Wawanesa Insurance Review: Cheap Rates, but Limited Availability

Wawanesa has cheap rates, but it's only available in a couple of states and the company is facing serious financial risks.

Find Cheap Auto Insurance Quotes in Your Area

Wawanesa may be a good option if cheap insurance is your top priority. However, Wawanesa's customer service gets mixed reviews. The company also has a subpar Financial Strength Rating from A.M. Best. That means it may have a hard time paying out a lot of claims at once, which should be concerning for potential customers.

In addition, not all drivers can buy car insurance from Wawanesa. The company keeps rates low by only covering drivers who have a clean driving record or only one recent ticket or accident.

Pros and cons

Pros

Cheap rates

Clear, user-friendly website

Cons

Only available in California and Oregon

May have difficulty paying claims after a disaster

No mobile app

Wawanesa auto insurance quotes

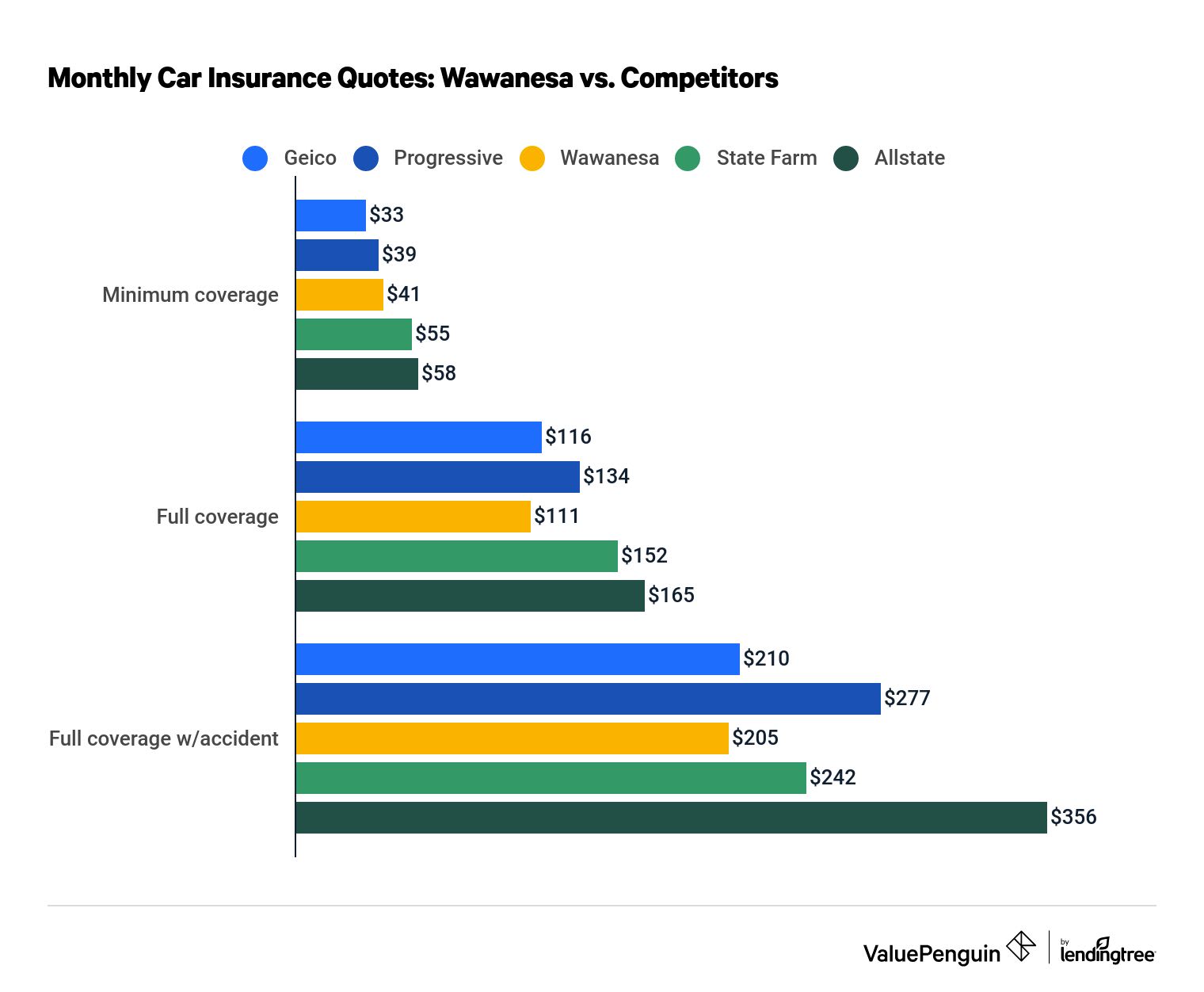

Wawanesa has very affordable car insurance quotes for most drivers.

Full coverage car insurance from Wawanesa costs $111 per month, which is 27% cheaper than average. Minimum coverage is 35% less expensive than average.

Find Cheap Auto Insurance Quotes in Your Area

Drivers with one at-fault accident on their record can also find affordable rates at Wawanesa. A full coverage policy from Wawanesa costs $205 per month after a single accident. That's 23% cheaper than average.

However, if you have multiple accidents or tickets, you may not be able to get insurance from Wawanesa.

Wawanesa auto quotes vs. competitors

Minimum coverage

Full coverage

Full coverage after an accident

Company | Monthly rate | ||

|---|---|---|---|

| Geico | $33 | ||

| AAA | $38 | ||

| Progressive | $39 | ||

| Wawanesa | $41 | ||

| State Farm | $55 | ||

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| Geico | $33 | ||

| AAA | $38 | ||

| Progressive | $39 | ||

| Wawanesa | $41 | ||

| State Farm | $55 | ||

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| Wawanesa | $111 | ||

| Geico | $116 | ||

| Progressive | $134 | ||

| AAA | $146 | ||

| State Farm | $152 | ||

Full coverage after an accident

Company | Monthly rate | ||

|---|---|---|---|

| Wawanesa | $205 | ||

| Geico | $210 | ||

| Progressive | $277 | ||

| Farmers | $304 | ||

| Travelers | $330 | ||

Wawanesa keeps rates low by only offering insurance to safe drivers.

Wawanesa considers you a safe driver if you have not had more than one traffic point or at-fault accident over the course of the previous three years. If you have more than one point or accident, you will probably have to get car insurance quotes from another company.

Which states does Wawanesa cover?

Wawanesa Insurance is only available in two states: California and Oregon. Primarily based in Canada, Wawanesa sells only a limited number of insurance policies in the U.S.

Wawanesa auto insurance discounts

Wawanesa offers more car insurance discounts to drivers in Oregon than to those in California. California drivers may be able to get cheaper rates if they qualify for more discounts from another insurance company.

California

Oregon

Wawanesa car insurance discounts in California

- Affinity group: Members of the California Coast Credit Union can get a discount.

- Good driver: Get a discount if all drivers on a policy have had a license for at least three years. Drivers must have no more than one ticket or at-fault accident in that time period. You also can't have any DUIs within the last 10 years.

- Loyalty: Save money once you're insured with Wawanesa for one year.

- Mature driver defensive driving course: Drivers ages 55 and older can get a discount if they complete a state-approved defensive driver course. The discount does not apply if you take the course because of a court order.

- Multi car: Save money if you insure multiple cars on one policy.

- Multi policy: Save money on your property insurance when you insure your home or condo, plus your car, with Wawanesa.

California

Wawanesa car insurance discounts in California

- Affinity group: Members of the California Coast Credit Union can get a discount.

- Good driver: Get a discount if all drivers on a policy have had a license for at least three years. Drivers must have no more than one ticket or at-fault accident in that time period. You also can't have any DUIs within the last 10 years.

- Loyalty: Save money once you're insured with Wawanesa for one year.

- Mature driver defensive driving course: Drivers ages 55 and older can get a discount if they complete a state-approved defensive driver course. The discount does not apply if you take the course because of a court order.

- Multi car: Save money if you insure multiple cars on one policy.

- Multi policy: Save money on your property insurance when you insure your home or condo, plus your car, with Wawanesa.

Oregon

Wawanesa car insurance discounts in Oregon

- Driver training: Drivers under the age of 19 can get a discount by completing a state-approved driver training course.

- Mature driver improvement course: Drivers over the age of 55 can get a discount by completing a DMV-approved defensive driver course in the past three years. You can't get a discount if the course was required by a court order.

- Multi car: Get a discount if you insure multiple cars on one Wawanesa policy.

- Vehicle recovery system: Save money if you have an anti-theft system installed in your car. This can include LoJack, OnStar, OnGuard or Teletrac.

- E-collect and e-distribute: Earn a discount when you set up automatic payments and paperless billing.

- Loyalty: Get a discount once you've been insured with Wawanesa for one year.

- Multi policy: Save money when you insure either a home or condo, plus your car, with Wawanesa.

- Military: Get a discount if you're an active or retired military member.

- Persistency: Automatically get a discount if you have car insurance prior to buying a policy from Wawanesa.

- Insurance score: Save money if you have a good insurance score. This score is based on factors like your accident and credit histories.

Wawanesa insurance coverage

Drivers who need more coverage than a basic car insurance policy should consider another company besides Wawanesa.

The company offers a few ways to add extra protection.

Roadside assistance

Roadside assistance helps get your car back on the road or tow it to a mechanic if you break down. Every policy period, Wawanesa covers roadside assistance twice, up to $100 each time.

Rental car coverage

Rental car coverage helps cover the cost of a rental car while your vehicle is in the shop after an accident.

Vehicle manufacturer replacement parts

Vehicle manufacturer replacement parts coverage helps guarantee that a mechanic will use parts made by the original manufacturer to fix your car after an accident. Other insurance companies may call this original equipment manufacturer (OEM) coverage.

Special vehicle equipment coverage

Special vehicle equipment coverage helps pay to repair or replace custom equipment on your car. For example, an aftermarket sound system or custom rims.

Uninsured motorist collision waiver

Uninsured motorist collision waiver fixes your car without requiring you to pay a deductible if you're hit by an uninsured driver. Also known as a collision deductible waiver, this coverage is only available in California.

Major national companies like Geico or Liberty Mutual have a lot more options to choose from. For example, Wawanesa does not offer gap insurance. So drivers who have a loan or lease may want to look elsewhere.

It also doesn't have rideshare coverage, which makes it a bad choice for people who drive for Uber or Lyft.

Wawanesa also offers basic auto insurance coverages.

A comprehensive policy from Wawanesa includes free windshield repair. You don't need separate coverage to pay for cracks or other repairs. And your rates won't go up if you make a claim.

Reviews and ratings of Wawanesa Insurance customer service

Wawanesa has mixed customer service reviews, and drivers should be concerned about its ability to pay out claims if there's a disaster.

Wawanesa received the second highest rating on J.D. Power's Auto Insurance Study for the state of California. That means drivers in California are generally happy with the service they receive from Wawanesa.

Reviewer | Wawanesa | Average |

|---|---|---|

| J.D. Power | 879 | 820 (higher is better) |

| NAIC | 2.01 | 1.00 (lower is better) |

| A.M. Best | C++ (Marginal) | n/a |

On the other hand, Wawanesa receives twice as many complaints as other companies of its size, according to the National Association of Insurance Commissioners (NAIC).

Most of the complaints focus on the claims department. Drivers were typically unhappy with the amount Wawanesa paid after a claim and the length of the claims process.

In addition, A.M. Best says Wawanesa may have a difficult time paying out many claims at once. This could be a problem if a natural disaster occurs in an area where lots of Wawanesa customers live.

Most major insurance companies have a Financial Strength Rating of A or higher, including State Farm, Geico and Progressive.

Alternatives to Wawanesa Insurance

About Wawanesa Insurance

Wawanesa Mutual Insurance Company is the Canadian parent company of Wawanesa General Insurance, which sells insurance to U.S. customers. Wawanesa General's headquarters are located in San Diego. The company was established in the U.S. in 1974.

Wawanesa customer service contact

To contact customer service at Wawanesa, you can call 1-800-640-2920. Drivers can also email Wawanesa Insurance customer service.

- New customers: [email protected]

- Existing customers: [email protected]

You can contact Wawanesa customer service to cancel your auto insurance policy. However, you'll be charged a $50 fee if you cancel within 60 days of your policy's start date.

Wawanesa claims contact

To report a claim to Wawanesa, you can:

- Call the Wawanesa auto insurance claims phone number at 888-929-2252. Once a claim is started, you can only contact Wawanesa to discuss it from 7:30 a.m. to 7:30 p.m. Monday through Friday and 8 a.m. to 4 p.m. on Saturday.

-

File a claim online. You'll need to share as much info about the car accident as you can in the online form. You do not need to log in to the Wawanesa website to file a claim. The company has a dedicated auto claims page on the website.

Other companies allow you to file a claim via mobile app. Wawanesa does not have an app, so this is not an option. If you prefer to manage your account using your phone, you'll want to consider another auto insurance company.

Other Wawanesa products

In addition to auto insurance, Wawanesa offers:

- Home insurance

- Renters insurance

- Pet insurance by Embrace

Wawanesa has stopped selling condo insurance. If you want to discuss your current Wawanesa condo insurance policy, you can call 1-800-640-2920.

Frequently asked questions

Is Wawanesa good insurance?

Wawanesa has cheap car insurance rates. But its financial stability is concerning. The company earned a C++ Financial Stability Rating from A.M. Best. That means it could have a hard time paying out lots of claims at once. For that reason, drivers should look for coverage elsewhere.

What states does Wawanesa cover?

Wawanesa car insurance is only available in California and Oregon.

Does Wawanesa have gap insurance?

No, Wawanesa doesn't offer gap insurance. If you have a loan or lease on a new vehicle, you should consider buying car insurance from a company that offers gap insurance, like Progressive or Allstate.

Does Wawanesa cover rental cars?

Yes, Wawanesa offers rental car coverage. For an extra fee, Wawanesa can help pay for a rental vehicle if your car is in the shop after an accident.

Methodology

To compare Wawanesa car insurance quotes, we gathered rates from all residential ZIP codes across California. Quotes are for a 30-year-old single man with a clean driving record and good credit score. He owns a 2015 Honda Civic EX.

Full coverage quotes have higher liability limits than the minimum requirements in California, along with comprehensive and collision coverages.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Medical payments: $10,000

- Uninsured and underinsured motorist bodily injury $50,000 per person and $100,000 per accident

- Comprehensive and collision deductible: $500

ValuePenguin used data provided by Quadrant Information Services for this study. Rates are publicly sourced from insurance company filings, and are intended solely for comparative purposes. Your own quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.