Hippo Home Insurance Review

Hippo home insurance combines low rates with great coverage — something that isn't common with other insurers.

Find Cheap Homeowners Insurance Quotes in Your Area

Update (August 2023): Hippo is not currently selling new home insurance policies in the U.S. The company says this is a temporary change. It plans to sell new policies again in the future. Hippo has not announced a timeline for selling new home policies in the U.S.

The company didn't share any plans to cancel existing policies, so current customers shouldn't be affected by this move.

Hippo insurance is a great option for homeowners. It offers excellent coverage at an affordable rate and has a long list of discounts available to lower your payments.

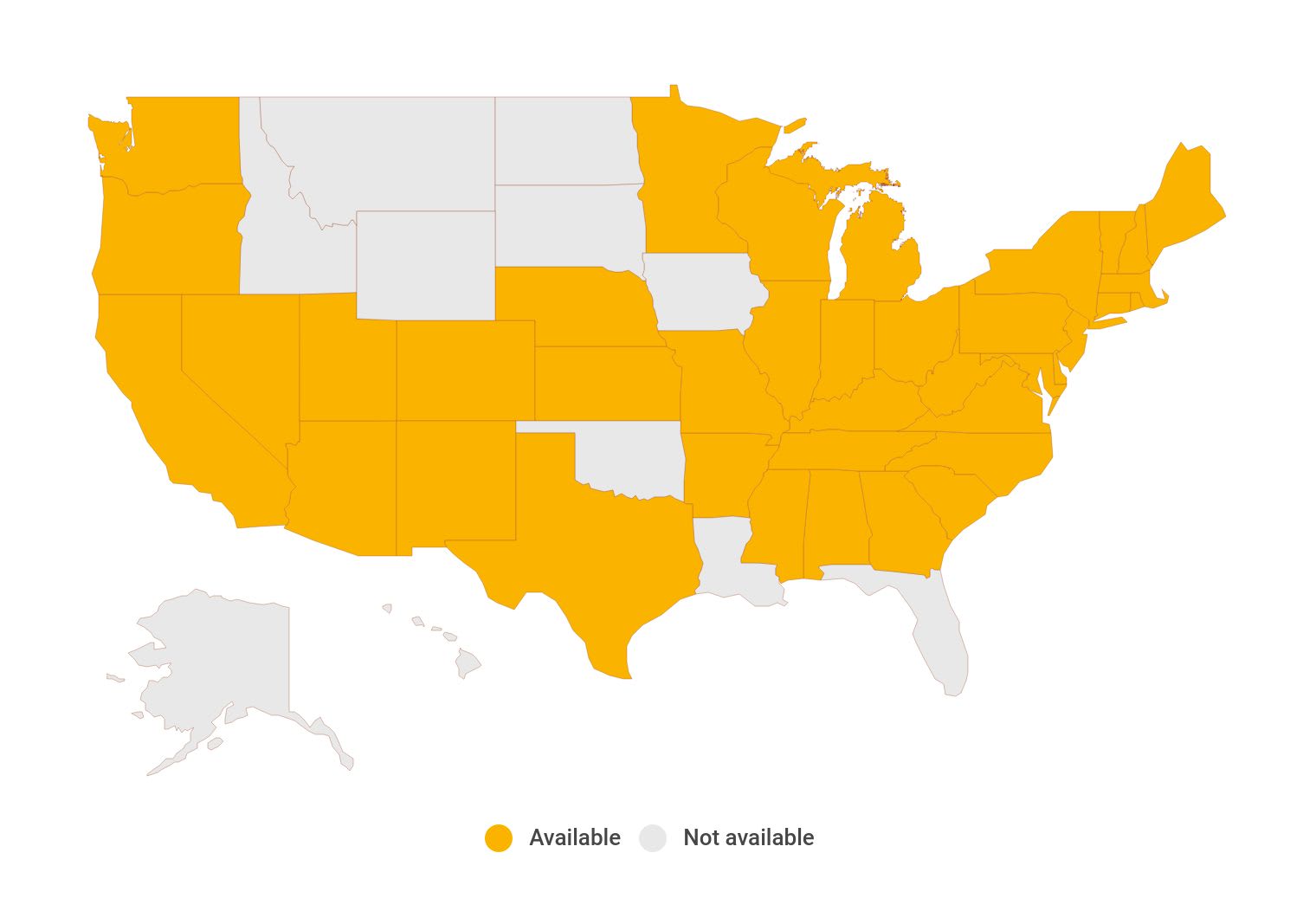

Unfortunately, Hippo isn't available nationwide, so some homeowners can't purchase a policy. In addition, one of the companies that underwrites Hippo policies has very poor customer service reviews, which may lead to a bad claims experience for some people.

Pros and cons

Pros

Cheap home insurance

Quick online quotes

Extra coverage at no additional cost

Cons

No online claims

Unreliable claims experience

Hippo insurance: Our thoughts

Bottom line: Hippo's basic home insurance coverage is among the most comprehensive we've seen, and its rates are cheaper than its competitors. Hippo's website allows you to get a quote quickly while seeing exactly which features and discounts you get.

However, Hippo doesn't give policyholders the option to file and manage a claim online, which can be inconvenient.

Generally, Hippo's home insurance coverage is both cheaper and more extensive than competitors' policies, and it includes a few extra forms of coverage for free.

For instance, all of Hippo's home insurance policies include coverage for up to $100,000 for appliances in the case of electrical or mechanical breakdown. Most other home insurers either charge extra for such coverage or don't offer it at all.

Unfortunately, Hippo isn't available to all homeowners — the company currently offers insurance in 39 states.

Hippo home insurance is underwritten by two different companies, Spinnaker Insurance Company and Topa Insurance Company. Spinnaker receives far fewer complaints from policyholders than Topa, which means your customer service experience may vary depending on which company services your policy.

Compare Hippo to other top home insurance companies | |

|---|---|

| Read review | |

| Read review | |

| Read review | |

Hippo home insurance quotes

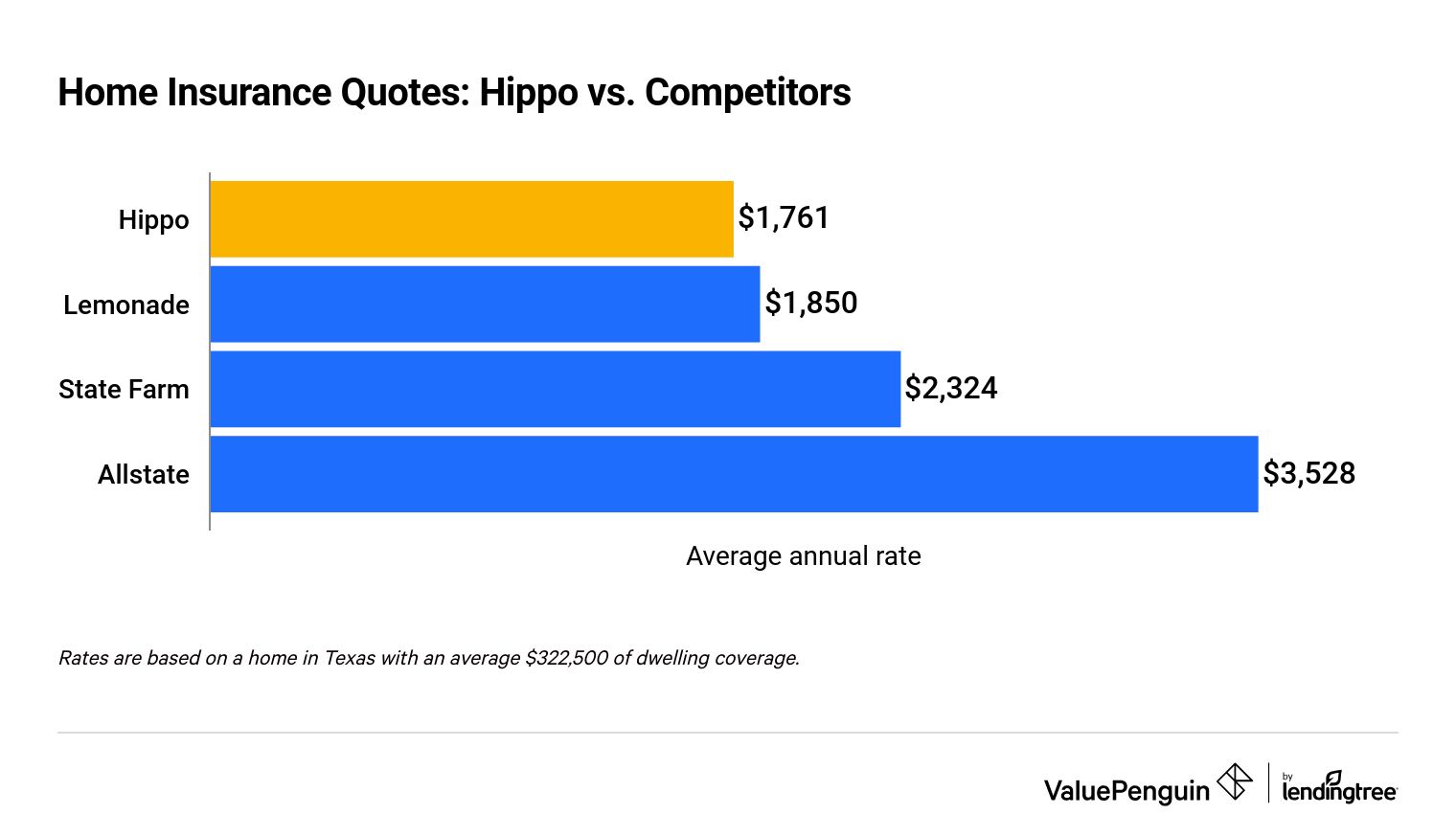

Hippo insurance quotes are 17% cheaper than its competitors, on average. A policy costs $1,761 per year, or $147 per month. That's $89 per year less than Lemonade, the second-cheapest company we analyzed.

Find Cheap Homeowners Insurance Quotes in Your Area

In addition, Hippo home insurance quotes are significantly cheaper than large insurance companies. Home insurance from Allstate costs twice as much as a policy from Hippo, on average.

Hippo homeowners insurance rates vs. competitors

Company | Average monthly rate | Average annual rate |

|---|---|---|

| Hippo | $147 | $1,761 |

| Lemonade | $154 | $1,850 |

| State Farm | $194 | $2,324 |

| Allstate | $294 | $3,528 |

Hippo home insurance does an exceptional job of delivering quotes quickly. In fact, it's possible to get a quote and purchase coverage in less than five minutes. You can also easily adjust your coverage limits to check if you qualify for Hippo's discounts. Compared to Hippo, Allstate and State Farm's quoting systems are slow and clunky.

Hippo home insurance discounts

Although its rates are already affordable, Hippo offers a number of discounts usually found with other homeowners insurance companies — as well as others that are less common.

- Affinity discount

- Claims free

- Companion policy discount

- Early shopper

- Fire extinguisher

- Hail-resistant roof

- Homeowners association

- Interior sprinkler system

- No mortgage

- Recent home purchase

- Smart home

- Storm shutters

- Theft protection device

Hippo smart home discount

One of the most notable discounts Hippo offers is its smart home discount. Not only does the company offer homeowners savings on their insurance, but it includes a free basic smart home system when you purchase a policy.

Hippo currently partners with three smart home monitoring companies: Kangaroo, Notion and SimpliSafe.

Homeowners can earn a discount of up to 10% on their annual premium for self-monitored systems, and up to 13% with a professionally monitored system. While the cost of a smart home plan is usually more than you'll save on your insurance, homeowners who already have a system or were planning to invest in home security may benefit from this discount.

Hippo's smart home discount is not available in Alabama, Kansas, Kentucky, Mississippi and Washington.

Hippo home insurance coverage

Hippo home insurance includes standard coverages, including dwelling, property and liability insurance. In addition, a standard Hippo home insurance policy includes practical types of coverage for which other insurers usually charge extra.

Extended dwelling coverage

If your home is destroyed by a covered event, like a house fire or vandalism, extended dwelling coverage pays up to 25% more than your policy's dwelling coverage limit. This can help protect against unforeseen expenses, like increased labor or material costs.

Equipment breakdown

Unlike other insurers, all Hippo home insurance policies provide up to $100,000 of appliance coverage to repair or replace units damaged by electrical or mechanical failure. The deductible for this coverage is $500. We consider this an excellent feature, especially if you own expensive appliances.

Home office and computer coverage

A basic policy from Hippo includes four times as much protection for your computer and other home office technology as most competitors. For example, Hippo includes coverage for a computer for up to $8,000. Typically, homeowners insurance companies provide less than $2,000 in coverage for computers.

Service line insurance

Hippo's home insurance policies cover the costs of repairing any damage to a sewer, water or electric line connecting your property to the street. This kind of protection usually requires the purchase of an extra endorsement on a typical policy.

Water backup coverage

This coverage offers up to $5,000 of protection against damage caused by water backup from drains or sewers. However, note that water backup coverage doesn't protect you from flood damage caused by storms or hurricanes. If you live in a flood-prone area, it's a good idea to purchase flood insurance.

Homeowners can enhance their Hippo policy with higher limits on many of the coverages above. You can also add extra protections, like full replacement cost for your belongings or mortgage payment protection, which provides up to $1,500 per month to cover your mortgage if your home becomes uninhabitable.

In addition, Hippo offers policyholders access to its home care program at no additional cost. Homeowners can receive maintenance or repair advice from home care experts about a variety of topics ranging from plumbing to painting. Experts are available via phone or email, and can also provide recommendations for service providers in your area.

Hippo insurance availability

Hippo insurance is currently available in 39 states. Unlike other providers, Hippo only offers homeowners, landlord and condo insurance. Hippo does not sell car insurance.

Hippo insurance is not available in the following states:

Hippo insurance reviews and ratings

Unlike conventional insurers, Hippo does not underwrite the insurance policies it sells. Instead, it sells policies for two partners: Spinnaker Insurance Company and Topa Insurance Company. That means either of those companies may service your policy and process claims.

Spinnaker services policies across all of the states where Hippo sells insurance, while Topa is limited to eight states.

This is important to note because Spinnaker has significantly better customer service reviews than Topa.

Hippo policyholders have access to its claims concierge service, which means that it can act as a liaison between you and the underwriting company. This resource can help improve your customer service experience throughout the claims process.

However, it won't affect the amount that your underwriter ultimately pays for your claim. This is important for homeowners underwritten by Topa because its policyholders complain about the amount of its claims payouts.

According to the National Association of Insurance Commissioners (NAIC), Spinnaker receives an average number of customer complaints for an insurer of its size. In contrast, Topa receives 40 times as many complaints, based on its size. The majority of complaints against Topa are due to delays in the claims process and unsatisfactory settlement offers.

On a positive note, both companies have an "A-" (Excellent) financial stability rating from A.M. Best, which means that they have the ability to pay out claims, even in difficult economic situations.

Contact Hippo Insurance

To contact Hippo, prospective policyholders can visit Hippo's website or call its customer service phone number at (800) 585-0705.

Frequently asked questions

Does Hippo offer auto insurance?

No, Hippo does not sell auto insurance. Homeowners looking to bundle home and auto insurance can still receive a companion policy discount if they have car insurance with one of its partner companies.

Who underwrites Hippo's insurance policies?

Hippo home insurance is underwritten by the Topa and Spinnaker Insurance Companies. Each carries at least an "A-" financial stability rating from A.M. Best, but Topa has poor customer service ratings.

Is Hippo a good insurance company?

Overall, Hippo is a good insurance company. It offers affordable rates, a convenient digital experience and free extra coverage options for things like appliances and sewer lines. However, the customer service you receive may vary depending on which of Hippo's partners underwrites your policy.

Methodology

We compared homeowners insurance quotes across eight addresses located in the largest cities in Texas. Rates are based on a 30-year-old single man with no prior history of claims.

Quotes are based on the following coverage limits:

Coverage | Limit |

|---|---|

| Dwelling | $322,500 |

| Personal liability | $100,000 |

| Medical payments | $5,000 |

Dwelling coverage is an average across all addresses quoted.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.