are having trouble finding insurance because of issues such as multiple accidents, a DUI or not having credit. It's owned by Farmers, a major insurer, so it has more features and better financial stability than other nonstandard insurance companies.

Who owns Bristol West insurance?

Bristol West is owned by

Methodology

ValuePenguin collected car insurance quotes from Bristol West and top competitors for a 30-year-old male in South Carolina who drives a 2015 Honda Civic EX. Average rates are based on thousands of quotes across every ZIP code in the state for a driver with a clean record, a speeding ticket or a DUI. The driver has good credit unless otherwise noted.

All quotes used auto insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should only be used for comparison. Your own quotes will be different.

Additional sources include AM Best, customer feedback and the National Association of Insurance Commissioners.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.