Best Cheap SR-22 and FR-44 Insurance in Virginia

Find Cheap SR-22 Auto Insurance Quotes in Virginia

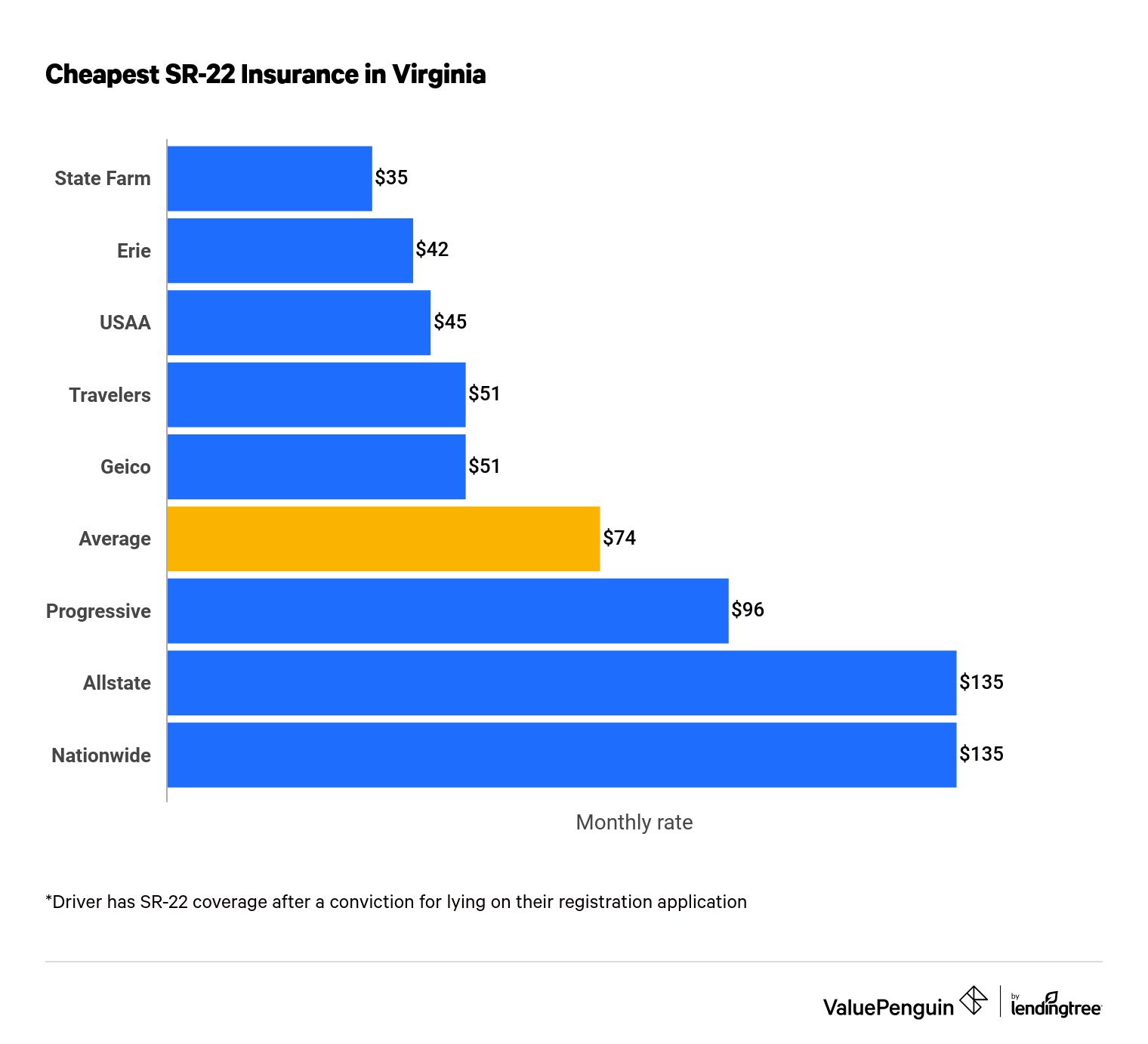

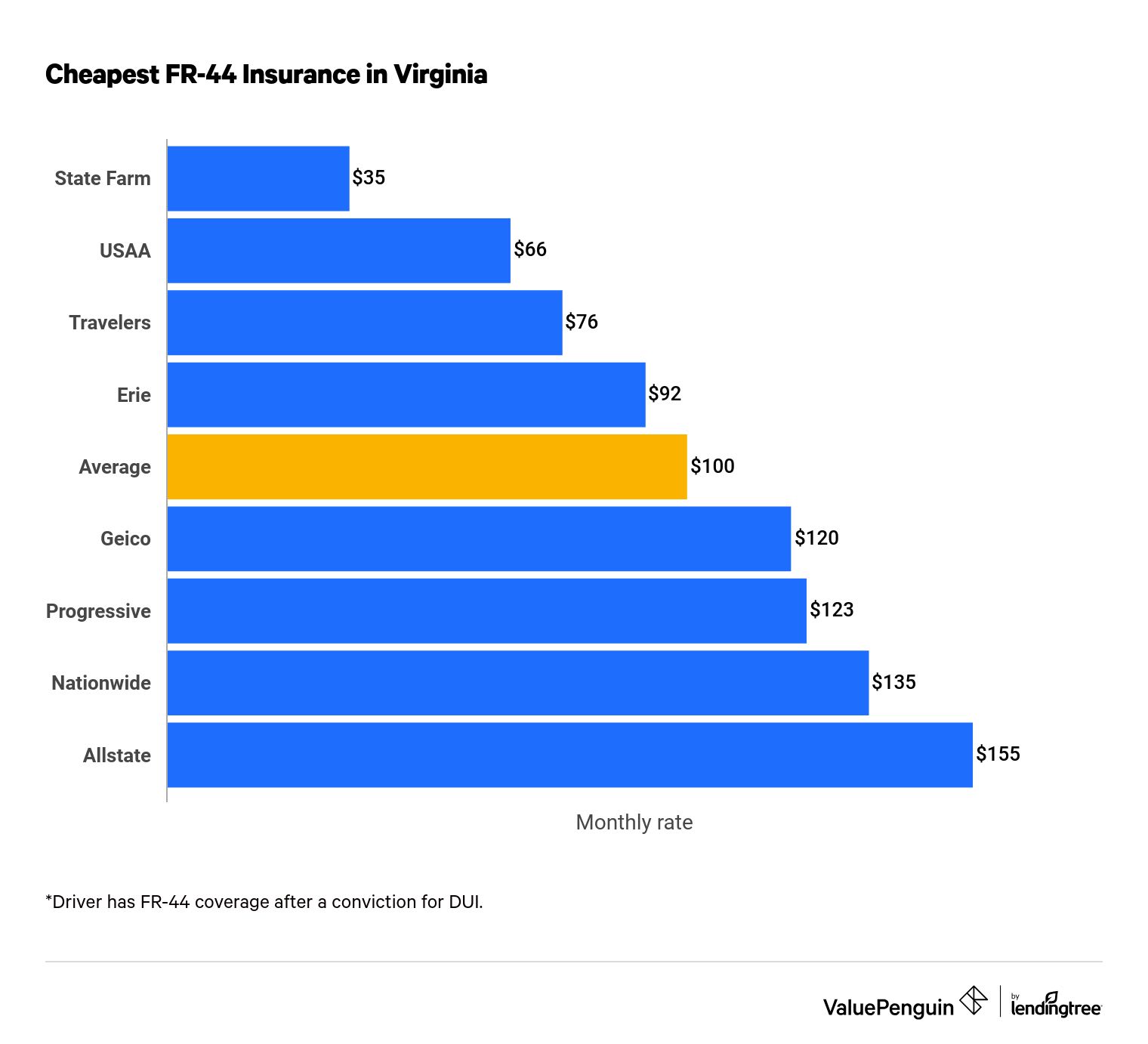

State Farm has the cheapest rates for both SR-22 and FR-44 insurance in Virginia.

Virginia drivers recently convicted of a serious driving violation, such as driving uninsured or manslaughter, are often required to file an SR-22. Virginia drivers with a DUI or DWI often must file an FR-44 form.

Both SR-22 and FR-44 insurance provide proof of insurance coverage that complies with Virginia's minimum car insurance requirements. Insurers will file the SR-22 or FR-44 form on your behalf and likely charge a fee for doing so.

Both SR-22 and FR-44 insurance in Virginia cost more than standard car insurance policies, as drivers with previous tickets are often higher risks to insure.

How much are SR-22 and FR-44 insurance in Virginia?

Both SR-22 and FR-44 insurance in Virginia cost more than standard car insurance policies. The average rate for an FR-44 policy after a DUI is $100 per month, while an SR-22 policy in Virginia with a conviction for falsifying info on your registration is $74 per month.

The cheapest rates for both are offered by State Farm, which charges an average of $35 per month for SR-22 coverage and FR-44 coverage.

The cost increase is primarily due to insurers treating those forms as a sign of riskier driving behaviors, which leads them to charge higher rates. Also, FR-44 liability coverage requirements are double those of SR-22 filings, making FR-44 insurance more expensive.

Find Cheap SR-22 Auto Insurance Quotes in Virginia

The rates for SR-22 or FR-44 insurance will vary greatly between insurers in Virginia, sometimes by more than $1,000 per year.

SR-22 and FR-44 rates by company

Insurer | SR-22 rates | FR-44 rates | |

|---|---|---|---|

| State Farm | $35 | $35 | |

| Erie | $42 | $92 | |

| USAA | $45 | $66 | |

| Travelers | $51 | $76 | |

| Geico | $51 | $120 |

Monthly SR-22 rates are for a driver whose license was suspended for misrepresenting themselves when getting their registration. Monthly FR-44 rates are for a driver with one DUI.

Minimum coverage car insurance policies in Virginia cost an average of $58 per month, or $690 per year. A single DUI on your driving record, however, can more than double your car insurance quotes, depending on your carrier and where you live.

To find cheap SR-22 or FR-44 insurance in Virginia, try to compare rates from multiple insurers. Every auto insurance company evaluates risk and determines rates differently, so getting several quotes is an effective way to find cheap SR-22 or FR-44 insurance.

It's also always a good idea to ask your insurer about potential discounts. Virginia drivers may still be eligible for rate reductions based on factors such as the car they drive and any defensive driving courses they've taken.

What is SR-22 insurance in Virginia, and when is it required?

An SR-22 filing in Virginia provides drivers with proof of insurance coverage or legal recognition that they carry the minimum liability insurance requirements in Virginia.

Virginia's liability car insurance coverage requirements for an SR-22 are:

- Bodily injury liability: $30,000 per person / $60,000 per accident

- Property damage liability: $20,000 per accident

- Uninsured/underinsured motorist bodily injury: $30,000 per person / $60,000 per accident

- Uninsured/underinsured motorist property damage: $20,000 per accident

After Dec. 31, 2024, the minimum insurance coverage requirements in Virginia will increase to $50,000 in bodily injury liability per person and $100,000 per accident and $25,000 in property damage liability per accident.

SR, in this case, stands for "safety responsibility." Some of the driving violations that may result in an SR-22 filing requirement in Virginia include:

- Driving uninsured

- Falsifying insurance coverage

- Unsatisfied judgments

- Any conviction for an accident resulting in death or serious injury

- Any violations of motor vehicle laws considered punishable as a felony

In some cases, a driver who doesn't own a car and is working toward getting their license reinstated may be required to carry nonowner SR-22 insurance coverage that permits them to occasionally drive a vehicle they don't own. Nonowner car insurance policies usually cost less than other SR-22 policies while still meeting necessary legal requirements.

If you have SR-22 insurance from another state and are driving in Virginia, you must keep your coverage in that state.

How do I get SR-22 insurance in VA?

To get SR-22 insurance coverage in Virginia, you will likely need to reach out to multiple car insurance companies because not all of them will offer coverage.

How long is SR-22 insurance required in Virginia?

In Virginia, drivers are required to hold SR-22 insurance for three years, though this period can be extended if you get another serious ticket or let your SR-22 coverage lapse. Insurance companies are legally required to tell the VA DMV if you cancel or do not renew your SR-22 policy.

A lapse in SR-22 coverage can result in license suspension, reinstatement fees and increased auto insurance rates.

In fact, if your SR-22 lapses, you will be required to carry the certification for another three-year period following the most recent date of license reinstatement.

To avoid a coverage lapse, we recommend renewing your policy as early as possible — at least 30 days in advance — while you're required to carry SR-22 insurance. Once you've held SR-22 insurance for the required length of time, be sure to contact the Virginia DMV to verify that your filing requirement is complete.

SR-26 in Virginia

An SR-26 form is sent by your insurance company to the DMV when your SR-22 coverage is discontinued. This can happen either because you no longer need SR-22 coverage or because you have allowed your insurance to lapse.

If you allow that lapse, you should get coverage as quickly as possible.

What is FR-44 insurance in Virginia?

Similar to an SR-22 filing, an FR-44 form provides Virginia drivers with legal proof of insurance coverage. However, FR-44 insurance, sometimes referred to as "DUI insurance," is most commonly required following a conviction for driving under the influence (DUI) or driving while intoxicated (DWI).

The key difference between an SR-22 and FR-44 filing in Virginia is that the latter is required following alcohol- or drug-related offenses.

Offenses that may result in an FR-44 filing requirement include:

- Maiming while under the influence

- Driving under the influence of intoxicants or drugs

- Driving with a license that's been forfeited for a conviction (or a not-innocent finding for juveniles)

- Any federal, state or local legal violations similar to the above

An FR-44 filing is typically considered more severe and higher risk than an SR-22 certificate. Virginia's FR-44 insurance coverage requirements are twice what's required for SR-22.

- Bodily injury liability: $60,000 per person / $120,000 per accident

- Property damage liability: $40,000 per accident

To get FR-44 insurance in Virginia, the steps are similar to those for an SR-22 filing.

How long is FR-44 insurance required in Virginia?

Typically in Virginia, you must have a FR-44 certificate for three years from the date of license reinstatement. However, in some cases, the required carrying period can be four years, depending on any specific restrictions associated with your recent conviction and license reinstatement.

As with SR-22 coverage, be sure not to let your FR-44 insurance lapse by renewing your policy as early as possible if you want to keep your driving privileges. Any lapse in coverage is subject to license suspension, fees, more expensive rates and an extended FR-44 carrying period.

Frequently asked questions

What are SR-22 and FR-44 insurance in Virginia?

SR-22 insurance in Virginia is required for drivers who are convicted of serious traffic tickets, such as driving uninsured. An SR-22 is a form that certifies you have met the minimum liability requirements of the state. An FR-44 does the same thing, but it is required after a DUI and has twice the required coverage limits.

How much does FR-44 insurance cost in Virginia?

FR-44 insurance costs an average of $100 per month in Virginia. That is with only one DUI, which accounts for most of the 74% increase in rates.

Methodology

ValuePenguin gathered quotes from every ZIP code across the state of Virginia for drivers with SR-22 and FR-44 insurance. The SR-22 policies are for drivers with a ticket for misrepresenting one's self on a registration application. FR-44 policies are for drivers with a single DUI.

All quotes are for the minimum coverage required in Virginia with SR-22 and FR-44 policies.

Rates were gathered using Quadrant Information Services. Data comes from publicly sourced insurance filings. Rates should be used for comparative purposes only, as your quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.