Best Cheap Car Insurance for Women

Find Cheap Auto Insurance Quotes

State Farm has the best cheap car insurance for most women based on its affordable rates, dependable service and national availability.

Travelers has cheaper rates overall, but its customer service is less dependable than State Farm's. In addition, some women may find cheaper rates at regional companies like Erie and Farm Bureau.

Best cheap car insurance companies for women

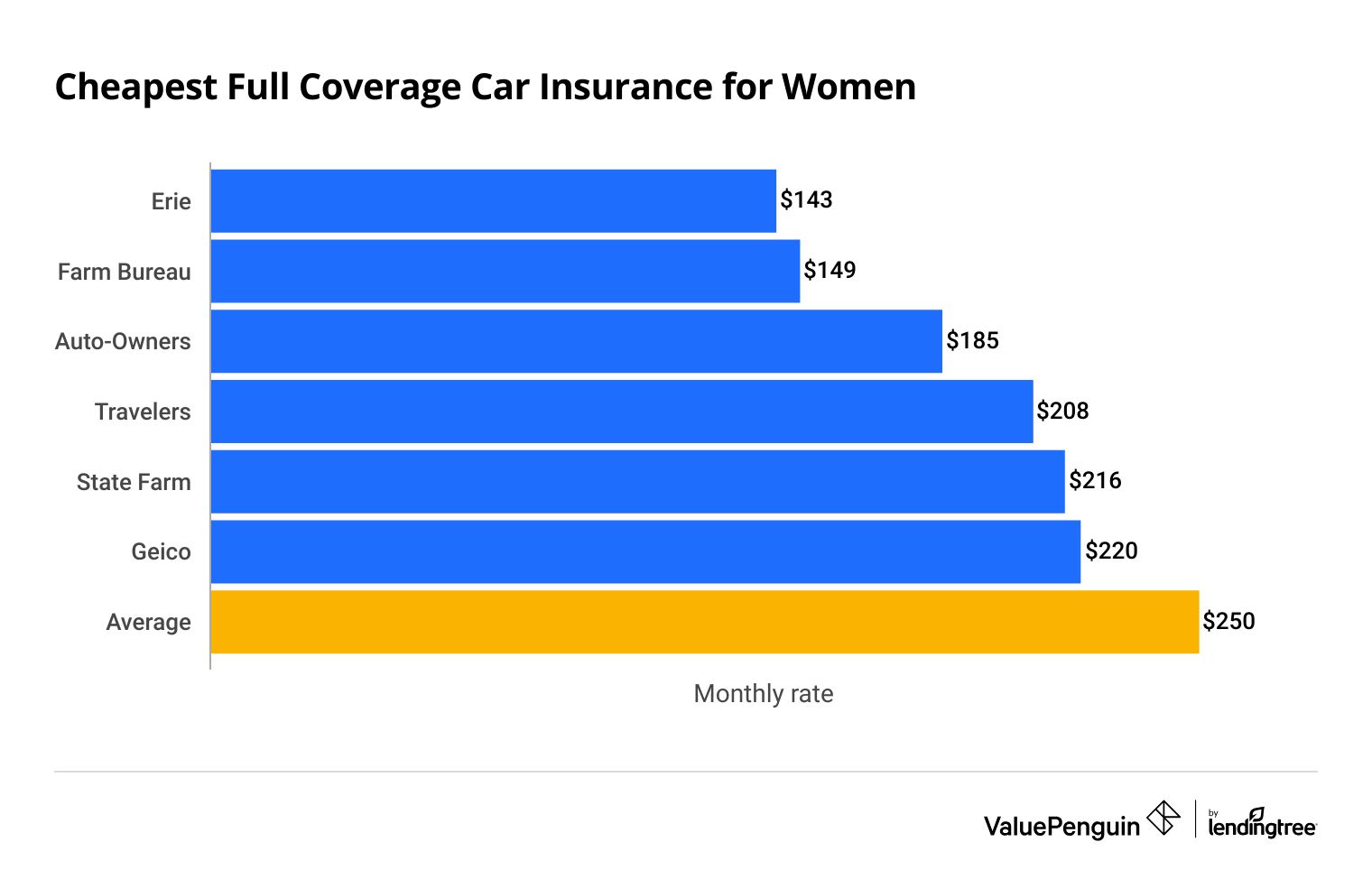

The average cost of full coverage car insurance for women in the U.S. is $250 per month. That's nearly 6% less than men pay for the same coverage.

Companies with cheap car insurance for women

Erie offers the cheapest car insurance for women overall.

A full coverage policy from Erie costs around $143 per month, which is 43% less than average. However, Erie is only available in 12 states and Washington, D.C., so not everyone can take advantage of its great rates.

Farm Bureau and Auto-Owners are also regional companies that offer affordable rates for women.

Travelers is the cheapest national insurance company for women, with a full coverage policy costing $208 per month. That's 17% less than average.

Find Cheap Auto Insurance Quotes

Female drivers should also compare car insurance quotes from State Farm. At $216 per month, full coverage from State Farm costs 14% less than average.

State Farm also has an excellent rating from ValuePenguin editors due to its reliable customer service and the overall value it provides customers.

Cheapest car insurance companies for women

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $143 | ||

| Farm Bureau | $149 | ||

| Auto-Owners | $185 | ||

| Travelers | $208 | ||

| State Farm | $216 | ||

Monthly rate is the average cost of car insurance for single women between the age of 16 and 85.

Women looking for the best car insurance shouldn't worry about choosing a company that caters to female drivers. There are a lot of other factors that affect your car insurance rates more than gender, including your age, your driving history and where you live.

The best way to find cheap car insurance rates is to compare quotes from multiple companies.

Best cheap car insurance for young female drivers

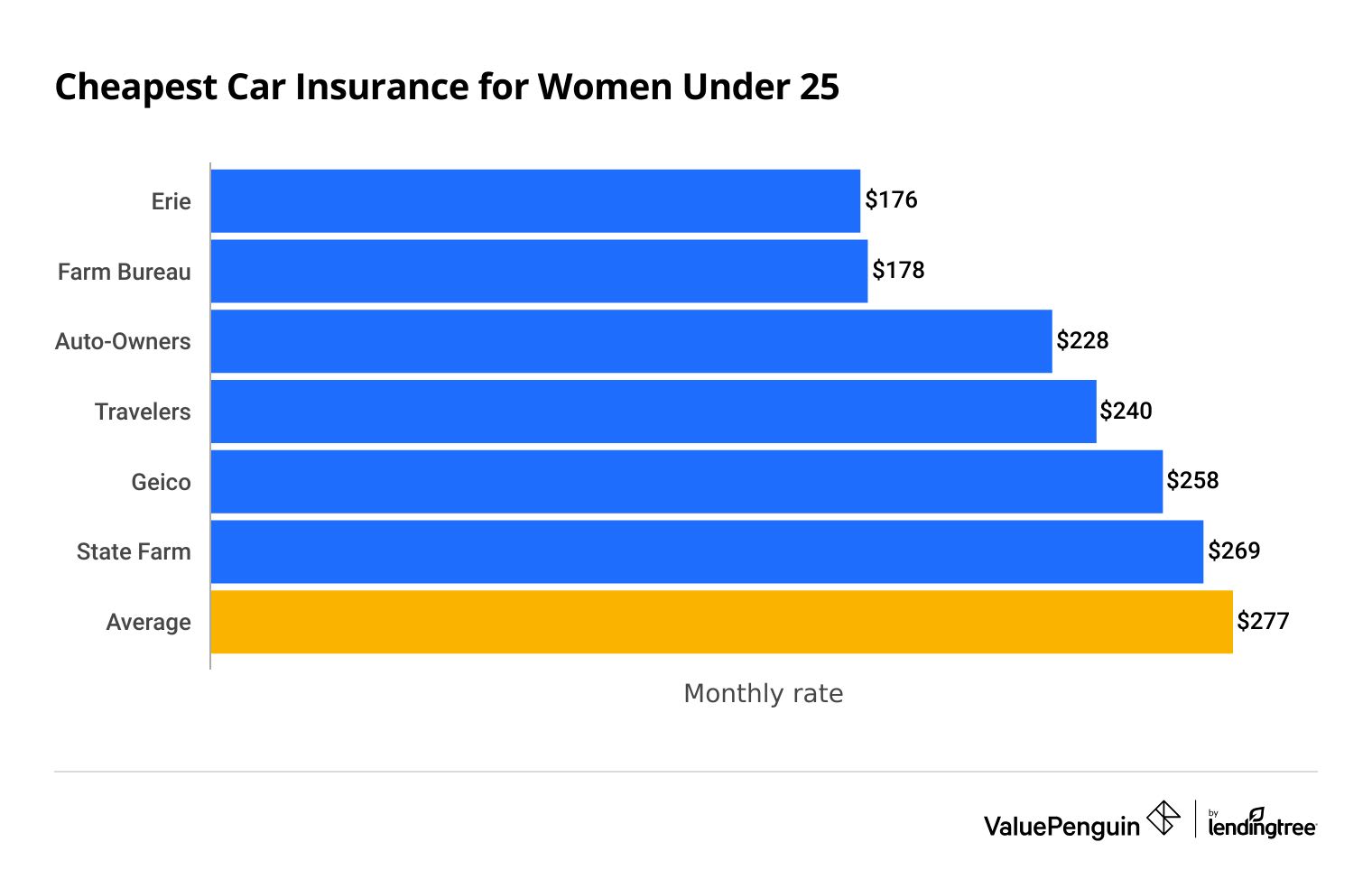

Erie and Farm Bureau have the cheapest car insurance rates for women under 25.

A full coverage policy from Farm Bureau costs $219 per month for an 18-year-old woman. That's half as much as the average 18-year-old female driver pays for coverage.

Find Cheap Auto Insurance Quotes

Young women pay more for car insurance than older women because they typically have less driving experience. For example, an 18-year-old woman pays two and a half times more for full coverage insurance than a 30-year-old.

Cheapest full coverage insurance for young female drivers

18-year-old

20-year-old

22-year-old

24-year-old

Company | Monthly rate | ||

|---|---|---|---|

| Farm Bureau | $219 | ||

| Erie | $234 | ||

| Auto-Owners | $292 | ||

| Travelers | $347 | ||

| Geico | $359 | ||

*USAA is only available to military members, veterans and their families.

18-year-old

Company | Monthly rate | ||

|---|---|---|---|

| Farm Bureau | $219 | ||

| Erie | $234 | ||

| Auto-Owners | $292 | ||

| Travelers | $347 | ||

| Geico | $359 | ||

*USAA is only available to military members, veterans and their families.

20-year-old

Company | Monthly rate | ||

|---|---|---|---|

| Farm Bureau | $177 | ||

| Erie | $184 | ||

| Travelers | $237 | ||

| Auto-Owners | $239 | ||

| Geico | $270 | ||

*USAA is only available to military members, veterans and their families.

22-year-old

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $153 | ||

| Farm Bureau | $162 | ||

| Travelers | $195 | ||

| Auto-Owners | $204 | ||

| Geico | $208 | ||

*USAA is only available to military members, veterans and their families.

24-year-old

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $131 | ||

| Farm Bureau | $153 | ||

| Auto-Owners | $178 | ||

| Travelers | $182 | ||

| Geico | $196 | ||

*USAA is only available to military members, veterans and their families.

The best way for young women to get cheap car insurance is to stay on a parent's policy. It costs a teen driver half as much to share a policy with her parents as it does to buy a separate policy.

Young female drivers can also get insurance discounts through good grades. If you're a young driver who has caused an accident or received a ticket, you may be able to take a defensive driving course and get a discount.

Best car insurance for single females

Erie, Farm Bureau and Auto-Owners have the cheapest car insurance for single women.

All three are regional companies, so they're only available to a smaller group of drivers.

Car insurance quotes for single females

Company | Monthly rate |

|---|---|

| Erie | $113 |

| Farm Bureau | $125 |

| Auto-Owners | $135 |

| State Farm | $155 |

| Travelers | $159 |

*USAA is only available to military members, veterans and their families.

Your relationship status impacts car insurance rates because some companies believe married drivers make fewer car insurance claims. On average, married drivers pay 6% less for full coverage insurance than single drivers, regardless of gender.

State Farm is an exception to this rule. It charges married and single drivers the same rate and has the cheapest rates of any national insurance company.

Do females pay less for car insurance?

On average, women pay 6% less for car insurance than men.

The average cost of full coverage car insurance for women is $250 per month, while men pay $264.

Male vs. female monthly car insurance rates

Age | Female | Male | Difference |

|---|---|---|---|

| 18 | $457 | $505 | 11% |

| 20 | $312 | $345 | 11% |

| 25 | $197 | $202 | 3% |

| 30 | $179 | $178 | -1% |

| 35 | $176 | $174 | -1% |

The difference between male and female car insurance rates changes with age.

For example, 18-year-old men pay 11% more than women — about $48 more monthly. By the time drivers reach 25 years old, the difference drops to 3% ($5 more for men). And by age 30, men pay 1% less than women.

The rate difference grows when drivers reach their 70s, when men pay 3% more than women.

Why is car insurance cheaper for women than for men?

Men typically pay more for car insurance because insurance companies have found that they're more likely to file a claim.

This is partially because men tend to drive more than women, which increases their chances of being in an accident.

Men also tend to have more risky driving behaviors like speeding and drunken driving. This is especially true for young drivers. Young men are twice as likely to be killed while driving as young women.

While your gender impacts your car insurance rates, other factors tend to have a much bigger effect on how much you pay for coverage.

Other factors that insurance companies consider include:

Your driving history usually has the largest impact on your rates. A single speeding ticket will raise your rates by an average of 23%. And an at-fault accident will cause quotes to go up by 49%.

States where car insurance is the same for men and women

Some states have banned insurance companies from using gender when setting rates. These include:

How to find cheap car insurance for women

The best way for women to save on car insurance is to compare quotes from multiple companies, drive safely, bundle policies and qualify for discounts.

Shop around

Women should always compare quotes from multiple insurance companies when shopping for a policy.

For example, a 30-year-old woman driving in California will save $94 per month if she switches from Nationwide to Geico. That means she might spend an additional $1,133 yearly if she doesn't shop around.

You should also shop for quotes yearly to ensure you're getting your best rate. This is especially true if you experience a life event like getting married, moving or buying a car.

Drive safely

Your driving history is one of the biggest factors insurance companies consider when setting rates. Avoid accidents to help prevent companies from raising your rates. Safe driving could also qualify you for big discounts through telematics programs.

For example, drivers using State Farm's Drive Safe & Save app can save up to 50% off their previous rates.

Bundle policies

Most companies offer discounts to customers who buy in bulk. That includes protecting multiple cars under the same policy or buying multiple types of insurance policies (such as home or life insurance) from the same company.

Qualify for discounts

Women can also save money on their car insurance with other discounts. These can include savings for paying their bills automatically, signing up for paperless statements or installing an alarm system in their car. It's important to ask each company which discounts you qualify for when getting quotes. That way you can make sure you're paying the absolute lowest rate.

Frequently asked questions

Is car insurance more expensive for male or female drivers?

Men typically pay more for car insurance than women do. Women generally drive less than men and get into fewer accidents, which makes them less risky to insure. That can lead to cheaper rates. However, a woman with incidents on her driving record will usually pay more than a man with a clean record.

What is the best car insurance for a 30-year-old woman?

State Farm has the best rates for a 30-year-old single female out of the national insurance companies. However, you may be able to find a better deal with a local or regional company like Erie.

Which group pays more for car insurance: single or married women?

Single women pay more for auto insurance, but only by a small amount. On average, married drivers pay 6% less for car insurance, regardless of gender. The best way to keep your rates low, regardless of relationship status, is to drive safely and compare multiple quotes.

At what age does insurance go down for female drivers?

The biggest single-year decreases in auto insurance rates for women come at ages 19 (a 24% decrease) and 21 (a 16% decrease). But there is no one age when women's car insurance suddenly drops. Your rates will be highest when you first start driving as a teenager and gradually drop as you age.

Methodology

To compare car insurance quotes for women, we collected rates from ZIP codes across the 10 most populated states in the U.S. Rates are based on a female driver with a good credit score and clean driving record who owns a 2015 Honda Civic EX.

Quotes are for a full coverage policy, including higher liability limits than required in each state and comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist coverage: $50,000 per person and $100,000 per accident

- Personal injury protection or medical payments coverage: $5,000 or state requirement

- Comprehensive and collision deductibles: $500

ValuePenguin's rate data was provided by Quadrant Information Services. Quotes are publicly sourced from insurer filings and intended for comparative purposes only. Your rates could differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.